Maricopa Arizona is a county located in the southern part of the state, known for its rich oil reserves and production. An Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced, is a legal agreement pertaining to the distribution of royalties from oil production in the Maricopa area. In this assignment, individuals or entities transfer their overriding royalty interest to another party, with the terms becoming effective when oil production reaches a certain level of profitability, commonly referred to as "payout." The amount of royalty payout is directly linked to the volume of oil produced. There are several types of assignments relating to overriding royalty interest in Maricopa Arizona: 1. Traditional Assignment: This type of assignment involves the transfer of overriding royalty interest to a third party, with the payout based on the volume of oil produced. The agreement specifies the conditions and terms surrounding the assignment, ensuring fair distribution of royalties. 2. Assignment with Varying Payout Rates: In some instances, assignment agreements may outline different payout rates depending on the volume of oil production. For example, if the production surpasses a particular threshold, the royalty payout rate might increase, incentivizing higher levels of production. 3. Assignments with Royalty Overrides: This variant of the assignment involves overriding royalty interest accruing to the interest owner until the specified payout is achieved. Once the payout is met, the overriding royalty interest changes hands, with the new assignee benefiting from subsequent production. 4. Multiple Assignments: Occasionally, there may be multiple assignments of overriding royalty interests in the same oil-producing region. Each assignment would outline its specific payout criteria, allowing multiple parties to benefit based on the volume of oil produced. In summary, the Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced, in Maricopa Arizona, signifies the transfer of royalty interests with the condition that the payout becomes effective when oil production reaches a certain profitability threshold. The specific type of assignment can vary, ranging from traditional assignments to varying payout rates, assignments with royalty overrides, and multiple assignments. These assignments play a crucial role in facilitating fair distribution of royalties among stakeholders in the Maricopa Arizona oil industry.

Maricopa Arizona Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced

Description

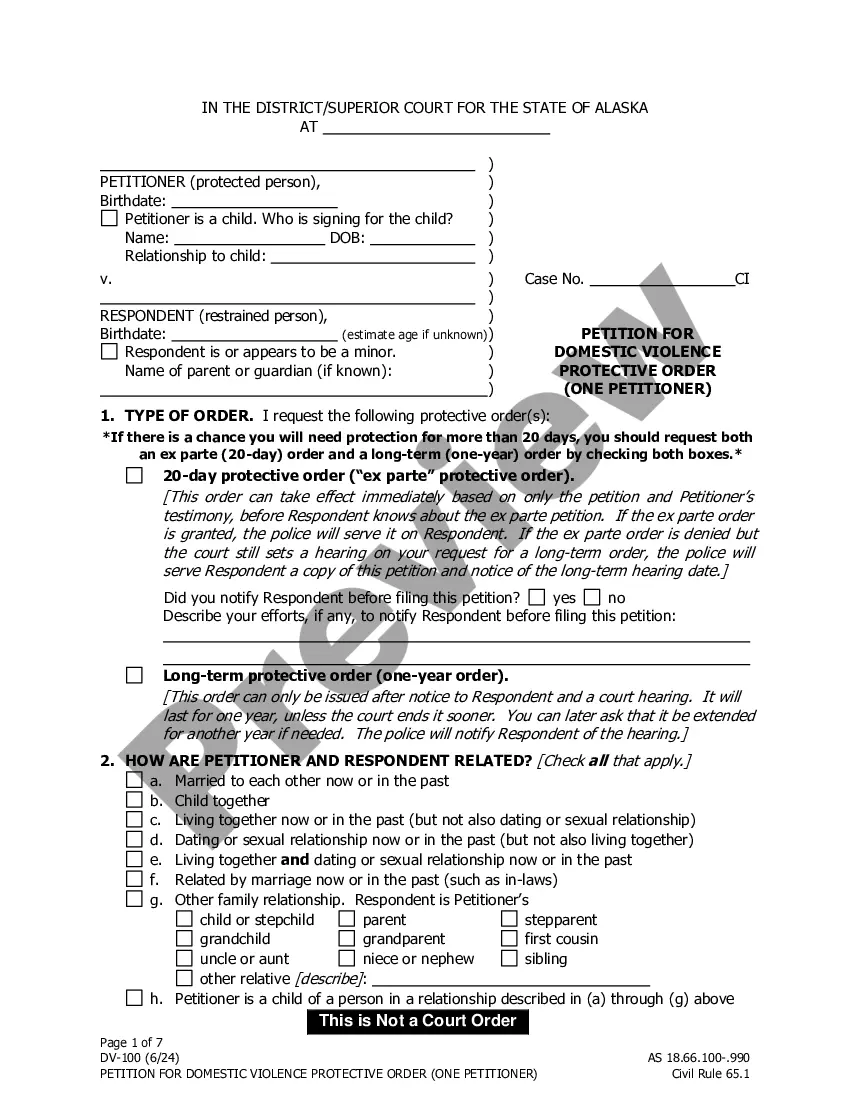

How to fill out Maricopa Arizona Assignment Of Overriding Royalty Interest To Become Effective At Payout, With Payout Based On Volume Of Oil Produced?

Preparing paperwork for the business or personal needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to create Maricopa Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced without professional help.

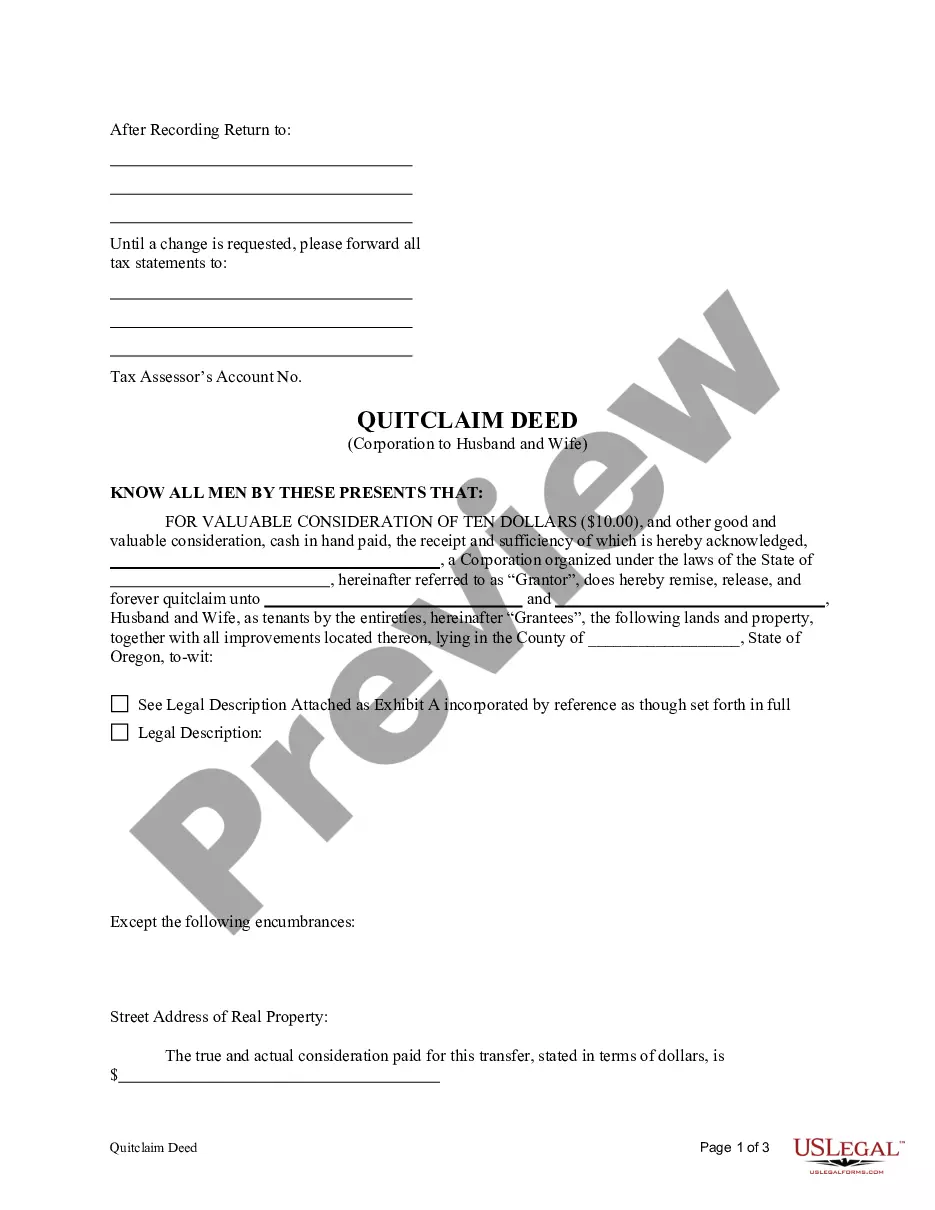

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Maricopa Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, follow the step-by-step guide below to get the Maricopa Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced:

- Look through the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any use case with just a couple of clicks!

Form popularity

FAQ

1. n. Oil and Gas Business A percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Calculating net revenue interest formula To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

The Bankruptcy Code defines a production payment as a type of term overriding royalty or an interest in liquid or gaseous hydrocarbons in place or to be produced from particular real property that entitles the owner thereof to a share of production, or the value thereof, for a term limited by time, quantity, or

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Interesting Questions

More info

The area has approximately 2.5 billion recoverable barrels of oil. In that area, a large, shallow, deep and continuous ridge of fractured, high pressure, dark sandstone occurs for 2 km in length. It is associated with an array of gas-containing fissures. • The Pecos and Maricopa T-31-P and T-31-D surveys reveal that in Pecos County, Texas, the Pecos Ridge to the south is approximately 2,400 feet thick and has an average width of 8 miles. T-31-D also identifies and maps more than 150 shallow geologic features, and a few have been mapped to as much as 250 miles. T-31-P and T-31-D have been completed in six counties: Maricopa, Final, Cochise, Bavaria and Sinaloa. A total of seven counties and the cities of Final and Phoenix are involved in the study.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.