Collin County, Texas, is a vibrant region located in the northern part of the state. Known for its rapid growth and vast energy resources, Collin County offers numerous opportunities in the oil and gas industry. With this growth comes the need for assignment and conveyance of overriding royalty interest, an integral part of the energy sector. Assignment and conveyance of overriding royalty interest refers to the legal process by which ownership rights and interests in oil and gas production are transferred from one party to another. This transfer allows the new owner, also known as the assignee, to receive a portion of the royalties derived from the production of oil and gas on a specific property or lease. Collin County presents various types of assignment and conveyance of overriding royalty interest, each designed to address different circumstances or ownership arrangements. These may include: 1. Statutory Assignments: These assignments involve the transfer of overriding royalty interest as required by legal statutes or regulations. They follow specific guidelines and formalities to ensure compliance with jurisdictional laws. 2. Voluntary Assignments: These assignments occur when the owner of the overriding royalty interest voluntarily transfers their ownership rights to another party. This could be due to financial reasons, estate planning, or any other personal or business considerations. 3. Partial Assignments: In some cases, an overriding royalty interest may only be partially assigned, meaning a percentage is transferred while the remaining interest is retained by the original owner. Such assignments can be made to spread the risk or enable diversification of investments. 4. Lease Assignments: Lease assignments are common in the oil and gas industry. They involve the transfer of a specific lease agreement from one party to another, including any overriding royalty interest associated with that lease. This allows the new assignee to receive future royalty payments as per the terms outlined in the agreement. 5. Temporary Assignments: Temporary assignments involve the temporary transfer of an overriding royalty interest for a specific duration or until certain conditions are met. These assignments are often utilized in joint ventures or temporary investment opportunities. It is important to note that the specific details and requirements of assignment and conveyance of overriding royalty interest in Collin County, Texas may vary depending on local laws and individual contractual agreements. Seeking legal advice or consulting experienced professionals in the field is crucial to ensure compliance and maximum benefit from these transactions.

Collin Texas Assignment and Conveyance of Overriding Royalty Interest

Description

How to fill out Collin Texas Assignment And Conveyance Of Overriding Royalty Interest?

Dealing with legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to create some of them from the ground up, including Collin Assignment and Conveyance of Overriding Royalty Interest, with a service like US Legal Forms.

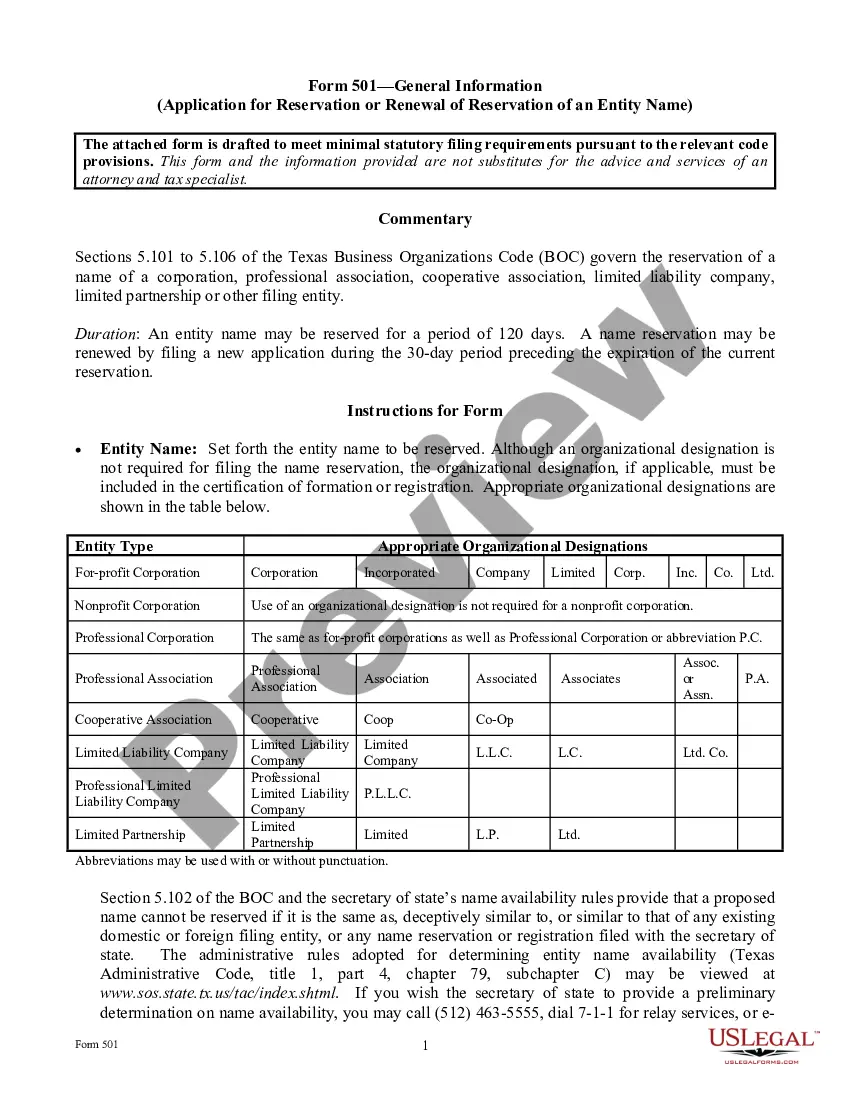

US Legal Forms has over 85,000 templates to choose from in various types varying from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find detailed resources and tutorials on the website to make any tasks related to document execution straightforward.

Here's how you can find and download Collin Assignment and Conveyance of Overriding Royalty Interest.

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state laws can affect the validity of some records.

- Check the related forms or start the search over to locate the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment gateway, and buy Collin Assignment and Conveyance of Overriding Royalty Interest.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Collin Assignment and Conveyance of Overriding Royalty Interest, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional completely. If you have to deal with an exceptionally difficult situation, we recommend using the services of a lawyer to review your document before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and get your state-compliant documents with ease!

Form popularity

FAQ

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Overriding royalty interests are an important financing tool for oil and gas companies involved in the exploration and development of oil gas and mineral interests. For investors, they provide an opportunity to participate in mineral production without incurring the costs.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.