Maricopa, Arizona is a vibrant city located in the southern part of the state, known for its stunning natural beauty, rich cultural heritage, and rapidly growing economy. The city is situated in Maricopa County, which is the most populous county in Arizona and home to several thriving industries such as tourism, agriculture, and technology. One significant aspect of Maricopa's economic landscape is the presence of the oil and gas industry. With numerous oil and gas wells scattered throughout the region, the city has witnessed a rising number of individuals and companies engaging in oil and gas exploration and production activities. As a result, various contractual agreements are crucial in managing the rights and royalties associated with these operations. An assignment of overriding royalty interest (ORRIS) is one such type of contractual agreement commonly used in the oil and gas industry. It refers to the transfer of a portion or all of the rights to receive royalty payments from the production of oil and gas to a third party, typically in exchange for a lump sum payment or other considerations. The party receiving the ORRIS, known as the assignee, obtains the right to a share of the revenue generated from the production activities without bearing any operational costs. In Maricopa, a specific type of ORRIS agreement known as the Assignment of Overriding Royalty Interest with Proportionate Reduction is frequently utilized. This type of assignment aims to ensure a fair distribution of royalty interests among multiple parties involved in a well or lease. Essentially, it involves proportionately reducing the royalty interests of each party based on their respective ownership share and assigning the resulting proportionate interest to the assignee. The Assignment of Overriding Royalty Interest with Proportionate Reduction is particularly valuable in situations where there are multiple owners or partners engaged in joint ventures within the oil and gas industry. By fairly apportioning royalty interests based on ownership percentages, this agreement helps maintain equitable revenue distribution in accordance with each party's ownership stake. Additionally, this type of assignment safeguards against potential disputes and conflicts that may arise among the parties involved. It establishes a clear framework for defining and calculating each party's proportionate share of the royalty interests, reducing ambiguity and promoting transparency in the distribution process. In summary, Maricopa, Arizona, is a flourishing city with a buoyant oil and gas industry. The Assignment of Overriding Royalty Interest with Proportionate Reduction serves as an essential contractual agreement within this industry, ensuring fair and transparent distribution of royalty interests among multiple parties.

Maricopa Arizona Assignment of Overriding Royalty Interest with Proportionate Reduction

Description

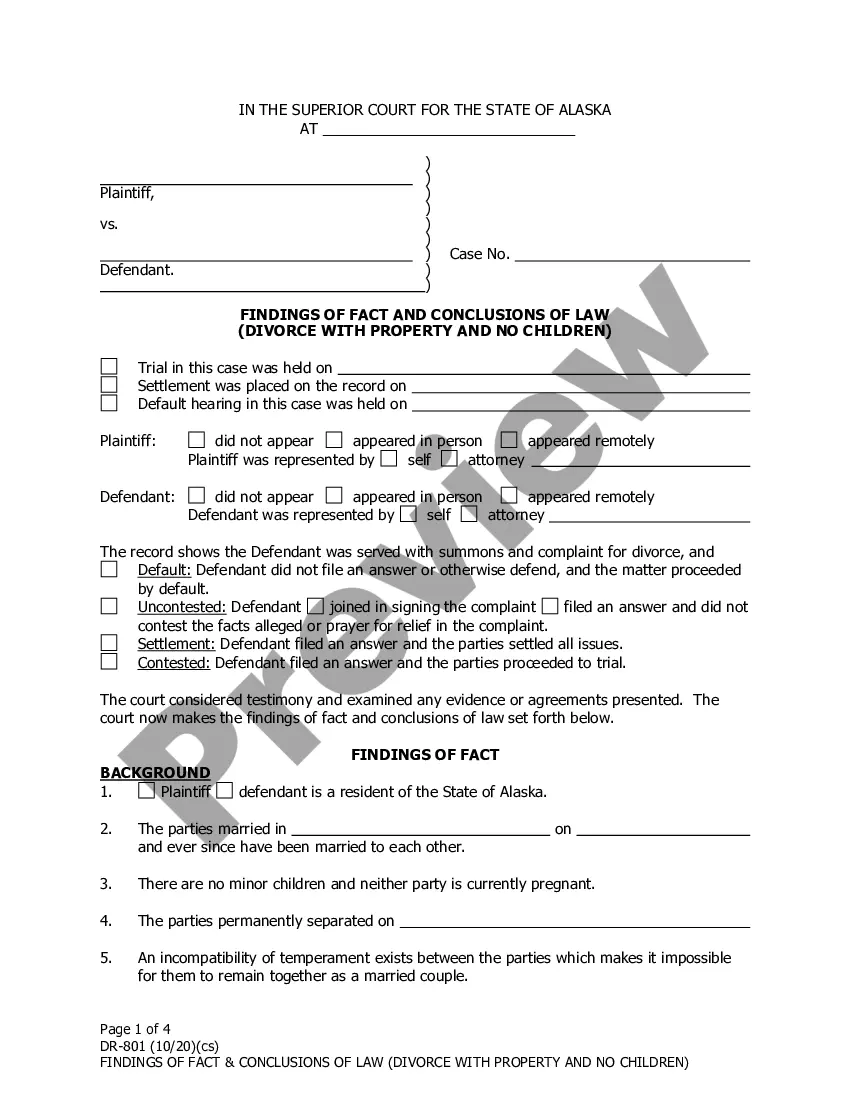

How to fill out Maricopa Arizona Assignment Of Overriding Royalty Interest With Proportionate Reduction?

Are you looking to quickly create a legally-binding Maricopa Assignment of Overriding Royalty Interest with Proportionate Reduction or probably any other document to take control of your personal or corporate affairs? You can go with two options: hire a professional to draft a legal document for you or create it entirely on your own. Thankfully, there's a third option - US Legal Forms. It will help you receive neatly written legal papers without paying sky-high prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant document templates, including Maricopa Assignment of Overriding Royalty Interest with Proportionate Reduction and form packages. We provide templates for a myriad of use cases: from divorce papers to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- To start with, carefully verify if the Maricopa Assignment of Overriding Royalty Interest with Proportionate Reduction is tailored to your state's or county's regulations.

- If the form has a desciption, make sure to check what it's suitable for.

- Start the searching process again if the template isn’t what you were seeking by using the search box in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Maricopa Assignment of Overriding Royalty Interest with Proportionate Reduction template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the templates we offer are reviewed by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!