Allegheny County, Pennsylvania is a diverse and vibrant county located in the southwestern part of the state. Renowned for its rich history, natural beauty, and thriving economy, Allegheny County offers a favorable environment for investments in the oil and gas industry. The Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage is a legal mechanism commonly used in the energy sector. This type of assignment allows an individual or entity that owns a working interest in a lease to assign a portion of their royalty interest to another party. In the context of the oil and gas industry, a working interest owner typically holds the rights to explore, develop, and produce hydrocarbons from a specific lease. The working interest owner bears the costs and risks associated with drilling, production, and operating expenses. By executing an Assignment of Overriding Royalty Interest, the working interest owner grants a stated percentage of their royalty interest to another party. This means that the assigned party will receive a portion of the royalty payments derived from the production and sale of oil and gas from the assigned lease. There may be different variations of the Allegheny Pennsylvania Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage, depending on the specifics of the agreement. These variations could include different percentages of the royalty interest assigned, specific terms and conditions, and provisions for potential adjustments based on production or economic factors. This type of assignment serves as a valuable tool for working interest owners to monetize and diversify their assets. It allows them to transfer a portion of their royalty interest to another party while still maintaining their working interest in the lease and retaining a share of the profits. The Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage provides flexibility and opportunities for collaboration within the oil and gas industry. It enables investors to participate in revenue streams generated by the production of hydrocarbons in Allegheny County, Pennsylvania. These assignments can enhance the exploration and development of natural resources, contributing to the economic growth of the region. Overall, the Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage is a crucial mechanism in the oil and gas industry, enabling owners of working interests to leverage their assets and maximize the value of their investments in the Allegheny County, Pennsylvania region.

Allegheny Pennsylvania Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage

Description

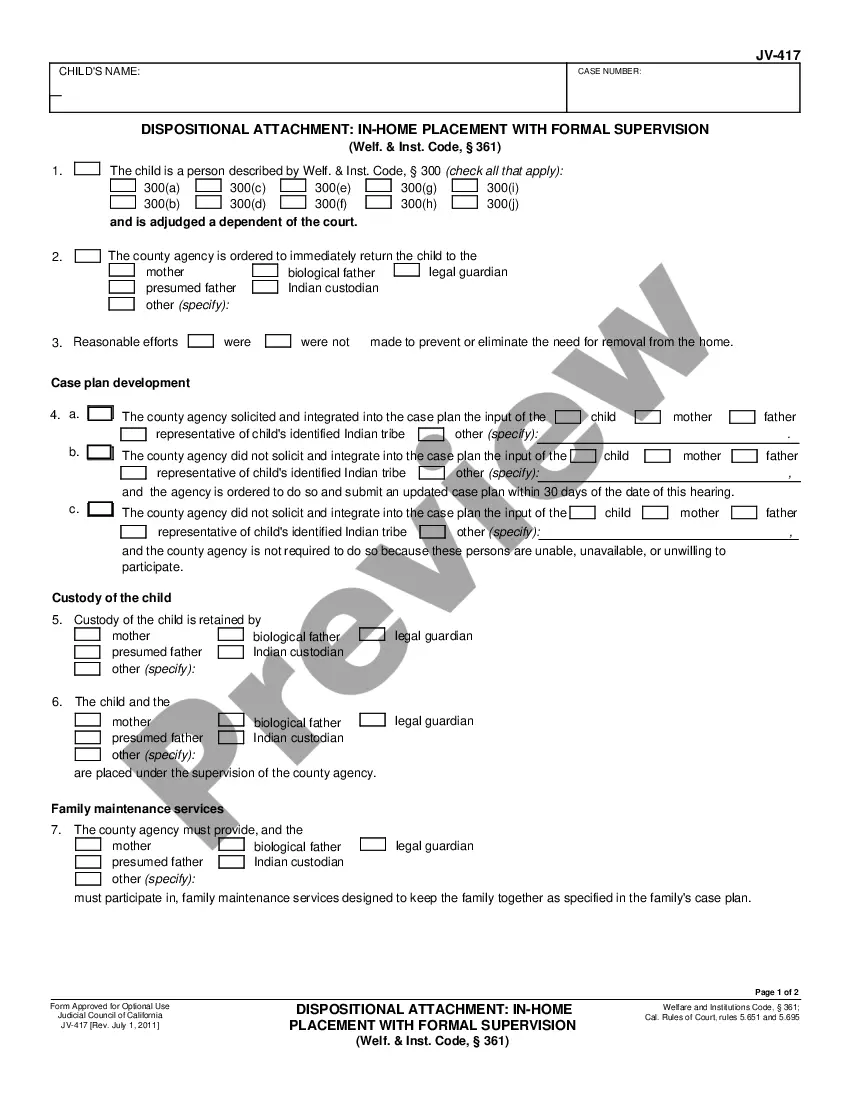

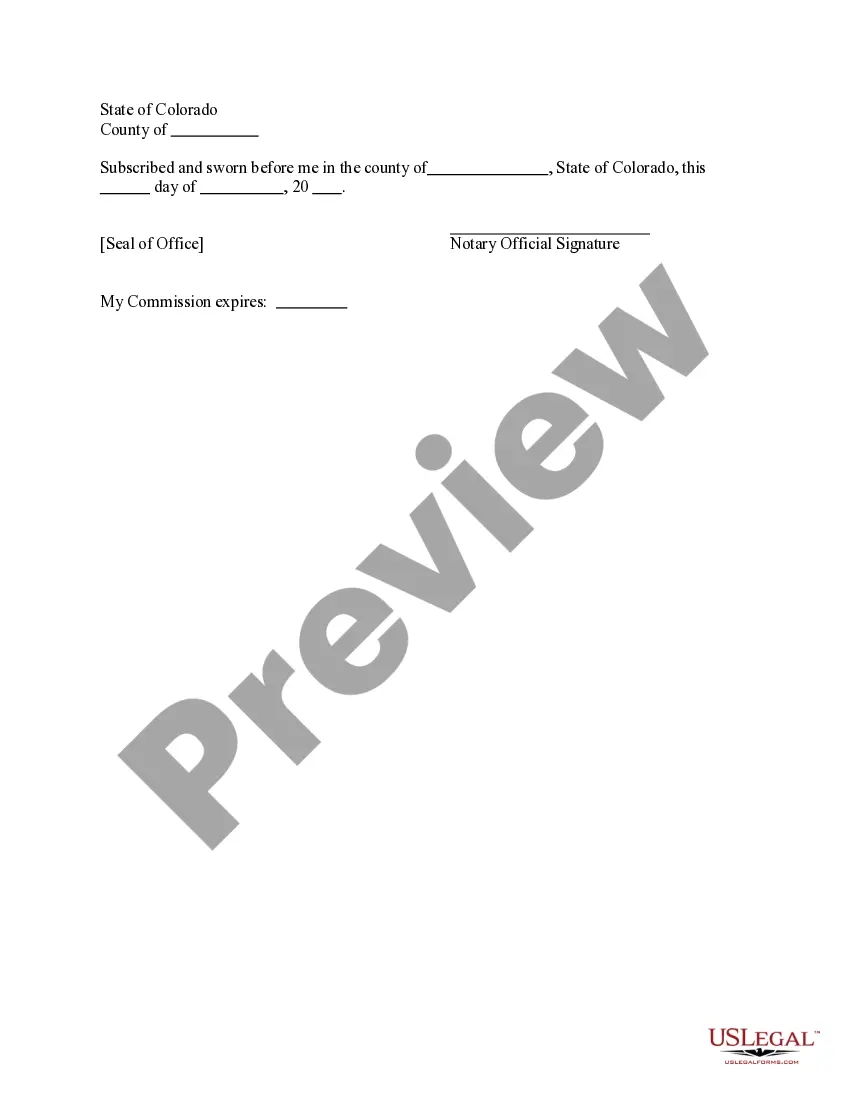

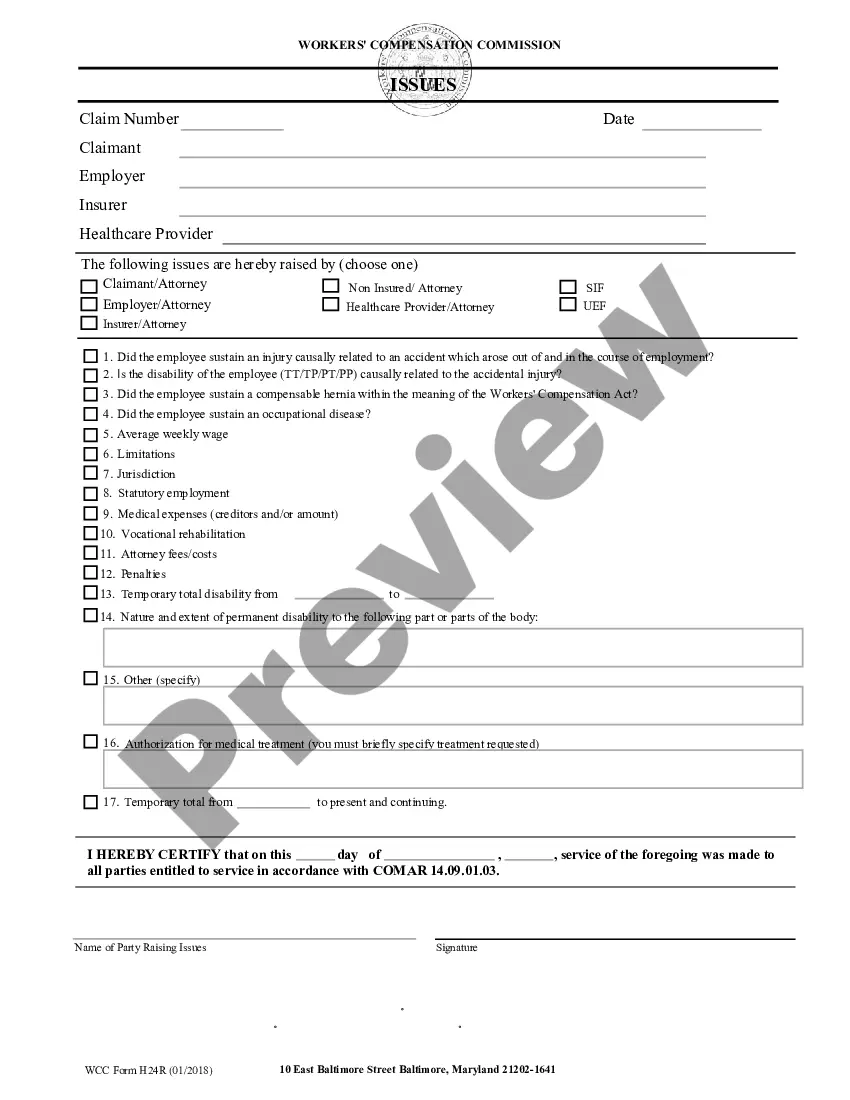

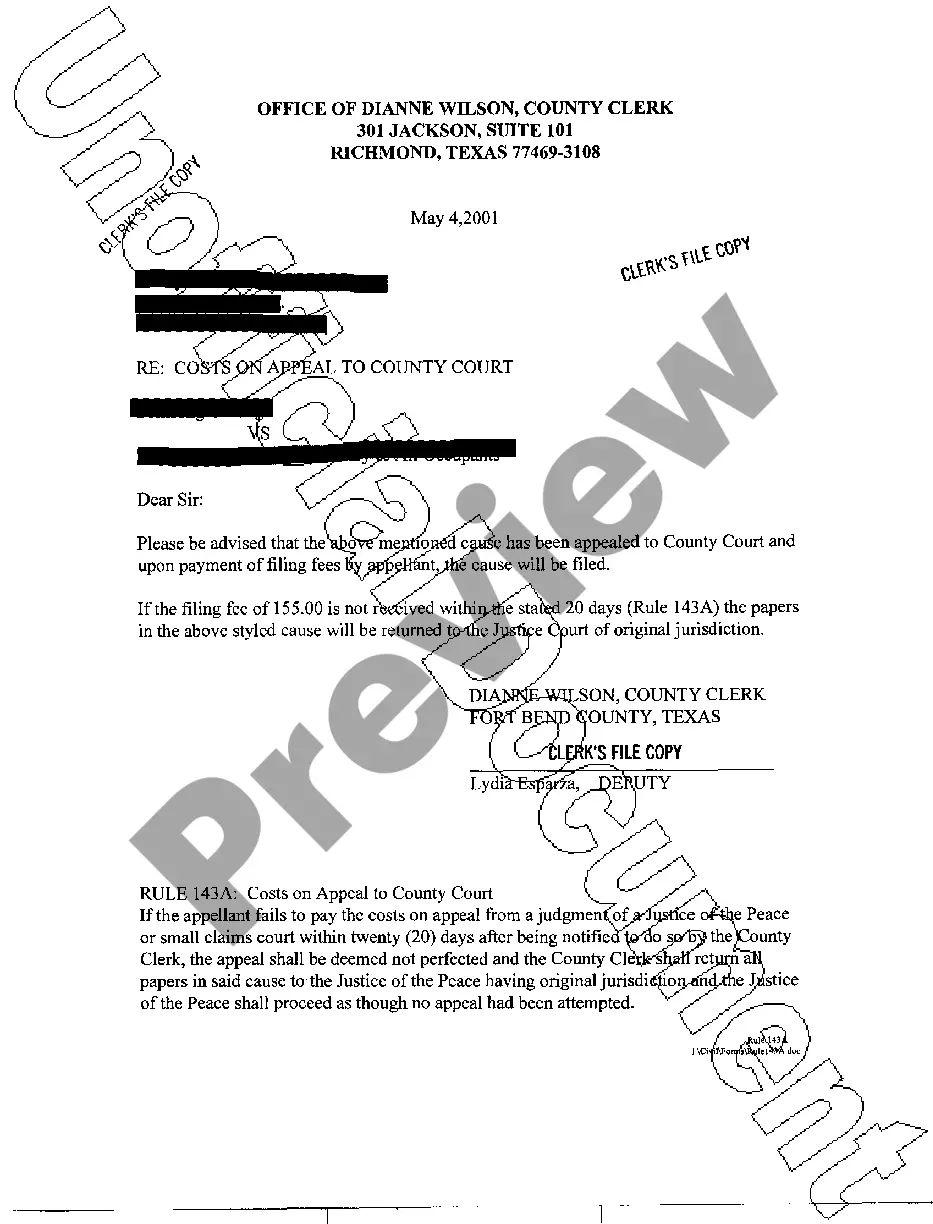

How to fill out Allegheny Pennsylvania Assignment Of Overriding Royalty Interest By Working Interest Owner, Single Lease, Stated Percentage?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Allegheny Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Allegheny Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Allegheny Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage:

- Analyze the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document when you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced.NRI = Working Interest Royalty Interests. 100 25 = 75 percent (NRI) $1,000,000 $250,000 = $750,000 (monthly NRI)

To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

The formula to calculate NPRI without proportionate share reduction is LRR RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners. The formula using proportionate reduction is LRR RI = NPRI.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.