Dallas, Texas Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest In the oil and gas industry, an Assignment of Oil and Gas Leases is a legal document that transfers the rights and interests of an oil and gas lease from one party to another. Specifically, in Dallas, Texas, the Assignment of Oil and Gas Leases is commonly used to transfer the rights to explore, drill, and extract oil and gas reserves found on a specific land or property. An Assignment of Oil and Gas Leases of all Interest involves the transfer of complete ownership and interest in the leased property from the assignor (the current leaseholder) to the assignee (the party acquiring the lease). This type of assignment ensures that the assignee gains all the rights, benefits, and obligations related to the oil and gas lease, including the ability to extract and generate revenue from any discovered resources. What sets the Dallas, Texas Assignment of Oil and Gas Leases apart is the inclusion of a Reserving An Overriding Royalty Interest. This clause allows the assignor to retain a percentage or fraction of the royalties generated from the production of oil and gas. The assignor, in this case, would become an overriding royalty interest owner, allowing them to receive regular payments from the assignee based on the production and sale of extracted resources from the leased property. The purpose of reserving an overriding royalty interest in a Dallas, Texas Assignment of Oil and Gas Leases is to provide ongoing financial benefits to the assignor even after transferring ownership. By reserving a share of the royalties, the assignor can continue to receive income from the assigned lease while giving the assignee the full rights to explore and exploit the resources. It's important to note that there may be different types of Dallas, Texas Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest, named according to the specific conditions or terminologies used in the agreement. Some examples of such assignments could include: 1. Partial Assignment: This type of assignment involves transferring only a portion of the assignor's rights, interests, and royalties to the assignee. 2. Multiple Assignor Assignment: When multiple leaseholders collectively assign their interests and royalties to a single assignee, this type of assignment occurs. 3. Development Assignment: An assignment intended for the development and extraction of oil and gas reserves, often involving significant financial and operational commitments. 4. Non-Operated Assignment: In some cases, an assignment involves non-operating parties, where the assignor retains the right to receive overriding royalties without participating in the management or decision-making processes. In summary, the Dallas, Texas Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest is a legal and financial arrangement that facilitates the transfer of lease ownership while allowing the assignor to retain a share of the royalties. These assignments can take different forms depending on the specific requirements and agreements between the assignor and assignee.

Dallas Texas Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest

Description

How to fill out Dallas Texas Assignment Of Oil And Gas Leases Of All Interest, Reserving An Overriding Royalty Interest?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare formal paperwork that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any individual or business purpose utilized in your region, including the Dallas Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Dallas Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Dallas Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest:

- Make sure you have opened the right page with your local form.

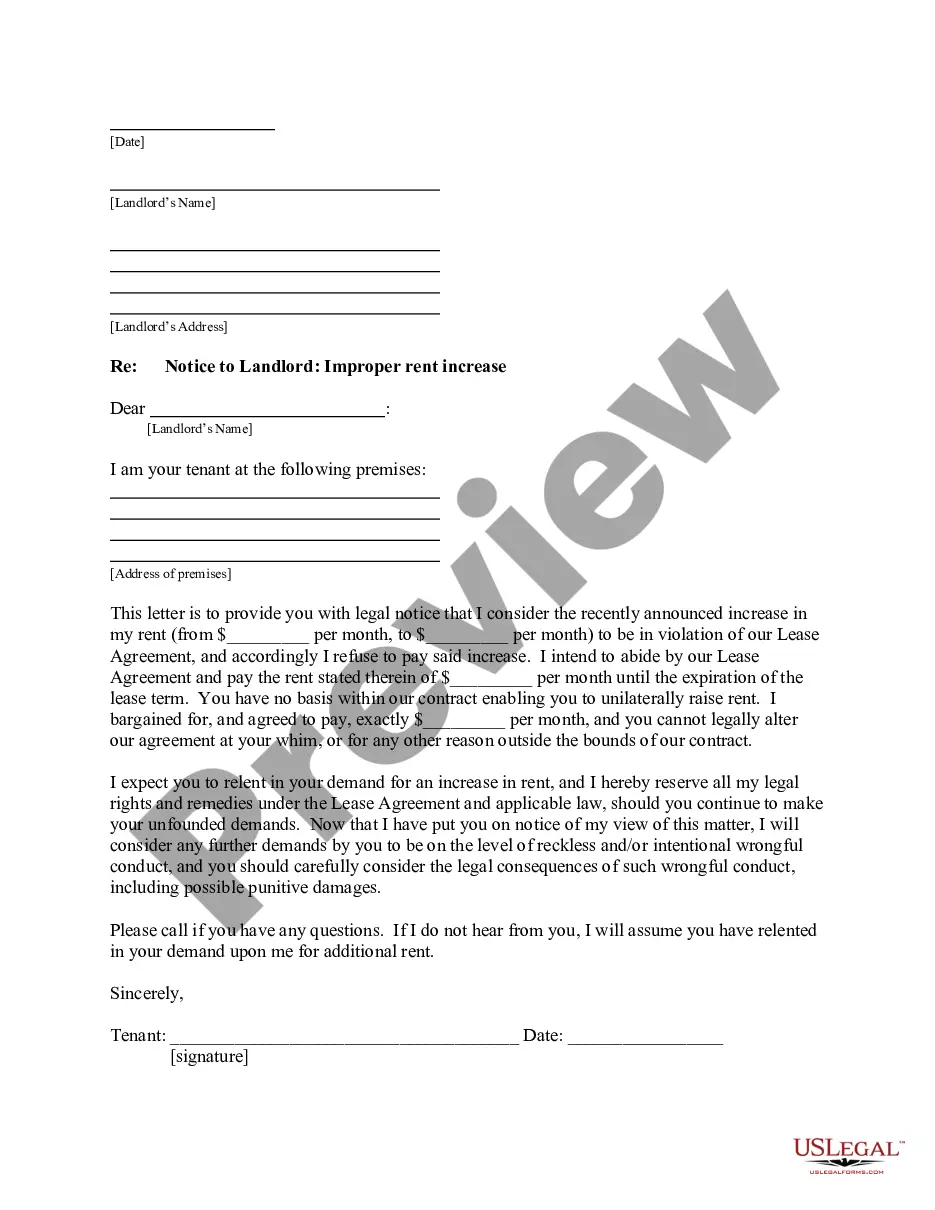

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Dallas Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!