Cuyahoga County, located in the state of Ohio, offers various types of Assignment of Overriding Royalty Interest for Multiple Leases. This legal document allows individuals or entities to assign their interest in revenue generated from oil and gas production to another party. The assigned interest is calculated by subtracting the existing leasehold burdens from a specified percentage agreed upon by both parties. One type of Cuyahoga Ohio Assignment of Overriding Royalty Interest for Multiple Leases is the Standard Assignment. This document is typically used when transferring overriding royalty interests from one party to another, and it follows the standard procedures and terms outlined by the county. Another type is the Limited Assignment, which involves assigning a specific portion or percentage of the overriding royalty interest to a third party. This type of assignment is often utilized when there is a desire to divide the royalty interest among multiple individuals or entities. The Cuyahoga Ohio Assignment of Overriding Royalty Interest for Multiple Leases also includes the Participating Assignment. In this case, the assignee not only receives a share of the overriding royalty interest but also acquires the right to actively participate in the operation and decision-making process associated with the lease. Additionally, there may be variations in the assignment based on the percentage specified and the existing leasehold burdens. The assignment can be either a straight percentage (e.g., 5% or 10%), or it may involve a percentage that varies based on production levels or other agreed-upon criteria. The existing leasehold burdens include any costs or obligations associated with the lease, such as royalty payments to the landowner or other contractual obligations. It is important to note that Cuyahoga Ohio Assignment of Overriding Royalty Interest for Multiple Leases is subject to applicable state laws and regulations. Parties involved in such assignments should consult with legal professionals to ensure compliance and protection of their rights and interests. In conclusion, the Cuyahoga Ohio Assignment of Overriding Royalty Interest for Multiple Leases allows for the transfer of overriding royalty interests between parties. The interest assigned is determined by subtracting the existing leasehold burdens from a specified percentage. Different types of assignments include the Standard, Limited, and Participating assignments, each serving different purposes and circumstances. It is crucial to understand the specific terms and consult legal professionals to navigate the assignment process correctly.

Cuyahoga Ohio Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens

Description

How to fill out Cuyahoga Ohio Assignment Of Overriding Royalty Interest For Multiple Leases - Interest Assigned Is Difference Between Specified Percentage And Existing Leasehold Burdens?

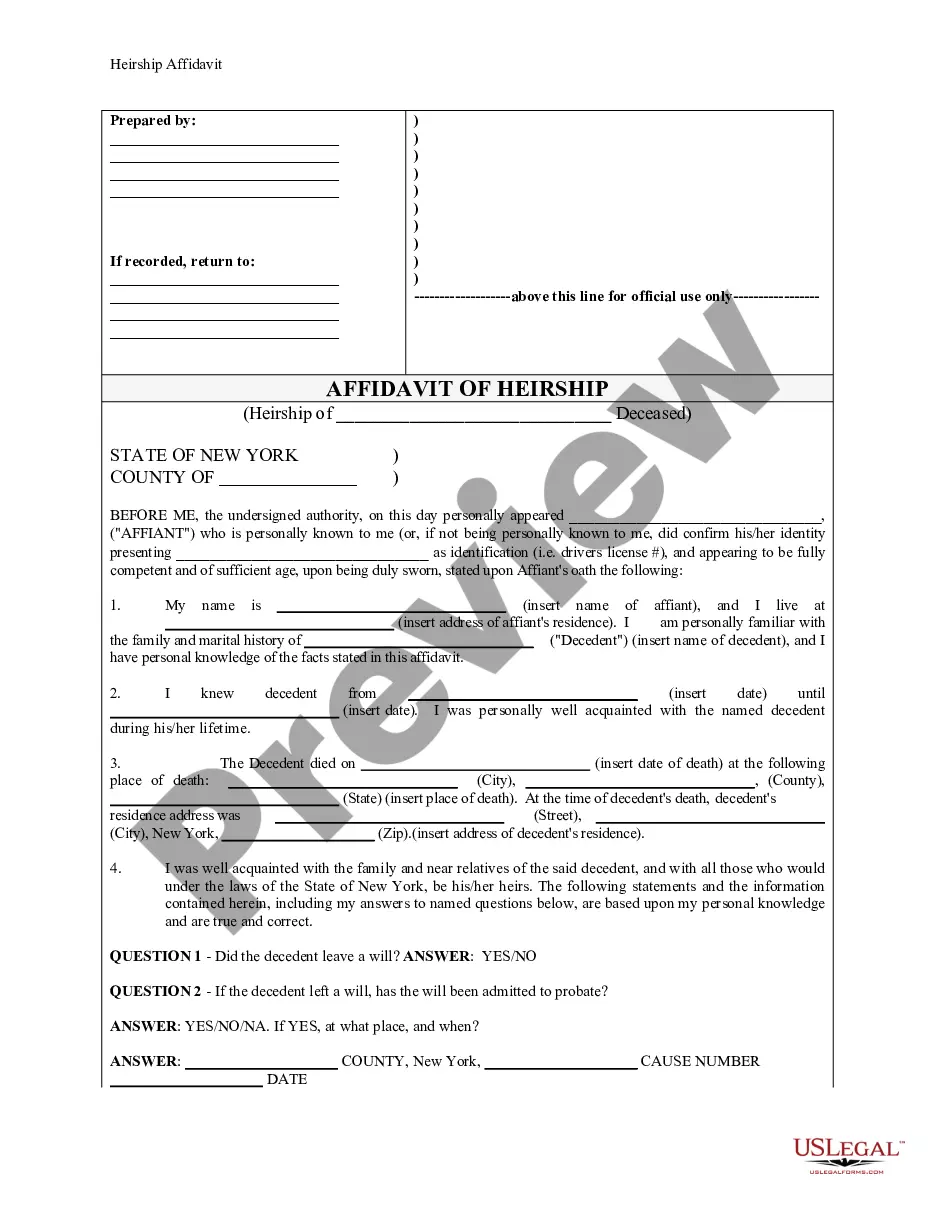

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a lawyer to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Cuyahoga Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Consequently, if you need the current version of the Cuyahoga Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Cuyahoga Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Cuyahoga Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Overriding royalty interests are an important financing tool for oil and gas companies involved in the exploration and development of oil gas and mineral interests. For investors, they provide an opportunity to participate in mineral production without incurring the costs.

If you receive more than $600 in a calendar year in overriding royalty interest payments, you will receive a 1099 tax form to claim the money as income during your annual tax filing.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Royalty Interest an ownership in production that bears no cost in production. Royalty interest owners receive their share of production revenue before the working interest owners. Working Interest an ownership in a well that bears 100% of the cost of production.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.