Broward Florida Escrow Agreement: A Detailed Description of Its Provision for Delivery of Assignment to Agent Until Payment Is Received In Broward County, Florida, an escrow agreement is a crucial legal instrument designed to provide security and assurance for parties involved in various financial transactions. Specifically, this agreement ensures the delivery of assignments to the designated agent until the agreed-upon payment is received. This robust system creates a trusted framework for parties engaging in business transactions, enabling them to proceed with confidence and minimizing potential risks. The Broward Florida Escrow Agreement typically involves three main parties: the buyer, the seller, and the escrow agent. The buyer initiates the agreement to ensure that their payment is protected until they receive the assignment or property title. Conversely, the seller seeks assurance that the buyer's payment is secured before transferring the assignment or title. The escrow agent, often a neutral third party such as a lawyer or a trusted financial institution, acts as a facilitator, holding the assignment or title until all conditions set forth in the agreement are met. This escrow agreement greatly benefits both parties involved by mitigating the risks associated with large financial transactions. It provides a mechanism that verifies the buyer's intent and ability to pay, while also offering reassurance to the seller that the payment will be received before ownership is transferred. By placing the assignment or title in the hands of the escrow agent, it essentially acts as collateral, ensuring that the transaction is completed smoothly and within the agreed-upon terms. Within Broward County, Florida, there may be several variations of the escrow agreement, tailored to the specific needs and requirements of various transactions. Some of these may include: 1. Real Estate Escrow Agreement: This specific type of Broward Florida Escrow Agreement is commonly used in property transactions. It ensures that the buyer's payment is held in escrow until all conditions, such as inspections, appraisals, and financing, are met. Once these conditions are fulfilled, the payment is released to the seller, and the property can be transferred to the buyer. 2. Business Acquisition Escrow Agreement: In cases where businesses are being bought or sold, this type of Broward Florida Escrow Agreement comes into play. It ensures that the buyer's funds are secured while the necessary due diligence, contractual obligations, or third-party approvals are obtained. The payment is only released to the seller once all conditions are fulfilled. 3. Intellectual Property Escrow Agreement: This variation of the Broward Florida Escrow Agreement is specifically designed to ensure the safe transfer of intellectual property rights. It provides security for both the buyer and the seller by holding the payment until ownership rights are confirmed and the transaction is completed. In conclusion, the Broward Florida Escrow Agreement plays a vital role in facilitating secure and reliable financial transactions within Broward County. It ensures the delivery of assignments to designated agents until payment is received, providing confidence and reassurance to both buyers and sellers. With variations tailored to specific needs, such as real estate, business acquisition, and intellectual property, this agreement serves as a robust system, protecting all parties involved in complex transactions.

Broward Florida Escrow Agreement Provides For Delivery of Assignment to Agent Until Payment Is Received

Description

How to fill out Broward Florida Escrow Agreement Provides For Delivery Of Assignment To Agent Until Payment Is Received?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business objective utilized in your region, including the Broward Escrow Agreement Provides For Delivery of Assignment to Agent Until Payment Is Received.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Broward Escrow Agreement Provides For Delivery of Assignment to Agent Until Payment Is Received will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Broward Escrow Agreement Provides For Delivery of Assignment to Agent Until Payment Is Received:

- Make sure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Broward Escrow Agreement Provides For Delivery of Assignment to Agent Until Payment Is Received on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

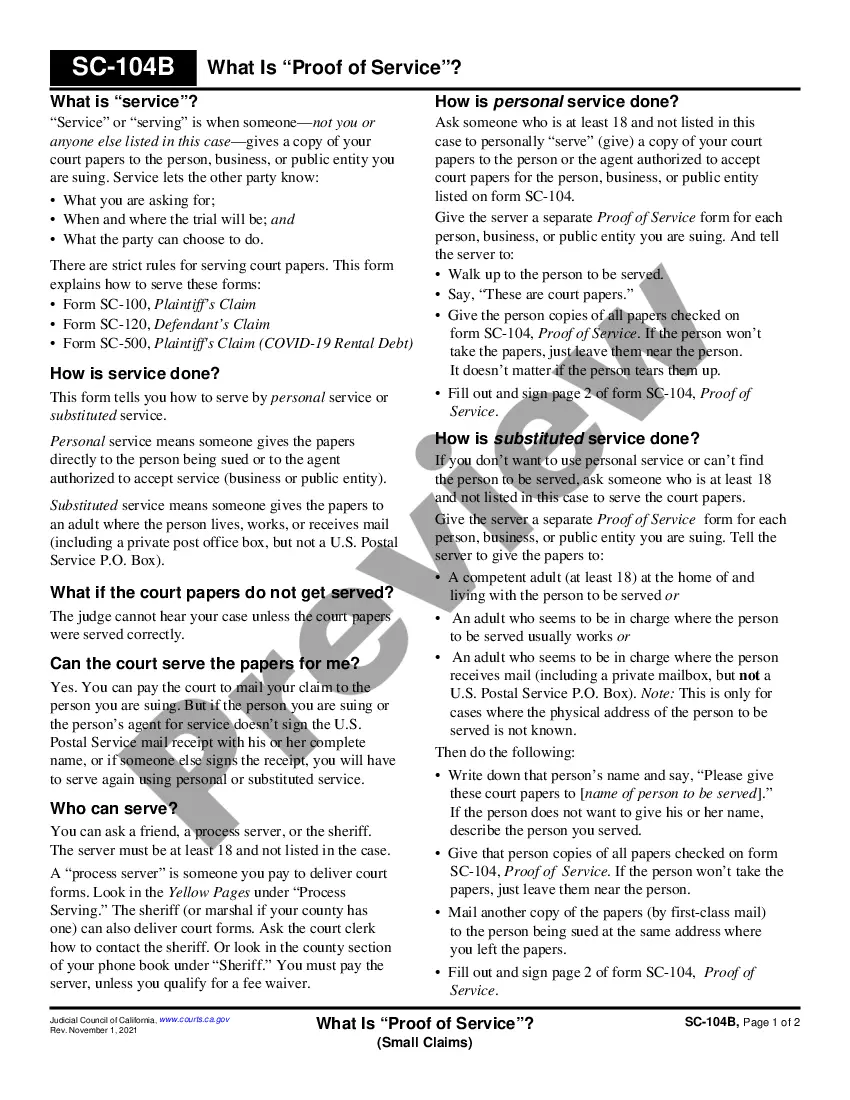

A source code escrow agreement typically instructs the agent to release the source code to the licensee if and when a specified event occurs, such as the licensor becoming insolvent or defaulting on its maintenance obligations under the principal license agreement.

When the executed escrow instructions differ from the purchase agreement, which of the following is correct? The escrow instructions take precedence. The escrow instructions take precedence over all other documents. - remain neutral by acting as an agent for both buyer and seller.

With an escrow payment, the Seller will only receive the funds when the Buyer has received and accepted the products and/or services that are part of the transaction. However, the Seller knows they will receive payment because Escrow.com is holding the funds on their behalf.

The escrow agreement is a contract entered by two or more parties under which an escrow agent is appointed to hold in escrow certain assets, documents, and/or money deposited by such parties until a contractual condition is fulfilled.

Escrow agreements provide security by delegating an asset to an escrow agent for safekeeping until each party meets his or her contractual obligations.

Escrow is the use of a third party, which holds an asset or funds before they are transferred from one party to another. The third-party holds the funds until both parties have fulfilled their contractual requirements.

If you are asking the difference between in escrow vs under contract well, they essentially mean the same thing. Kind of like how people in one state call a fizzy sugary drink soda and others call it pop.

The two essential elements for a valid sale escrow are a binding contract/agreement between buyer and seller and the conditional delivery to a neutral third party of something of value, as defined, which typically includes written instruments of conveyance (grant deed) or encumbrance (deed of trust) and related

Most escrow agreements are put into place when one party wants to make sure the other party meets certain conditions or obligations before it moves forward with a deal. For instance, a seller may set up an escrow agreement to ensure a potential homebuyer can secure financing before the sale goes through.

The escrow instructions define the events and conditions that must take place and the manner in which the escrow agent shall deliver or release to the beneficiary of the escrow the assets, documents, and/or money held in escrow. The escrow instructions are commonly contemplated by the escrow agreement.