Salt Lake City, located in the state of Utah, is a vibrant and bustling urban center surrounded by breathtaking natural landscapes. As the state capital, it serves as the economic and cultural hub of Utah. Known for its beautiful mountain views, robust economy, and thriving arts scene, Salt Lake City attracts both tourists and residents alike. Within the Salt Lake City region, there are numerous opportunities for investment in the oil and gas industry. One such investment option is the partial assignment of interest in an oil and gas lease, specifically for converting an overriding royalty interest to a working interest. A partial assignment of interest involves transferring a portion of the ownership rights and obligations related to an oil and gas lease. In this case, it specifically relates to converting overriding royalty interest to a working interest. Overriding royalty interest (ORRIS) is a share of revenue earned from the production of oil and gas, usually in the form of a percentage. It does not carry any responsibility for the costs or risks associated with exploration and extraction activities. On the other hand, working interest represents an ownership stake in the lease, entitling the owner to a share of both revenue and associated costs and risks. By converting the overriding royalty interest to a working interest, an investor gains more control and involvement in the operations of the lease. This shift allows for a direct participation in decision-making and profit-sharing, making it an attractive option for those seeking a more hands-on approach to investment. Different types of Salt Lake Utah partial assignment of interest in oil and gas lease converting overriding royalty interest to working interest can include varying percentages of interest transferred and specific terms and conditions agreed upon by the involved parties. These terms and conditions typically outline the responsibilities, liabilities, and profit-sharing arrangements for both the assignor and the assignee. Investing in the oil and gas industry can be a lucrative venture, and the opportunity to convert an overriding royalty interest to a working interest in Salt Lake City presents a unique chance for increased involvement and potential returns. However, it is essential to conduct thorough research and consult with legal and industry experts to ensure a sound investment strategy and mitigate any potential risks.

Salt Lake Utah Partial Assignment of Interest in Oil and Gas Lease Converting Overriding Royalty Interest to Working Interest

Description

How to fill out Salt Lake Utah Partial Assignment Of Interest In Oil And Gas Lease Converting Overriding Royalty Interest To Working Interest?

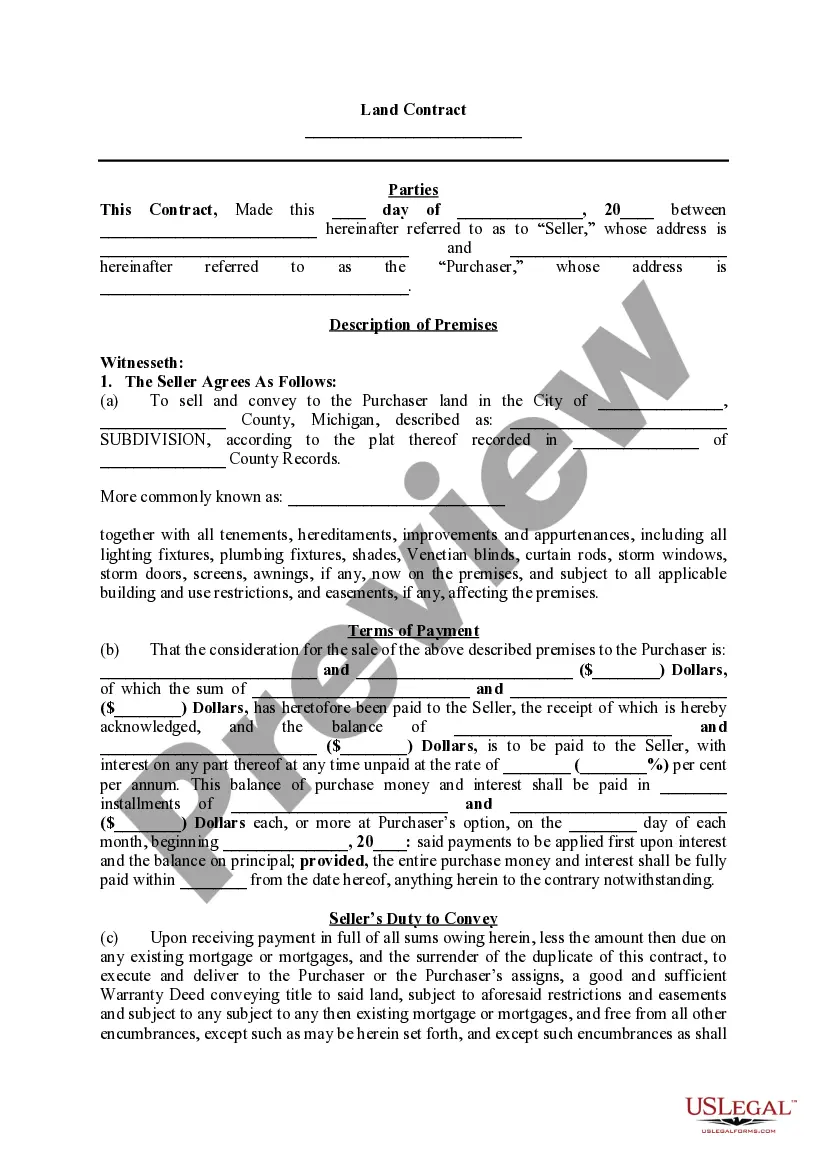

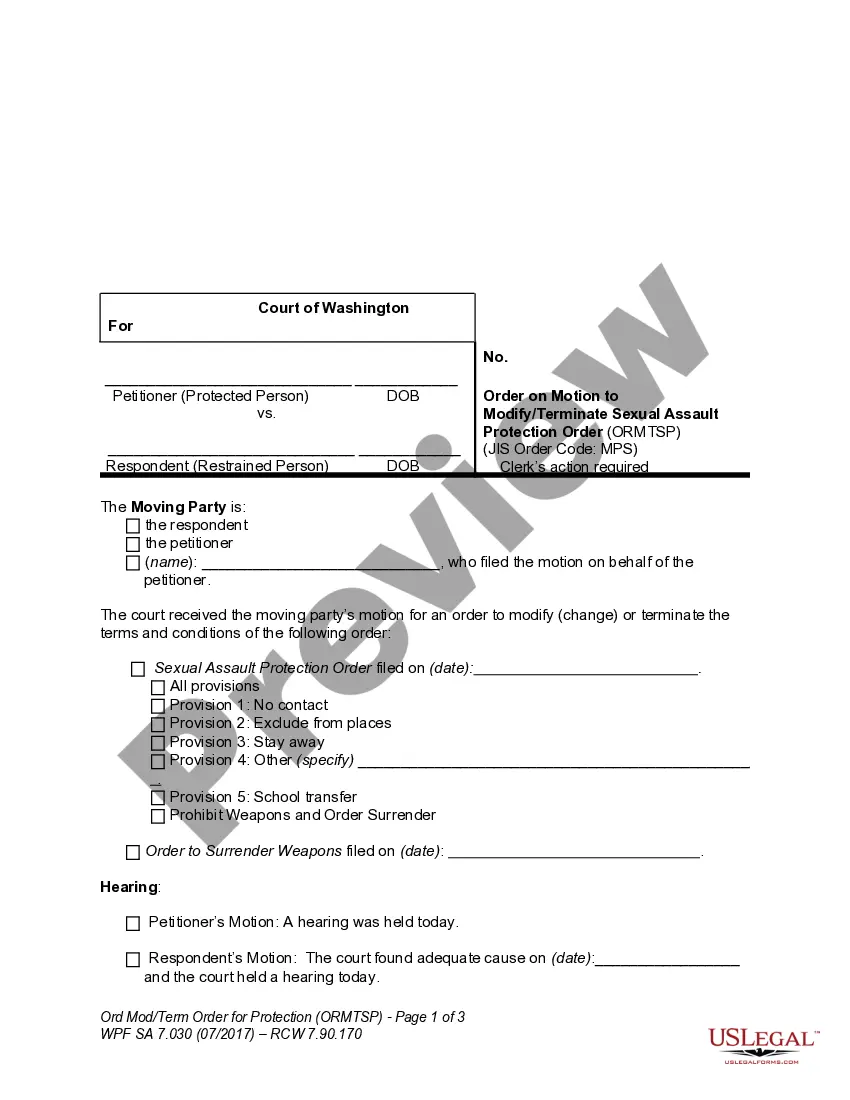

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Salt Lake Partial Assignment of Interest in Oil and Gas Lease Converting Overriding Royalty Interest to Working Interest, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find information resources and tutorials on the website to make any tasks associated with document execution straightforward.

Here's how you can purchase and download Salt Lake Partial Assignment of Interest in Oil and Gas Lease Converting Overriding Royalty Interest to Working Interest.

- Take a look at the document's preview and description (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Examine the similar document templates or start the search over to find the correct file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and buy Salt Lake Partial Assignment of Interest in Oil and Gas Lease Converting Overriding Royalty Interest to Working Interest.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Salt Lake Partial Assignment of Interest in Oil and Gas Lease Converting Overriding Royalty Interest to Working Interest, log in to your account, and download it. Of course, our platform can’t replace an attorney completely. If you have to cope with an exceptionally challenging situation, we recommend getting an attorney to review your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-compliant documents with ease!

Form popularity

FAQ

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.

Legal Definition of overriding royalty : an interest in and royalty on the oil, gas, or minerals extracted from another's land that is carved out of the producer's working interest and is not tied to production costs compare royalty.

Royalty Interest an ownership in production that bears no cost in production. Royalty interest owners receive their share of production revenue before the working interest owners. Working Interest an ownership in a well that bears 100% of the cost of production.

1. n. Oil and Gas Business A percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.