The Houston, Texas Assignment of Overriding Royalty Interests (Orris) of a Percentage of Assignor's Net Revenue Interest, after Deductions of Certain Costs — effectively a Net Profits arrangement, is a contractual agreement unique to the oil and gas industry. This type of assignment allows the assignee to receive a portion of the assignor's revenue interest from an oil and gas lease, after deducting certain expenses. In this agreement, the assignor (usually the owner of the oil and gas lease) transfers a fixed percentage or fraction of their net revenue interest to the assignee. Net revenue interest refers to the proportionate share of revenue received from the sale of oil and gas after deducting expenses such as production costs, operating expenses, and taxes. The Houston, Texas Assignment of Overriding Royalty Interests is commonly used in royalty and leasing transactions, allowing the assignee to bypass the burdensome costs associated with exploration, drilling, and production. By acquiring an overriding royalty interest, the assignee can benefit from the production revenue without bearing the risk and costs of operation. There are various types of Houston, Texas Assignment of Overriding Royalty Interests, depending on the specific terms and conditions agreed upon by the assignor and assignee. Some variations include: 1. Flat Percentage ORRIS: In this type, the assignor transfers a fixed percentage of their net revenue interest, regardless of the production volume. This arrangement provides a steady income stream to the assignee. 2. Sliding Scale ORRIS: Here, the assignor assigns a varying percentage of net revenue interest based on production volume or oil and gas prices. The percentage may increase or decrease depending on predefined thresholds. 3. Term ORRIS: This type of assignment has a specific time limit. The assignee receives a percentage of the net revenue interest for a specified period, after which the assignment terminates. 4. Geographic ORRIS: In this arrangement, the assignee only receives a percentage of the net revenue interest from a particular geographical area or lease. It allows for a more targeted investment strategy. 5. Assignment of Temporary ORRIS: This type of assignment grants the assignee the right to a percentage of the net revenue interest for a temporary period, usually during a specific project or phase of production. The Houston, Texas Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, after Deductions of Certain Costs, provides an opportunity for both the assignor and assignee to optimize their involvement in the oil and gas industry. This arrangement allows the assignor to monetize their lease interests while the assignee benefits from the potential profits without assuming the risks and costs associated with operations.

Houston Texas Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits

Description

How to fill out Houston Texas Assignment Of Overriding Royalty Interests Of A Percentage Of Assignor's Net Revenue Interest, After Deductions Of Certain Costs - Effectively A Net Profits?

Preparing papers for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Houston Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits without expert help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Houston Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Houston Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits:

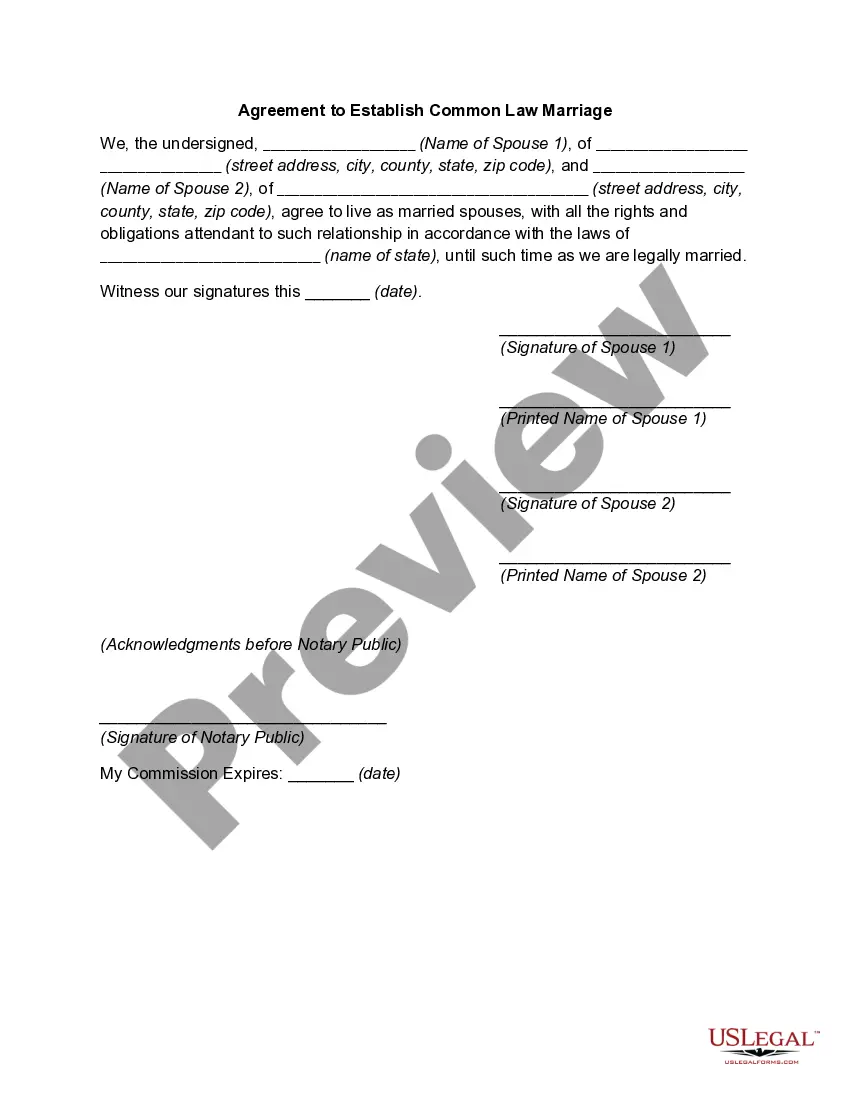

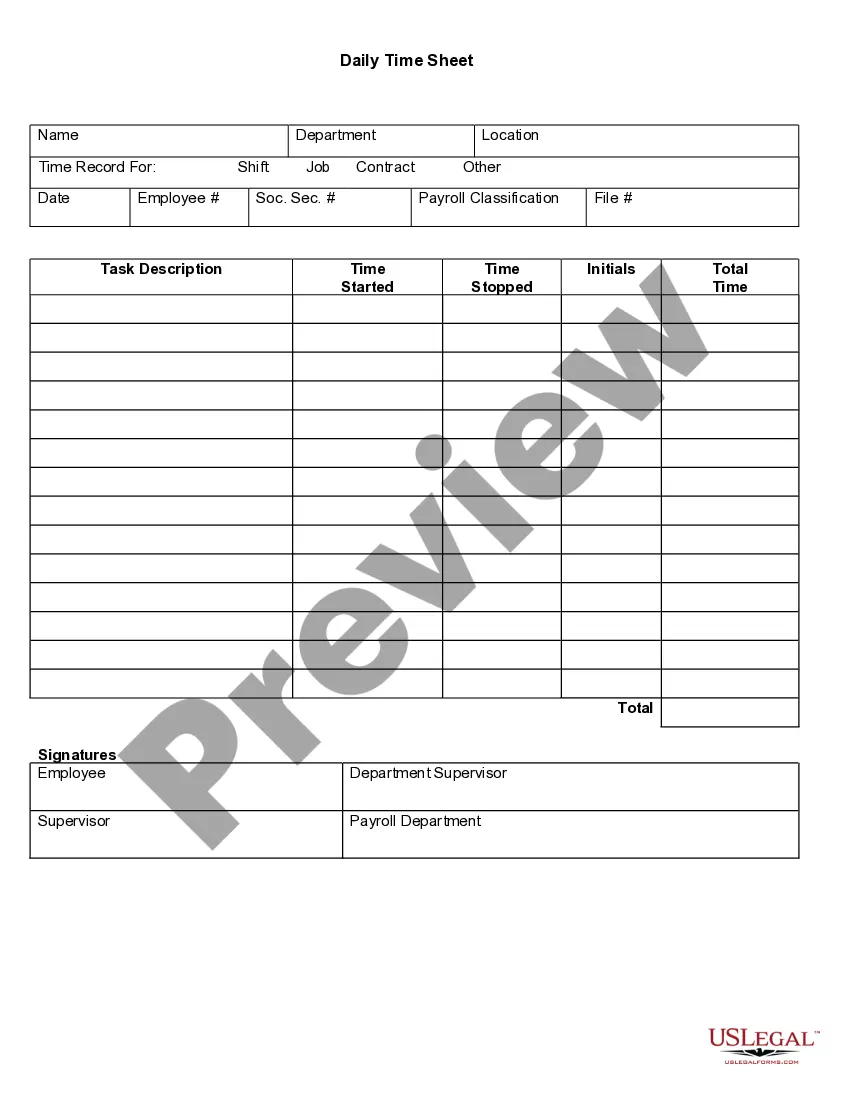

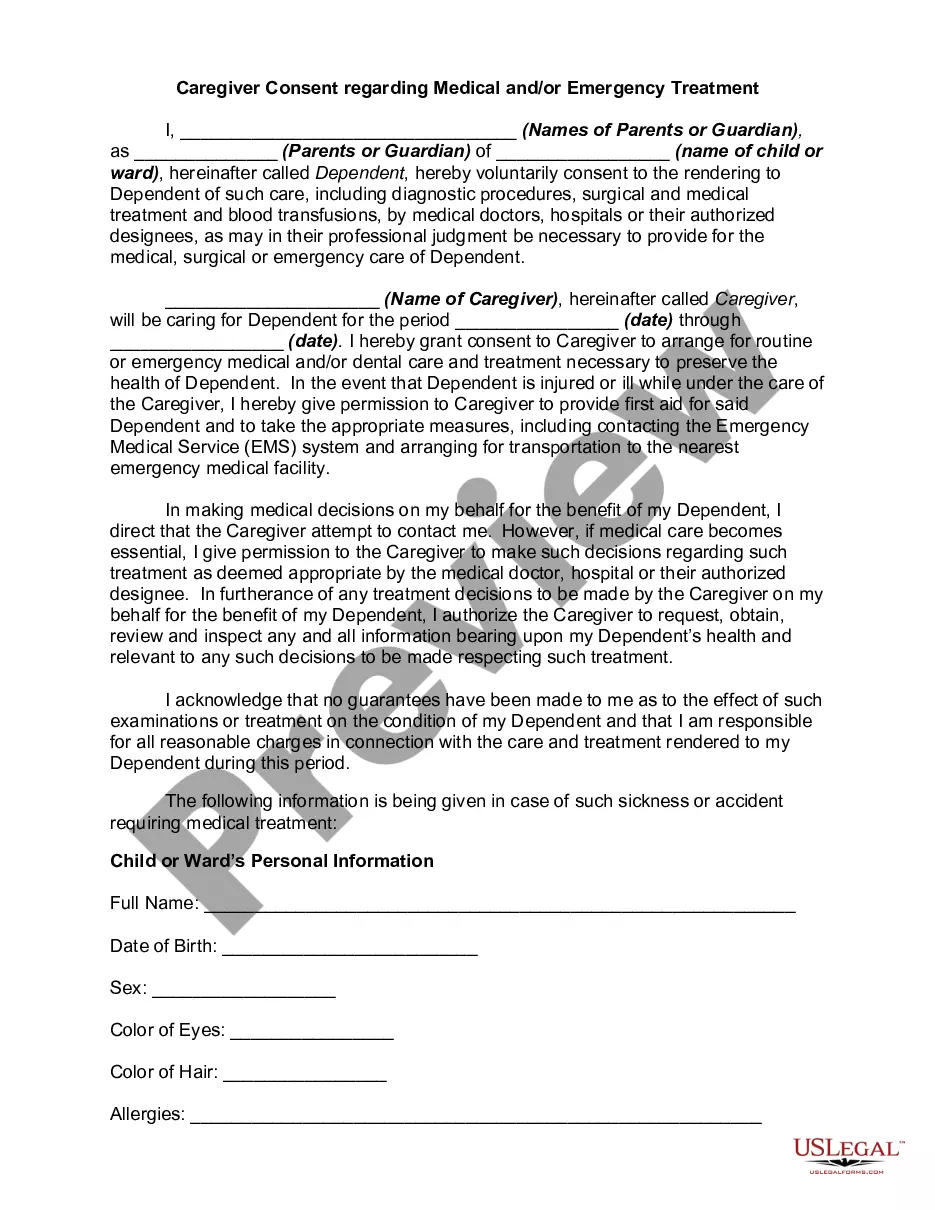

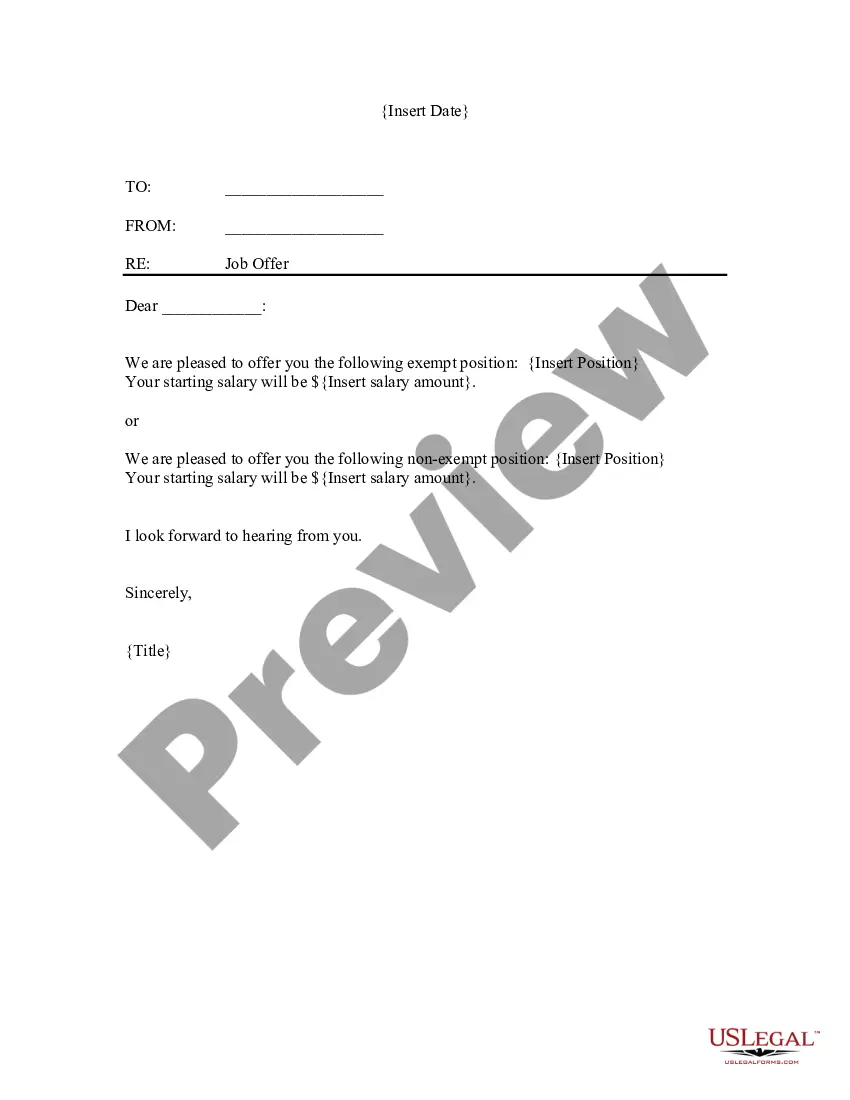

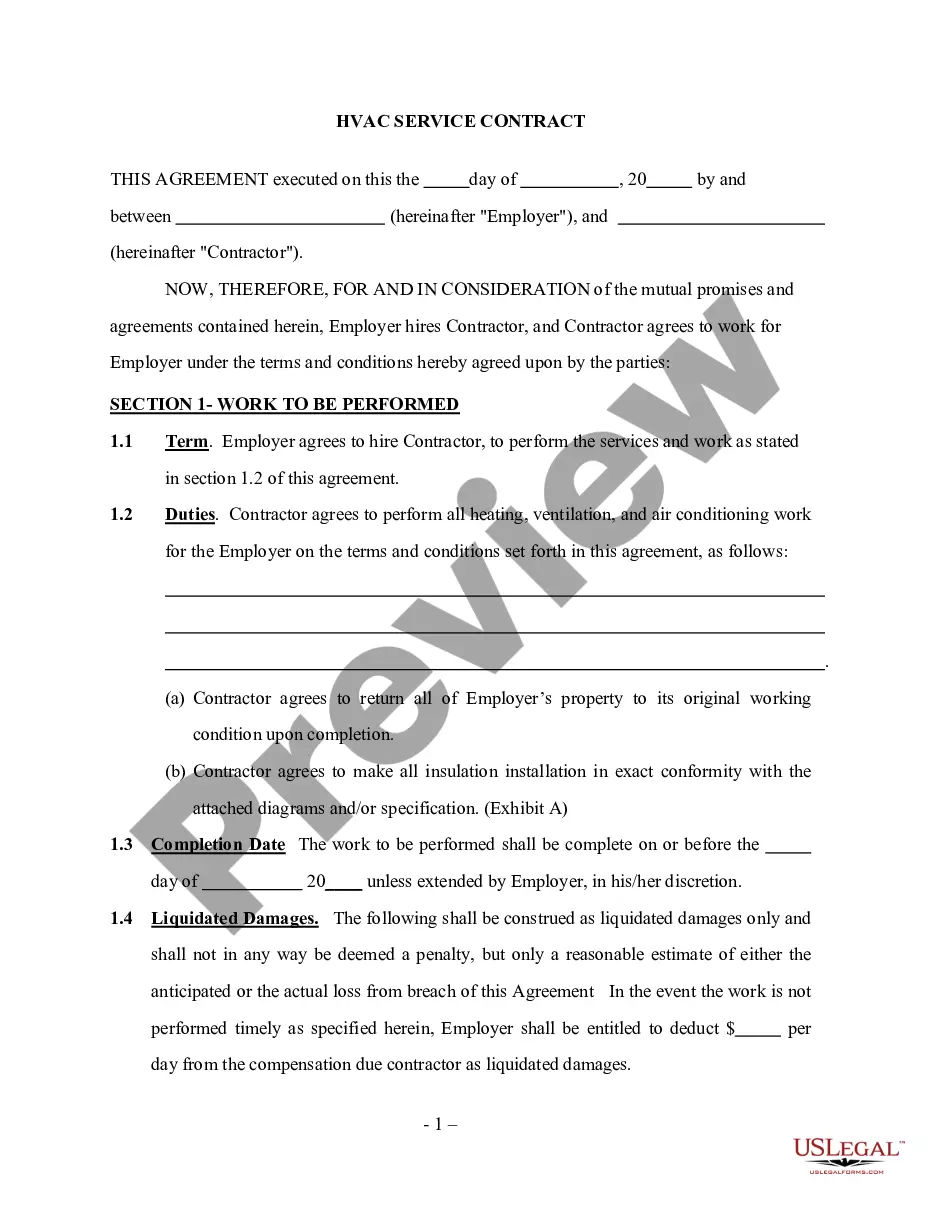

- Examine the page you've opened and check if it has the sample you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any situation with just a couple of clicks!