Philadelphia, Pennsylvania is a vibrant city located in the northeastern part of the United States. Known for its rich history and diverse culture, Philadelphia offers a plethora of attractions, landmarks, and activities for locals and tourists alike. Philadelphia is home to iconic sites such as Independence Hall, where the Declaration of Independence and the Constitution were signed, and the Liberty Bell, a symbol of American freedom. History buffs can explore the renowned museums like the Philadelphia Museum of Art, the National Constitution Center, and the African American Museum in Philadelphia. Beyond its historical significance, Philadelphia is famous for its vibrant food scene, particularly its beloved cheese steaks and soft pretzels. The city is dotted with an array of top-notch restaurants, food trucks, and markets, offering a blend of international cuisines and locally sourced ingredients. Sports enthusiasts can cheer for their favorite teams at Philadelphia's professional sports stadiums, including Lincoln Financial Field (home to the Philadelphia Eagles), Citizens Bank Park (home to the Philadelphia Phillies), and Wells Fargo Center (home to the Philadelphia 76ers and Philadelphia Flyers). Moreover, Philadelphia boasts a thriving arts and music scene, with numerous theaters, concert venues, and art galleries. The Philadelphia Orchestra, Walnut Street Theater, and the Barnes Foundation are just a few examples of the city's cultural institutions. As for the different types of Philadelphia Pennsylvania Assignment of Overriding Royalty Interest for Multiple Leases — Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens, they may include variations in the specified percentage of royalty interest assigned, the nature of leasehold burdens, and the number and types of leases involved. These variations depend on the specific agreements and negotiations between the parties involved in the assignment.

Philadelphia Pennsylvania Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens

Description

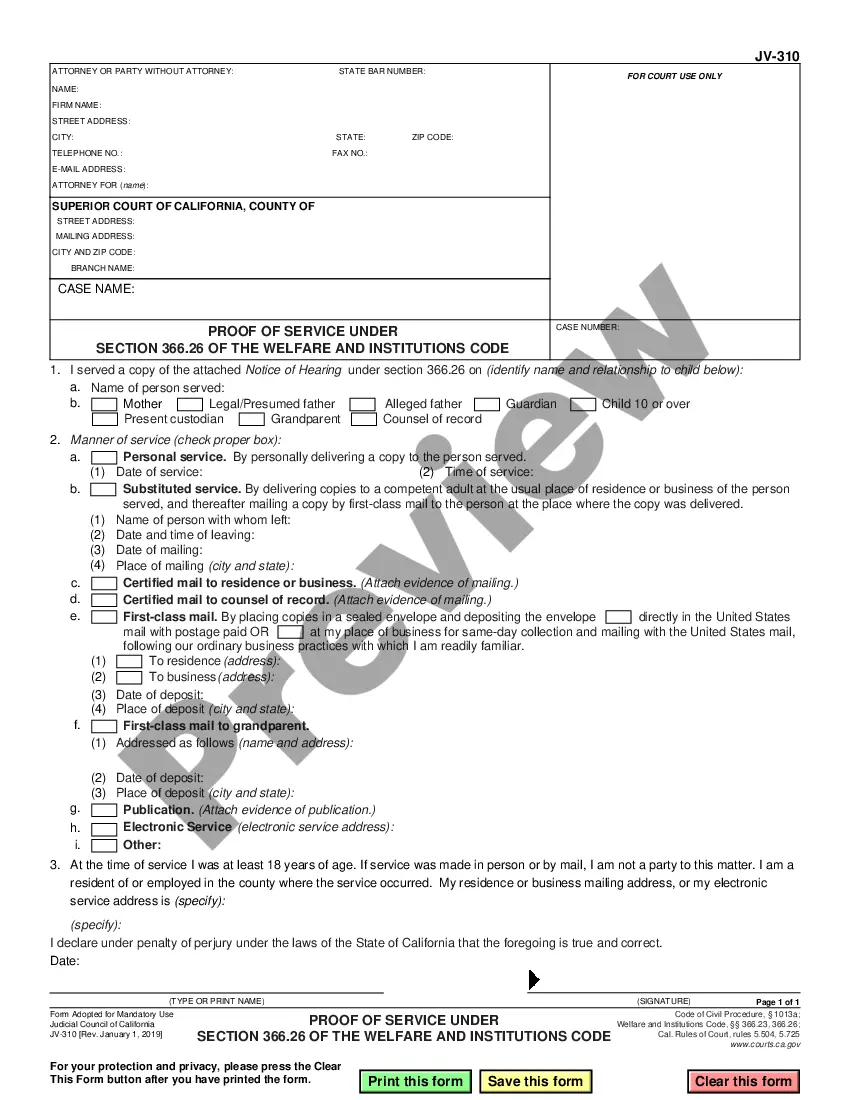

How to fill out Philadelphia Pennsylvania Assignment Of Overriding Royalty Interest For Multiple Leases - Interest Assigned Is Difference Between Specified Percentage And Existing Leasehold Burdens?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business purpose utilized in your county, including the Philadelphia Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Philadelphia Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Philadelphia Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens:

- Make sure you have opened the proper page with your local form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Philadelphia Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.