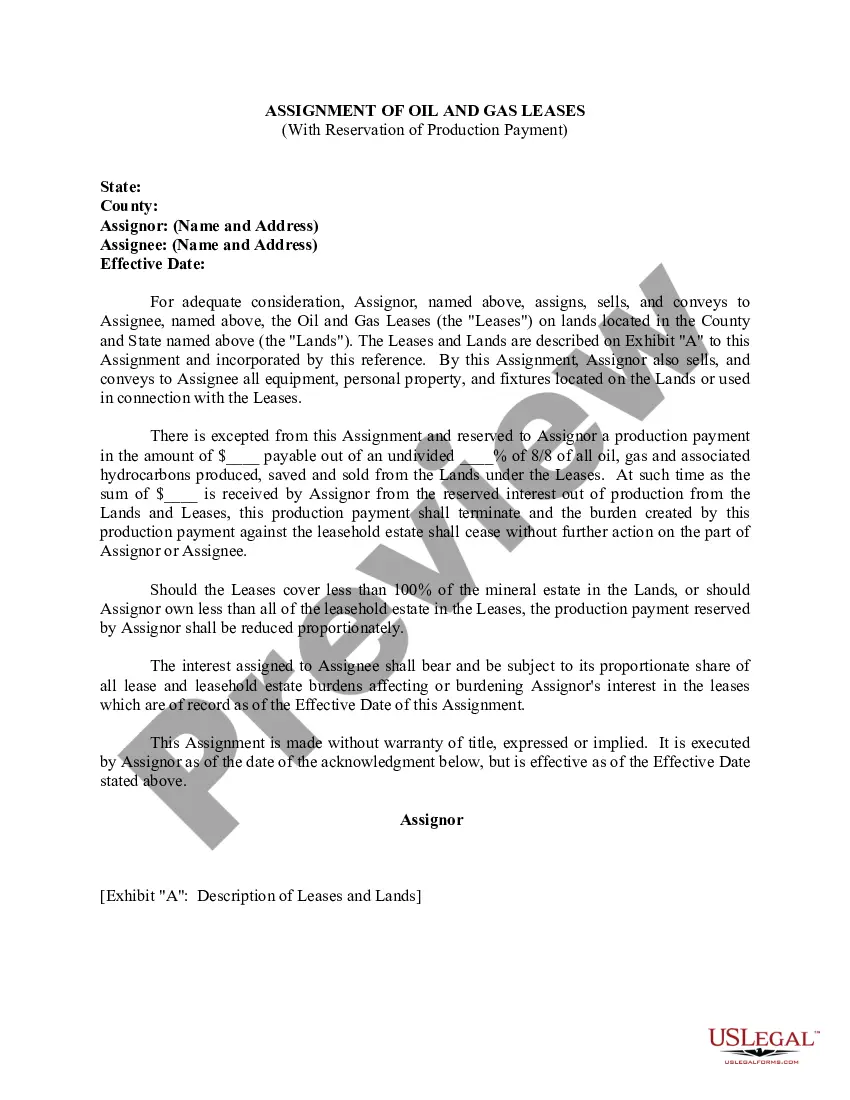

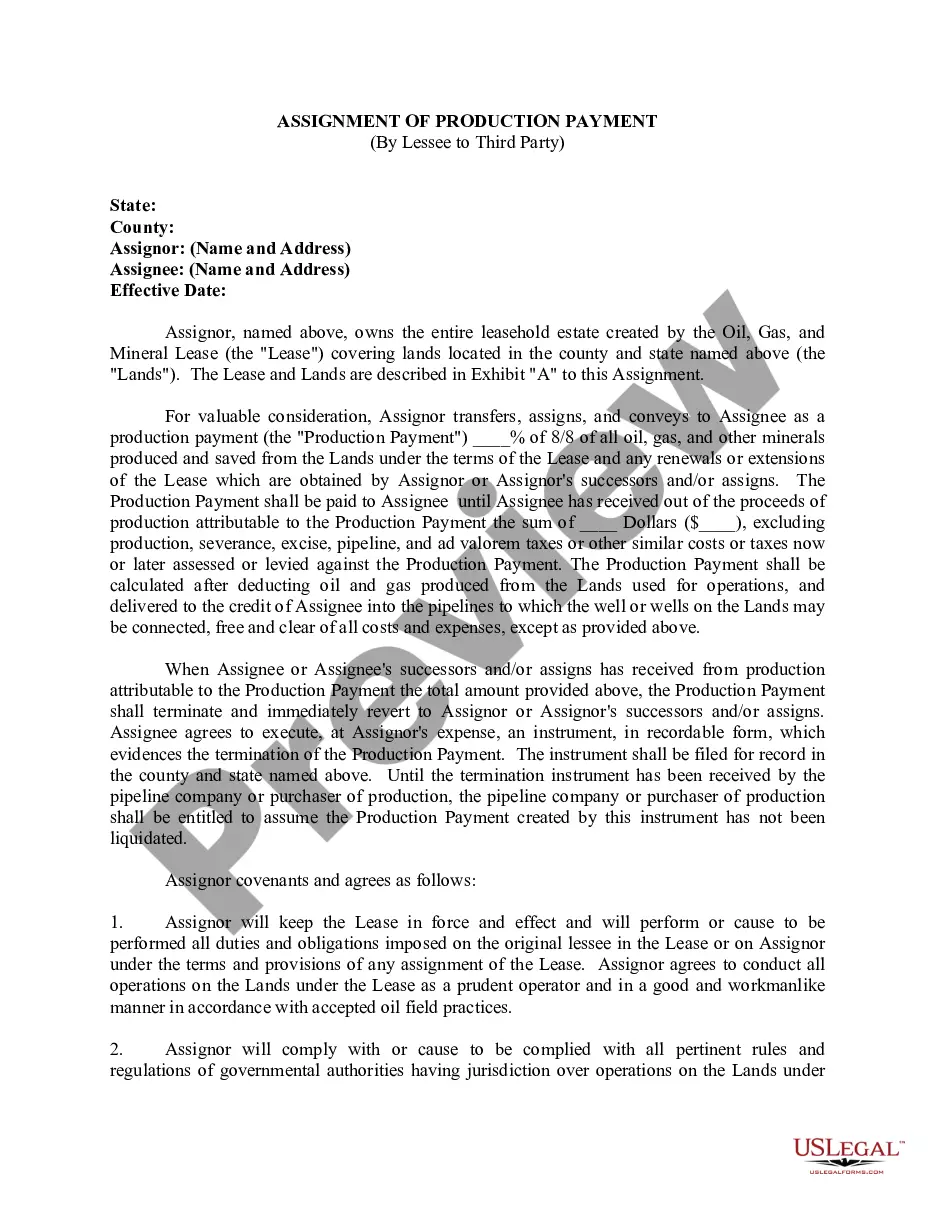

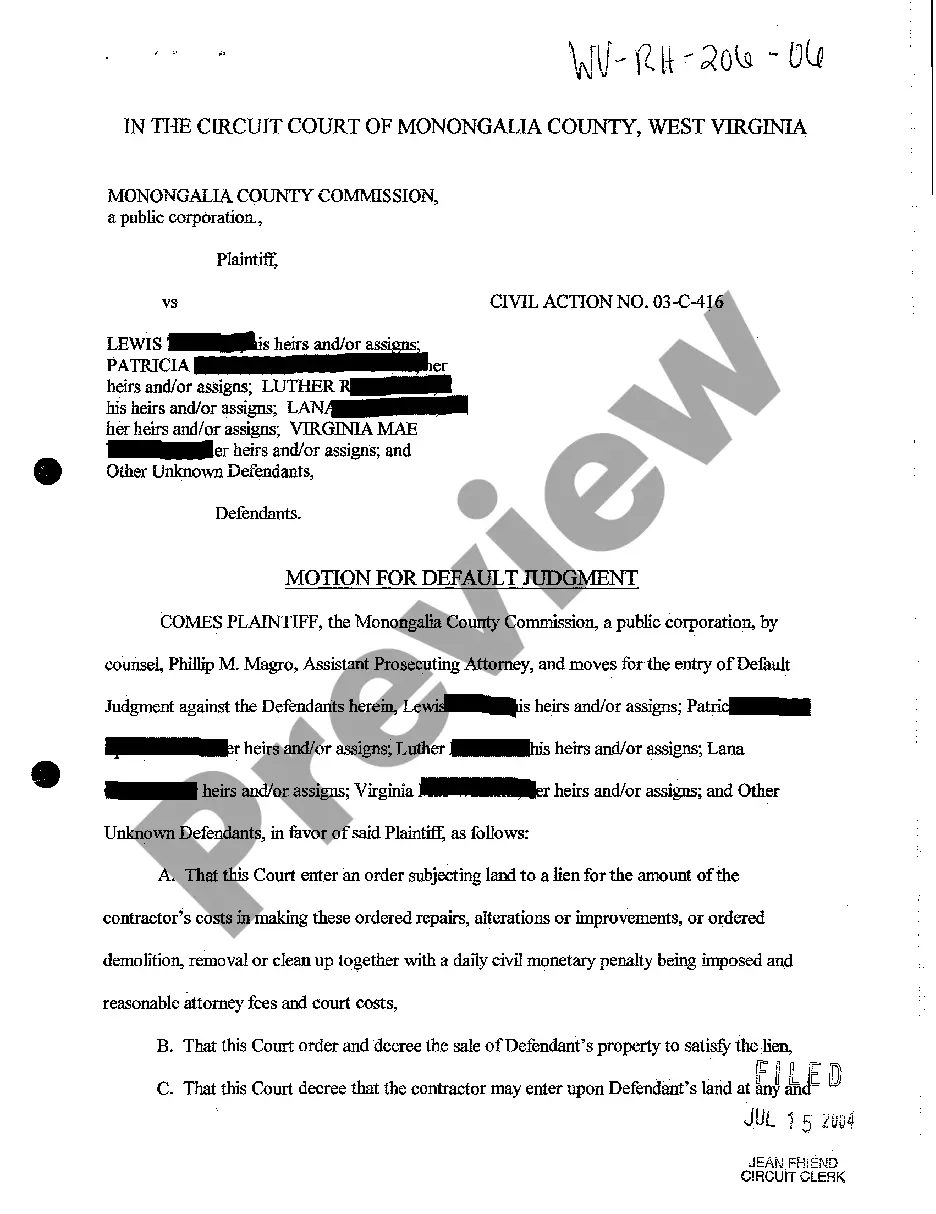

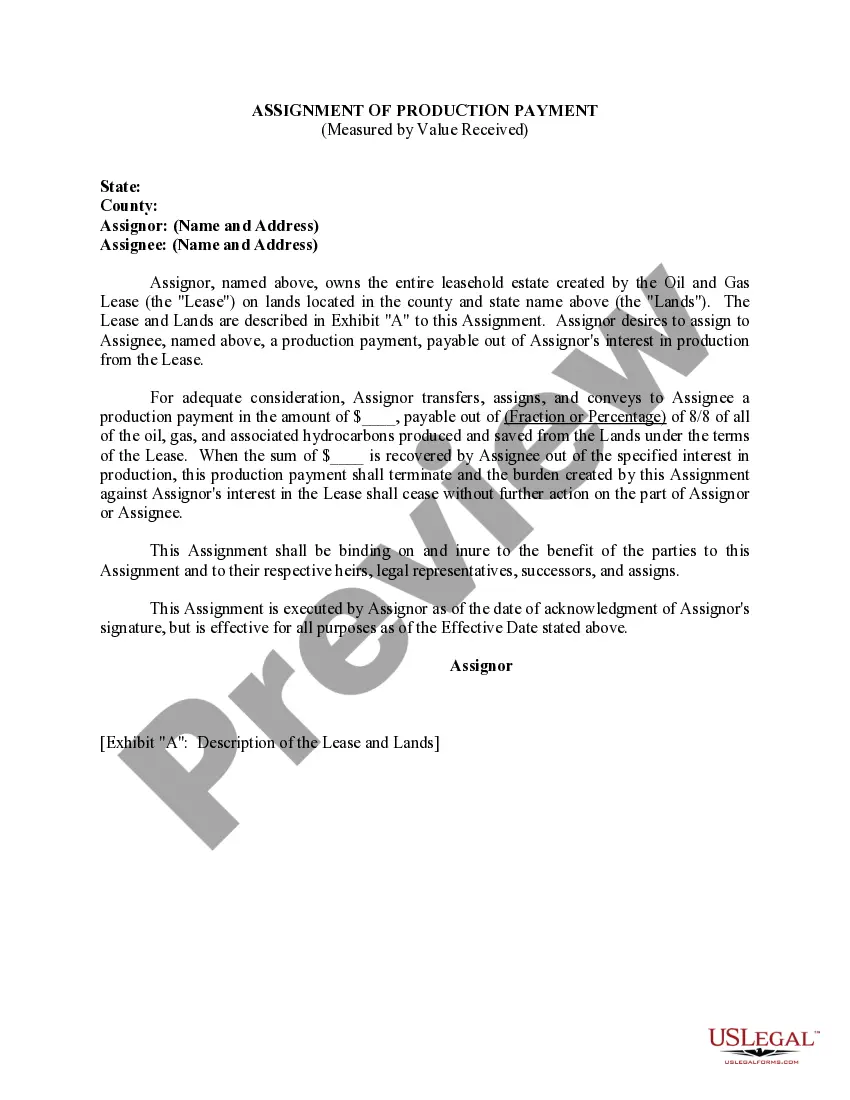

Bronx New York Assignment of Production Payment Measured by Value Received

Description

How to fill out Assignment Of Production Payment Measured By Value Received?

A document procedure consistently accompanies any legal action you undertake.

Establishing a business, submitting or accepting a job proposal, transferring ownership, and various other life situations require you to prepare formal documentation that varies by state.

That’s the reason having everything gathered in one location is extremely advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

This is the simplest and most dependable method to acquire legal documents. All the templates available in our library are professionally created and confirmed for compliance with local laws and regulations. Prepare your documentation and manage your legal matters efficiently with US Legal Forms!

- Here, you can effortlessly locate and download a document for any personal or business purpose relevant to your area, including the Bronx Assignment of Production Payment Measured by Value Received.

- Finding forms on the platform is extraordinarily easy.

- If you own a subscription to our collection, Log In to your account, search for the template using the search bar, and hit Download to save it to your device.

- After that, the Bronx Assignment of Production Payment Measured by Value Received will be available for further use in the My documents section of your profile.

- If you are utilizing US Legal Forms for the first time, follow this brief guide to acquire the Bronx Assignment of Production Payment Measured by Value Received.

- Ensure you have accessed the correct page with your regional form.

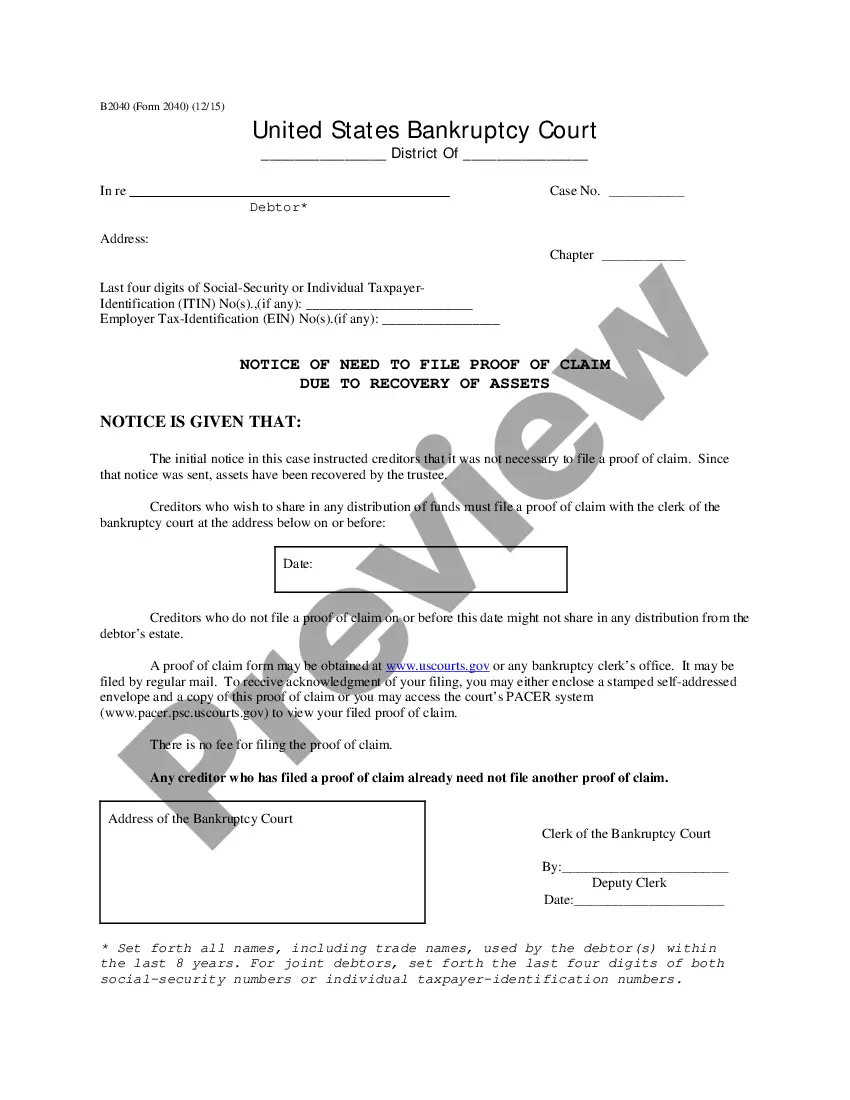

- Use the Preview mode (if available) and browse through the sample.

- Examine the description (if available) to confirm the template meets your requirements.

- Search for another document through the search tab if the sample does not suit you.

- Click Buy Now once you identify the necessary template.

- Choose the suitable subscription plan, then Log In or create an account.

- Select your preferred payment method (via credit card or PayPal) to continue.

- Choose the file format and save the Bronx Assignment of Production Payment Measured by Value Received on your device.

- Utilize it as required: print it, fill it out electronically, sign it, and send it where needed.

Form popularity

FAQ

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

Nonresident and Part-Year Resident Income Tax Return; Description of Form IT-203. This is the only return for taxpayers who are nonresidents or part-year residents of New York State, whether they are itemizing their deductions or claiming the standard deduction.

Complete Form IT-225 and submit it with your return to report any New York additions and subtractions that do not have their own line on your return. Refer to the charts found on pages 17-20 for a listing of addition and subtraction modification(s) for your specific filing that may be entered on this form.

Form IT-558 is a new form for tax year 2020, which adjusts your federal adjusted gross income. Certain items this year are being added back and subtracted from your federal adjusted gross income. It is similar to previous year Form IT-225, except that it is included items that cover the CARES act.

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

Line 1 is for all income reported on your W-2 forms. Attach your W-2 forms, unless you're e-filing. Line 2 has two parts, one for tax-exempt interest (mainly municipal bonds) and one for taxable interest. Taxable interest includes income from a 1099-INT or 1099-OID.

This linkage between federal and state tax calculations is referred to as Internal Revenue Code (IRC) conformity. In conforming states, any changes in federal tax law affecting AGI and/or corporate taxable income affect the calculation of state tax liability unless the state amends its tax laws to decouple from

New York additions and subtractions that relate to intangible items of income, such as interest or ordinary dividends, are only required to the extent the property that generates the income is employed in a business, trade, profession, or occupation carried on in New York State.

The New York adjusted gross income of a nonresident individual includes all items of income, gain, loss and deductions which enter into his Federal adjusted gross income; limited, however, to the portions of such items derived from or connected with New York State sources as determined under sections 132.2 through

Form IT-558 is a new form for tax year 2020, which adjusts your federal adjusted gross income. Certain items this year are being added back and subtracted from your federal adjusted gross income. It is similar to previous year Form IT-225, except that it is included items that cover the CARES act.