Fulton, Georgia is a county located in the state of Georgia, USA. It is home to various industries, including the oil and gas sector, which often involves the assignment of overriding royalty interests. In this assignment, a percentage of the assignor's net revenue interest is transferred, after deducting certain costs, resulting in what is effectively a net profits arrangement. The Fulton Georgia Assignment of Overriding Royalty Interests allows for the transfer of a portion of the assignor's net revenue interest to a new party. This can be done in various scenarios, such as when the original owner of the royalty interest wants to sell a portion of it for financial reasons or when there is a need for capital investment in other projects. The overriding royalty interest represents the percentage share of revenue generated from the production and sale of oil and gas from a particular well or field. By assigning a part of this interest, the assignor agrees to transfer a portion of the revenue stream derived from their ownership in the project to the assignee. However, before the assignor's net revenue interest is assigned, certain costs are deducted. These costs may include operating expenses, lease expenses, taxes, and other deductions as agreed upon in the assignment contract. After these deductions, the assignor's net revenue interest is determined, and a percentage of it is then assigned to the new party. The assignment of overriding royalty interests effectively results in a net profits arrangement. The assignee receives a percentage of the net revenue interest, which allows them to benefit from the profits generated by the oil and gas operations in the assigned area. This can be a beneficial arrangement for investors and individuals looking to capitalize on the potential profitability of the oil and gas industry in Fulton, Georgia. Different types of Fulton Georgia Assignment of Overriding Royalty Interests may exist based on the specific terms and conditions agreed upon between the parties involved. These variations can include the percentage of the assignor's net revenue interest being assigned, the duration of the assignment, and any additional rights or restrictions outlined in the agreement. In summary, the Fulton Georgia Assignment of Overriding Royalty Interests involves the transfer of a percentage of the assignor's net revenue interest, after the deduction of certain costs, to a new party. This arrangement allows the assignee to benefit from the net profits generated by the assigned interest in the oil and gas industry.

Fulton Georgia Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits

Description

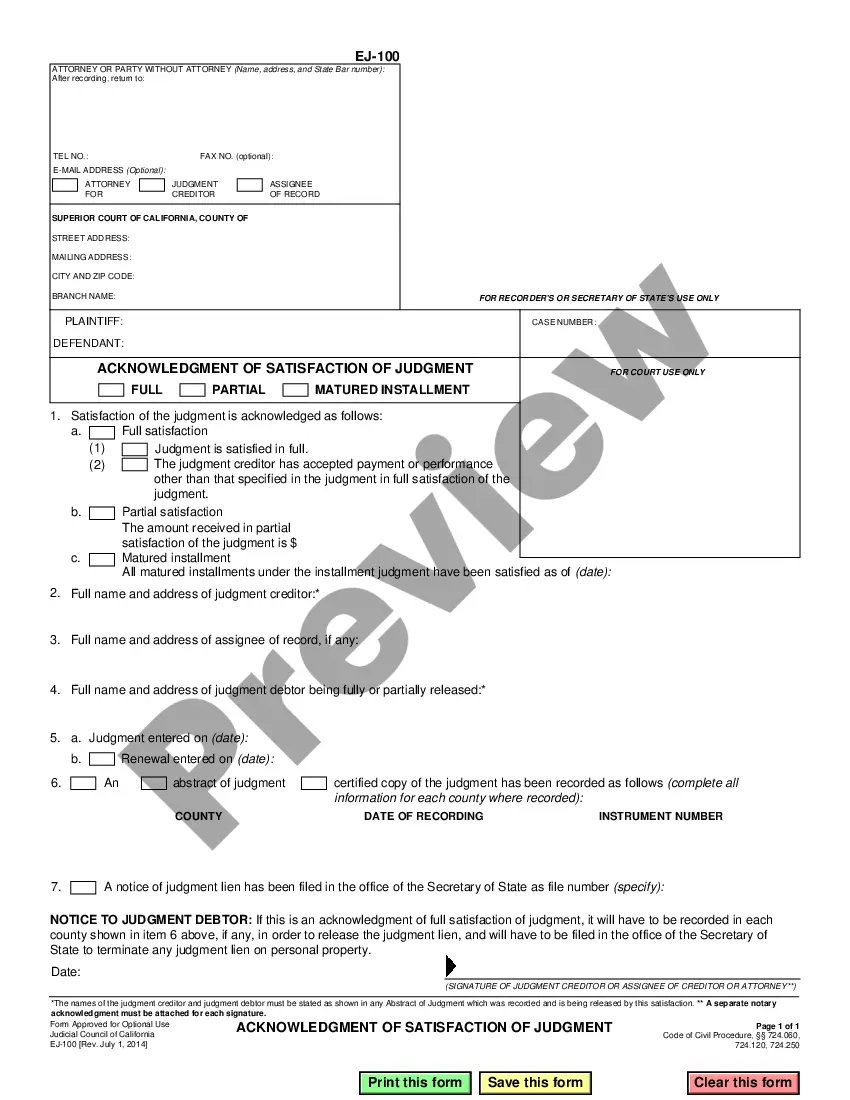

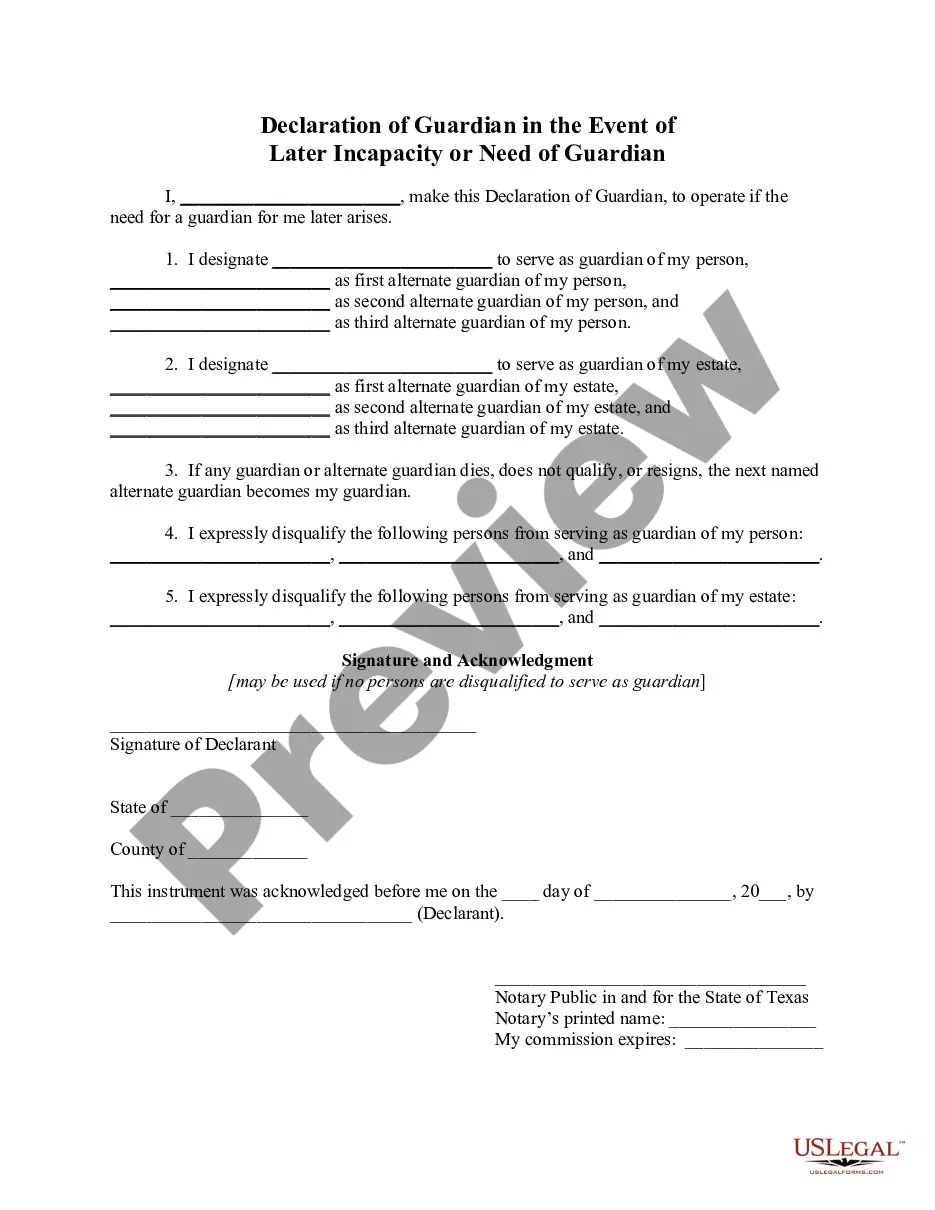

How to fill out Fulton Georgia Assignment Of Overriding Royalty Interests Of A Percentage Of Assignor's Net Revenue Interest, After Deductions Of Certain Costs - Effectively A Net Profits?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life sphere, locating a Fulton Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits meeting all regional requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. In addition to the Fulton Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can get the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Fulton Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Fulton Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding royalty interests are an important financing tool for oil and gas companies involved in the exploration and development of oil gas and mineral interests. For investors, they provide an opportunity to participate in mineral production without incurring the costs.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.

If you receive more than $600 in a calendar year in overriding royalty interest payments, you will receive a 1099 tax form to claim the money as income during your annual tax filing.