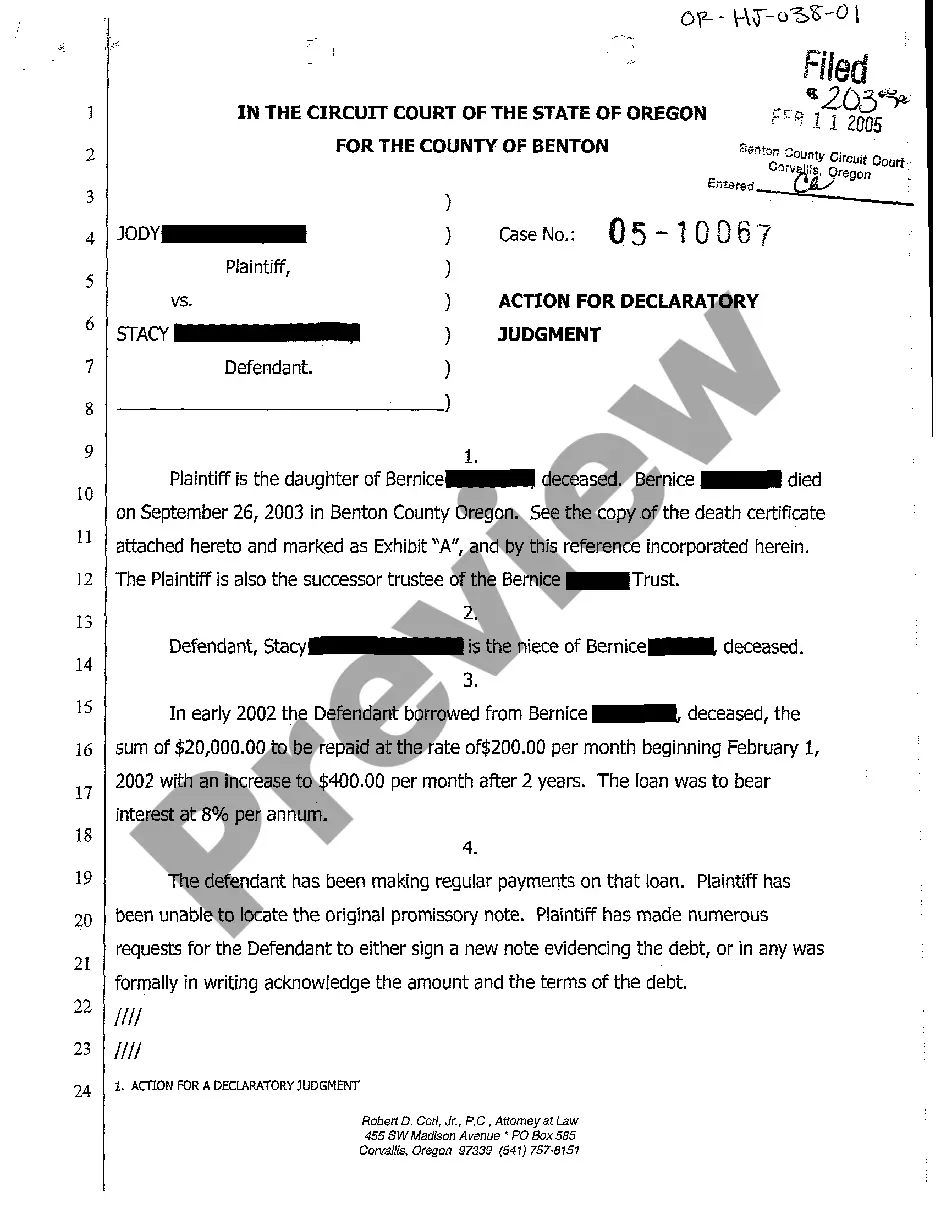

Alameda, California is a vibrant city located in Alameda County, situated on the eastern shore of the San Francisco Bay. Known for its picturesque beaches, charming neighborhoods, and historic sites, Alameda offers residents and visitors a unique and welcoming environment. Assignment and Conveyance of Net Profits Interest refers to the transfer of the economic interest in the net profits generated from a specific project or investment. It involves the allocation and transfer of the rights, benefits, and responsibilities associated with the financial gains generated from the project. In the context of Alameda, California, there are various types of Assignment and Conveyance of Net Profits Interest agreements that can occur. These include commercial real estate developments, such as retail shopping centers or office buildings, where developers may assign their net profits interest to another party. Additionally, in the energy sector, renewable energy projects like wind or solar farms may also involve the assignment and conveyance of net profits interest. One common type of Assignment and Conveyance of Net Profits Interest in Alameda, California, is related to real estate investments. This involves the transfer of shares or ownership in a property development project and the subsequent net profits generated from rental income or property value appreciation. Another type of Alameda, California Assignment and Conveyance of Net Profits Interest may arise in the joint venture agreements between investors and developers. Joint ventures often involve the pooling of resources and expertise to undertake a specific project. The net profits interest can be assigned or conveyed to different parties based on the agreed terms and conditions of the venture. The assignment and conveyance of net profits interest in Alameda, California, may also occur in the context of infrastructure projects such as roads, bridges, or public facilities. Government entities or private investors may assign their net profits interest to other parties involved in the project, allowing for a distribution of the financial gains. Overall, the Assignment and Conveyance of Net Profits Interest in Alameda, California, involve intricate legal agreements that outline the rights, obligations, and financial benefits associated with a specific project. These transactions play a crucial role in the economic development and investment opportunities present in the city, creating opportunities for collaboration and growth in various sectors.

Alameda California Assignment and Conveyance of Net Profits Interest

Description

How to fill out Alameda California Assignment And Conveyance Of Net Profits Interest?

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life situation, locating a Alameda Assignment and Conveyance of Net Profits Interest suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. In addition to the Alameda Assignment and Conveyance of Net Profits Interest, here you can get any specific form to run your business or personal deeds, complying with your county requirements. Experts verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Alameda Assignment and Conveyance of Net Profits Interest:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Alameda Assignment and Conveyance of Net Profits Interest.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Profits interest is a way for partnerships to reward and retain employees in lieu of having equity to grant. Profits interest gives key employees a share in the future growth in value of the partnership in return for their efforts in making that happen.

A profits interest is an equity interest that is not a capital interest; a capital interest is an equity interest for which the holder would be entitled to immediate receipt of cash or property if the partnership were to be liquidated on the day such interest is issued.

Generally, an NPI is computed by deducting the cumulative capital (CAPEX) and operating expenses (OPEX) from the revenues associated with the production of oil/gas. When there is a cumulative positive balance, that amount multiplied by the NPI percentage is the NPI amount.

Bottom line, a profits interest (also commonly known as a carried interest) is a non-capital interest in the profits of a partnership or a membership interest in a limited liability company taxed as a partnership.

A possessory interest is the intent and right of a party to occupy or exercise control over a particular plot of land. This is the type of ownership most of us think about when we think about land ownership. There are three main types of possessory interests: fee simple absolute, life estate, and leasehold.

What is a Possessory Interest? A taxable possessory interest (PI) is created when a private party is granted the exclusive use of real property owned by a non-taxable entity. An expanded definition may be found in Revenue and Taxation (R&T) Code Sections 61, 62, 107-107.9, 480.

Possessory interest refers to the right of an individual to occupy a piece of land or possess a piece of property. A person with a possessory interest does not own the property, but the person has some present right to control it such as a lease.

A taxable possessory interest is defined as a possession, a right to the possession, or a claim to a right of the possession of publicly owned real property that is independent, durable, and exclusive of rights held by others, and that provides a private benefit to the possessor.

A net profits interest is an agreement that provides a payout of an operation's net profits to the parties of the agreement. It is a non-operating interest that may be created when the owner of a property, typically an oil and gas property, leases it out to another party for development and production.