Houston, Texas, is widely known for its thriving energy industry, making it a prime location for various oil and gas operations. In this context, the Assignment of Overriding Royalty Interest Convertible to a Working Interest at Assignee's Option plays a crucial role in the local business landscape. This agreement allows parties involved to transfer a portion of their royalty interests to another party, ultimately converting it into a working interest. The Houston Texas Assignment of Overriding Royalty Interest Convertible to a Working Interest At Assignee's Option comes in several types to cater to different scenarios and requirements. Some of these types include: 1. Fixed Percentage Conversion: Under this type, the assignee has the option to convert a fixed percentage of the overriding royalty interest into a working interest. This allows the assignee to actively participate in the exploration and production processes, sharing in the costs, risks, and potential rewards of the project. 2. Time-Bound Conversion: In this variant, the assignee holds the right to convert the overriding royalty interest into a working interest within a specific timeframe. This ensures that the assignee has a defined period to assess the project's viability before making the conversion decision. 3. Performance-Based Conversion: This type of Assignment of Overriding Royalty Interest entails the assignee's conversion option being tied to predefined performance metrics or project milestones. For example, the assignee may convert the interest once a specific production threshold is met or when the project becomes profitable. 4. Partial Conversion: As the name suggests, this type allows for the assignment of only a portion of the overriding royalty interest to be converted into a working interest. This could be favorable when the assignee wants to limit their exposure to risks or when the assignor wishes to retain some royalty benefits. These different types of Assignment of Overriding Royalty Interest Convertible to a Working Interest At Assignee's Option provide flexibility to both parties involved, allowing them to structure their agreements based on their unique circumstances and objectives. Ultimately, this arrangement fosters collaboration, investment, and growth within Houston's energy industry, contributing to the region's economic prosperity.

Houston Texas Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option

Description

How to fill out Houston Texas Assignment Of Overriding Royalty Interest Convertible To A Working Interest At Assignee's Option?

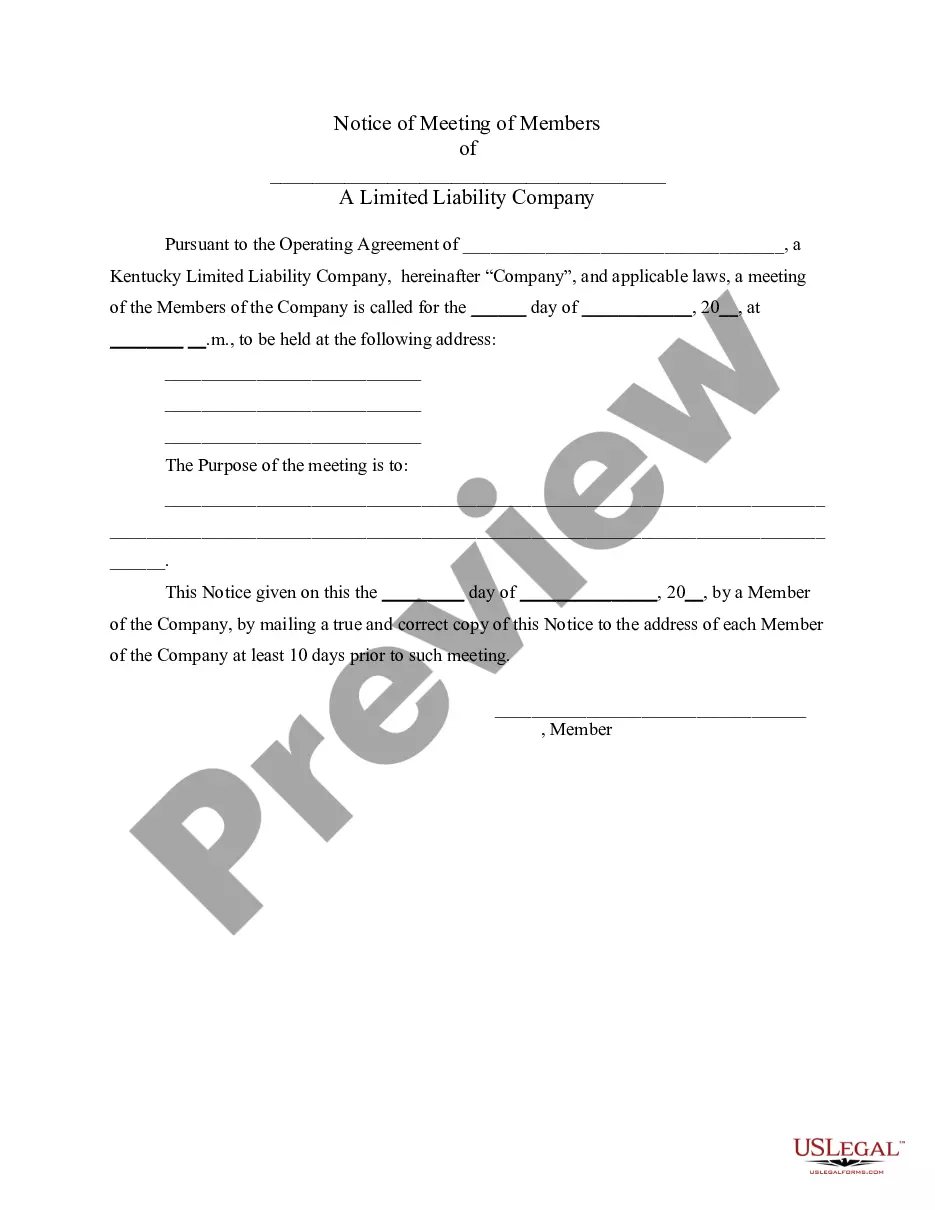

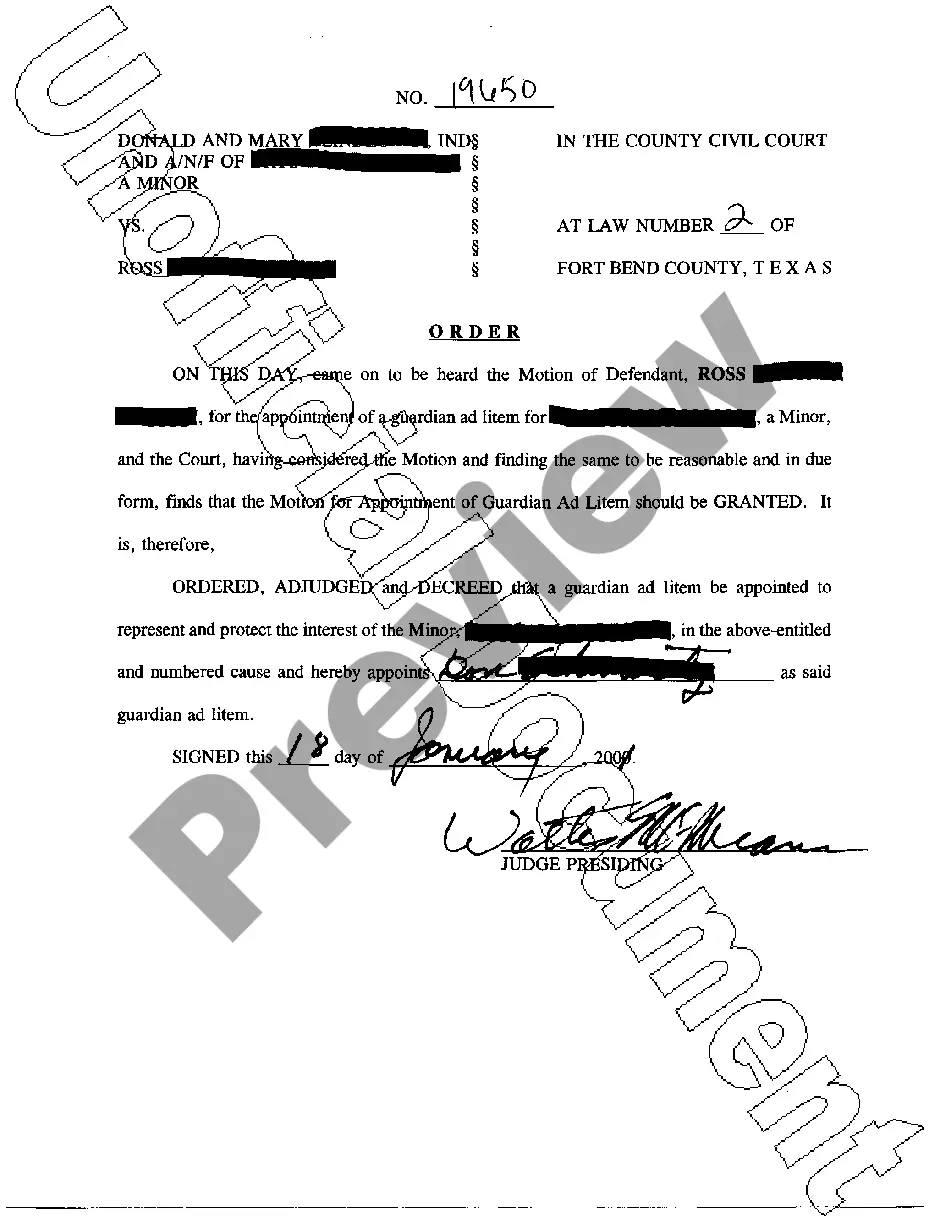

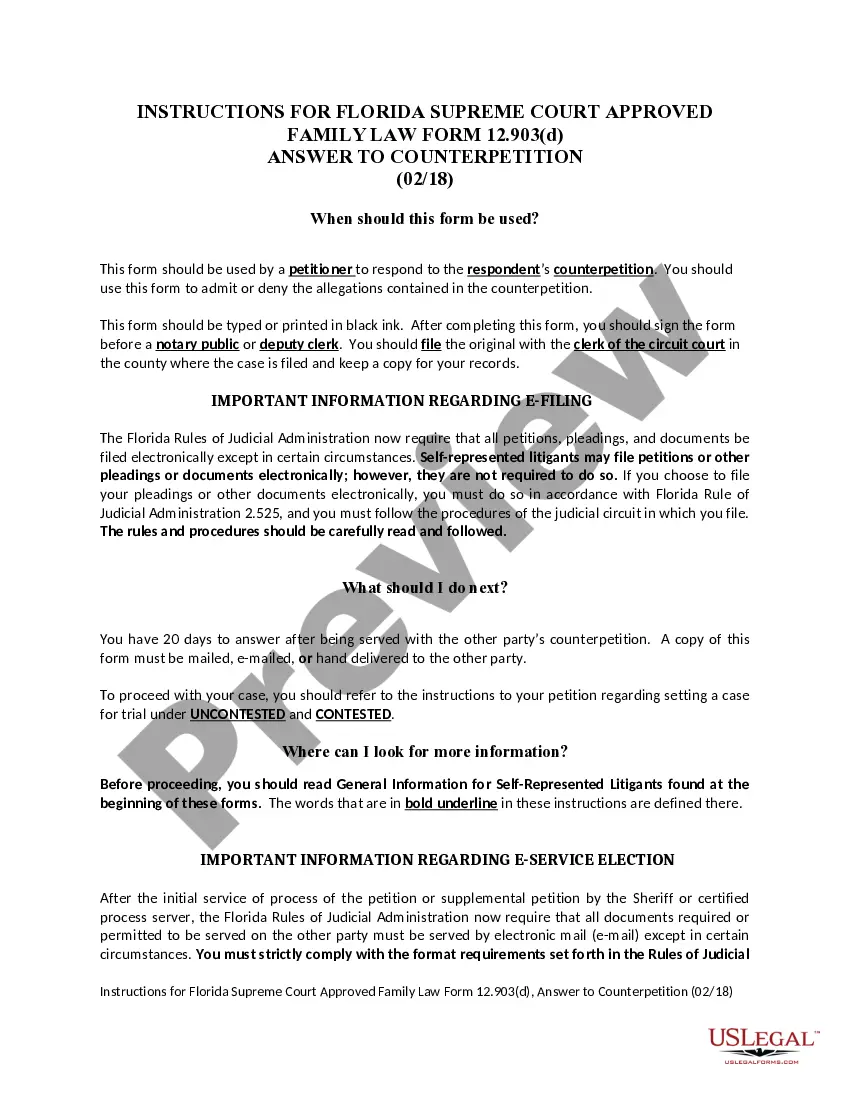

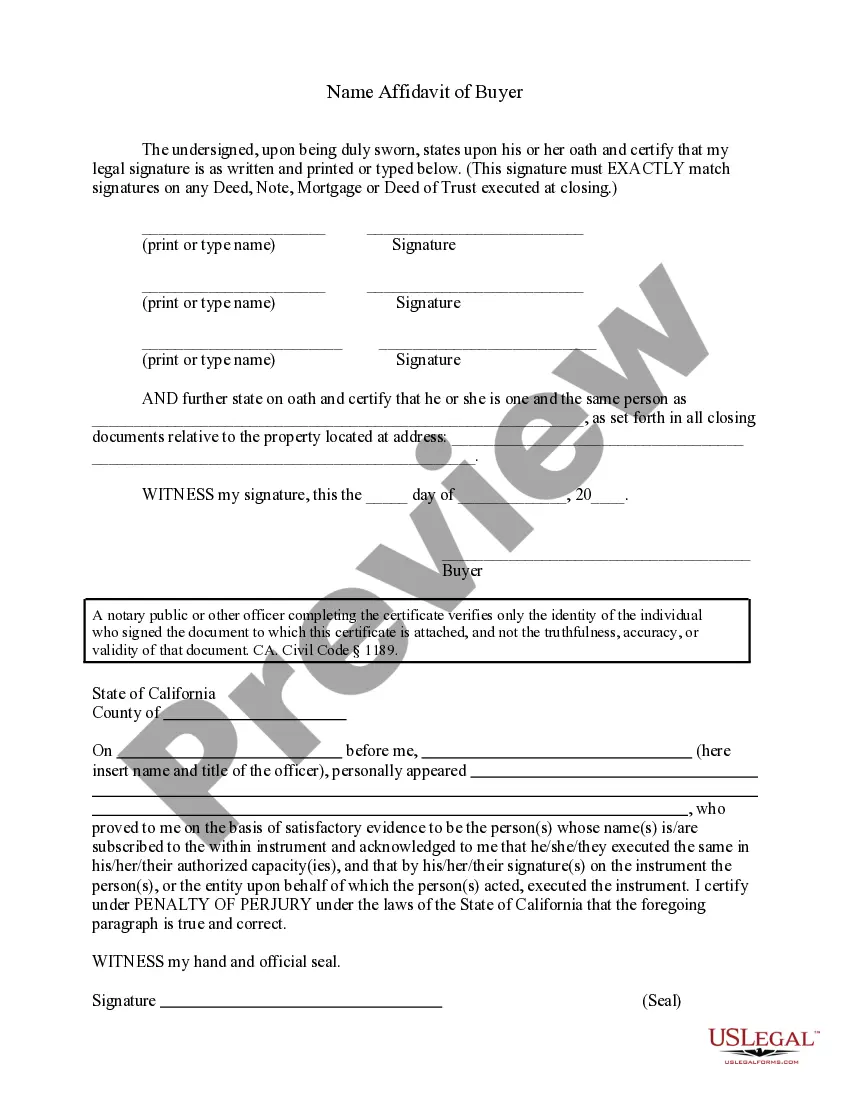

Draftwing documents, like Houston Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option, to manage your legal affairs is a challenging and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal matters into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents created for different scenarios and life situations. We make sure each form is compliant with the laws of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Houston Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before downloading Houston Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option:

- Ensure that your template is compliant with your state/county since the regulations for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a quick intro. If the Houston Assignment of Overriding Royalty Interest Convertible to A Working Interest At Assignee's Option isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin utilizing our website and get the document.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is ready to go. You can try and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!