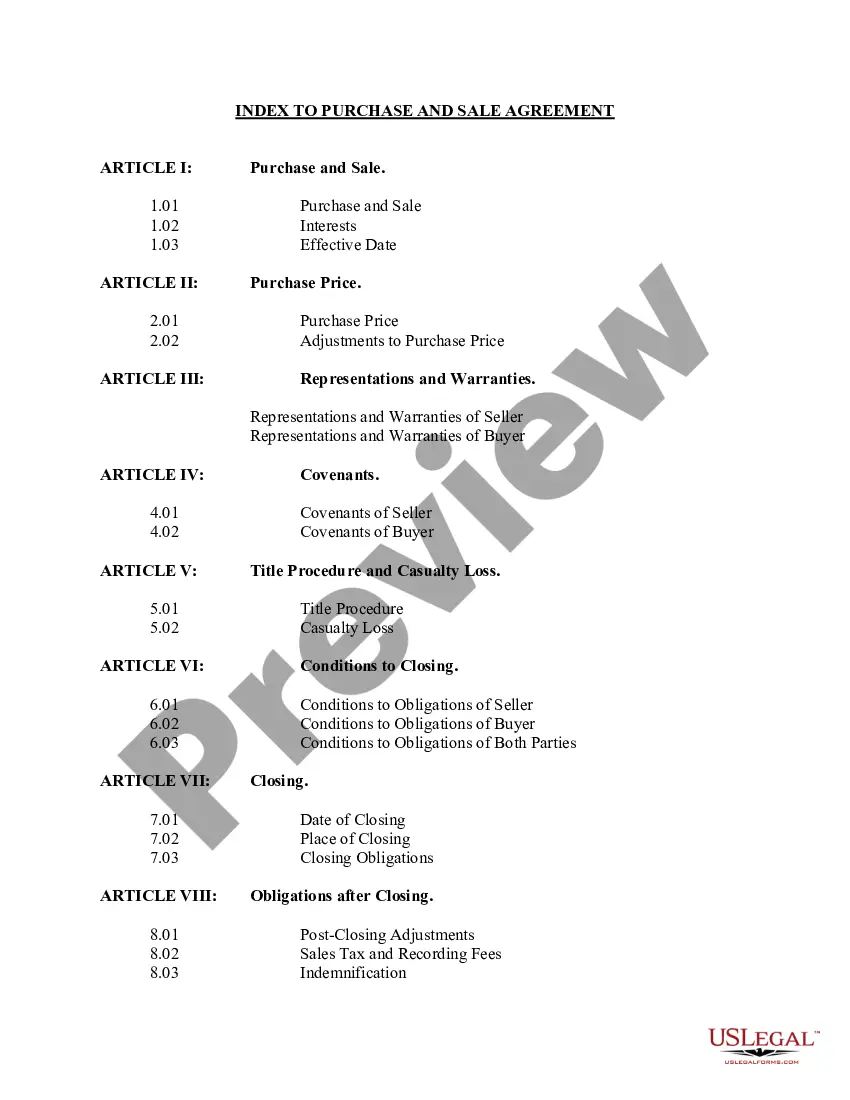

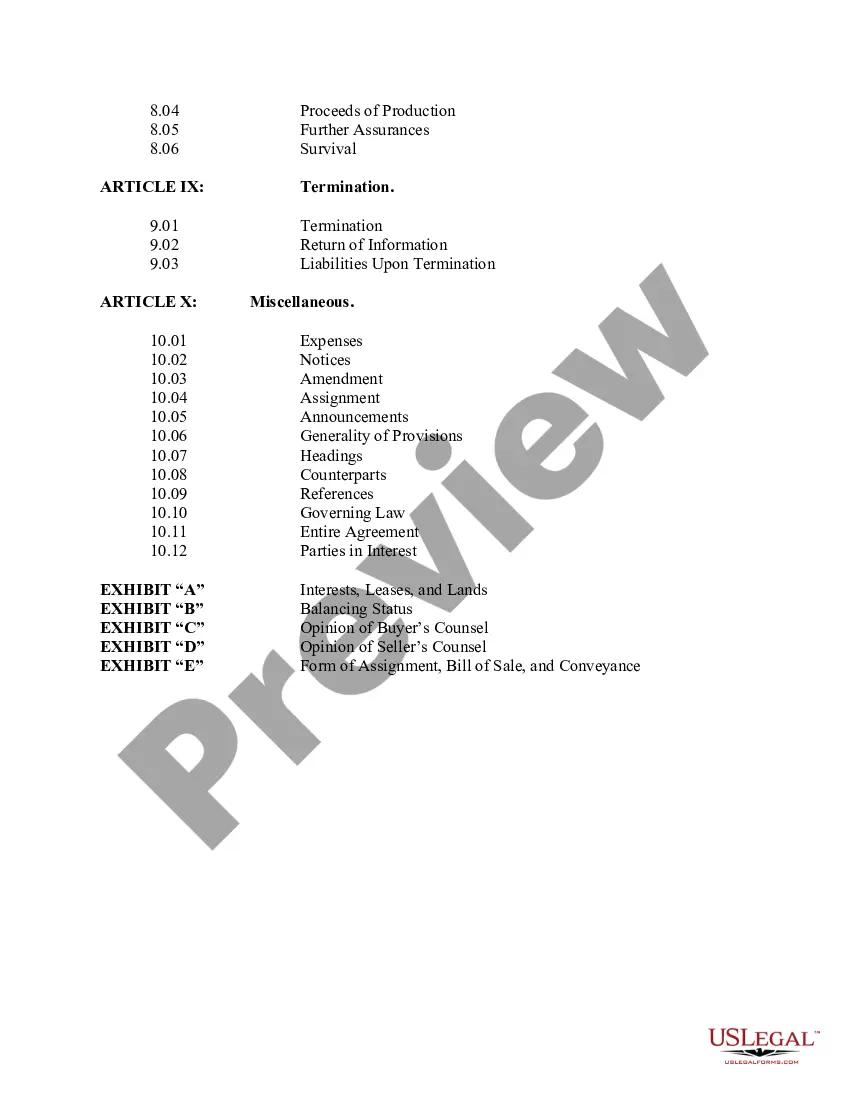

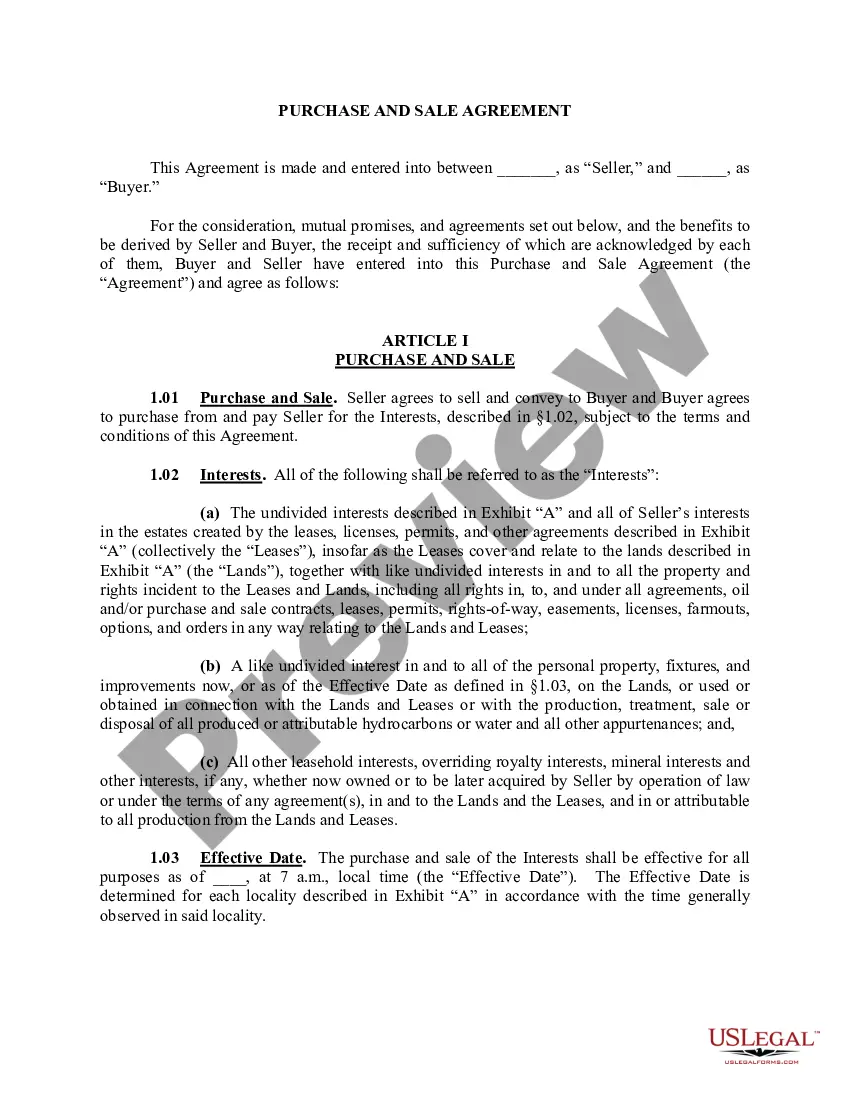

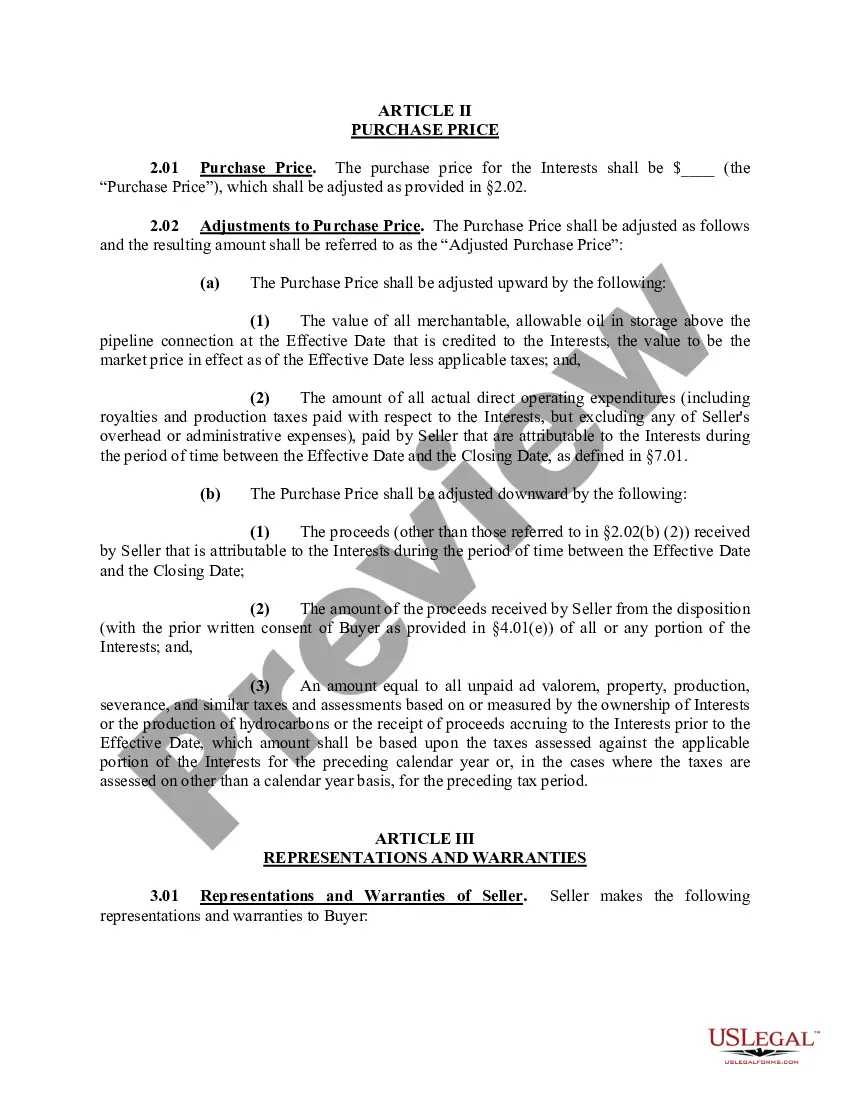

This form is used when Seller and Buyer are entering into a Purchase and Sale Agreement including all of the Seller's rights, title and interests in and to the oil, gas and other minerals in and under and that may be produced from the lands described in Exhibit "A" including, without limitation, interests in oil, gas and/or mineral leases covering any part of the lands, overriding royalty interests, production payments, and net profits interests in any part of the lands or leases, fee royalty interests, fee mineral interests, and other interests in oil, gas and other minerals in any part of the lands.

Nassau New York Purchase and Sale Agreement is a legally binding contract that outlines the terms and conditions of buying and selling real estate properties in Nassau County, New York. This agreement serves as a crucial document in the purchase or sale of residential and commercial properties, ensuring clarity and protection for both the buyer and seller. The Nassau New York Purchase and Sale Agreement typically includes details such as the property's address, legal description, purchase price, financing terms, contingencies (such as inspections and mortgage approvals), deposit amount, closing date, and provisions for potential disputes. Key terms involved in a Nassau New York Purchase and Sale Agreement include: 1. Property details: This section includes the property's address, legal description, and any specific details that distinguish it from other properties. Accurate and comprehensive descriptions are essential to avoid future conflicts. 2. Purchase price: The agreement specifies the agreed-upon purchase price for the property. It may also outline any additional costs, such as taxes, closing costs, or commission fees. 3. Financing terms: If the buyer plans to finance a portion of the purchase, the agreement should state the terms of the loan, including the interest rate, loan amount, and any contingency related to mortgage approval. 4. Contingencies: These provisions protect the buyer by allowing them to back out of the agreement if certain conditions aren't met. Typical contingencies include satisfactory home inspections, appraisal results, and mortgage approval. 5. Deposit amount and terms: The agreement stipulates the amount of earnest money (deposit) to be provided by the buyer as a sign of good faith. It also outlines what happens to the deposit in case of a breach of contract. 6. Closing date: This date marks the transfer of ownership from the seller to the buyer. It is crucial to establish a mutually agreed-upon closing date to ensure a smooth transaction. 7. Dispute resolution: The agreement may include provisions for resolving disputes, such as mediation or arbitration, before resorting to legal action. Different types of Nassau New York Purchase and Sale Agreements may vary based on the type of property being bought or sold. For instance, there may be separate agreements for residential properties, commercial properties, or vacant land. Additionally, different agreements may be used for properties being sold through a foreclosure or short sale process. Overall, a well-drafted Nassau New York Purchase and Sale Agreement is essential to protecting the rights and interests of both buyers and sellers, providing a clear framework for the transfer of real estate property in Nassau County, New York.Nassau New York Purchase and Sale Agreement is a legally binding contract that outlines the terms and conditions of buying and selling real estate properties in Nassau County, New York. This agreement serves as a crucial document in the purchase or sale of residential and commercial properties, ensuring clarity and protection for both the buyer and seller. The Nassau New York Purchase and Sale Agreement typically includes details such as the property's address, legal description, purchase price, financing terms, contingencies (such as inspections and mortgage approvals), deposit amount, closing date, and provisions for potential disputes. Key terms involved in a Nassau New York Purchase and Sale Agreement include: 1. Property details: This section includes the property's address, legal description, and any specific details that distinguish it from other properties. Accurate and comprehensive descriptions are essential to avoid future conflicts. 2. Purchase price: The agreement specifies the agreed-upon purchase price for the property. It may also outline any additional costs, such as taxes, closing costs, or commission fees. 3. Financing terms: If the buyer plans to finance a portion of the purchase, the agreement should state the terms of the loan, including the interest rate, loan amount, and any contingency related to mortgage approval. 4. Contingencies: These provisions protect the buyer by allowing them to back out of the agreement if certain conditions aren't met. Typical contingencies include satisfactory home inspections, appraisal results, and mortgage approval. 5. Deposit amount and terms: The agreement stipulates the amount of earnest money (deposit) to be provided by the buyer as a sign of good faith. It also outlines what happens to the deposit in case of a breach of contract. 6. Closing date: This date marks the transfer of ownership from the seller to the buyer. It is crucial to establish a mutually agreed-upon closing date to ensure a smooth transaction. 7. Dispute resolution: The agreement may include provisions for resolving disputes, such as mediation or arbitration, before resorting to legal action. Different types of Nassau New York Purchase and Sale Agreements may vary based on the type of property being bought or sold. For instance, there may be separate agreements for residential properties, commercial properties, or vacant land. Additionally, different agreements may be used for properties being sold through a foreclosure or short sale process. Overall, a well-drafted Nassau New York Purchase and Sale Agreement is essential to protecting the rights and interests of both buyers and sellers, providing a clear framework for the transfer of real estate property in Nassau County, New York.