This form is used when Seller and Buyer are entering into a Purchase and Sale Agreement including all of the Seller's rights, title and interests in and to the oil, gas and other minerals in and under and that may be produced from the lands described in Exhibit "A" including, without limitation, interests in oil, gas and/or mineral leases covering any part of the lands, overriding royalty interests, production payments, and net profits interests in any part of the lands or leases, fee royalty interests, fee mineral interests, and other interests in oil, gas and other minerals in any part of the lands.

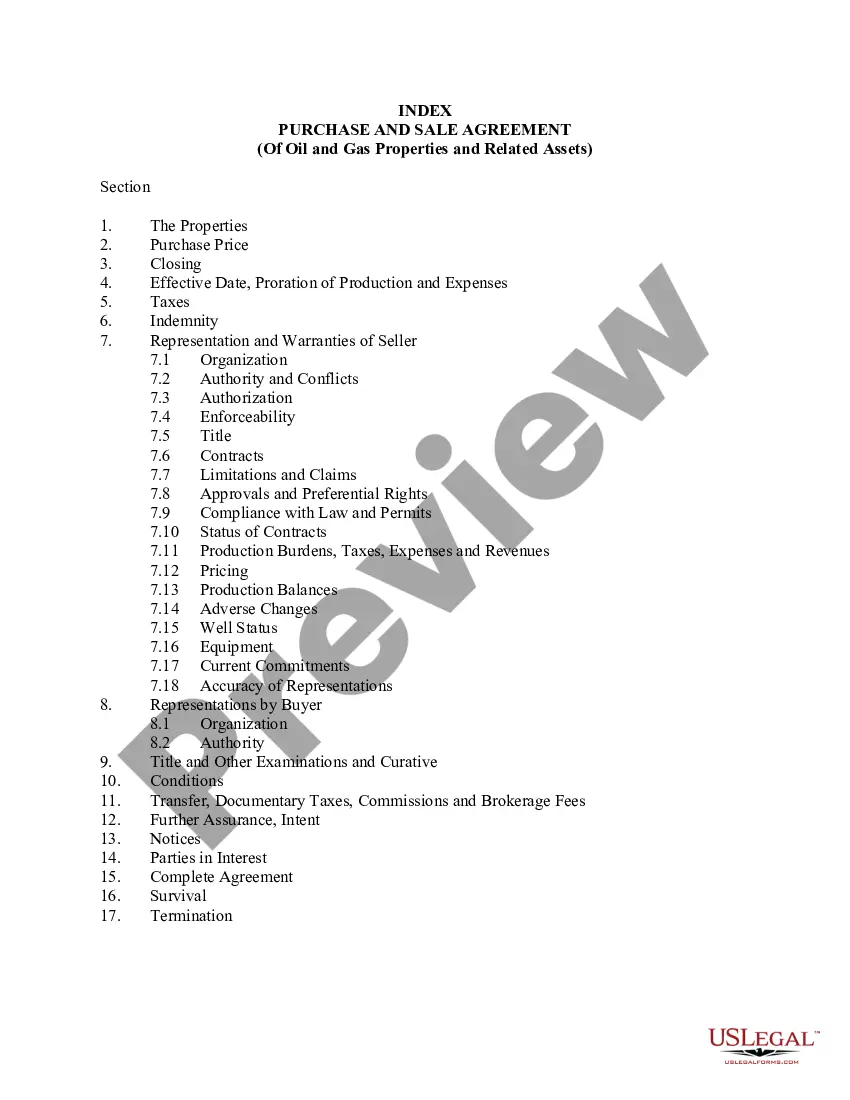

Travis Texas Purchase and Sale Agreement of Oil and Gas Properties and Related Assets is a legally binding contract used in the oil and gas industry to facilitate the transfer of ownership of properties and assets. This agreement outlines the terms and conditions of the purchase and sale transaction, protecting the rights and interests of both the buyer and seller involved. Keyword: Purchase and Sale Agreement The Travis Texas Purchase and Sale Agreement of Oil and Gas Properties and Related Assets can cover various types of transactions, including but not limited to: 1. Conventional Oil and Gas Properties: This agreement is used for the transfer of ownership of traditional oil and gas properties, including leased land, wells, infrastructure, and associated assets. 2. Unconventional Oil and Gas Properties: As the energy industry evolves, this agreement can also encompass the purchase and sale of unconventional oil and gas properties, such as shale gas reserves, tight oil formations, or coal bed methane assets. 3. Mineral Rights: In many cases, the agreement may focus on the transfer of mineral rights alone, allowing the buyer to access and extract oil and gas reserves while the landowner retains ownership of the surface property. 4. Royalty Interests: This type of agreement can specifically address the purchase and sale of royalty interests, wherein the buyer acquires a percentage of future revenue generated from oil and gas production on a particular property. 5. Working Interests: Another variation of this agreement pertains to working interests, where the buyer procures an ownership stake in the operations and development of an oil and gas property. This may involve sharing costs, risks, and profits with other working interest owners. 6. Midstream Assets: The Travis Texas Purchase and Sale Agreement can further include midstream assets like pipelines, compressor stations, storage facilities, or gathering systems, which are crucial for transporting and processing oil and gas. 7. Infrastructure and Equipment: Besides land and subsurface assets, the agreement may encompass the sale of associated infrastructure, machinery, equipment, and facilities necessary for oil and gas operations. Keywords: Oil and Gas Properties, Related Assets, Travis Texas As a legally intricate document, the Travis Texas Purchase and Sale Agreement of Oil and Gas Properties and Related Assets addresses key provisions, including purchase price, payment terms, representations and warranties, due diligence, title examination, approval processes, closing conditions, and dispute resolution mechanisms. It is imperative for both parties to engage legal counsel to ensure compliance with applicable state and federal laws, as well as industry standards and regulations. Overall, the Travis Texas Purchase and Sale Agreement of Oil and Gas Properties and Related Assets serves as a vital tool for facilitating transparent, fair, and efficient transactions within the dynamic and ever-evolving oil and gas industry in Travis County, Texas.Travis Texas Purchase and Sale Agreement of Oil and Gas Properties and Related Assets is a legally binding contract used in the oil and gas industry to facilitate the transfer of ownership of properties and assets. This agreement outlines the terms and conditions of the purchase and sale transaction, protecting the rights and interests of both the buyer and seller involved. Keyword: Purchase and Sale Agreement The Travis Texas Purchase and Sale Agreement of Oil and Gas Properties and Related Assets can cover various types of transactions, including but not limited to: 1. Conventional Oil and Gas Properties: This agreement is used for the transfer of ownership of traditional oil and gas properties, including leased land, wells, infrastructure, and associated assets. 2. Unconventional Oil and Gas Properties: As the energy industry evolves, this agreement can also encompass the purchase and sale of unconventional oil and gas properties, such as shale gas reserves, tight oil formations, or coal bed methane assets. 3. Mineral Rights: In many cases, the agreement may focus on the transfer of mineral rights alone, allowing the buyer to access and extract oil and gas reserves while the landowner retains ownership of the surface property. 4. Royalty Interests: This type of agreement can specifically address the purchase and sale of royalty interests, wherein the buyer acquires a percentage of future revenue generated from oil and gas production on a particular property. 5. Working Interests: Another variation of this agreement pertains to working interests, where the buyer procures an ownership stake in the operations and development of an oil and gas property. This may involve sharing costs, risks, and profits with other working interest owners. 6. Midstream Assets: The Travis Texas Purchase and Sale Agreement can further include midstream assets like pipelines, compressor stations, storage facilities, or gathering systems, which are crucial for transporting and processing oil and gas. 7. Infrastructure and Equipment: Besides land and subsurface assets, the agreement may encompass the sale of associated infrastructure, machinery, equipment, and facilities necessary for oil and gas operations. Keywords: Oil and Gas Properties, Related Assets, Travis Texas As a legally intricate document, the Travis Texas Purchase and Sale Agreement of Oil and Gas Properties and Related Assets addresses key provisions, including purchase price, payment terms, representations and warranties, due diligence, title examination, approval processes, closing conditions, and dispute resolution mechanisms. It is imperative for both parties to engage legal counsel to ensure compliance with applicable state and federal laws, as well as industry standards and regulations. Overall, the Travis Texas Purchase and Sale Agreement of Oil and Gas Properties and Related Assets serves as a vital tool for facilitating transparent, fair, and efficient transactions within the dynamic and ever-evolving oil and gas industry in Travis County, Texas.