Fairfax Virginia is a vibrant city located in the northern region of the state. It is known for its rich history, cultural diversity, and a thriving local economy. Situated just outside of Washington D.C., Fairfax offers residents and visitors a blend of suburban charm and urban amenities. One type of assignment in Fairfax Virginia is related to the realm of royalties and interests in oil and gas production. The Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout is a specific agreement often used in the energy industry. This type of assignment allows an individual or entity to transfer a portion of their overriding royalty interest to another party in exchange for a working interest that becomes active once certain conditions are met. The purpose of this arrangement is to maximize returns and incentivize increased production. By converting a portion of the royalty interest to a working interest at payout, the assignor gains a direct working interest in the project, thus increasing their potential profits. This type of assignment can be beneficial for individuals or entities looking to take an active role in oil and gas operations rather than solely relying on royalty income. Furthermore, this assignment offers flexibility in terms of the portion being converted. It allows the assignor to maintain a certain percentage of the original overriding royalty interest while converting the remainder into a working interest. The specific terms and conditions of the assignment can vary depending on the negotiation between the parties involved. As with any financial agreement, it is crucial to thoroughly understand the terms and consult legal professionals knowledgeable in oil and gas leases before engaging in or entering into this type of assignment. In summary, Fairfax Virginia presents a fertile ground for assignments in the energy industry, including the Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout. This unique type of assignment allows individuals or entities to transfer a portion of their royalty interest and convert it into a working interest at a later stage of production. By doing so, assignors can actively participate in operations and potentially increase their overall profits. However, it is vital to seek professional advice and fully understand the terms and conditions before finalizing any assignment agreement in Fairfax Virginia.

Fairfax Virginia Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout

Description

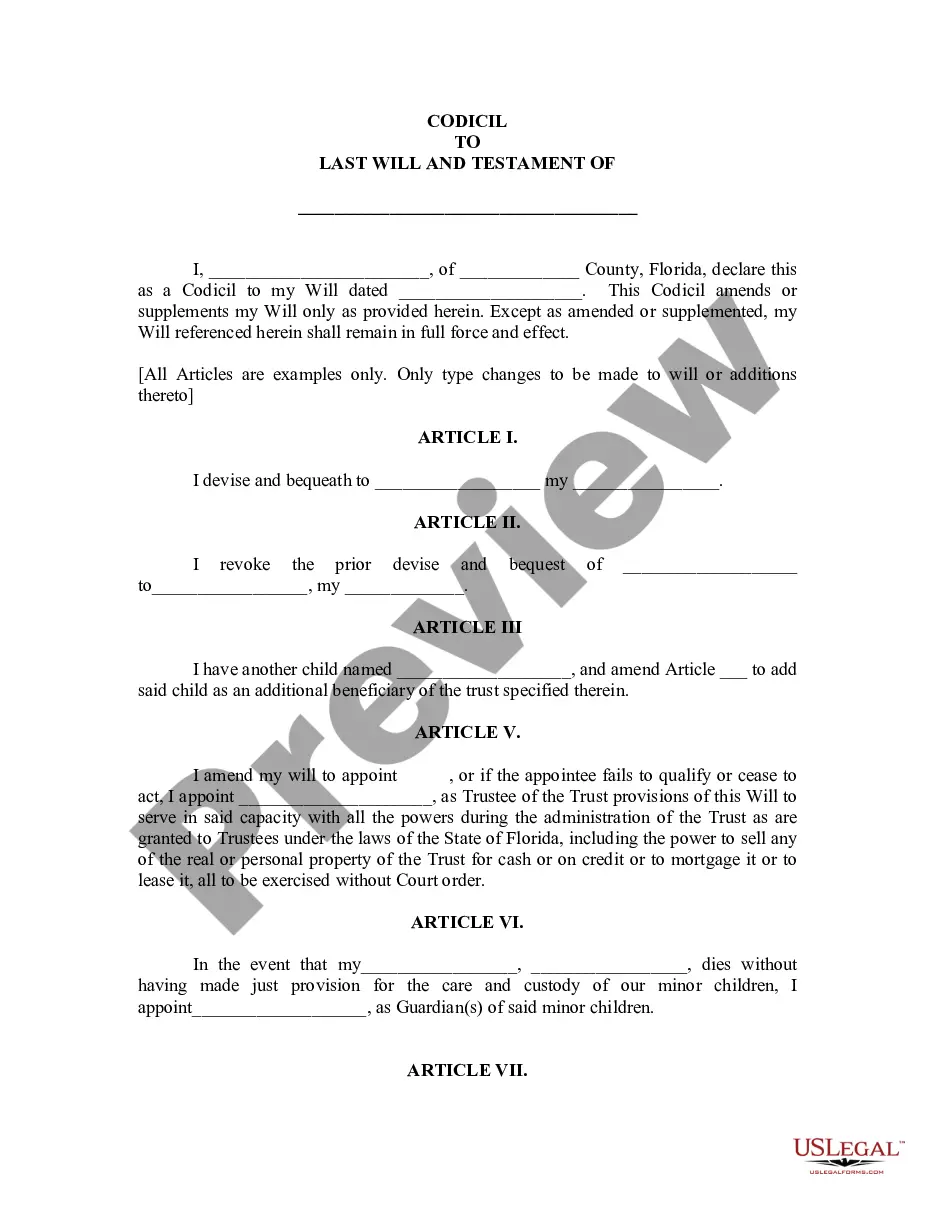

How to fill out Fairfax Virginia Assignment Of Overriding Royalty Interest Partially Convertible To A Working Interest At Payout?

Whether you intend to open your company, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Fairfax Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to get the Fairfax Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout. Follow the guidelines below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Fairfax Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

Royalty Interest an ownership in production that bears no cost in production. Royalty interest owners receive their share of production revenue before the working interest owners. Working Interest an ownership in a well that bears 100% of the cost of production.

Overriding Royalty Interest (ORRI) A royalty in excess of the royalty provided in the Oil & Gas Lease. Usually, an override is added during an intervening assignment. ORRIs are created out of the working interest in a property and do not affect mineral owners.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.