Allegheny County, Pennsylvania is a region located in the southwestern part of the state. It encompasses the city of Pittsburgh and its surrounding areas. Known for its rich industrial history and diverse landscapes, Allegheny County offers numerous opportunities for real estate investments and energy development. Assignment of overriding royalty interest, or ORRIS, is a common practice in the oil and gas industry. It involves the transfer of a portion of the royalty interest from the lessor to a third party, known as the assignee. In Allegheny County, there may be multiple leases in which the overriding royalty interest is assigned. The assignment of overriding royalty interest in Allegheny County typically involves calculating the difference between the specified percentage and the existing leasehold burdens. The specified percentage refers to the percentage of royalty interest that is being assigned, while the leasehold burdens represent any expenses or commitments associated with the lease. There may be different types of Allegheny County assignments of overriding royalty interest for multiple leases, including: 1. Conventional Oil and Gas Leases: In these assignments, the overriding royalty interest is assigned for leases that pertain to conventional oil and gas extraction methods. This may include vertical drilling techniques, such as those used in the Marcellus Shale formation. 2. Unconventional Oil and Gas Leases: Unconventional leases involve the extraction of oil and gas from shale formations using techniques like hydraulic fracturing, or fracking. The assignment of overriding royalty interest may differ for these leases due to the unique challenges and costs associated with unconventional extraction methods. 3. Mineral Rights Leases: Assignments of overriding royalty interest can also pertain to mineral rights leases, where the focus is on the extraction of specific minerals, such as coal, limestone, or sand. These assignments may have different considerations and agreement terms compared to oil and gas leases. 4. Surface Rights Leases: In some cases, the assignment of overriding royalty interest may involve surface rights leases, where the emphasis is on land use rather than mineral extraction. These assignments may pertain to activities like farming, forestry, or renewable energy projects. It is essential for parties involved in the assignment of overriding royalty interest in Allegheny County to carefully review the terms and conditions of the leases, assess the existing leasehold burdens, and negotiate the assigned percentage to ensure a fair and equitable agreement. Professional legal assistance is highly recommended navigating the complexities of these transactions. In conclusion, Allegheny County in Pennsylvania offers various opportunities for the assignment of overriding royalty interest for multiple leases. Whether it's conventional or unconventional oil and gas leases, mineral rights leases, or surface rights leases, thorough understanding and careful consideration of the existing leasehold burdens are crucial for successful assignments.

Allegheny Pennsylvania Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens

Description

How to fill out Allegheny Pennsylvania Assignment Of Overriding Royalty Interest For Multiple Leases - Interest Assigned Is Difference Between Specified Percentage And Existing Leasehold Burdens?

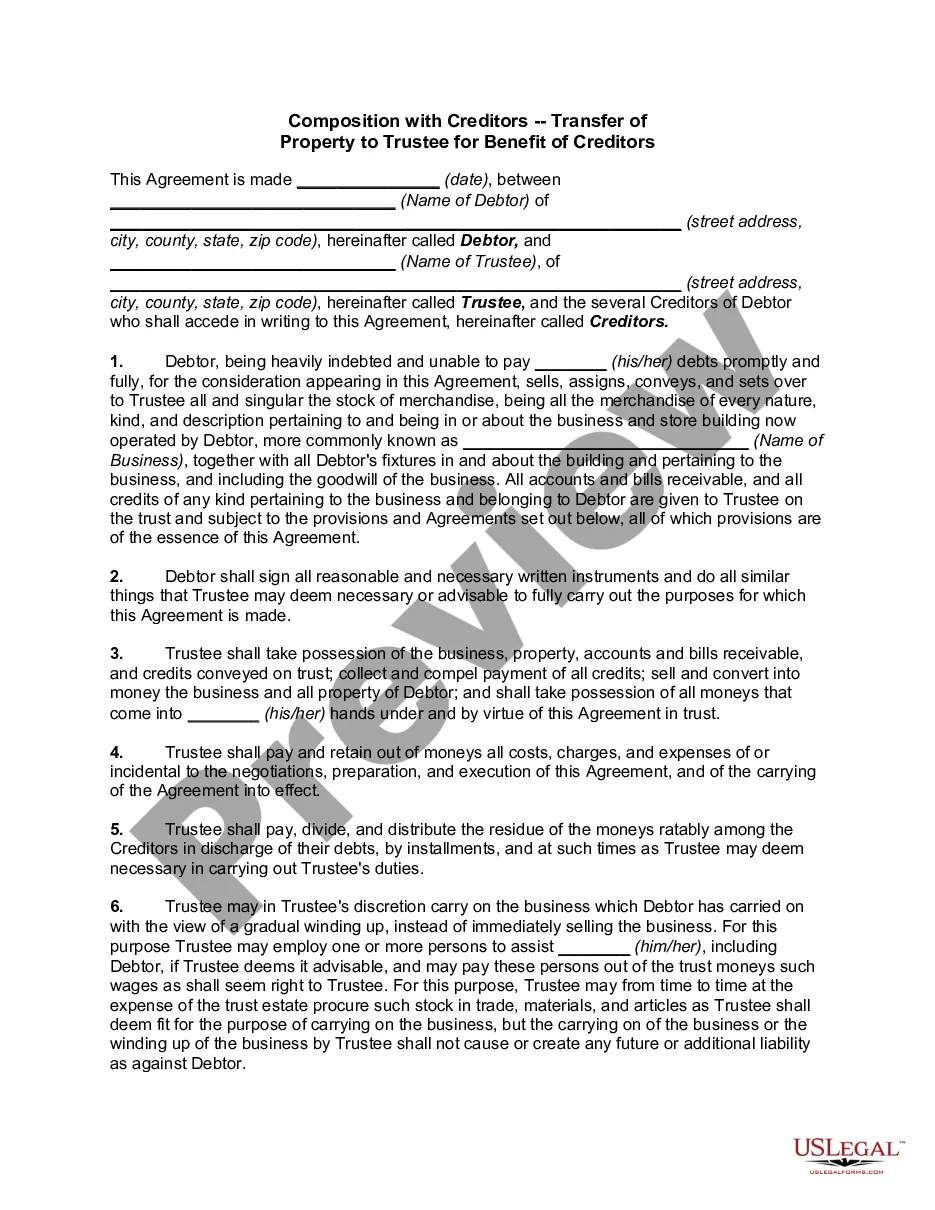

If you need to get a trustworthy legal document provider to obtain the Allegheny Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can select from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of learning materials, and dedicated support make it easy to locate and execute different paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply select to look for or browse Allegheny Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens, either by a keyword or by the state/county the document is intended for. After locating required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Allegheny Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be immediately available for download as soon as the payment is processed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes these tasks less expensive and more reasonably priced. Create your first business, arrange your advance care planning, draft a real estate contract, or execute the Allegheny Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens - all from the convenience of your sofa.

Sign up for US Legal Forms now!