Bronx, New York is a vibrant borough located within New York City. It is known for its rich history, diverse communities, and cultural landmarks. The Bronx offers a unique mix of residential, commercial, and entertainment opportunities, making it an attractive destination for residents and visitors alike. When it comes to the Bronx New York Assignment of Overriding Royalty Interest for Multiple Leases, there are several types that can be identified based on the interest assigned and the existing leasehold burdens. These types include: 1. Percentage-Based Assignment: This type of assignment involves determining the percentage of the overriding royalty interest that will be assigned to the assignee. The specified percentage represents the share of revenue or profits from the leases that the assignee will receive. 2. Burdened Leasehold Assignment: In this type of assignment, the existing leasehold burdens are taken into consideration. Burdens can include any obligations or limitations placed on the lease, such as royalty payments to previous assignees. The interest assigned will be the difference between the specified percentage and the existing burdens. 3. Multiple Lease Assignment: This refers to the assignment of overriding royalty interests in multiple leases. Assignors may have interests in various leases within the Bronx, and they choose to assign a portion of those interests to assignees. This consolidation of interests can provide assignees with a diverse portfolio and potential revenue streams. An Assignment of Overriding Royalty Interest for Multiple Leases in the Bronx aims to efficiently manage and distribute the rights and interests associated with oil, gas, or mineral leases. It allows for the allocation of revenues or profits from these leases to be shared among assignors and assignees based on the specified percentage and the existing burdens. Overall, the Bronx New York Assignment of Overriding Royalty Interest for Multiple Leases is a mechanism designed to streamline the distribution of revenue and facilitate a fair and transparent process for all parties involved.

Bronx New York Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens

Description

How to fill out Bronx New York Assignment Of Overriding Royalty Interest For Multiple Leases - Interest Assigned Is Difference Between Specified Percentage And Existing Leasehold Burdens?

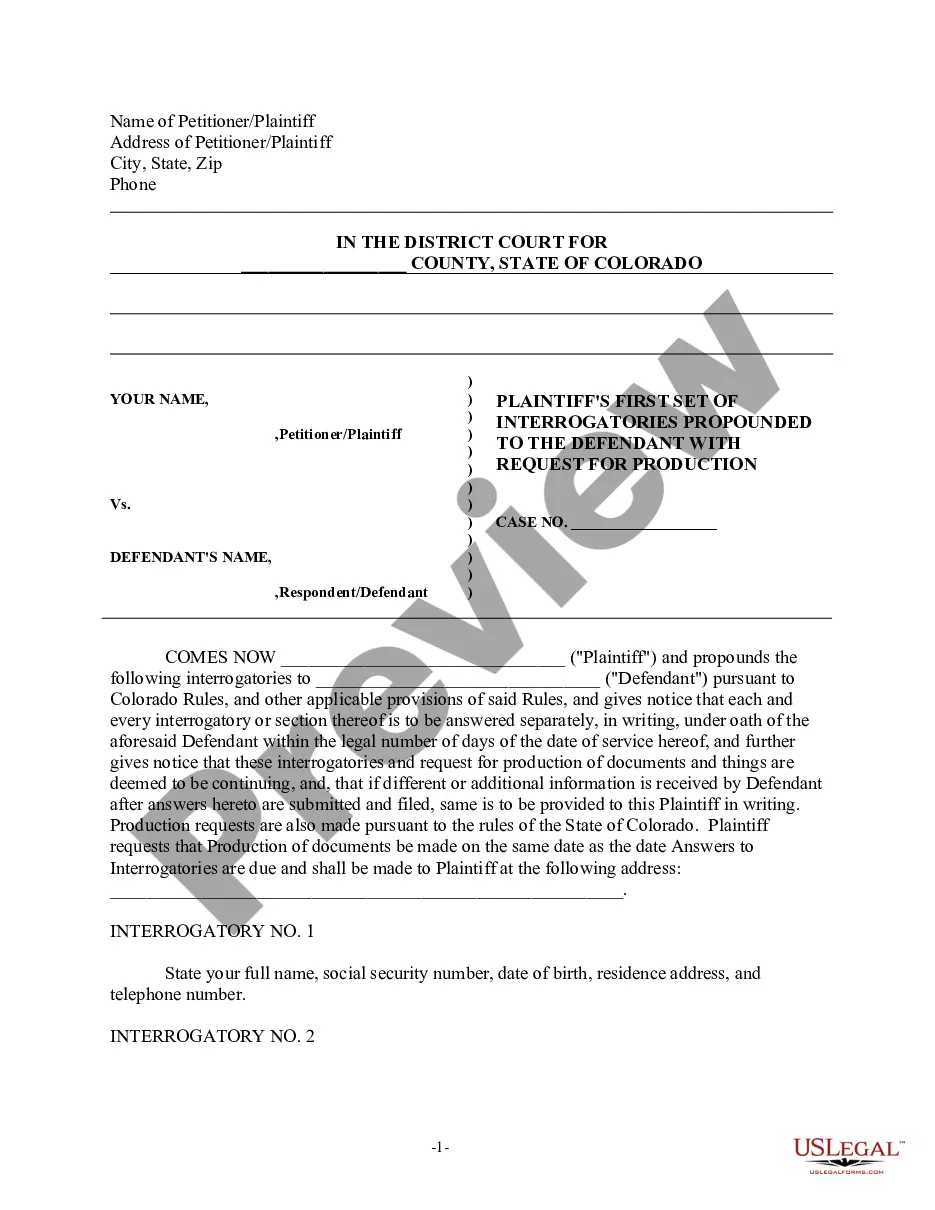

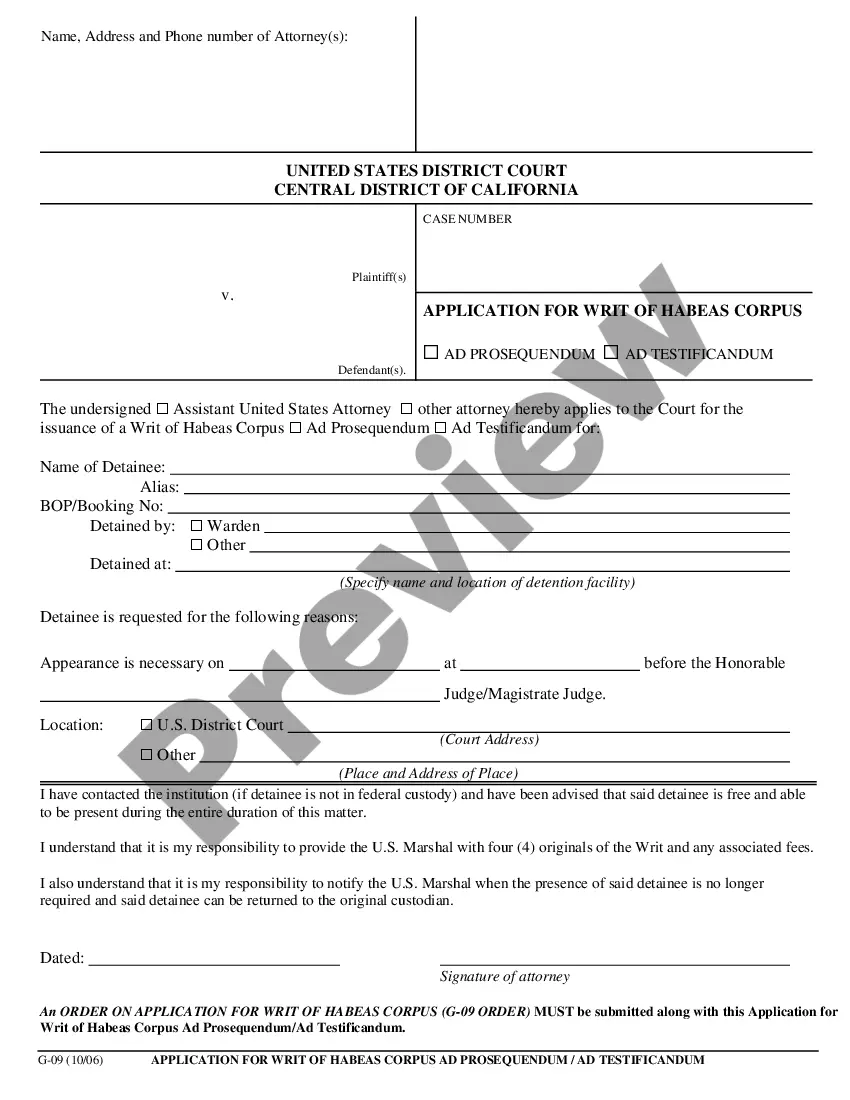

Whether you intend to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Bronx Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Bronx Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens. Follow the guide below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Bronx Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

A working interest is a type of investment in oil and gas operations. In a working interest, investors are liable for ongoing costs associated with the project but also share in any profits of production. Both the costs and risks of a working interest are extremely high.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced.NRI = Working Interest Royalty Interests. 100 25 = 75 percent (NRI) $1,000,000 $250,000 = $750,000 (monthly NRI)

Working Interest a percentage of ownership in a mineral lease granting its owner the right to explore, drill, and produce oil and gas from the leased property.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Royalty Interest an ownership in production that bears no cost in production. Royalty interest owners receive their share of production revenue before the working interest owners. Working Interest an ownership in a well that bears 100% of the cost of production.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

A mineral interest owner also possesses the right to receive lease bonuses, delay rental payments, shut-in payments and royalties. A royalty interest, on the other hand, is the property interest created that entitles the owner to receive a share of the production.

To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.