The Cuyahoga Ohio Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs, also known as a Net Profits agreement, is a legal arrangement in which a party transfers a portion of their net revenue interest in an oil, gas, or mineral lease to another party. This assignment allows the assignee to receive a percentage of the assignor's net profits from the lease, after deducting certain costs. In Cuyahoga County, Ohio, this type of assignment is commonly used in the oil and gas industry to allocate revenue rights and mitigate risks associated with drilling and production ventures. The assignor, who holds a working interest in the lease, assigns a predetermined percentage of their net revenue interest to the assignee, who becomes the overriding royalty interest holder. The overriding royalty interest holder is entitled to receive a percentage of the revenue generated from the lease, proportionate to their assigned interest. However, it is important to note that this interest is subject to certain deductions of costs. These deductions may include operating expenses, capital expenditures, production taxes, or any other applicable costs associated with exploration, development, and production activities. The purpose of this assignment is to provide the assignee with a passive investment opportunity, allowing them to potentially generate income from the lease without actively participating in its operations or assuming any associated risks. The assignor, on the other hand, may seek this arrangement to secure additional capital or mitigate potential losses by sharing the financial burden. Various types of Cuyahoga Ohio Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs exist, depending on the specific terms negotiated between the assignor and assignee. These agreements may differ in the assigned percentage of net revenue interest, the duration of the assignment, or any additional provisions related to costs or termination. In conclusion, the Cuyahoga Ohio Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs is a contractual arrangement commonly used in the oil and gas industry that allows for the transfer of a portion of net revenue interest from the assignor to the assignee. This arrangement helps allocate revenue rights and risks associated with oil, gas, or mineral leases, while deducting certain costs to calculate the net profits. Different types of assignments may exist depending on the negotiated terms between the parties involved.

Cuyahoga Ohio Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits

Description

How to fill out Cuyahoga Ohio Assignment Of Overriding Royalty Interests Of A Percentage Of Assignor's Net Revenue Interest, After Deductions Of Certain Costs - Effectively A Net Profits?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Cuyahoga Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different categories ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less challenging. You can also find detailed resources and guides on the website to make any activities related to document execution simple.

Here's how you can purchase and download Cuyahoga Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits.

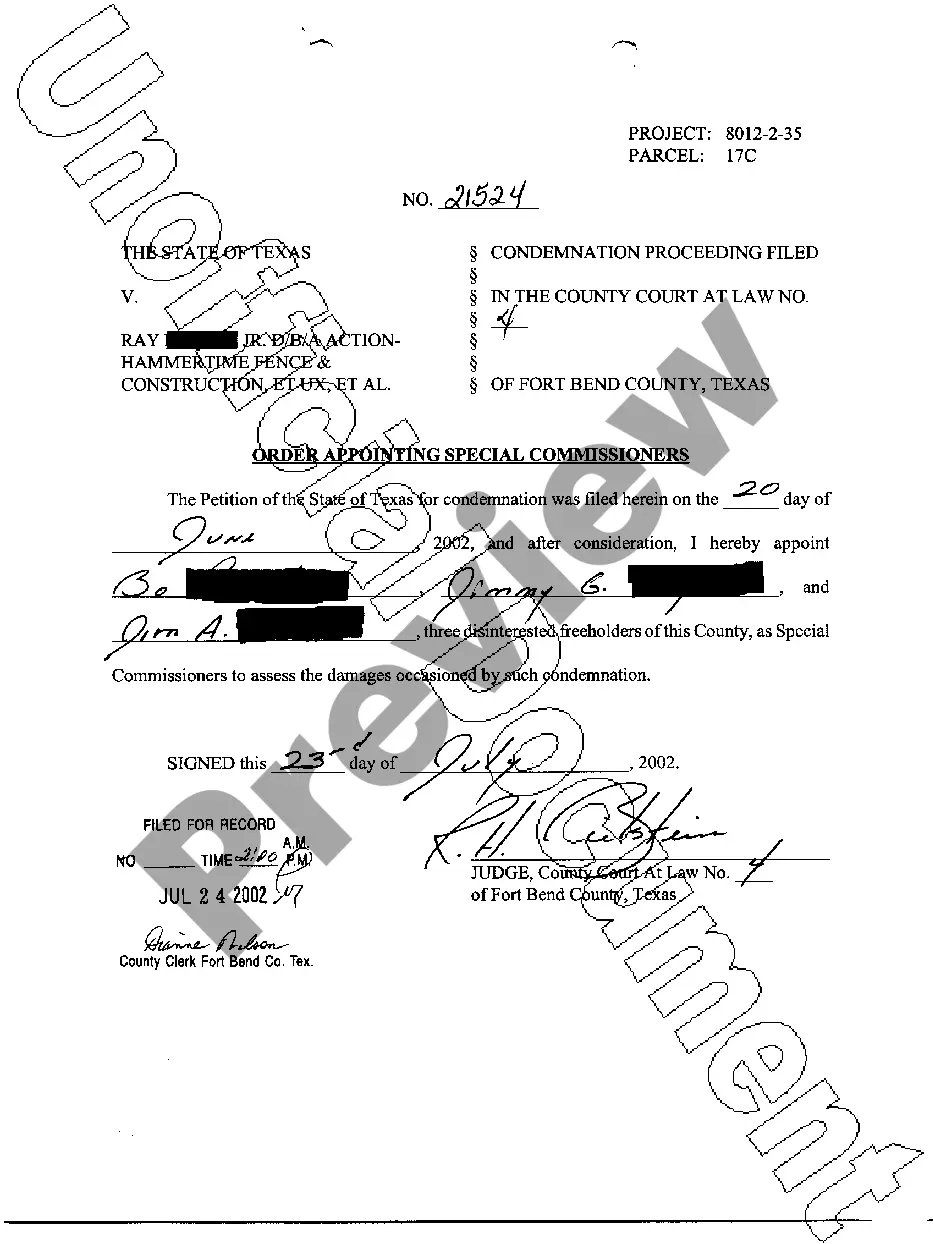

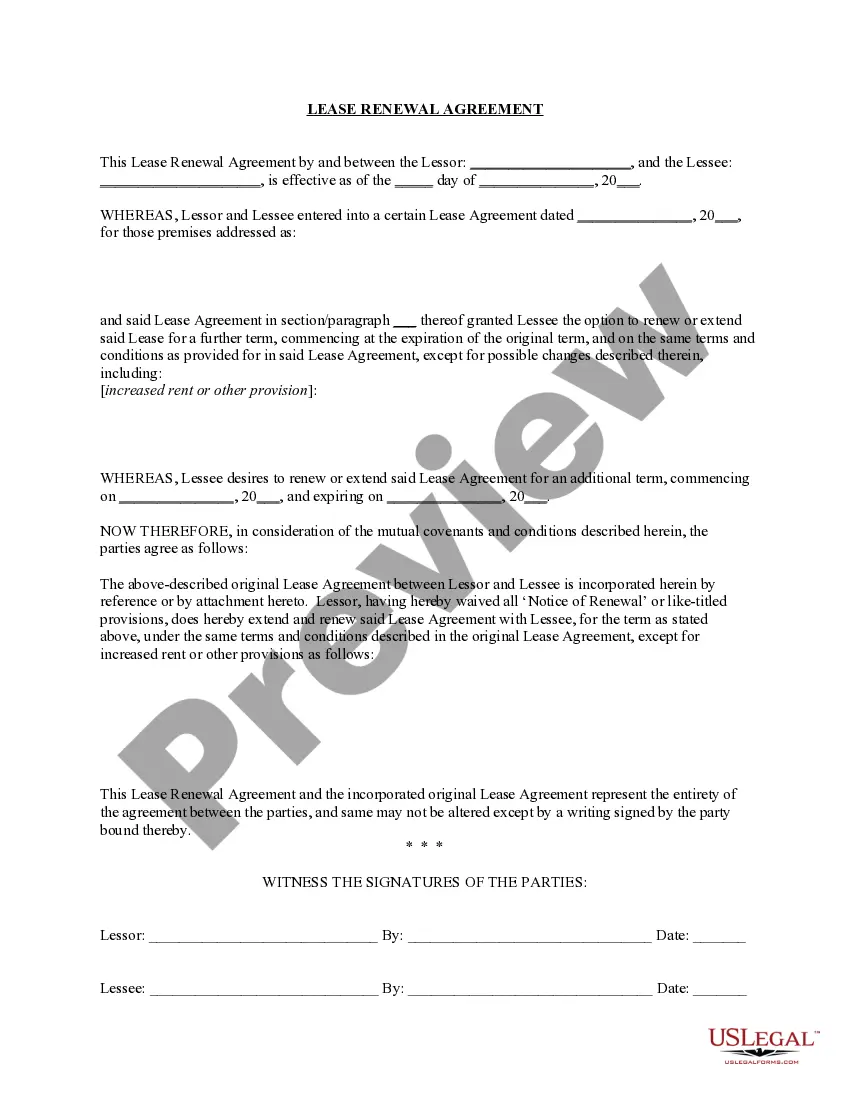

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can affect the validity of some records.

- Check the similar document templates or start the search over to locate the correct file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment gateway, and purchase Cuyahoga Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Cuyahoga Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer entirely. If you have to cope with an exceptionally complicated case, we recommend getting a lawyer to examine your document before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Become one of them today and get your state-specific paperwork with ease!