Salt Lake Utah is a populous city located in the western part of the United States, specifically in the state of Utah. Known for its breathtaking natural scenery, vibrant culture, and rich history, Salt Lake Utah offers a diverse range of activities and attractions for residents and visitors alike. One of the important aspects of the oil and gas industry in Salt Lake Utah is the Assignment of Overriding Royalty Interest with Proportionate Reduction. This legal procedure allows a party to assign or transfer their overriding royalty interest in an oil or gas lease to another party, while ensuring that the proportionate reduction of royalty interest is properly accounted for. There are different types of Salt Lake Utah Assignment of Overriding Royalty Interest with Proportionate Reduction, including: 1. Voluntary Assignments: In this type, the assignor willingly transfers their overriding royalty interest to another party. This can be done for various reasons, such as financial gain or strategic business decisions. 2. Involuntary Assignments: Sometimes, an overriding royalty interest may be involuntarily assigned due to legal matters, such as court orders or judgments. These assignments are typically enforced when there are outstanding debts or legal obligations involved. 3. Partial Assignments: A partial assignment occurs when the assignor transfers only a portion of their overriding royalty interest, while retaining the remaining interest for themselves. This can be done to diversify investments or to bring in additional partners. 4. Complete Assignments: In contrast to partial assignments, a complete assignment refers to the transfer of the entire overriding royalty interest from the assignor to the assignee. This can happen when the assignor wants to exit the oil or gas venture completely. It is important to follow the legal procedures and regulations when executing a Salt Lake Utah Assignment of Overriding Royalty Interest with Proportionate Reduction. Parties involved must ensure that the assignment is done accurately and that the proportionate reduction of royalty interest is calculated and recorded correctly to avoid any disputes or legal issues. Overall, the Assignment of Overriding Royalty Interest with Proportionate Reduction is a crucial aspect of the oil and gas industry in Salt Lake Utah, allowing parties to transfer or assign their royalty interests while ensuring fairness and proper accounting.

Salt Lake Utah Assignment of Overriding Royalty Interest with Proportionate Reduction

Description

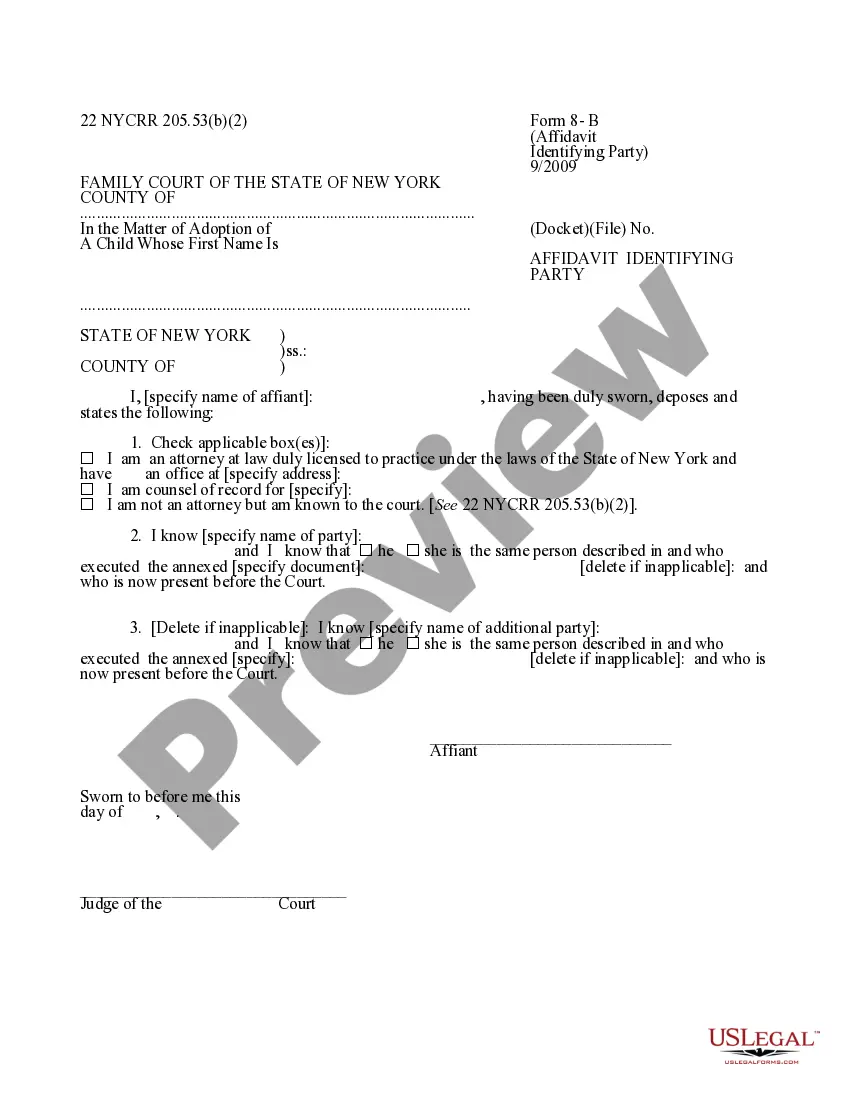

How to fill out Salt Lake Utah Assignment Of Overriding Royalty Interest With Proportionate Reduction?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Salt Lake Assignment of Overriding Royalty Interest with Proportionate Reduction, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Consequently, if you need the recent version of the Salt Lake Assignment of Overriding Royalty Interest with Proportionate Reduction, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Salt Lake Assignment of Overriding Royalty Interest with Proportionate Reduction:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Salt Lake Assignment of Overriding Royalty Interest with Proportionate Reduction and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.

If you receive more than $600 in a calendar year in overriding royalty interest payments, you will receive a 1099 tax form to claim the money as income during your annual tax filing.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

Overriding royalty interests are an important financing tool for oil and gas companies involved in the exploration and development of oil gas and mineral interests. For investors, they provide an opportunity to participate in mineral production without incurring the costs.