San Bernardino California Assignment and Conveyance of Net Profits Interest is a legal process that involves transferring the ownership rights and interests in net profits from one party to another in San Bernardino, California. This process can occur in various situations, such as the sale of a business, partnership or investment agreements, or estate planning. When entering into an Assignment and Conveyance of Net Profits Interest in San Bernardino, California, it is important to understand the different types of assignments that can take place. These types may include: 1. Business Assignment of Net Profits Interest: This type of assignment occurs when a business owner transfers their ownership rights and interests in the net profits of a business to another party. It typically involves the transfer of financial benefits, rights, and responsibilities related to the business profits. 2. Partnership Assignment of Net Profits Interest: In a partnership, this type of assignment involves transferring the ownership rights and interests in the net profits from one partner to another partner or a new incoming partner. It may involve various legal and financial considerations based on the terms established in the partnership agreement. 3. Investment Assignment of Net Profits Interest: This assignment occurs when an individual transfers their ownership rights and interests in the net profits of an investment to another person or entity. It commonly happens in investment agreements, such as the transfer of stock, ownership in limited liability companies (LCS), or other forms of investments. The San Bernardino California Assignment and Conveyance of Net Profits Interest process typically involves several steps. Firstly, both parties involved should negotiate and agree upon the terms and conditions of the assignment, including the transfer price, responsibilities, and any accompanying legal documentation. Once these terms are finalized, a written agreement outlining the assignment details should be executed by both parties. To ensure the assignment is legally binding and enforceable, it is advisable to seek legal guidance from a qualified San Bernardino attorney who specializes in business or contract law. They will assist in drafting the assignment agreement and making sure all legal requirements are met. Overall, the San Bernardino California Assignment and Conveyance of Net Profits Interest process allows for the transfer of ownership rights and interests in net profits, facilitating changes in business structures, investment strategies, or partnership agreements. It is essential for all parties involved to understand their rights, obligations, and seek professional advice to ensure a smooth and legally compliant transfer of net profits interest in San Bernardino, California.

San Bernardino California Assignment and Conveyance of Net Profits Interest

Description

How to fill out San Bernardino California Assignment And Conveyance Of Net Profits Interest?

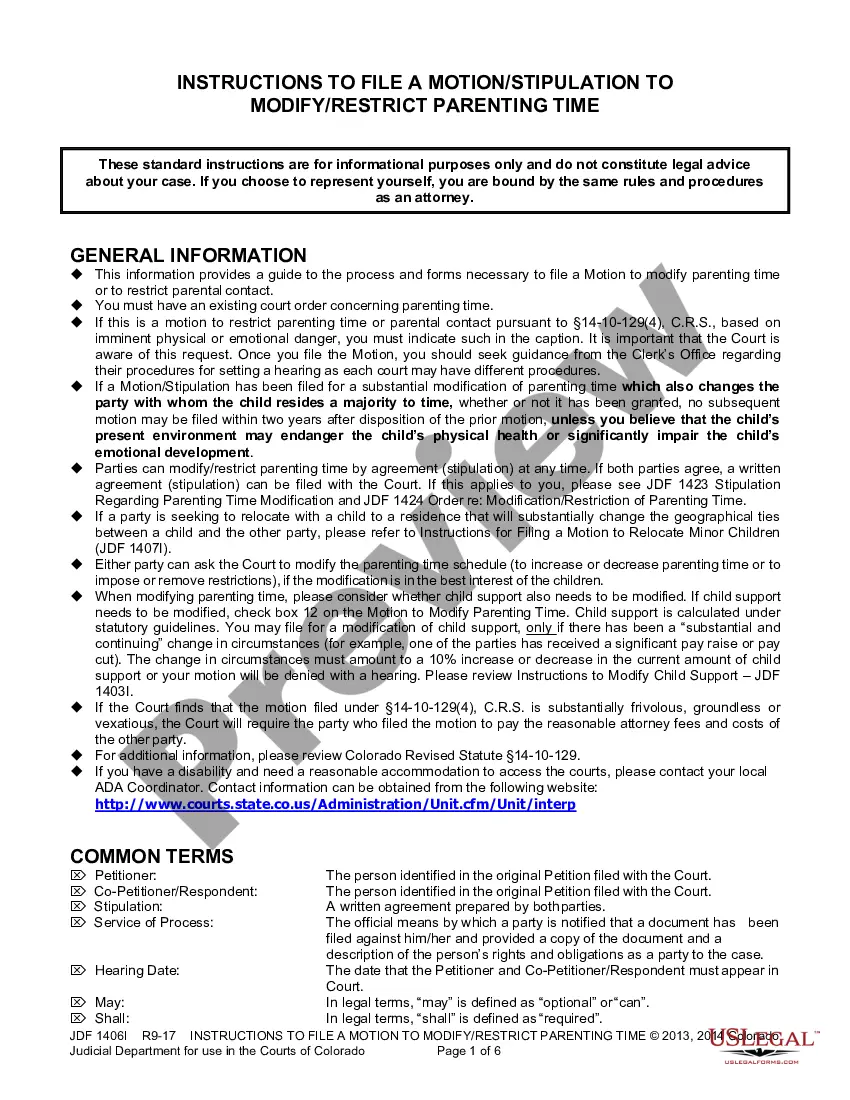

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life scenario, locating a San Bernardino Assignment and Conveyance of Net Profits Interest suiting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. Aside from the San Bernardino Assignment and Conveyance of Net Profits Interest, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your San Bernardino Assignment and Conveyance of Net Profits Interest:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Bernardino Assignment and Conveyance of Net Profits Interest.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

State law requires the buyer of real property to file a Preliminary Change of Ownership Report with the County Recorder's Office at the time a document is recorded which transfers ownership of the property. If this form is not filed, the recorder will charge an additional fee of $20.

Documentary Transfer Tax (DTT) Statement Documentary Transfer Tax is due on all taxable conveyances in excess of $100 at a rate of $. 55 per $500 or fractional portion of real property value, excluding any liens or encumbrances already of record. Transfer tax is collected at the time of recording.

Civil Division of the San Bernardino District, 247 West 3rd St, San Bernardino, CA 92415-0210 (located in the San Bernardino Justice Center) Filings Accepted: C.E.Q.A.

Civil Division of the San Bernardino District, 247 West 3rd St, San Bernardino, CA 92415-0210 (located in the San Bernardino Justice Center) Filings Accepted: C.E.Q.A.

Upon taking effect, the recorder's office will impose a fee of $75.00 to be paid when recording every real estate instrument, paper, or notice required or permitted by law to be recorded, per each single transaction per single parcel of real property, not to exceed $225.00.

Recorder Offices San Bernardino County Recorder. Hall of Records - 222 West Hospitality Ln, 1st floor, San Bernardino, California 92415-0022.Joshua Tree-Satellite Office. 63665 29 Palms Highway-1st Floor, Joshua Tree, California 92252.High Desert Office. Government Center - 15900 Smoke Tree St, Hesperia, California 92345.

No companies that serve legal papers will go above and beyond for your service like eFile Expert. We are an San Bernardino County California e-filing company and certified E-Filing Service Provider (EFSP) for all 58 counties.

The Recorder's Office probably has a notary available. Date the form and have the grantor and grantee sign in front of the notary. Fill in the state and county names and have the notary public date the form, print and sign her name, and apply her seal. Complete a Change of Ownership Report, required by California law.

What is Documentary Transfer Tax? A tax collected when an interest in real property is conveyed. Collected by the County Recorder at the time of recording. A Transfer Tax Declaration must appear on each deed. There is a County tax and in some cases, a City tax.