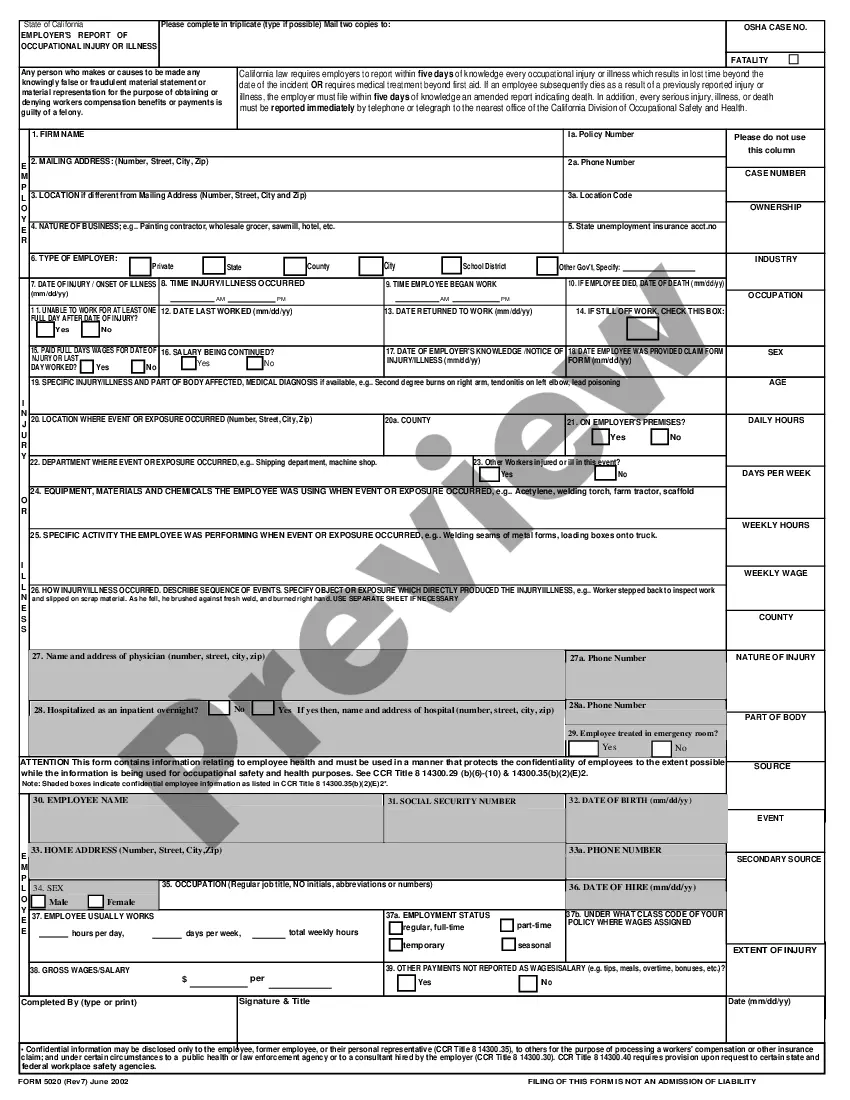

This form is used when Assignor transfers, assigns and conveys to Assignee an overriding royalty interest in all of the oil, gas, and other minerals produced, saved, and marketed from all of the Lands and Leases equal to a determined amount (the Override ).

Queens, New York is a densely populated borough located in New York City. It is known for its vibrant diversity, cultural attractions, and historical significance. Within Queens, there is a variety of Assignment of Overriding Royalty Interest options, including those performed by multiple assignors. One type of Assignment of Overriding Royalty Interest in Queens, New York is the joint assignment. In this scenario, multiple assignors collectively transfer their rights to overriding royalty interests to a third party. This allows for a more diverse and extensive ownership of the royalty interests, providing potential financial benefits to all parties involved. Joint assignments are commonly used in oil, gas, and mineral industries, where the assignors share interests in a specific property or resource. Another type of Queens, New York Assignment of Overriding Royalty Interest is the individual assignment. In this case, each assignor transfers their own overriding royalty interests independently, without the involvement of other parties. This type of assignment allows for specific and personalized transactions, where each assignor has complete control over their interests and agreements. Additionally, there may be assignments of overriding royalty interests in Queens, New York that involve a combination of joint and individual assignments. This could occur when some assignors collectively assign their interests, while others prefer to assign individually. Such arrangements might be implemented to accommodate different preferences, negotiate specific terms, or reflect varying levels of involvement or investment by each assignor. When considering Queens, New York Assignment of Overriding Royalty Interests by Multiple Assignors, it is essential to understand the legal aspects and contractual agreements involved. Assignors should prioritize thorough due diligence and seek appropriate legal advice to ensure that their rights are protected and the assignment is in compliance with relevant laws and regulations. Overall, Queens, New York offers various options for Assignment of Overriding Royalty Interest in Multiple Assignors, including joint assignments, individual assignments, and combinations thereof. Understanding the specific requirements, benefits, and legal implications associated with each type of assignment is crucial for a successful and mutually beneficial outcome.