Chicago, Illinois is a vibrant city located in the Midwest region of the United States. As the third most populous city in the country, Chicago is known for its rich history, diverse culture, and iconic landmarks. From its stunning skyline adorned with architectural marvels to its world-class museums, art galleries, and theaters, the city offers a plethora of attractions and activities for residents and visitors alike. Now, let's delve into the intricacies of the Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage, specifically in the context of Chicago, Illinois. The Assignment of Overriding Royalty Interest is an agreement between a working interest owner and a royalty interest holder. In this scenario, a working interest owner is an individual or company that has a direct ownership stake and is responsible for the operational and financial aspects of an oil or gas lease. On the other hand, a royalty interest holder is entitled to a share of the revenue generated from the lease. In the context of Chicago, Illinois, this type of assignment may occur in relation to the exploration and production of natural resources, specifically oil or gas, within the state boundaries. This might involve the operation of wells, drilling, extraction, and subsequent distribution of the resources. The Single Lease aspect indicates that the assignment pertains to a specific agreement or contract related to one lease. This can include areas within the city or surrounding regions where oil or gas exploration and production activities are ongoing. The Stated Percentage signifies the portion of the overriding royalty interest that the working interest owner is assigning to the royalty interest holder. For example, if the stated percentage is 10%, it means that the royalty interest holder will be entitled to receive 10% of the revenue generated from the lease. It's important to note that while the description above covers the key aspects of the Chicago, Illinois Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage, there might be variations in terminology or specific clauses depending on the individual agreements or contracts in place. In conclusion, Chicago, Illinois presents diverse opportunities for assignments involving overriding royalty interests in the field of oil and gas exploration and production. The Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage offers a mechanism for working interest owners and royalty interest holders to collaborate and allocate revenue from the lease based on agreed-upon percentages.

Chicago Illinois Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage

Description

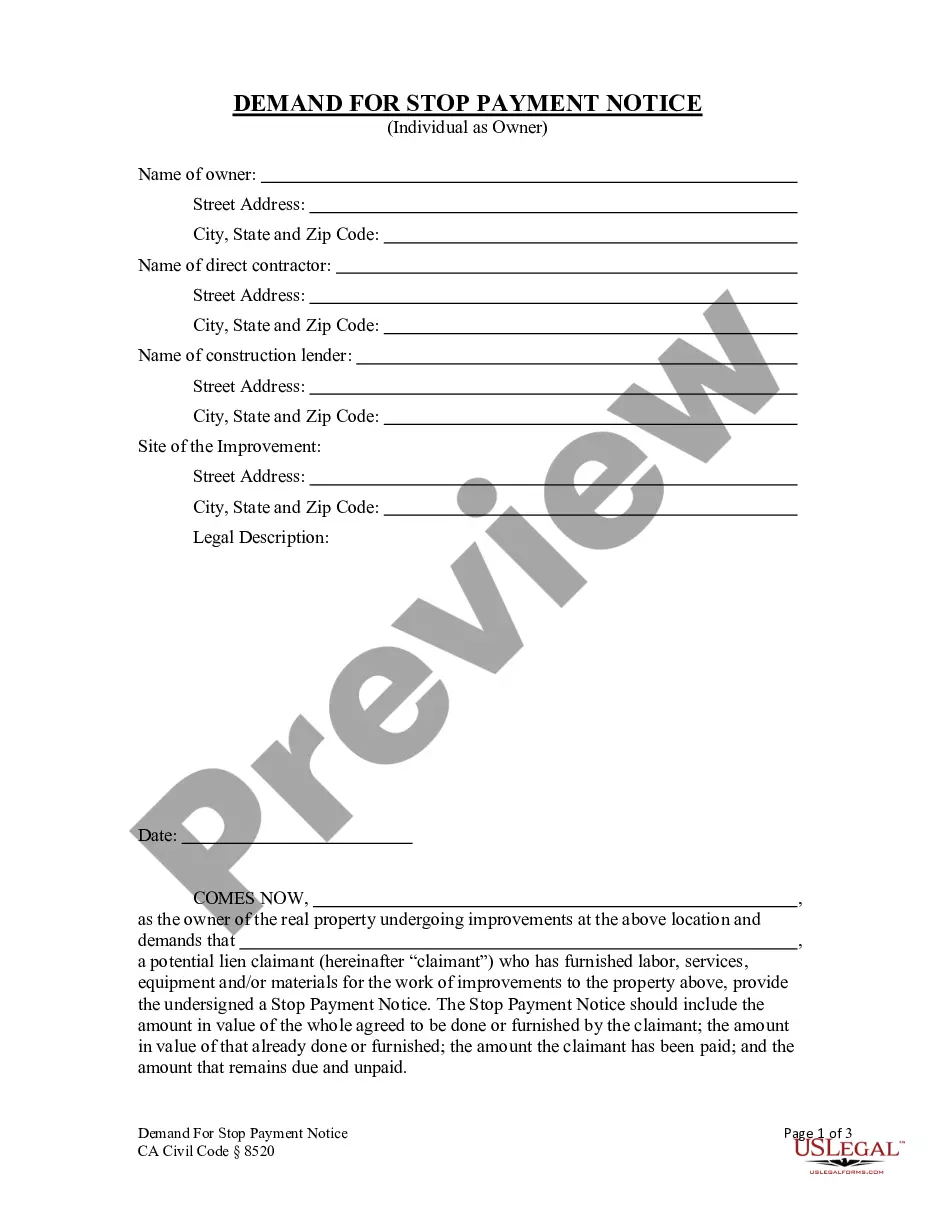

How to fill out Chicago Illinois Assignment Of Overriding Royalty Interest By Working Interest Owner, Single Lease, Stated Percentage?

If you need to get a trustworthy legal document provider to obtain the Chicago Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage, consider US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can search from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of supporting resources, and dedicated support make it easy to get and complete various documents.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply select to look for or browse Chicago Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage, either by a keyword or by the state/county the document is created for. After locating needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Chicago Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage template and take a look at the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and select a subscription option. The template will be instantly ready for download as soon as the payment is completed. Now you can complete the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less pricey and more affordable. Set up your first company, organize your advance care planning, draft a real estate agreement, or execute the Chicago Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage - all from the comfort of your sofa.

Sign up for US Legal Forms now!