San Diego, California is a vibrant coastal city known for its stunning beaches, perfect weather, and diverse culture. It offers a wide range of attractions and activities, making it an ideal destination for tourists and residents alike. One notable type of San Diego California Assignment of Overriding Royalty Interests is in the oil and gas industry. Companies often enter agreements in which the assignor grants a certain percentage of their net revenue interest to another party, after deducting certain costs. This arrangement allows the assignee to receive a portion of the profits generated from the oil and gas operations in San Diego. These profits are commonly referred to as net profits, as they are calculated by subtracting specific expenses or deductions from the overall revenue. Another type of San Diego California Assignment of Overriding Royalty Interests is prevalent in the real estate sector. Assignors may assign a percentage of their net revenue interest, after deducting certain costs, to investors or partners involved in property development or leasing. This allows the assignee to share in the profits generated from the rental income or appreciation of properties in San Diego. In the renewable energy industry, there are also assignments of overriding royalty interests in San Diego. Companies engaged in solar, wind, or other renewable energy projects may assign a portion of their net revenue interest to individuals or entities investing in or supporting the development of these projects. After deducting certain costs, the assignor's net revenue interest is effectively converted into net profits, which are shared with the assignee. It's important to note that the specifics of each San Diego California Assignment of Overriding Royalty Interests may vary depending on the industry, parties involved, and terms of the agreement. However, they generally involve the assignor granting a percentage of their net revenue interest, after certain deductions, to the assignee, resulting in the shared distribution of net profits.

San Diego California Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits

Description

How to fill out San Diego California Assignment Of Overriding Royalty Interests Of A Percentage Of Assignor's Net Revenue Interest, After Deductions Of Certain Costs - Effectively A Net Profits?

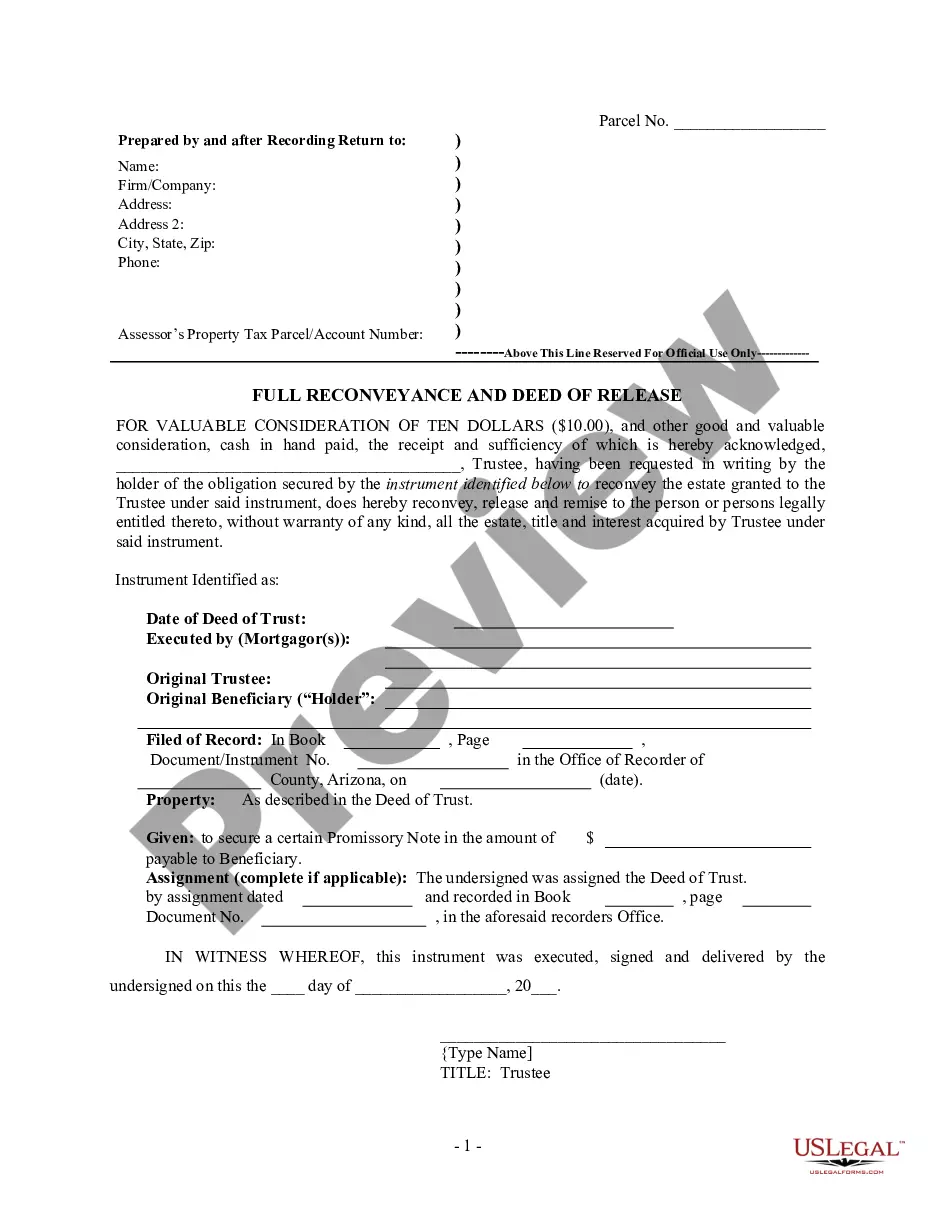

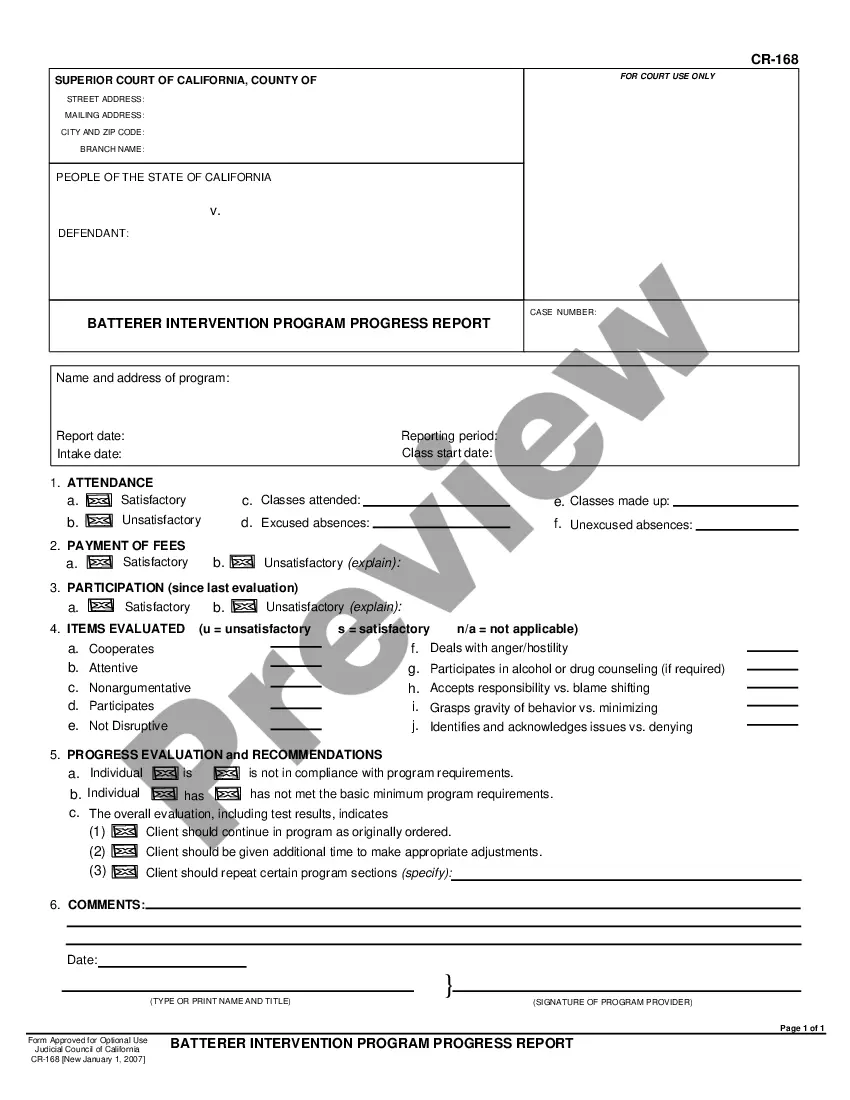

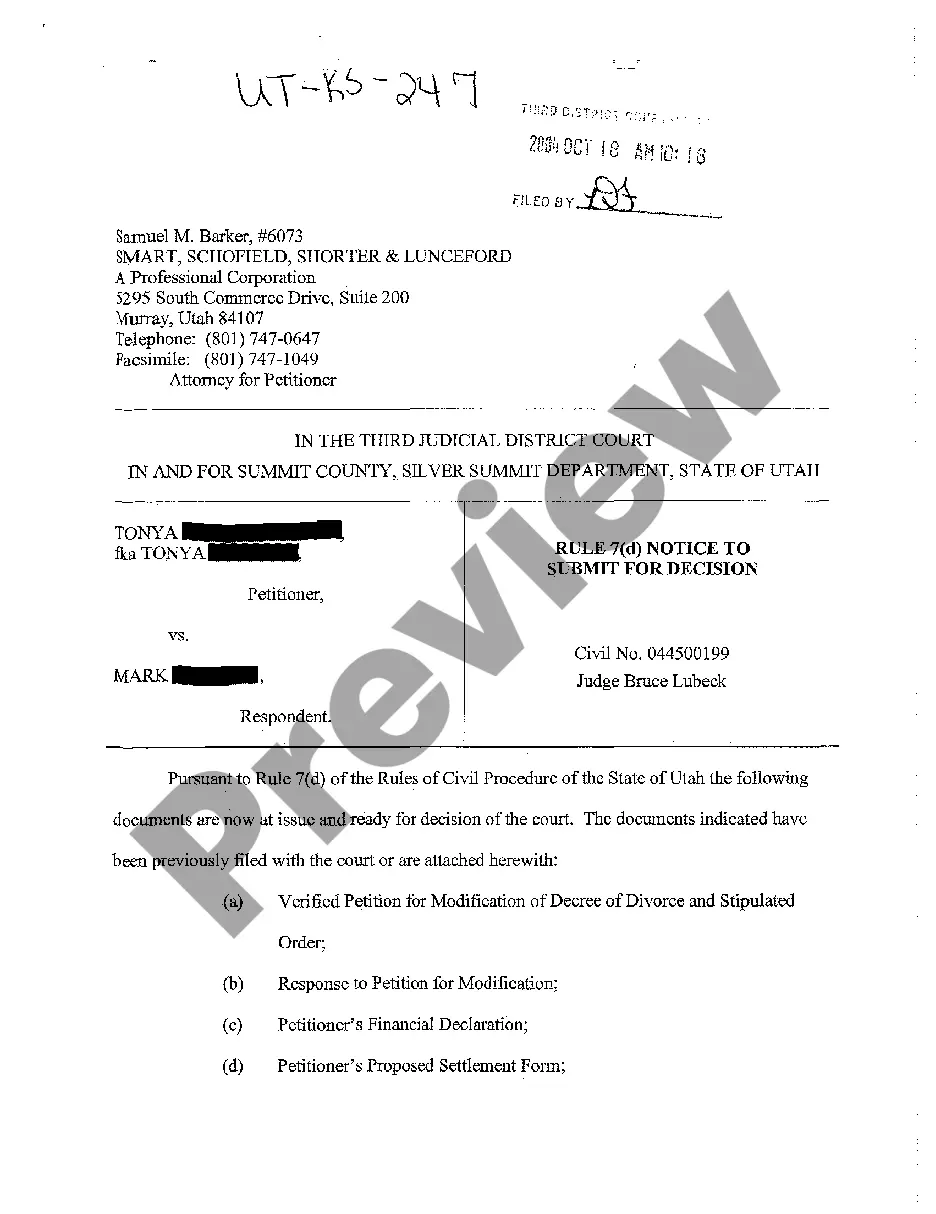

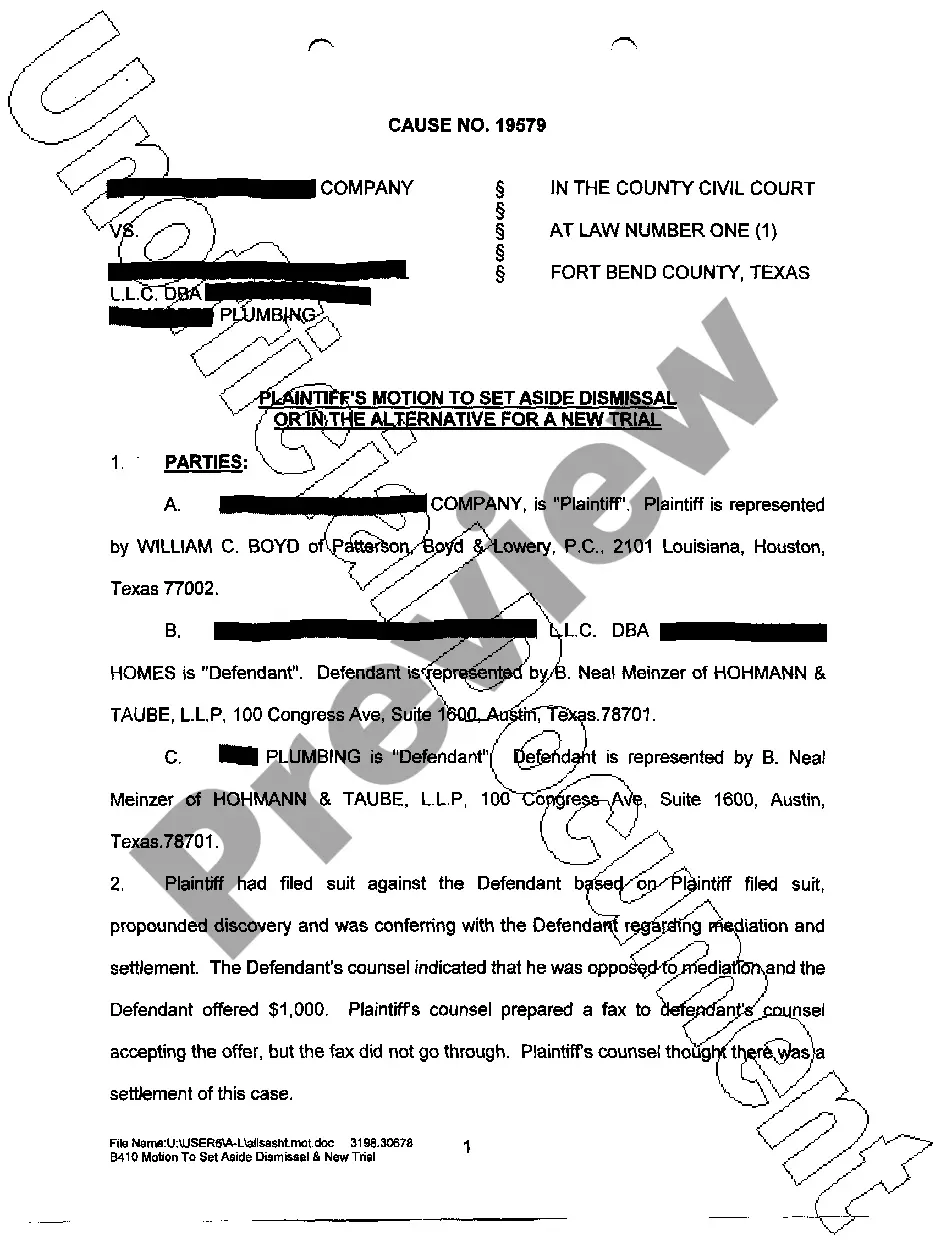

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life sphere, locating a San Diego Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits meeting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. Apart from the San Diego Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Specialists verify all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your San Diego Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Diego Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

If you receive more than $600 in a calendar year in overriding royalty interest payments, you will receive a 1099 tax form to claim the money as income during your annual tax filing.

When valuing a royalty interest or ORRI, here are a few items to keep in mind: Understand the rights and restrictions of the subject royalty interest:Understand the differences between the subject ORRI and a publicly traded security that owns ORRI's and make adjustments for the differences;

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.