Phoenix, Arizona is a vibrant city located in the southwestern United States. Known for its warm climate, stunning desert landscapes, and thriving economy, Phoenix is a hub for various industries, including the oil and gas sector. When it comes to the assignment of oil and gas leases by an original lessee, a short form document is often used to simplify the process. This assignment involves the transfer of rights and responsibilities from the original lessee to a new party or entity. In Phoenix, Arizona, there are a few types of short form assignment of oil and gas leases by original lessee. These include: 1. Standard Short Form Assignment: This is a basic document that covers the necessary information related to the transfer of a lease. It outlines the parties involved, details about the original lease, and specifies the terms and conditions of the assignment. 2. Partial Assignment: In some cases, the original lessee may choose to assign only a portion of their rights and interests in the lease. This type of assignment allows for the division of responsibilities and benefits among multiple parties. 3. Temporary Assignment: When the original lessee wants to temporarily transfer their rights and obligations under the oil and gas lease, a short form temporary assignment document is utilized. This type of assignment typically includes a specific time frame and conditions for the transfer. 4. Sublease Assignment: In certain circumstances, the original lessee may decide to sublease the oil and gas lease to a third party. This type of assignment involves the transfer of rights to explore and extract resources, but the original lessee retains some level of control or interest in the lease. Regardless of the specific type of assignment, a short form document ensures that both parties involved in the transaction have a clear understanding of their rights and obligations. This simplifies the process and helps protect the interests of all parties. If you are involved in an assignment of oil and gas lease in Phoenix, Arizona, consulting with legal professionals experienced in the local regulations and industry practices is essential to ensure compliance and mitigate potential risks.

Phoenix Arizona Assignment of Oil and Gas Lease by Original Lessee, Short Form

Description

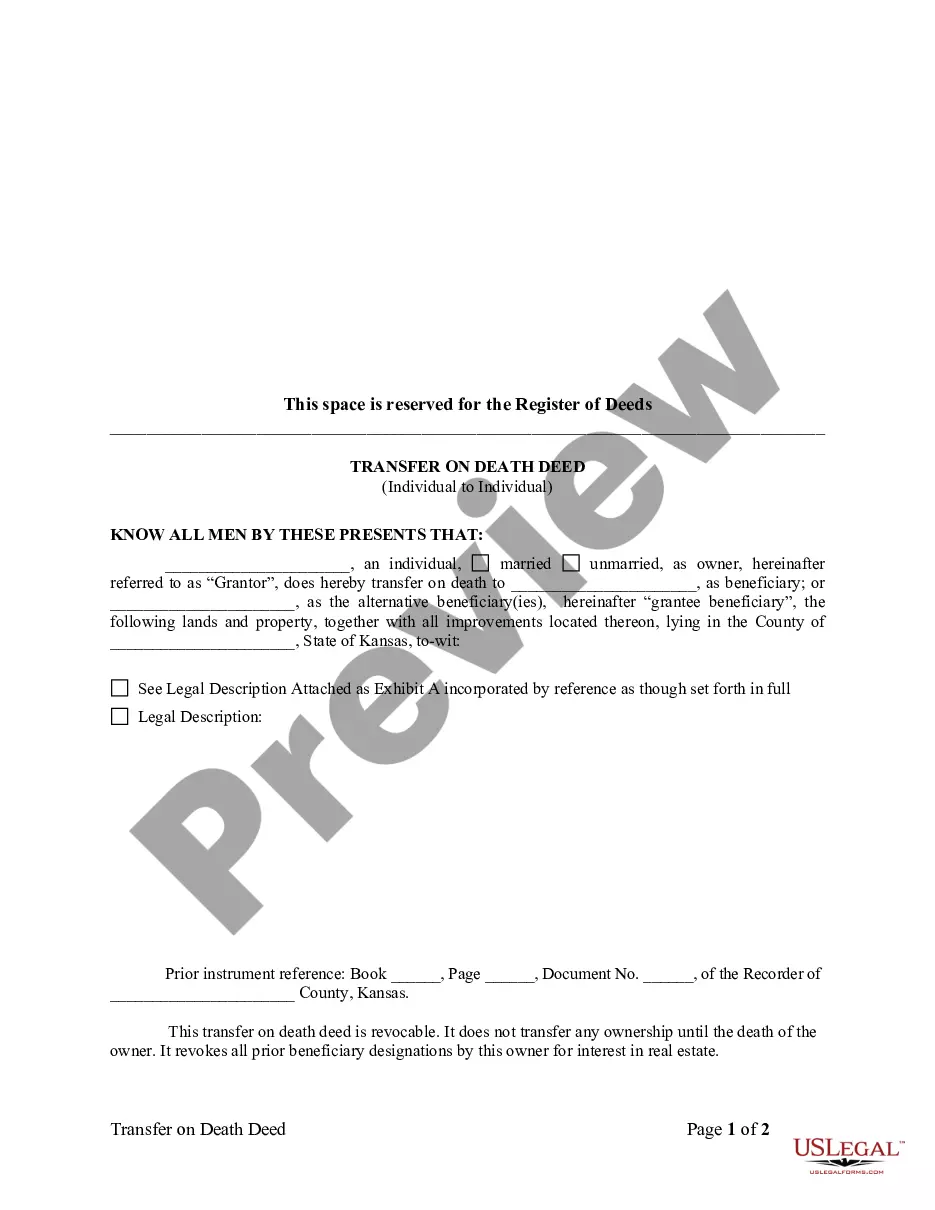

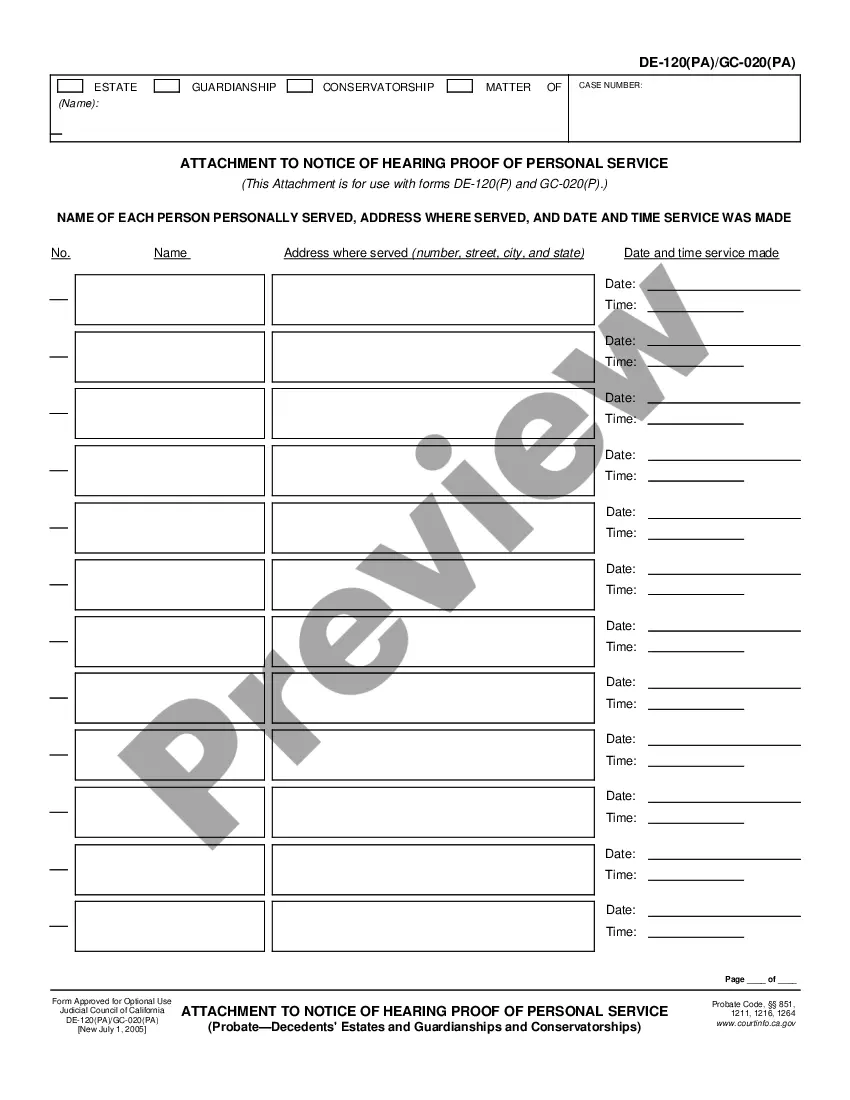

How to fill out Phoenix Arizona Assignment Of Oil And Gas Lease By Original Lessee, Short Form?

Are you looking to quickly create a legally-binding Phoenix Assignment of Oil and Gas Lease by Original Lessee, Short Form or probably any other document to manage your own or business matters? You can select one of the two options: hire a legal advisor to write a valid document for you or draft it completely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you receive professionally written legal papers without paying unreasonable prices for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific document templates, including Phoenix Assignment of Oil and Gas Lease by Original Lessee, Short Form and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, carefully verify if the Phoenix Assignment of Oil and Gas Lease by Original Lessee, Short Form is adapted to your state's or county's laws.

- If the form has a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Select the plan that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Phoenix Assignment of Oil and Gas Lease by Original Lessee, Short Form template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the templates we offer are reviewed by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

The holders of the term ORRI interests moved for summary judgment on the characterization issue, arguing that as a matter of Louisiana state law, a term ORRI is an absolute conveyance of a real property interest.

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

Definition of oil and gas lease : a deed by which a landowner authorizes exploration for and production of oil and gas on his land usually in consideration of a royalty.

An ORRI is a fractional, undivided interest with the right to participate or receive proceeds from the sale of oil and/or gas. It is not an interest in the minerals, but an interest in the proceeds or revenue from the oil & gas minerals sold.

An assignment is when the tenant transfers their lease interest to a new tenant using a Lease Assignment. The assignee takes the assignor's place in the landlord-tenant relationship, although the assignor may remain liable for damages, missed rent payments, and other lease violations.

If the lessee transfers his or her entire remaining interest in the tenancy, then the transfer is known as an assignment. If the lessee transfers only part of his or her interest, then the transfer is known as a sublease.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

The assignment serves three basic functions. First, it is the operative document that assigns rights and delegates duties between the assignor and the assignee. 22/ Second, it allocates liabilities between the assignor and assignee and may create obligations in addition to those imposed by the oil and gas lease.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Interesting Questions

More info

Bureau of Land Management. Washington D.C., April 2017. a. The fee to be remitted to each landowner is 20.00 per month for a full payment plan (up to 24 months), including all expenses and taxes. b. A land lease application must be received by the nearest tax office by the due date after the due date of the return. The application fee is to be remitted by the due dates within three years from the application. c. An assignment made electronically must be accompanied by a copy of the IRS Form 1099. (All electronically-assisted land leases will be made electronically. Form 1099 can not be made on paper. Please request a copy of Form 1099.) D. CUSTOM ORDERS ON RIGHTS AND INTERESTS OF ALIENS 1. GENERAL. The General Services Administration does not provide a tax planning program for the citizens of the United States. Instead, that service is provided to the government of the United States by the United States Government through the General Services Administration. 2.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.