Nassau New York Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced When it comes to the Nassau County in New York, the concept of "Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced" holds significant importance in the oil industry. This type of assignment acts as a collaboration between oil producers and royalty interest owners within the county. In this arrangement, the overriding royalty interest refers to a share of the oil production proceeds that the royalty interest owner receives. However, in Nassau County, this assignment becomes effective only once the payout threshold is reached. The payout threshold is usually determined based on the volume of oil produced by the operators. The primary objective behind this type of assignment is to ensure a fair distribution of profits among all involved parties. By linking the payout to the volume of oil produced, it incentivizes the operators to maximize their production efforts while also benefiting the royalty interest owners. Different types of Nassau New York Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced may include: 1. Traditional Assignment: This is the most common type of assignment where the overriding royalty interest becomes effective once the payout threshold is reached. It follows a straightforward structure and is widely used in Nassau County. 2. Graduated Assignment: In this type, the payout percentage gradually increases as the volume of oil produced surpasses certain milestones. This approach can provide additional incentives to operators and encourage heightened production efforts. 3. Multi-Tier Assignment: This assignment incorporates multiple payout thresholds, each associated with different levels of overriding royalty interest. It allows for a step-by-step increase in payouts with increased oil production, creating a tiered structure benefitting the royalty interest owners. 4. Performance-Based Assignment: This type of assignment sets additional criteria, apart from the volume of oil produced, to determine the effective payout of the overriding royalty interest. These criteria may include factors like operational efficiency, environmental sustainability, or safety standards. It provides an avenue for rewarding operators who excel beyond production numbers. By implementing such Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced, Nassau County ensures a fair distribution of profits among oil producers and royalty interest owners. This collaborative approach fosters growth in the oil industry while incentivizing responsible and sustainable practices.

Nassau New York Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced

Description

How to fill out Nassau New York Assignment Of Overriding Royalty Interest To Become Effective At Payout, With Payout Based On Volume Of Oil Produced?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Nassau Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Nassau Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Nassau Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced:

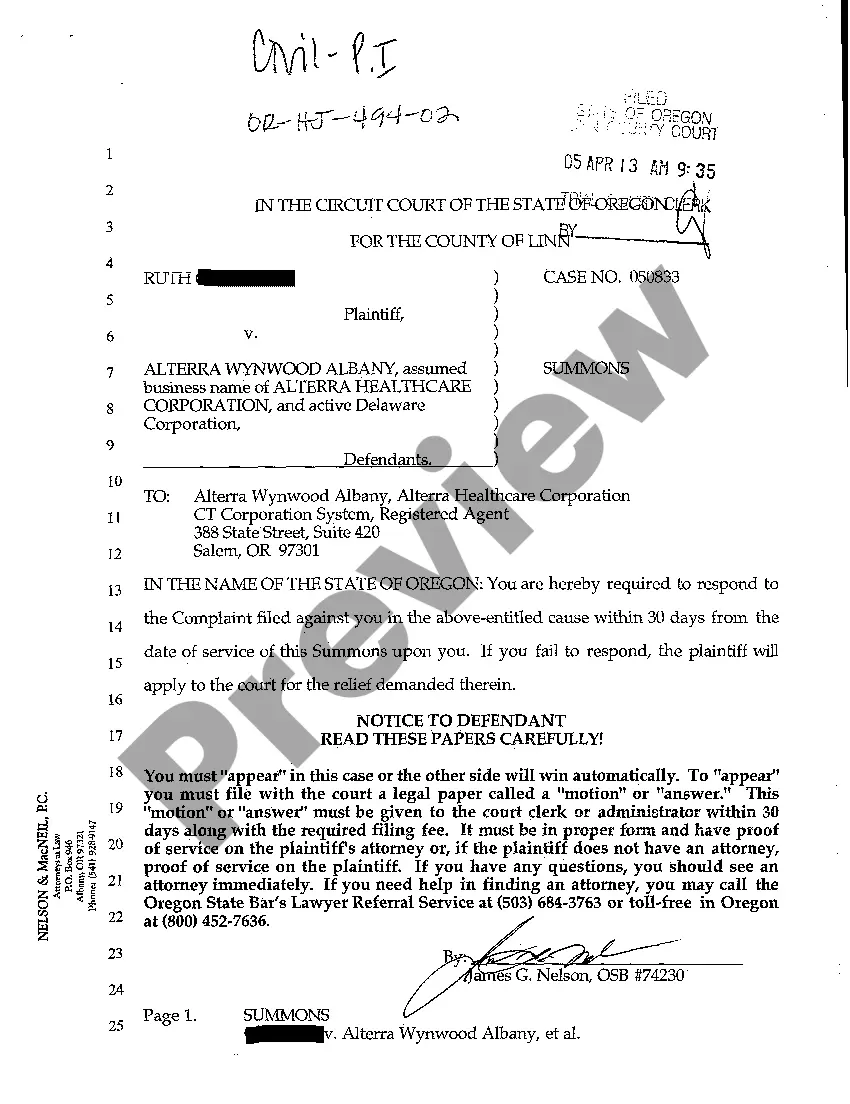

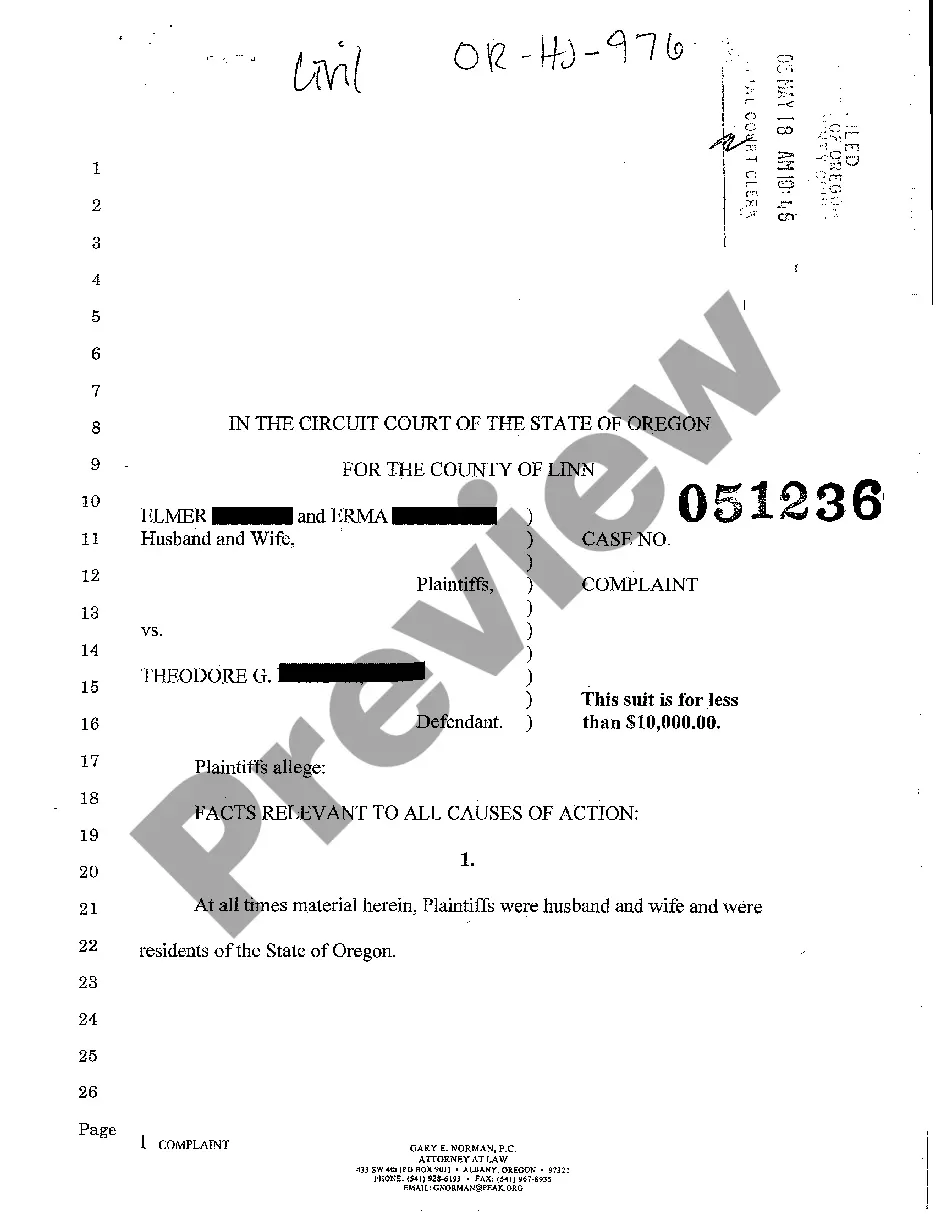

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

For a producing well, royalties could easily be 10 to 20 times the bonus payment in the first year of production alone. Private landowners are normally offered the standard royalty of 1/8 share of production.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.