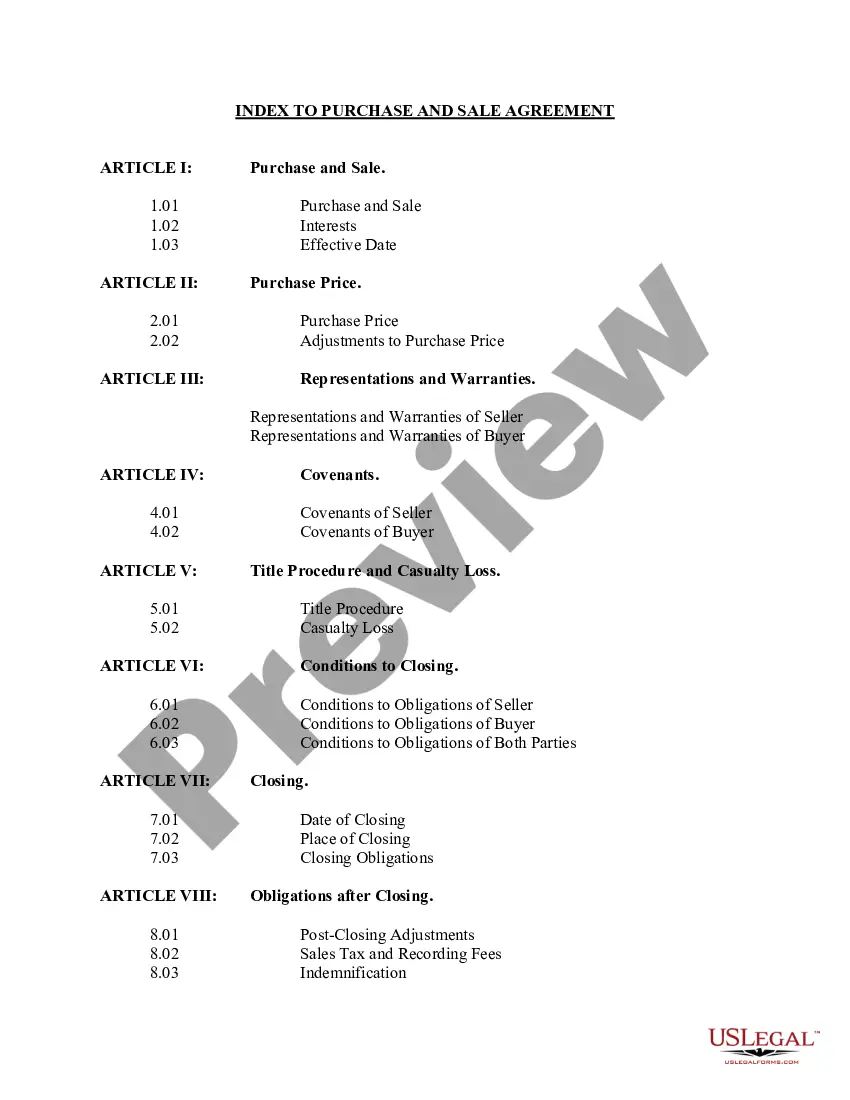

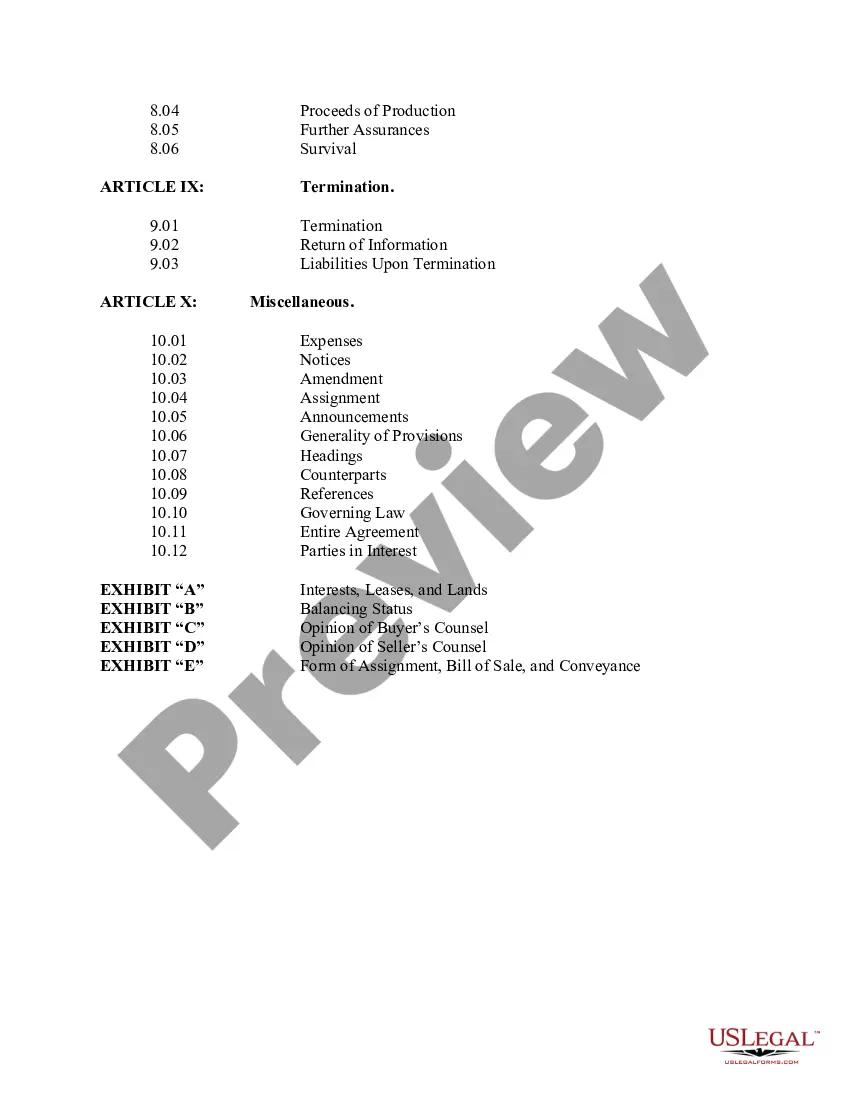

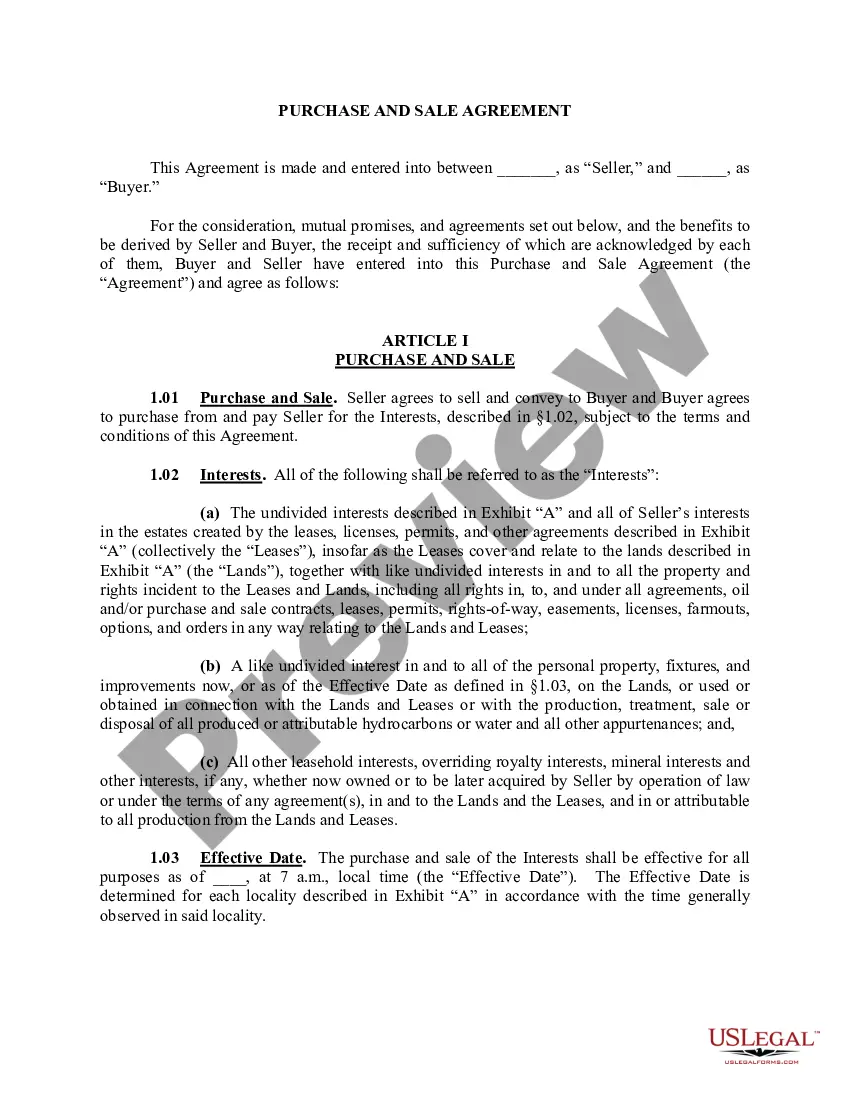

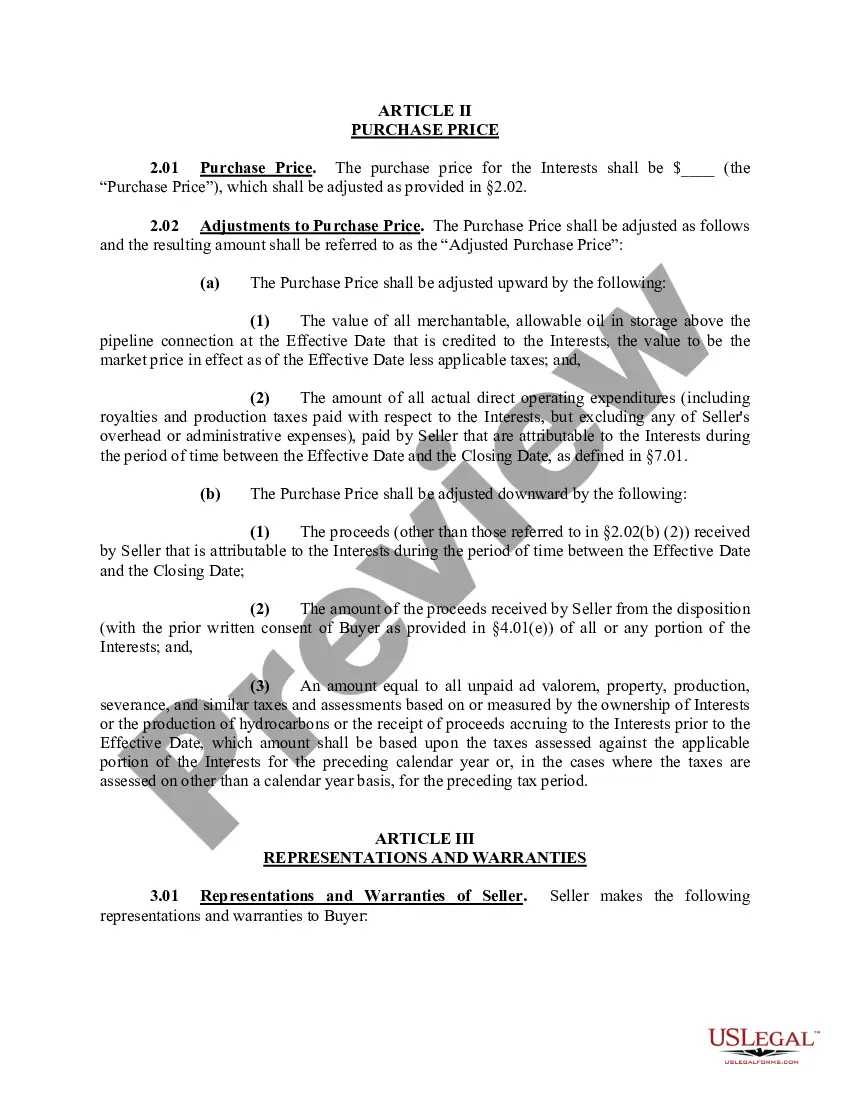

This form is used when Seller and Buyer are entering into a Purchase and Sale Agreement including all of the Seller's rights, title and interests in and to the oil, gas and other minerals in and under and that may be produced from the lands described in Exhibit "A" including, without limitation, interests in oil, gas and/or mineral leases covering any part of the lands, overriding royalty interests, production payments, and net profits interests in any part of the lands or leases, fee royalty interests, fee mineral interests, and other interests in oil, gas and other minerals in any part of the lands.

A Harris Texas Purchase and Sale Agreement is a legally binding document that outlines the terms and conditions of a real estate transaction in the Harris County area of Texas. This agreement serves as a contract between the buyer and the seller, establishing their respective rights and obligations throughout the buying or selling process. The Harris Texas Purchase and Sale Agreement typically includes key details such as the names and contact information of both parties, property description (including address, lot size, and any included fixtures or appliances), purchase price, earnest money deposit, financing terms, closing date, contingencies, and provisions for property inspections and repairs. It is important to note that while there might not be different types of Harris Texas Purchase and Sale Agreements, the agreement can be customized or modified with specific clauses or addendums tailored to the needs of the buyer and seller. Some common variations may include: 1. As-Is Agreements: This type of agreement states that the property is being sold in its current condition, and the seller is not responsible for any repairs or issues discovered after the sale. 2. Contingency Agreements: These agreements include specific provisions that allow the buyer to terminate the contract if certain conditions are not met. Examples of common contingencies include financing contingencies, inspection contingencies, or the sale of the buyer's current home. 3. Lease Purchase Agreements: This type of agreement combines a lease agreement and a purchase agreement, allowing the buyer to rent the property for a specified period before completing the purchase. 4. Cash Sale Agreements: In this type of agreement, the buyer purchases the property with cash, eliminating the need for financing or mortgage contingencies. Overall, a Harris Texas Purchase and Sale Agreement serves as a crucial document that protects the interests of both parties involved in a real estate transaction. It ensures transparency, safeguards against potential disputes, and provides a clear framework for completing the sale of a property in the Harris County area of Texas.A Harris Texas Purchase and Sale Agreement is a legally binding document that outlines the terms and conditions of a real estate transaction in the Harris County area of Texas. This agreement serves as a contract between the buyer and the seller, establishing their respective rights and obligations throughout the buying or selling process. The Harris Texas Purchase and Sale Agreement typically includes key details such as the names and contact information of both parties, property description (including address, lot size, and any included fixtures or appliances), purchase price, earnest money deposit, financing terms, closing date, contingencies, and provisions for property inspections and repairs. It is important to note that while there might not be different types of Harris Texas Purchase and Sale Agreements, the agreement can be customized or modified with specific clauses or addendums tailored to the needs of the buyer and seller. Some common variations may include: 1. As-Is Agreements: This type of agreement states that the property is being sold in its current condition, and the seller is not responsible for any repairs or issues discovered after the sale. 2. Contingency Agreements: These agreements include specific provisions that allow the buyer to terminate the contract if certain conditions are not met. Examples of common contingencies include financing contingencies, inspection contingencies, or the sale of the buyer's current home. 3. Lease Purchase Agreements: This type of agreement combines a lease agreement and a purchase agreement, allowing the buyer to rent the property for a specified period before completing the purchase. 4. Cash Sale Agreements: In this type of agreement, the buyer purchases the property with cash, eliminating the need for financing or mortgage contingencies. Overall, a Harris Texas Purchase and Sale Agreement serves as a crucial document that protects the interests of both parties involved in a real estate transaction. It ensures transparency, safeguards against potential disputes, and provides a clear framework for completing the sale of a property in the Harris County area of Texas.