The Lima Arizona Assignment of Overriding Royalty Interest For A Term of Years is a legally binding document that establishes the transfer of rights and interests in an oil and gas lease located in Pima County, Arizona. This assignment enables the assignor (the current royalty interest owner) to transfer their royalty interest to the assignee (the new recipient) for a specific term. Keywords: Lima Arizona, assignment, overriding royalty interest, term of years, oil and gas lease, transfer, assignor, assignee. Different Types of Lima Arizona Assignment of Overriding Royalty Interest For A Term of Years: 1. Permanent Assignment: This type of assignment involves the complete and permanent transfer of the overriding royalty interest for an indefinite term. Once the assignment is executed, the assignor no longer holds any rights or interests in the oil and gas lease. 2. Temporary Assignment: In this case, the assignor grants the assignee the overriding royalty interest for a specific, predetermined period. Once the term expires, the rights and interests revert to the assignor. 3. Partial Assignment: This type of assignment entails the transfer of a portion of the overriding royalty interest for a specified term. The assignor retains ownership of the remaining portion, while the assignee acquires the designated percentage for the agreed-upon duration. 4. Relinquishment Assignment: Often used when an assignor no longer wishes to maintain their overriding royalty interest, a relinquishment assignment involves the voluntary surrender of the interest. The assignee assumes ownership for the remaining term of years. 5. Assignment with Diversionary Interest: In this scenario, the assignment is structured in a way that enables the overriding royalty interest to revert to the assignor or another designated party upon the fulfillment of certain conditions or at the conclusion of the term. 6. Assignment with Override on Reassignment: This type of assignment grants the assignor the right to receive an overriding royalty interest should the assignee decide to reassign or transfer their rights to a third party during the term. Overall, the Lima Arizona Assignment of Overriding Royalty Interest For A Term of Years serves as a crucial legal instrument in facilitating the transfer of royalty interests and protects the rights of both the assignor and assignee within the context of an oil and gas lease located in Pima County, Arizona.

Pima Arizona Assignment of Overriding Royalty Interest For A Term of Years

Description

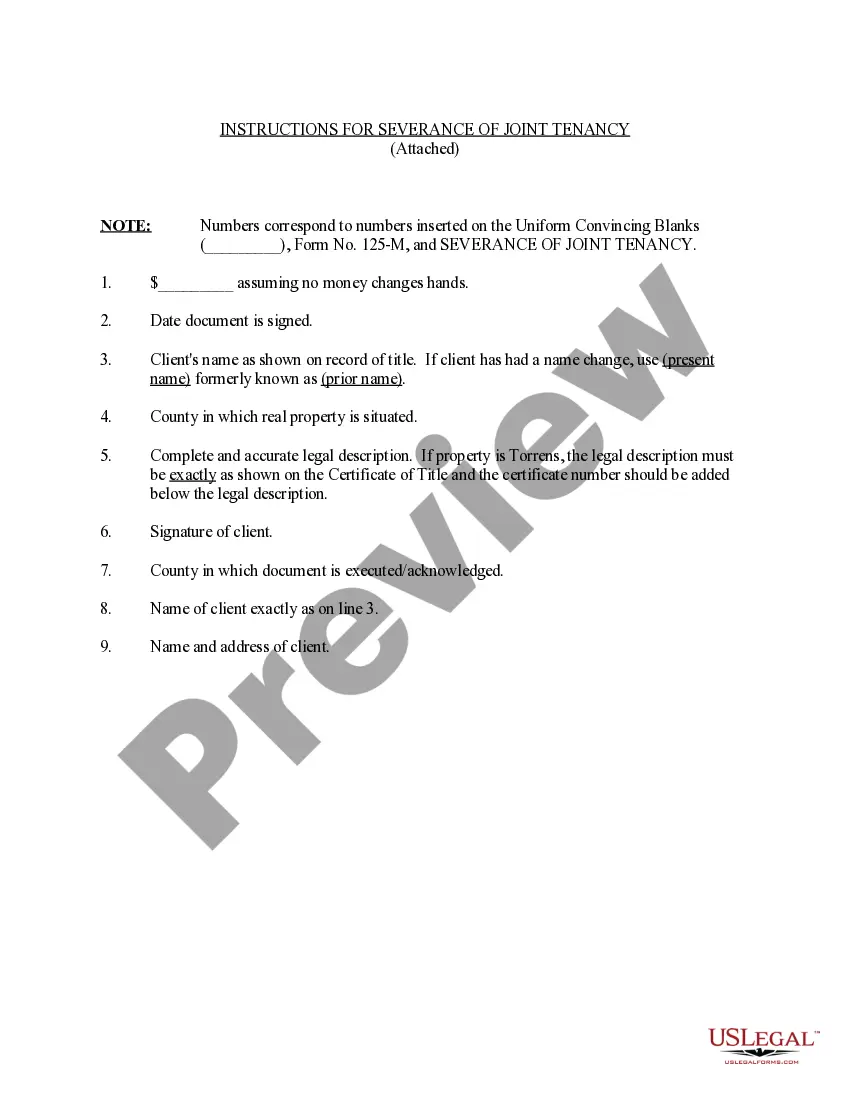

How to fill out Pima Arizona Assignment Of Overriding Royalty Interest For A Term Of Years?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so helpful.

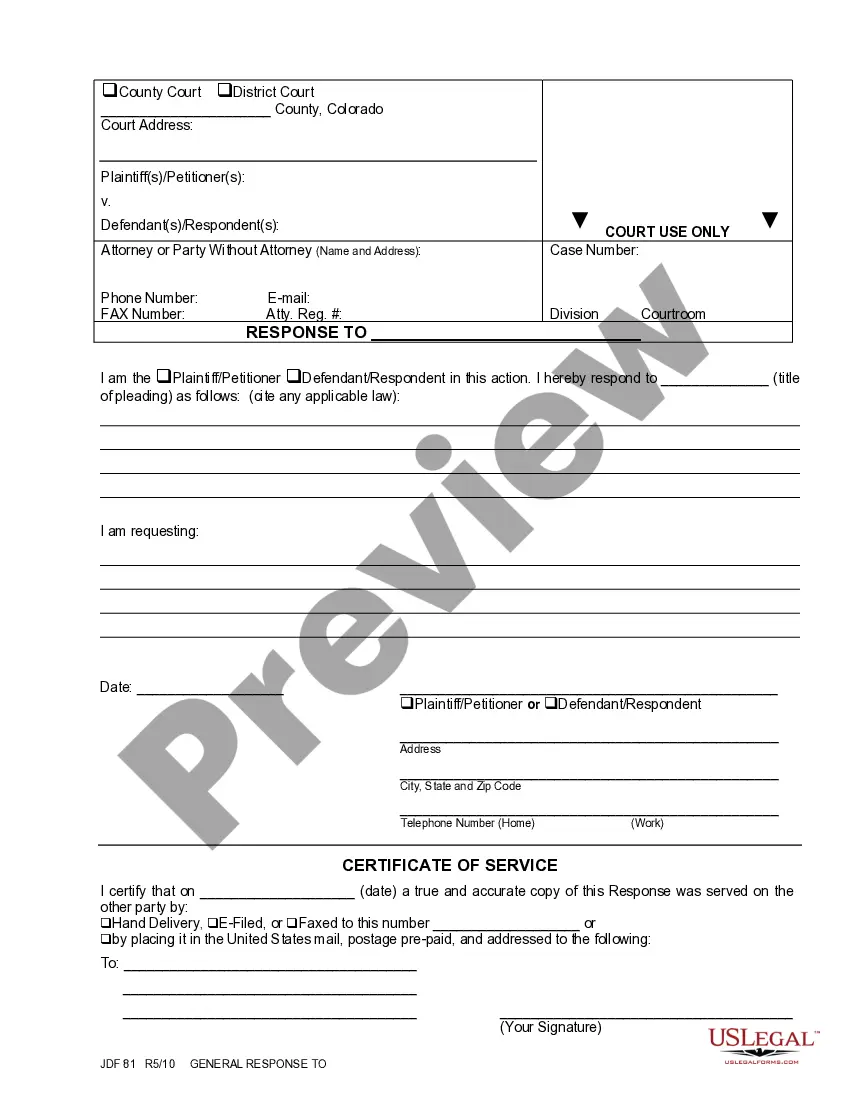

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business objective utilized in your region, including the Pima Assignment of Overriding Royalty Interest For A Term of Years.

Locating samples on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Pima Assignment of Overriding Royalty Interest For A Term of Years will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Pima Assignment of Overriding Royalty Interest For A Term of Years:

- Ensure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Pima Assignment of Overriding Royalty Interest For A Term of Years on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced.NRI = Working Interest Royalty Interests. 100 25 = 75 percent (NRI) $1,000,000 $250,000 = $750,000 (monthly NRI)

The formula to calculate NPRI without proportionate share reduction is LRR RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners. The formula using proportionate reduction is LRR RI = NPRI.

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

Overriding Royalty Interest (ORRI) A royalty in excess of the royalty provided in the Oil & Gas Lease. Usually, an override is added during an intervening assignment. ORRIs are created out of the working interest in a property and do not affect mineral owners.

Overriding royalty interests are an important financing tool for oil and gas companies involved in the exploration and development of oil gas and mineral interests. For investors, they provide an opportunity to participate in mineral production without incurring the costs.

To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.