Cuyahoga Ohio Assignment of Overriding Royalty Interest (ORRIS) is a legal agreement that entitles the assignee to a portion of the oil production revenue generated from a specific property or well in Cuyahoga County, Ohio. This assignment becomes effective once the assigned well reaches the payout stage, meaning that the production revenue covers all the costs incurred during drilling and initial development. In this type of agreement, the payout amount is determined based on the volume of oil produced. The more oil extracted, the higher the payout for the assignee. This provides a fair and proportional distribution of revenue, incentivizing both the assignee and the operator to maximize oil production. There are different variations of Cuyahoga Ohio Assignment of Overriding Royalty Interest, including: 1. Fixed Rate ORRIS Assignment: In this type, the assignee receives a fixed percentage of the oil production revenue regardless of the actual volume of oil produced. 2. Sliding Scale ORRIS Assignment: The payout percentage for the assignee varies depending on the volume of oil produced. This means that as production increases, the payout percentage also increases, ensuring a larger share of revenue for the assignee. 3. Alternative Payout Structures: Some ORRIS assignments may have unique payout structures, such as tiered percentages based on different production thresholds or additional bonuses tied to specific milestones or market conditions. When entering into a Cuyahoga Ohio Assignment of Overriding Royalty Interest, it is crucial for both parties to clearly define the terms and conditions of the agreement, including the exact percentage of the assignment, payout calculations, and any additional provisions related to pooling or future development of the property. Overall, Cuyahoga Ohio Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced is a beneficial arrangement that allows assignees to earn a share of the oil production revenue while providing operators with an incentive to optimize oil extraction in Cuyahoga County, Ohio.

Cuyahoga Ohio Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced

Description

How to fill out Cuyahoga Ohio Assignment Of Overriding Royalty Interest To Become Effective At Payout, With Payout Based On Volume Of Oil Produced?

Drafting paperwork for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to generate Cuyahoga Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced without expert assistance.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Cuyahoga Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Cuyahoga Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced:

- Look through the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a couple of clicks!

Form popularity

FAQ

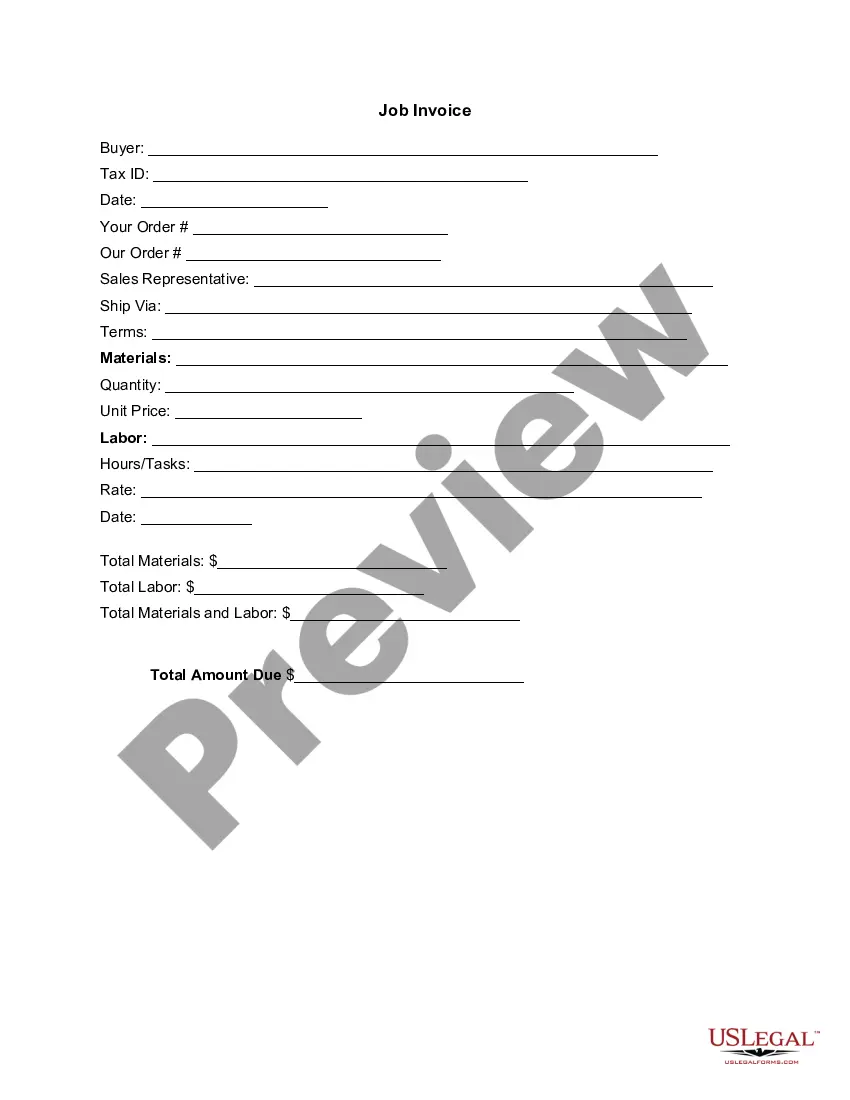

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

Royalty Interest an ownership in production that bears no cost in production. Royalty interest owners receive their share of production revenue before the working interest owners. Working Interest an ownership in a well that bears 100% of the cost of production.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

If you receive more than $600 in a calendar year in overriding royalty interest payments, you will receive a 1099 tax form to claim the money as income during your annual tax filing.

Overriding Royalty Interest (ORRI) A royalty in excess of the royalty provided in the Oil & Gas Lease. Usually, an override is added during an intervening assignment. ORRIs are created out of the working interest in a property and do not affect mineral owners.

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.