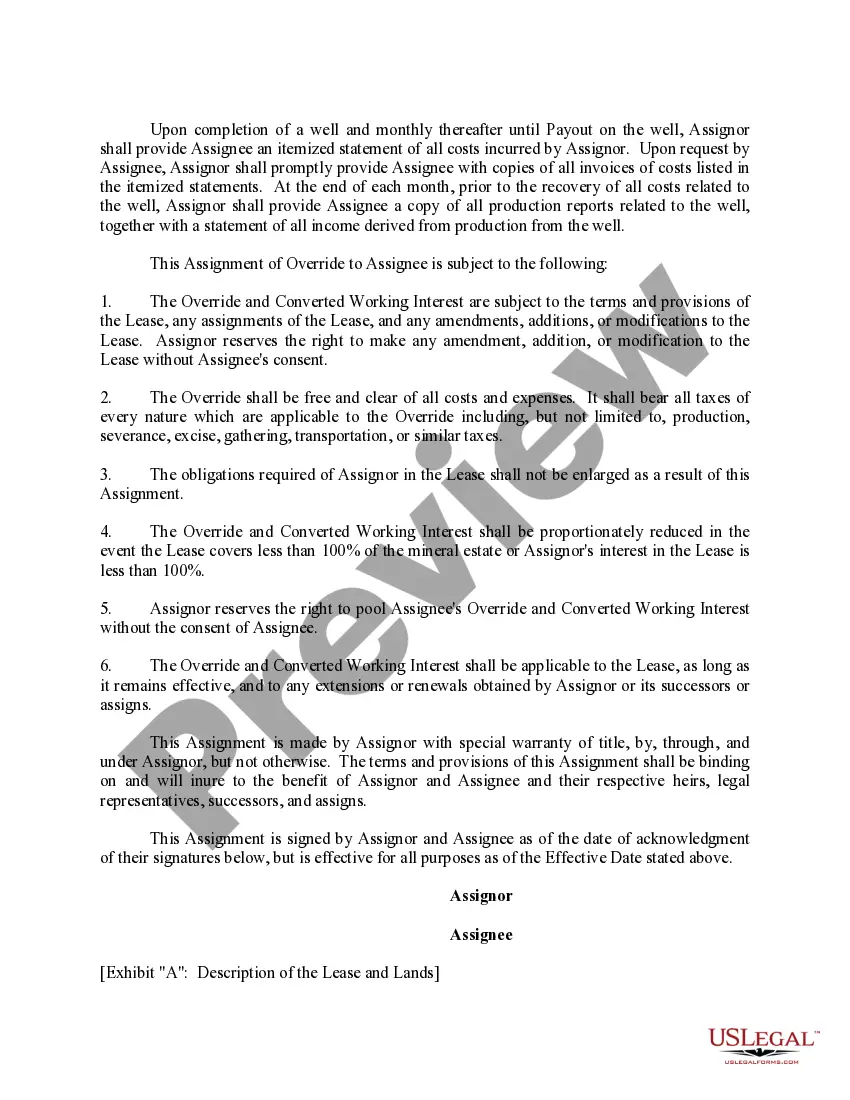

Maricopa, Arizona is a vibrant city located in Pinal County, Arizona, United States. Known for its breathtaking landscapes, rich cultural heritage, and diverse community, Maricopa offers a wide range of attractions and opportunities. The Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout is a unique arrangement in the energy industry that involves the transfer of rights and interests in oil, gas, or mineral resources. This assignment allows for the conversion of a percentage of the royalty interest to a working interest at a certain point in time, typically when certain financial milestones are met, such as reaching payout. This type of arrangement provides an opportunity for investors to potentially increase their returns on investment by converting the passive royalty interest into an active working interest. By doing so, investors become actively involved in the exploration, production, and development of the resources, which may result in increased revenues and control over the project. It's important to note that there are several variations of the Maricopa Arizona Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout. Some key types include: 1. Mineral Rights Assignment: This type of assignment specifically focuses on the transfer of mineral rights, allowing investors to potentially convert a portion of their royalty interest to a working interest. It is commonly seen in regions with substantial mineral deposits, such as Maricopa, Arizona. 2. Oil and Gas Assignment: This assignment type pertains specifically to the transfer of rights and interests in oil and gas resources. Investors can convert a percentage of their royalty interest to a working interest, gaining more involvement and control over the oil and gas operations. 3. Royalty Interest Conversion Agreement: This agreement outlines the terms and conditions for converting a royalty interest to a working interest. It establishes the payout threshold and other criteria that need to be met before the conversion takes place. These agreements are often negotiated between the parties involved, ensuring clarity and transparency in the conversion process. Overall, the Maricopa Arizona Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout provides investors with a unique opportunity to maximize their returns and actively participate in the development of valuable resources. The specific terms and conditions of these assignments vary, depending on the nature of the resources and the agreement between the parties involved.

Maricopa Arizona Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout

Description

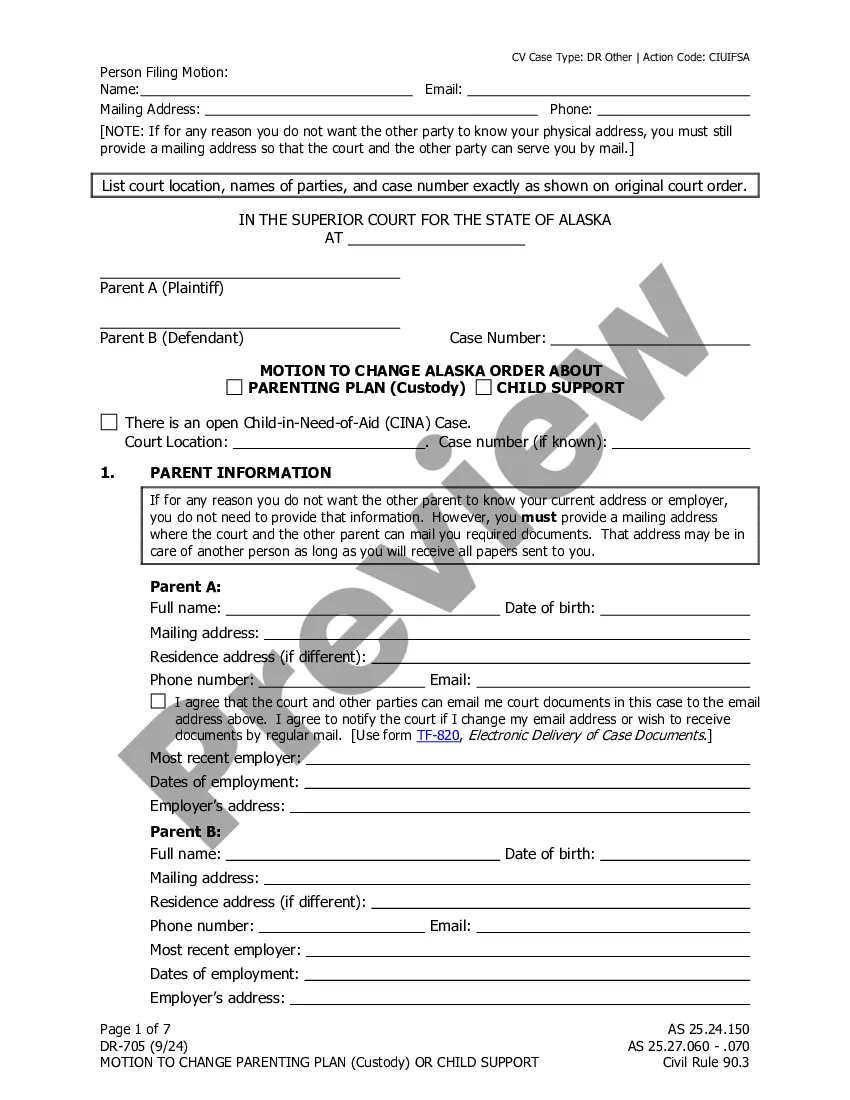

How to fill out Maricopa Arizona Assignment Of Overriding Royalty Interest Partially Convertible To A Working Interest At Payout?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Maricopa Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Consequently, if you need the latest version of the Maricopa Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Maricopa Assignment of Overriding Royalty Interest Partially Convertible to A Working Interest At Payout and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

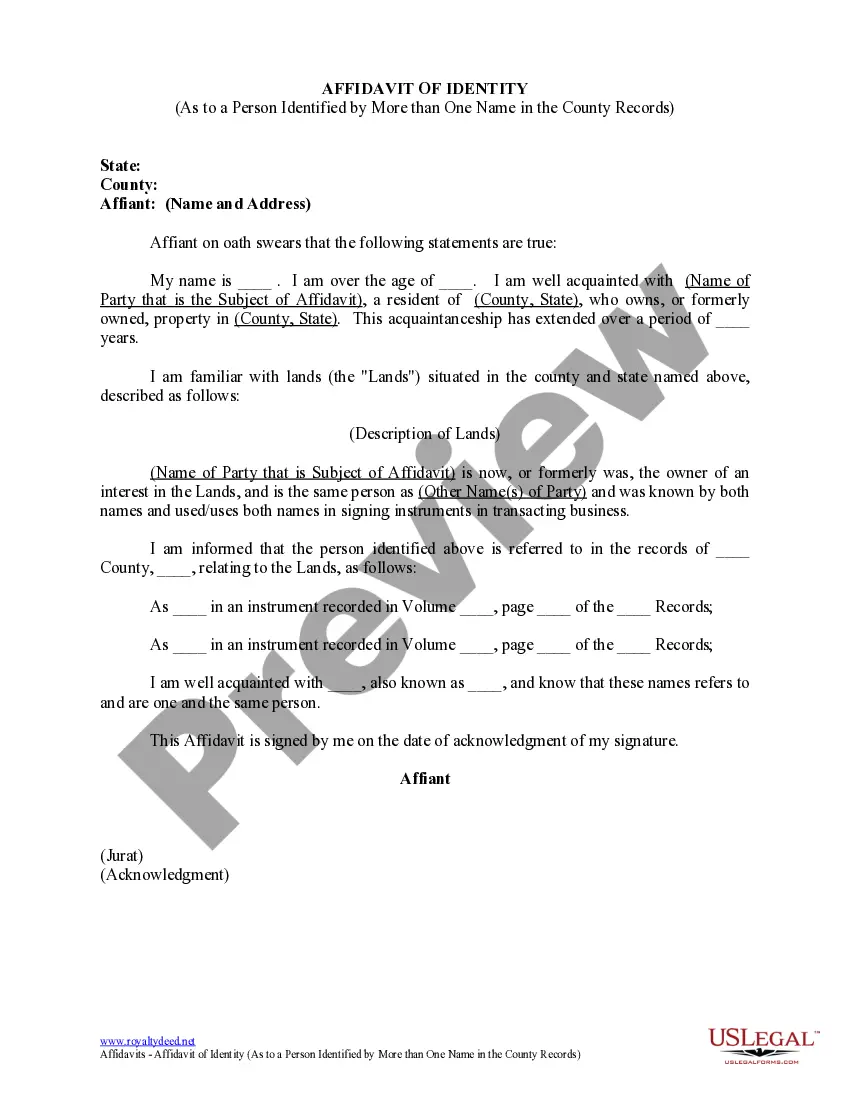

A mineral interest owner also possesses the right to receive lease bonuses, delay rental payments, shut-in payments and royalties. A royalty interest, on the other hand, is the property interest created that entitles the owner to receive a share of the production.

If you receive more than $600 in a calendar year in overriding royalty interest payments, you will receive a 1099 tax form to claim the money as income during your annual tax filing.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

The net revenue interest is the income, the working interest is the expenses.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

A working interest is a type of investment in oil and gas operations. In a working interest, investors are liable for ongoing costs associated with the project but also share in any profits of production. Both the costs and risks of a working interest are extremely high.

Royalty Interest an ownership in production that bears no cost in production. Royalty interest owners receive their share of production revenue before the working interest owners. Working Interest an ownership in a well that bears 100% of the cost of production.

Interesting Questions

More info

Documents of less than four pages have been scanned for ease of reproduction. Not all documents listed are available for copying, except for the original documents of record, as set out in Item 6 of the schedule. These documents cover such subjects as energy and power legislation, the Constitution, the Government's role in the regulation of power and gas supplies, and related laws and regulations relating to electricity and gas. These documents are also available online. Document Description: The Joint Financial Statement for Dominion Canada Limited (Dominion) dated June 27, 1992, is a copy of the Dominion Agreement of November 24, 1982, as amended. This document lists certain assets and liabilities of Dominion. It provides for a payment to Dominion of 5.1 billion to be paid out over 18 years and includes various adjustments.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.