Oakland Michigan Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage allows a working interest owner to assign a portion of their royalties to another party. This legal document ensures that the assigned party, known as the overriding royalty interest owner, receives a stipulated percentage of the earnings generated from a specific lease located in Oakland, Michigan. In the realm of oil, gas, and mineral rights, an overriding royalty interest refers to a percentage of revenue obtained solely from the production of an oil or gas well. The working interest owner, who is actively involved in the drilling and operation of the well, can assign a portion or the entirety of their overriding royalty interest to another party. This assignment serves as a contractual agreement between the working interest owner and the overriding royalty interest owner. It outlines the specific lease in Oakland, Michigan, which grants the right to extract and sell the oil, gas, or other minerals found on the property. The stated percentage represents the proportion of the overriding royalty interest that the working interest owner is assigning to a third party. Different variations of the Oakland Michigan Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage may exist based on specific conditions or provisions agreed upon between the two parties involved. These variations can include: 1. Percentage Range: The assignment document may outline a range of percentages that can be assigned, providing flexibility to the working interest owner to assign a variable stake. 2. Limited Term: The assignment may have a specified duration, allowing the overriding royalty interest owner to receive royalties only for a certain period. This could be beneficial if there are uncertain production prospects or exploration ventures planned for the lease. 3. Stipulated Minimum Royalty: The agreement may include a provision guaranteeing the overriding royalty interest owner a minimum royalty payment per period, regardless of the actual revenues generated. This clause ensures a certain level of economic stability for the overriding royalty interest owner. 4. Drilling and Operating Obligations: The assignment might contain provisions specifying the obligations of the working interest owner in terms of drilling, maintenance, and operating costs for the lease. These conditions help ensure the effective development and production of the oil or gas well. In conclusion, the Oakland Michigan Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage is a crucial legal document used in the energy industry. It enables working interest owners to assign a portion of their royalties to overriding royalty interest owners, providing them with a stipulated percentage of the earnings from a specific lease in Oakland, Michigan. Various types of this assignment may exist, incorporating additional provisions and conditions to suit specific circumstances.

Oakland Michigan Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage

Description

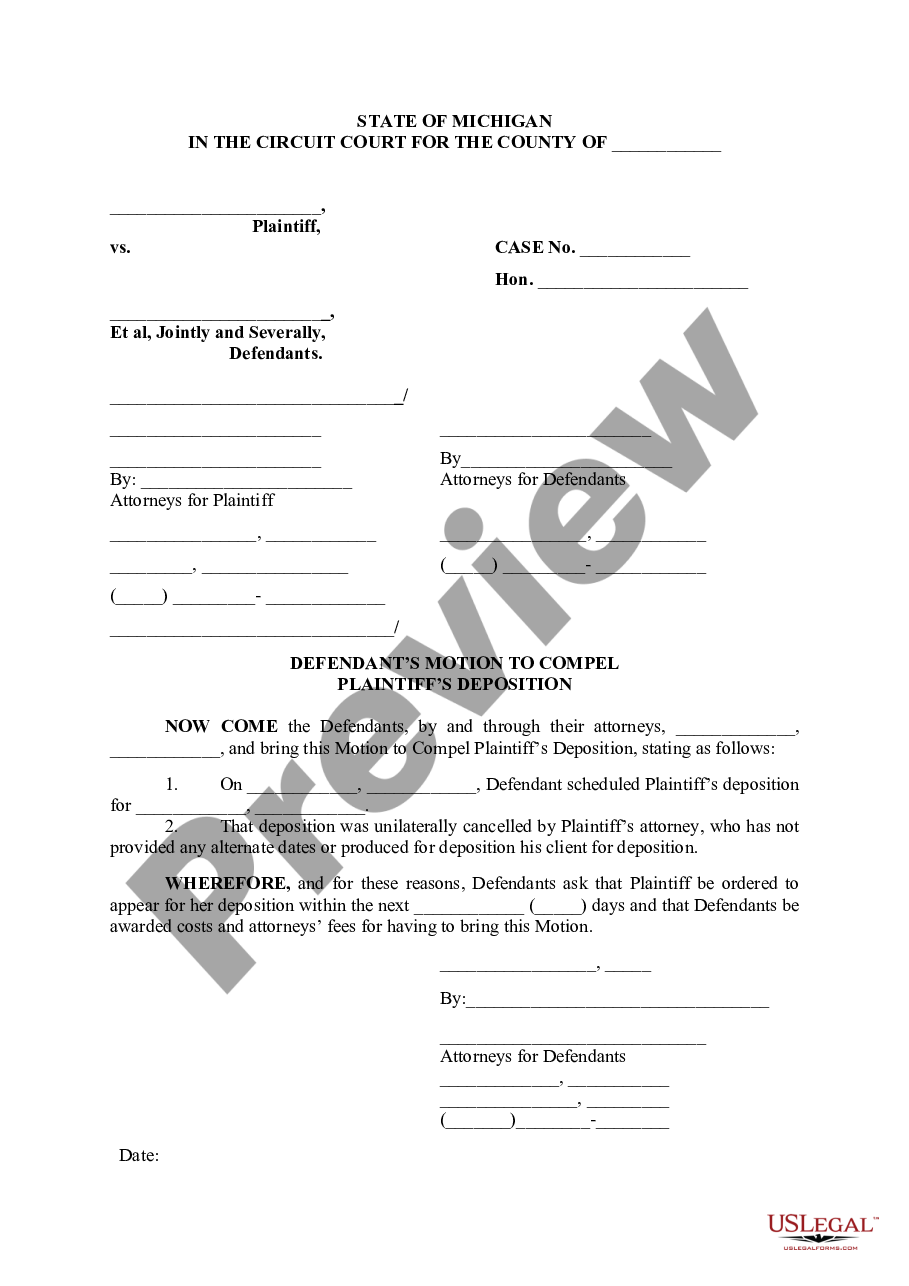

How to fill out Oakland Michigan Assignment Of Overriding Royalty Interest By Working Interest Owner, Single Lease, Stated Percentage?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Oakland Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different categories ranging from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching process less challenging. You can also find information materials and guides on the website to make any activities associated with paperwork execution straightforward.

Here's how to locate and download Oakland Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage.

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the legality of some documents.

- Examine the similar forms or start the search over to find the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Oakland Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Oakland Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage, log in to your account, and download it. Of course, our website can’t replace a lawyer entirely. If you have to cope with an exceptionally challenging case, we recommend using the services of an attorney to check your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and get your state-specific documents effortlessly!

Form popularity

FAQ

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced.NRI = Working Interest Royalty Interests. 100 25 = 75 percent (NRI) $1,000,000 $250,000 = $750,000 (monthly NRI)

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

The formula to calculate NPRI without proportionate share reduction is LRR RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners. The formula using proportionate reduction is LRR RI = NPRI.

Legal Definition of overriding royalty : an interest in and royalty on the oil, gas, or minerals extracted from another's land that is carved out of the producer's working interest and is not tied to production costs compare royalty.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.