Los Angeles, California is a vibrant and diverse city located in Southern California. Known as the entertainment capital of the world, Los Angeles is home to Hollywood and the film industry, making it an iconic destination for artists, actors, and dreamers. With its beautiful beaches, stunning landscapes, and a year-round mild climate, Los Angeles attracts millions of visitors and residents alike. Now let's dive into the topic of the Los Angeles California Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs — Effectively A Net Profits. This assignment refers to a legal agreement or transaction where a party (referred to as the assignor) grants a portion of their net revenue interest to another party (referred to as the assignee) in exchange for a share of the profits generated. Within this assignment, there might be different types that vary in specific terms and conditions. Some examples include: 1. Standard Assignment of Overriding Royalty Interests: This type involves the transfer of a fixed percentage of the assignor's net revenue interest to the assignee, after certain costs have been deducted. It provides the assignee with a consistent share of the net profits. 2. Limited Assignment of Overriding Royalty Interests: In this variant, the assignor grants a temporary or restricted percentage of their net revenue interest to the assignee. This could be for a specific period of time or until a certain condition or milestone is met. 3. Conditional Assignment of Overriding Royalty Interests: This type of assignment is dependent on certain conditions being fulfilled, such as a project reaching a certain level of profitability or revenue. The assignee's interest is contingent upon the achievement of these conditions. 4. Joint Assignment of Overriding Royalty Interests: This involves multiple assignors transferring a percentage of their net revenue interests to an assignee. It allows for the pooling of resources and the sharing of profits among the assignors. These various types of Los Angeles California Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs — Effectively A Net Profits allow for flexible arrangements tailored to specific circumstances and preferences of the parties involved.

Los Angeles California Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits

Description

How to fill out Los Angeles California Assignment Of Overriding Royalty Interests Of A Percentage Of Assignor's Net Revenue Interest, After Deductions Of Certain Costs - Effectively A Net Profits?

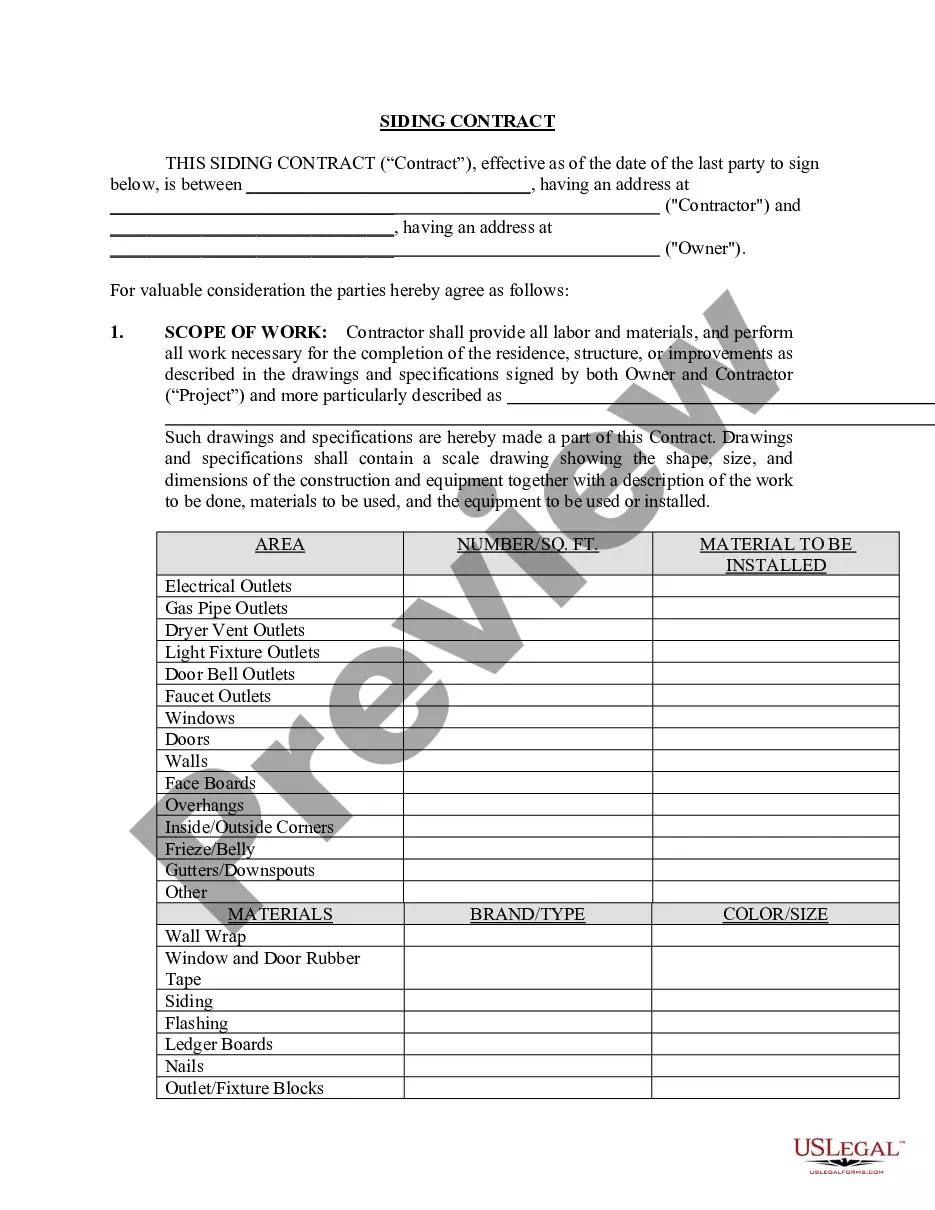

Are you looking to quickly create a legally-binding Los Angeles Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits or probably any other form to take control of your own or corporate affairs? You can select one of the two options: hire a professional to draft a legal document for you or draft it completely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive professionally written legal papers without having to pay unreasonable prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-specific form templates, including Los Angeles Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits and form packages. We provide templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed template without extra hassles.

- First and foremost, carefully verify if the Los Angeles Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits is tailored to your state's or county's laws.

- In case the document has a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the document isn’t what you were looking for by utilizing the search box in the header.

- Select the plan that is best suited for your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Los Angeles Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the paperwork we provide are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!