San Diego, California, is a beautiful coastal city located in the southern part of the state. Known for its pleasant climate, stunning beaches, and vibrant culture, San Diego is a popular destination for both travelers and residents alike. In the realm of business, San Diego offers various opportunities, including the Option Agreement to Acquire Oil and Gas Lease. This agreement refers to a legal contract between a property owner, commonly referred to as the lessor, and an interested party, known as the lessee, who wishes to explore and potentially extract oil and gas resources from the lessor's property. The San Diego California Option Agreement to Acquire Oil and Gas Lease represents an agreement wherein the lessee gains the exclusive right to explore and develop oil and gas reserves on the lessor's property. This type of agreement typically includes terms and conditions related to the lease duration, payment structure, royalties, and environmental considerations. There are several types of San Diego California Option Agreements to Acquire Oil and Gas Lease, each offering varying terms and conditions: 1. Standard Option Agreement: This type of agreement is the most common and includes provisions regarding lease duration, payment schedule, royalty rates, and operational guidelines. 2. Joint Venture Option Agreement: This agreement involves a partnership between the lessor and the lessee, where both parties contribute resources and expertise to explore and extract oil and gas reserves. This type of agreement often includes a profit-sharing arrangement and allows for shared risks and rewards. 3. Farm out Option Agreement: In this type of agreement, the lessee takes over the exploration and development of the lessor's property, while the lessor retains an ownership interest in the potential oil and gas reserves. The lessor usually receives a royalties' percentage from the future production. 4. Unitization Option Agreement: This agreement involves combining several small leases or portions of leases into a single unit to streamline operations and improve efficiency in oil and gas extraction. It ensures proper utilization of resources and allows for cost-sharing among the participants. San Diego California Option Agreements to Acquire Oil and Gas Lease play a crucial role in promoting energy exploration, production, and economic growth in the region. These agreements establish a legal framework for both parties, ensuring fair compensation, environmental compliance, and sustainable resource management. Investing in San Diego's oil and gas sector through a well-structured Option Agreement to Acquire Oil and Gas Lease can present significant opportunities for both the lessor and the lessee. It is crucial for all parties involved to thoroughly review and negotiate the terms, seek legal counsel, and ensure compliance with regulatory requirements to maximize the benefits and minimize potential risks.

San Diego California Option Agreement to Acquire Oil and Gas Lease

Description

How to fill out San Diego California Option Agreement To Acquire Oil And Gas Lease?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any personal or business purpose utilized in your region, including the San Diego Option Agreement to Acquire Oil and Gas Lease.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the San Diego Option Agreement to Acquire Oil and Gas Lease will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to obtain the San Diego Option Agreement to Acquire Oil and Gas Lease:

- Make sure you have opened the right page with your local form.

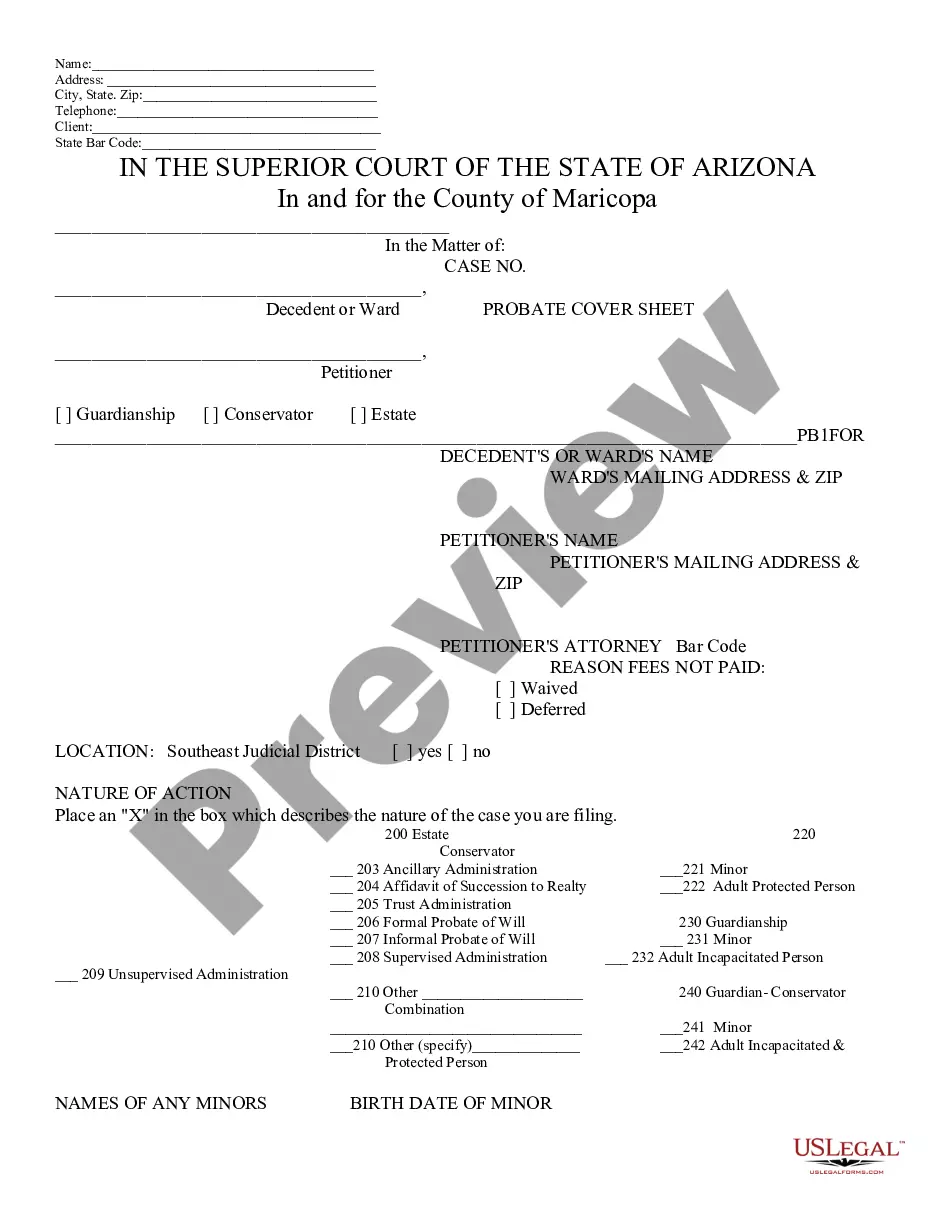

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the San Diego Option Agreement to Acquire Oil and Gas Lease on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!