Dallas, Texas is a vibrant city known for its booming oil and gas industry. It serves as a hub for energy exploration and production, making it an ideal location for various types of assignments related to partial interests in oil and gas leases and the reservation of overriding royalty interests. An assignment of partial interest in an oil and gas lease in Dallas, Texas is a legal document that allows an individual or company to transfer a portion of their ownership rights to another party. This type of assignment is commonly used when multiple individuals or entities own a lease and want to divide their interests among themselves or sell a portion of their rights to a third party. One specific type of assignment involving partial interest in an oil and gas lease is reserving an overriding royalty interest (ORRIS). An ORRIS allows the assignor to retain a portion of the future revenue generated from the lease, even after selling or transferring their interest to another party. This means that the assignor will continue to receive a specified percentage of the revenue derived from the lease, regardless of the changes in ownership that may occur in the future. The assignment of partial interest in an oil and gas lease reserving an overriding royalty interest can be further categorized into various subtypes, based on the specific terms and conditions outlined in the assignment agreement. Some of these subtypes include: 1. Assignment with Fixed Percentage ORRIS: In this type of assignment, the assignor reserves a fixed, predetermined percentage of the future revenue derived from the lease. For example, an assignor may reserve a 5% overriding royalty interest, entitling them to 5% of all revenue generated from the lease. 2. Assignment with Sliding Scale ORRIS: This subtype involves an overriding royalty interest that is calculated based on a sliding scale. The percentage of the revenue reserved by the assignor may vary depending on factors such as production volume, commodity pricing, or specific milestones outlined in the agreement. 3. Assignment with Carried Interest ORRIS: Carried interest refers to a situation where the assignor retains a portion of the overriding royalty interest without contributing financially to the exploration or development of the lease. This type of assignment is often used when an experienced operator wishes to secure future revenue while partnering with another party who funds the drilling and operational costs. 4. Assignment with Specific Term ORRIS: In some cases, an assignor may reserve an overriding royalty interest for a specific duration of time. This subtype allows the assignor to receive a percentage of the revenue for a defined period, after which the interest reverts to the assignee. Overall, the assignment of partial interest in an oil and gas lease reserving an overriding royalty interest in Dallas, Texas involves the transfer of ownership rights while retaining a certain portion of the future revenue from the lease. This legal arrangement offers a flexible approach for individuals or companies to optimize their interests in the lucrative oil and gas industry within the city.

Dallas Texas Assignment of Partial Interest in Oil and Gas Lease Reserving An Overriding Royalty Interest

Description

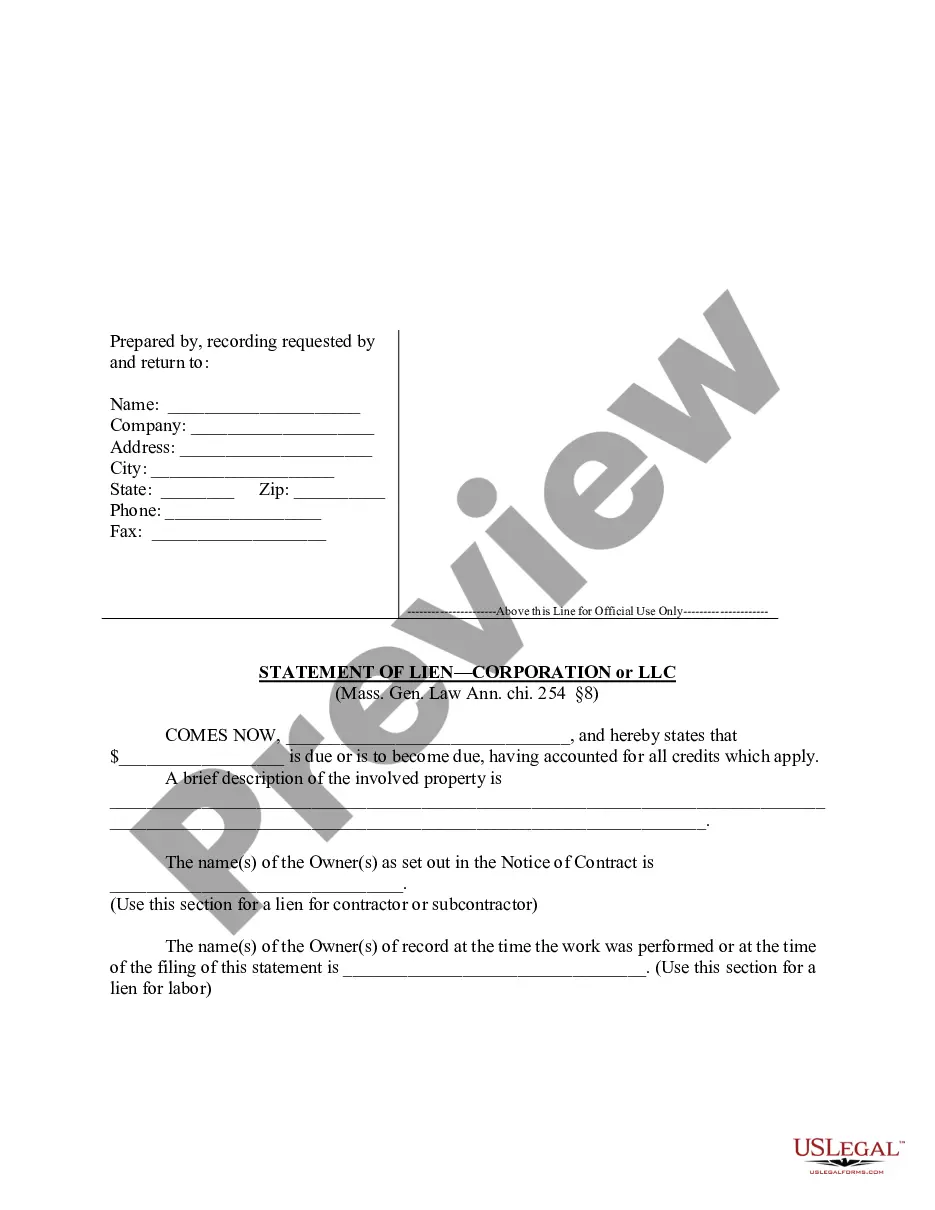

How to fill out Dallas Texas Assignment Of Partial Interest In Oil And Gas Lease Reserving An Overriding Royalty Interest?

Whether you intend to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business case. All files are collected by state and area of use, so opting for a copy like Dallas Assignment of Partial Interest in Oil and Gas Lease Reserving An Overriding Royalty Interest is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to get the Dallas Assignment of Partial Interest in Oil and Gas Lease Reserving An Overriding Royalty Interest. Adhere to the guide below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Assignment of Partial Interest in Oil and Gas Lease Reserving An Overriding Royalty Interest in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!