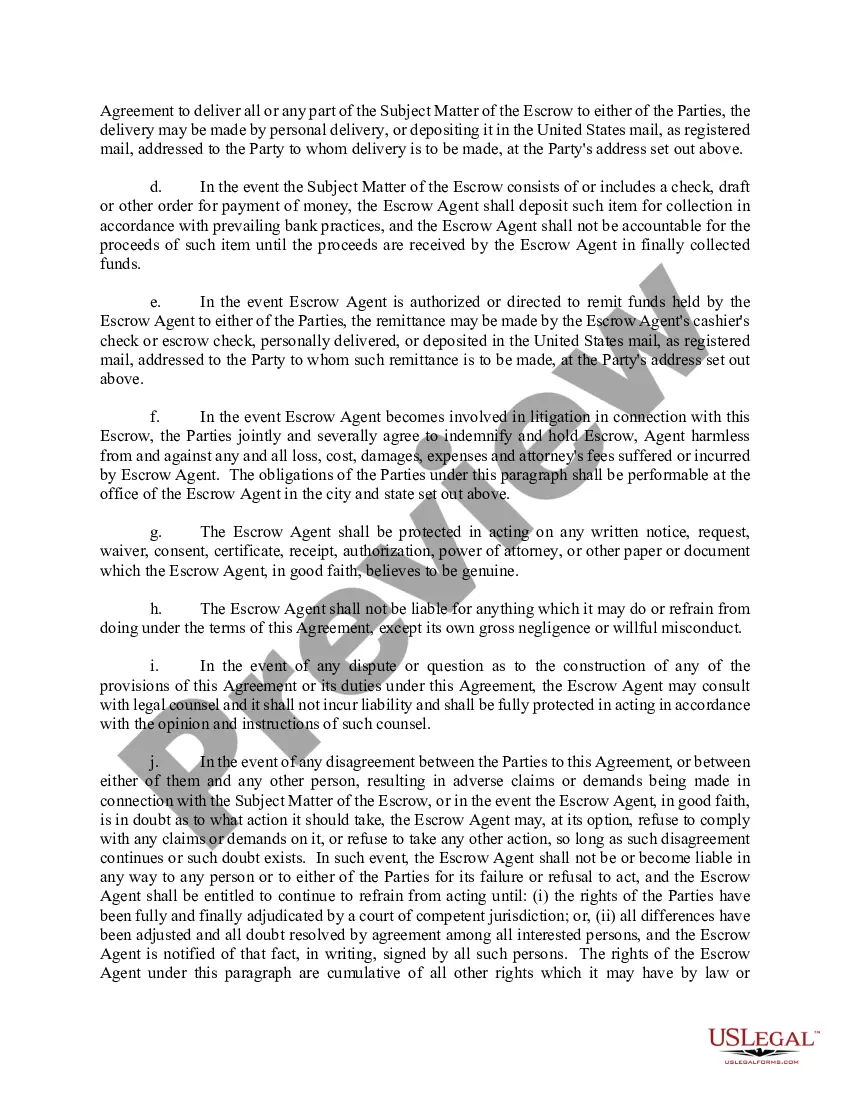

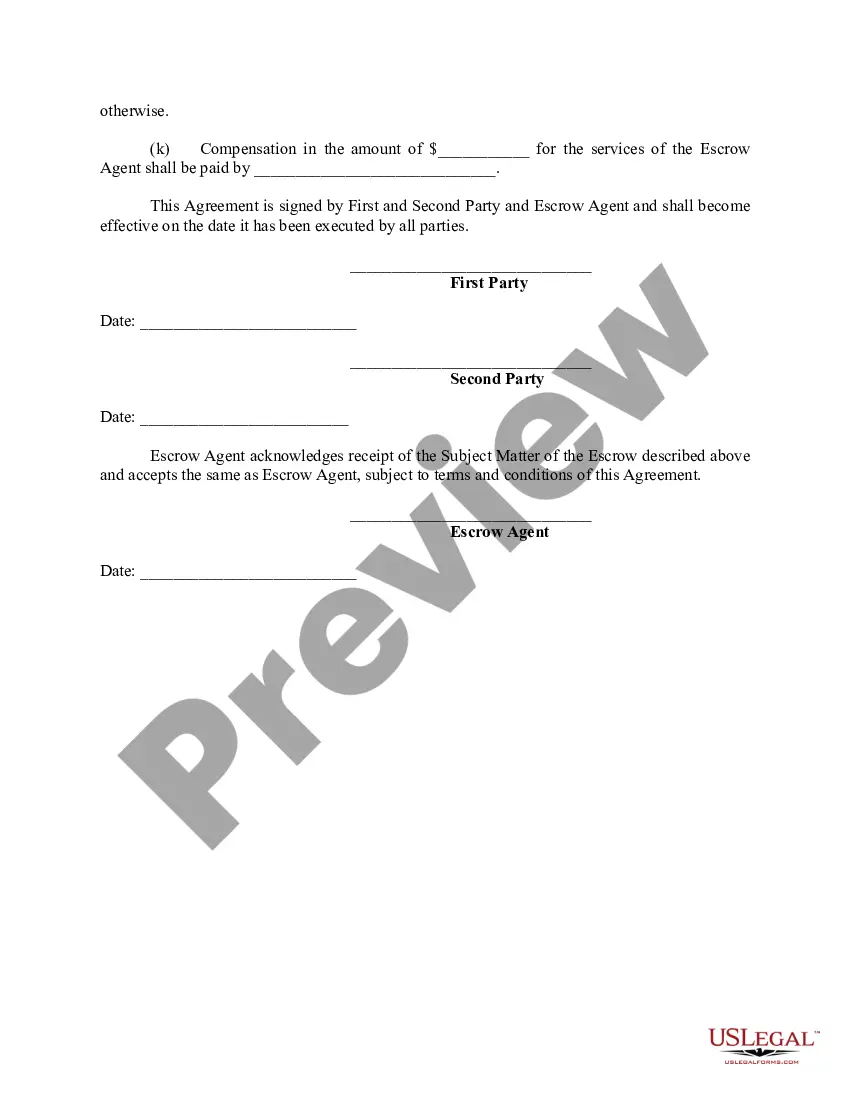

Escrow refers to a type of account in which the funds, escrow "instructions" from both parties, an accounting of the funds and other documents necessary to complete the transaction by a certain date, is held by a third party, called an "escrow agent", until the conditions of an agreement are met. This is a form of an Escrow Agreement.

San Diego California Escrow Agreement is a legally binding contract between two parties involved in a real estate transaction, ensuring the secure handling of funds and documents throughout the process. This agreement is commonly used in San Diego, California, to facilitate the closing of a real estate deal while protecting both the buyer and seller. In a San Diego California Escrow Agreement, an impartial third party, called an escrow agent, is appointed to act as a trusted intermediary. The escrow agent is responsible for holding all relevant documents, funds, and instructions until all the terms and conditions of the transaction are met. The San Diego California Escrow Agreement serves to safeguard the interests of both the buyer and seller during the transaction. It offers protection against fraudulent activities, ensures the transfer of clear title, and verifies the completion of all agreed-upon obligations and contingencies. There are various types of San Diego California Escrow Agreements, each tailored to specific real estate transactions. Some of these include: 1. Residential Escrow Agreement: This type of agreement is used when buying or selling residential properties, such as houses, condominiums, or townhouses, in San Diego, California. 2. Commercial Escrow Agreement: Often used for purchasing or selling commercial properties, such as office buildings, retail spaces, or industrial properties, this agreement provides a framework for secure transactions specifically in the commercial real estate sector. 3. Bulk Sale Escrow Agreement: This agreement applies when a business owner intends to sell or transfer many assets, inventory, or equipment as a single transaction. It ensures that both parties comply with the legal obligations and protects the interests of all involved. 4. Construction Escrow Agreement: When undertaking a construction project in San Diego, California, this agreement is used to hold funds in escrow and disburse them as milestones or specific conditions are met throughout the construction process. 5. Refinance Escrow Agreement: This type of escrow agreement is relevant in the case of refinancing a property in San Diego, California. It ensures that all outstanding balances, liens, and fees are settled correctly before the new loan is finalized. In summary, a San Diego California Escrow Agreement plays a crucial role in ensuring a secure and transparent real estate transaction in San Diego, California. It protects the interests of both parties, provides a neutral intermediary, and ensures compliance with all legal requirements. The specific type of escrow agreement used depends on the nature of the transaction, whether it involves residential properties, commercial properties, bulk sales, construction projects, or refinancing.San Diego California Escrow Agreement is a legally binding contract between two parties involved in a real estate transaction, ensuring the secure handling of funds and documents throughout the process. This agreement is commonly used in San Diego, California, to facilitate the closing of a real estate deal while protecting both the buyer and seller. In a San Diego California Escrow Agreement, an impartial third party, called an escrow agent, is appointed to act as a trusted intermediary. The escrow agent is responsible for holding all relevant documents, funds, and instructions until all the terms and conditions of the transaction are met. The San Diego California Escrow Agreement serves to safeguard the interests of both the buyer and seller during the transaction. It offers protection against fraudulent activities, ensures the transfer of clear title, and verifies the completion of all agreed-upon obligations and contingencies. There are various types of San Diego California Escrow Agreements, each tailored to specific real estate transactions. Some of these include: 1. Residential Escrow Agreement: This type of agreement is used when buying or selling residential properties, such as houses, condominiums, or townhouses, in San Diego, California. 2. Commercial Escrow Agreement: Often used for purchasing or selling commercial properties, such as office buildings, retail spaces, or industrial properties, this agreement provides a framework for secure transactions specifically in the commercial real estate sector. 3. Bulk Sale Escrow Agreement: This agreement applies when a business owner intends to sell or transfer many assets, inventory, or equipment as a single transaction. It ensures that both parties comply with the legal obligations and protects the interests of all involved. 4. Construction Escrow Agreement: When undertaking a construction project in San Diego, California, this agreement is used to hold funds in escrow and disburse them as milestones or specific conditions are met throughout the construction process. 5. Refinance Escrow Agreement: This type of escrow agreement is relevant in the case of refinancing a property in San Diego, California. It ensures that all outstanding balances, liens, and fees are settled correctly before the new loan is finalized. In summary, a San Diego California Escrow Agreement plays a crucial role in ensuring a secure and transparent real estate transaction in San Diego, California. It protects the interests of both parties, provides a neutral intermediary, and ensures compliance with all legal requirements. The specific type of escrow agreement used depends on the nature of the transaction, whether it involves residential properties, commercial properties, bulk sales, construction projects, or refinancing.