Collin, Texas Assignment of Overriding Royalty Interest For A Term of Years is a legal agreement that involves the transfer of a portion of an oil and gas lease's royalty interest from the assignor to the assignee for a specified period. This assignment of overriding royalty interest (ORRIS) allows the assignee to receive a percentage of the revenues generated from oil and gas production for a set number of years. In Collin, Texas, there are several types of Assignment of Overriding Royalty Interest For A Term of Years, classified based on specific terms and conditions. Some common types include: 1. Standard Assignment: This type of ORRIS assignment entails the transfer of a fixed percentage of the royalty interest to the assignee for a predetermined number of years. The assignee enjoys the benefits of the assigned royalty interest during this period. 2. Fractional Assignment: In this type, the assignor transfers a specific fraction or a percentage of the overriding royalty interest to the assignee. The assigned fraction will be applicable for a certain duration of years, as stated in the agreement. 3. Multiple Assignments: This category encompasses situations where multiple overriding royalty interest assignments are made to different assignees, each with their own term of years. This typically occurs when the original assignor wants to divide the royalty interest among different parties. 4. Conditional Assignment: A conditional assignment is based on specific conditions or events that need to occur for the assignment to take effect. The term of years will begin only once the predetermined condition is satisfied. 5. Renewal Assignments: These assignments allow the assignee to extend the term of the overriding royalty interest beyond the initially agreed period. The renewal terms and conditions are typically negotiated in the agreement. Regardless of the type of Collin Texas Assignment of Overriding Royalty Interest For A Term of Years, the agreement generally includes key elements such as the effective date of assignment, the percentage or fraction of royalty interest assigned, the term of years, and any specific conditions or obligations related to the assignment. It is essential to consult with legal professionals experienced in oil and gas law while drafting or negotiating an Assignment of Overriding Royalty Interest For A Term of Years in Collin, Texas, to ensure compliance with state regulations and protect the rights and interests of both parties involved.

Collin Texas Assignment of Overriding Royalty Interest For A Term of Years

Description

How to fill out Collin Texas Assignment Of Overriding Royalty Interest For A Term Of Years?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Collin Assignment of Overriding Royalty Interest For A Term of Years, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in different categories ranging from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find information resources and guides on the website to make any tasks associated with document completion simple.

Here's how you can locate and download Collin Assignment of Overriding Royalty Interest For A Term of Years.

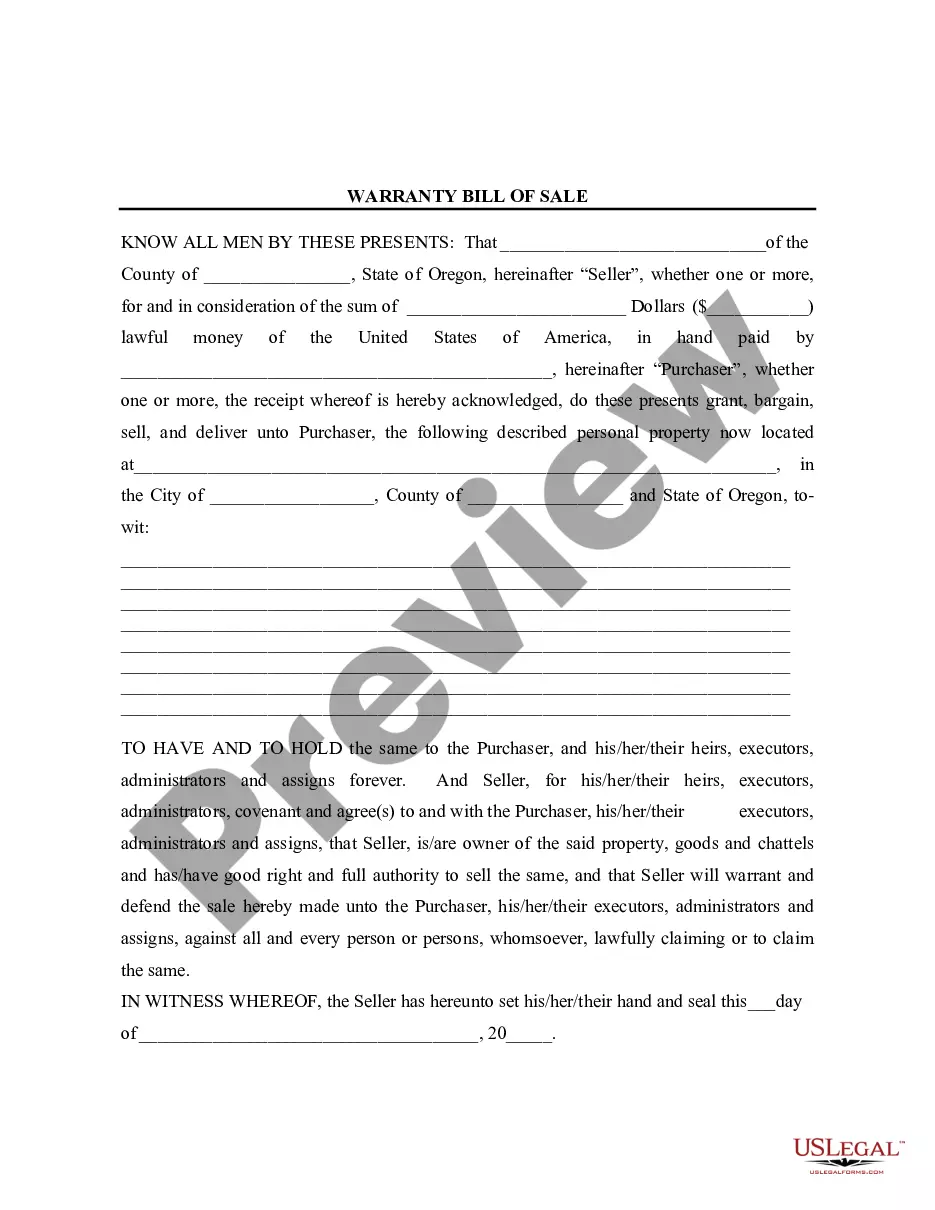

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after downloading the form.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can affect the validity of some records.

- Check the similar forms or start the search over to locate the right file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment gateway, and purchase Collin Assignment of Overriding Royalty Interest For A Term of Years.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Collin Assignment of Overriding Royalty Interest For A Term of Years, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional entirely. If you need to cope with an extremely difficult situation, we recommend using the services of an attorney to review your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Become one of them today and purchase your state-specific documents effortlessly!