Collin Texas Assignment of Overriding Royalty Interest for Multiple Leases: Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens Description: The Collin Texas Assignment of Overriding Royalty Interest for Multiple Leases is a legal agreement that allows for the transfer of a specified percentage of royalty interest from one party to another. This assignment specifically focuses on overriding royalty interests (ORRIS) and involves multiple leases within the Collin, Texas region. The key aspect of this assignment is that the interest assigned is the difference between the specified percentage and the existing leasehold burdens. Leasehold burdens refer to any obligations or burdens associated with the lease, such as taxes, encumbrances, or operating costs. This assignment plays a crucial role in the oil and gas industry, as it allows for the diversification and redistribution of royalty interests among parties involved in leasing activities. By assigning overriding royalty interests, the assignor (the party transferring the interest) can receive compensation while the assignee (the party receiving the interest) gains the right to a portion of future royalty payments. Different Types of Collin Texas Assignment of Overriding Royalty Interest for Multiple Leases: 1. Voluntary Assignment: This type of assignment occurs when the assignor willingly transfers their overriding royalty interest to the assignee. It can be part of a strategic business decision or may be driven by financial considerations. 2. Forced Assignment: This type of assignment may occur when certain circumstances, such as bankruptcy or foreclosure, compel the assignor to transfer their overriding royalty interest to the assignee. In such cases, the decision may not be voluntary and may be mandated by legal proceedings. 3. Partial Assignment: This type of assignment involves the transfer of only a portion of the assignor's overriding royalty interest, rather than the entirety. This could be done to generate immediate cash flow or to mitigate risks associated with a specific lease or well. 4. Temporary Assignment: In some cases, an overriding royalty interest may be temporarily assigned for a predetermined period. This could be done to address financial needs or to allow for the assignor to retain certain rights and benefits for a specific duration. 5. Permanent Assignment: This type of assignment involves a complete and permanent transfer of the overriding royalty interest from the assignor to the assignee. The assignor gives up all future rights, benefits, and responsibilities associated with the assigned interest. Overall, the Collin Texas Assignment of Overriding Royalty Interest for Multiple Leases provides a mechanism for the transfer of royalty interests among parties involved in oil and gas leasing in the Collin, Texas region. The specific interest assigned is the difference between the specified percentage and the existing leasehold burdens. Different types of assignments exist, depending on the circumstances and intentions of the parties involved.

Collin Texas Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens

Description

How to fill out Collin Texas Assignment Of Overriding Royalty Interest For Multiple Leases - Interest Assigned Is Difference Between Specified Percentage And Existing Leasehold Burdens?

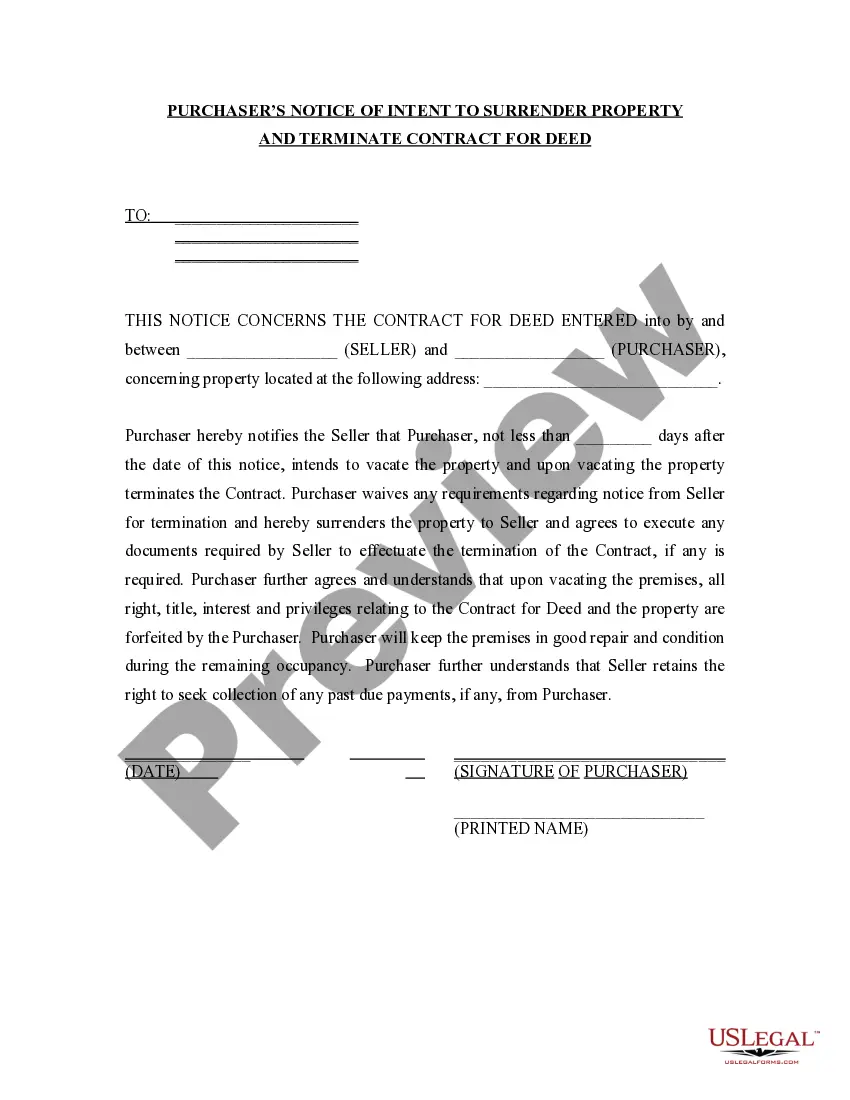

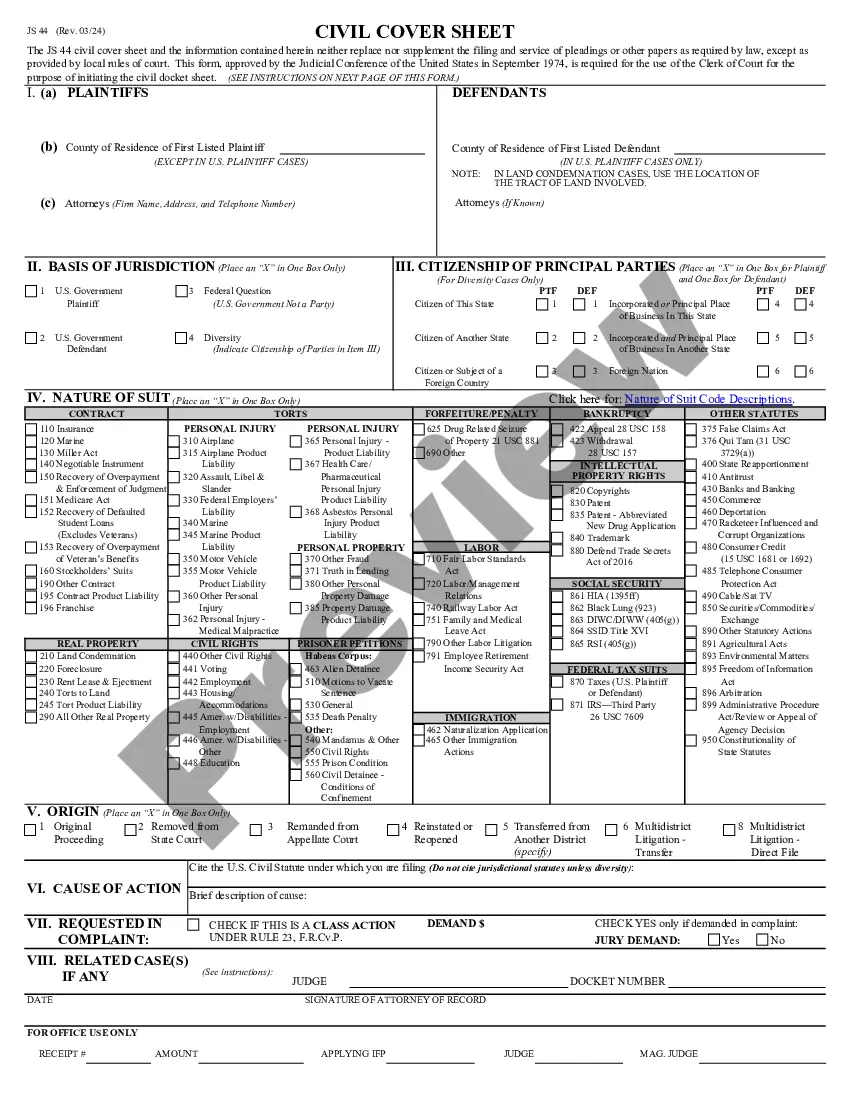

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Collin Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various categories ranging from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching process less challenging. You can also find detailed materials and guides on the website to make any activities associated with document completion straightforward.

Here's how you can locate and download Collin Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens.

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the validity of some records.

- Check the related document templates or start the search over to find the right file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Collin Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Collin Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens, log in to your account, and download it. Needless to say, our website can’t replace a legal professional completely. If you have to deal with an exceptionally difficult situation, we advise getting a lawyer to review your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and get your state-specific paperwork with ease!