Wayne Michigan Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage In Wayne, Michigan, the Assignment of Overriding Royalty Interest in Working Interest Owner refers to a contractual agreement where the party holding the working interest owner's rights transfers a percentage of their share in the lease to another party, known as the assignee. This assignment grants the assignee an overriding royalty interest, which entitles them to a portion of the revenue generated from the oil and gas production on the specified lease. The Single Lease aspect of this assignment denotes that it pertains to a specific lease rather than multiple leases or properties. The Stated Percentage represents the agreed-upon share that the working interest owner is assigning to the assignee. This type of assignment is encountered in the oil and gas industry and is particularly relevant in Wayne, Michigan due to its rich energy resources. Wayne is home to numerous oil and gas wells and has a thriving industry surrounding exploration and production activities. The Assignment of Overriding Royalty Interest in Working Interest Owner can present different variations based on specific terms and conditions agreed upon by the parties involved. Some possible variations include: 1. Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Fixed Percentage: In this scenario, the stated percentage remains fixed throughout the term of the assignment, providing the assignee a consistent share in the revenue. 2. Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Floating Percentage: Here, the stated percentage may vary based on factors like production rates, market conditions, or other predetermined criteria. This flexible arrangement allows the assignee's share to adjust accordingly. 3. Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Conditional Percentage: In this type, the assignee's stated percentage may be contingent on specific conditions being met. For instance, the percentage could be tied to achieving certain production targets or reaching a particular level of profitability. 4. Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Limited Duration: This refers to an assignment with a predetermined expiration date. It grants the assignee a share in the revenue for a fixed period, after which the interests revert to the working interest owner. These variations highlight the flexibility and customization available in Wayne, Michigan's Assignment of Overriding Royalty Interest in Working Interest Owner transactions. Oil and gas companies often engage in these assignments to optimize their portfolios, manage risk, diversify investments, or unlock value from their working interests. It is crucial for all parties involved to carefully negotiate and document the terms of the assignment to ensure clarity and efficiency in the distribution of royalty payments.

Wayne Michigan Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage

Description

How to fill out Wayne Michigan Assignment Of Overriding Royalty Interest By Working Interest Owner, Single Lease, Stated Percentage?

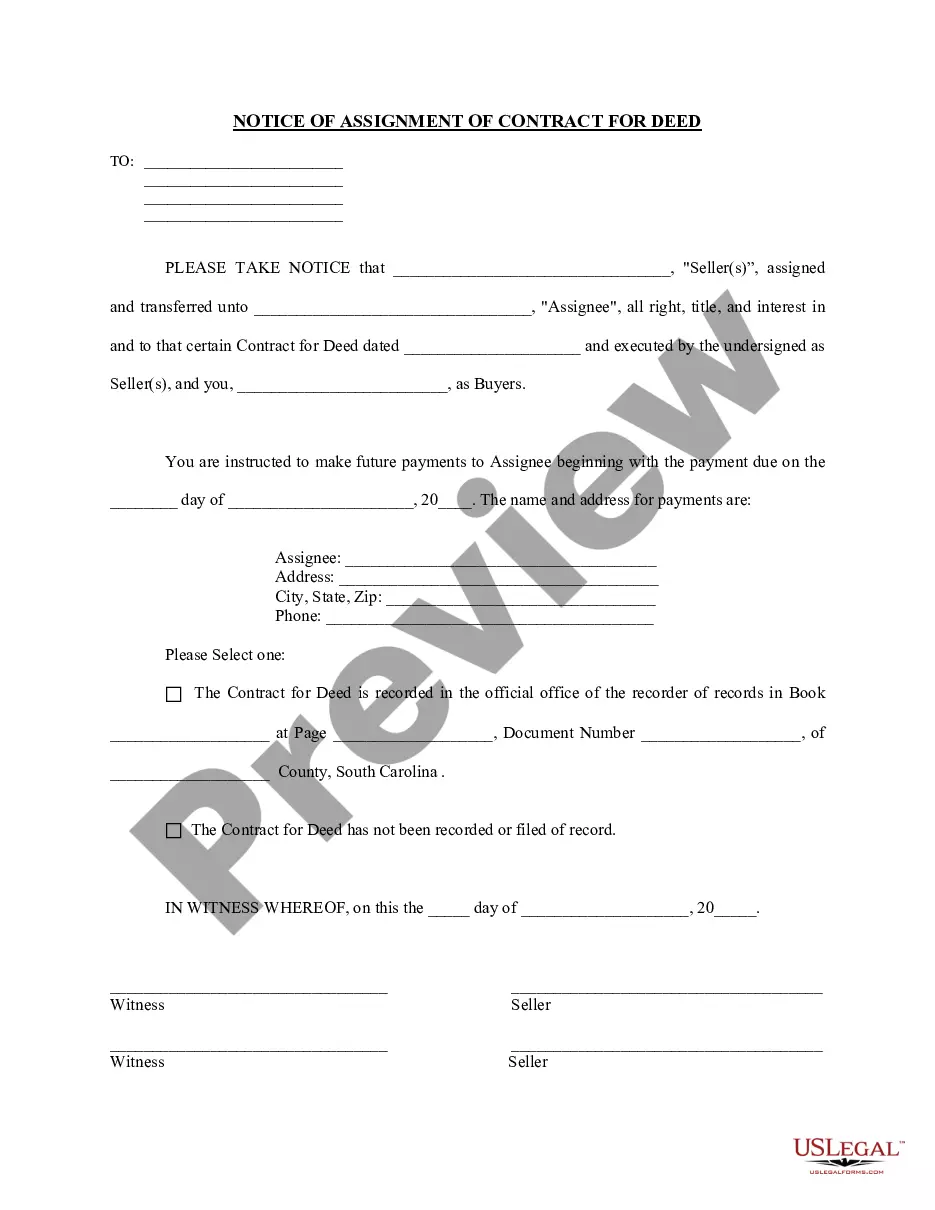

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Wayne Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case accumulated all in one place. Consequently, if you need the current version of the Wayne Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Wayne Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Wayne Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Overriding royalty interests are an important financing tool for oil and gas companies involved in the exploration and development of oil gas and mineral interests. For investors, they provide an opportunity to participate in mineral production without incurring the costs.

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.