King Washington Warranty Deed for Surface and Mineral Interests, With Reservation of All Coal

Description

How to fill out King Washington Warranty Deed For Surface And Mineral Interests, With Reservation Of All Coal?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the King Warranty Deed for Surface and Mineral Interests, With Reservation of All Coal, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you pick a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the King Warranty Deed for Surface and Mineral Interests, With Reservation of All Coal from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the King Warranty Deed for Surface and Mineral Interests, With Reservation of All Coal:

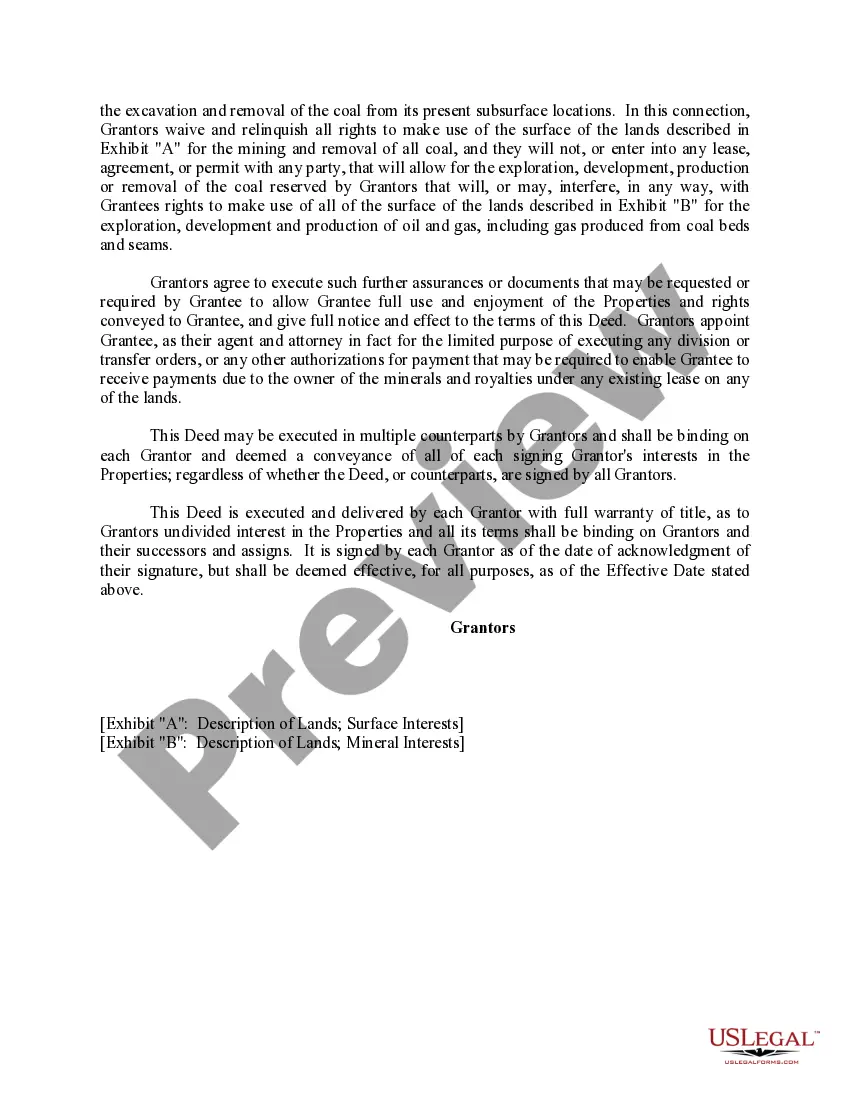

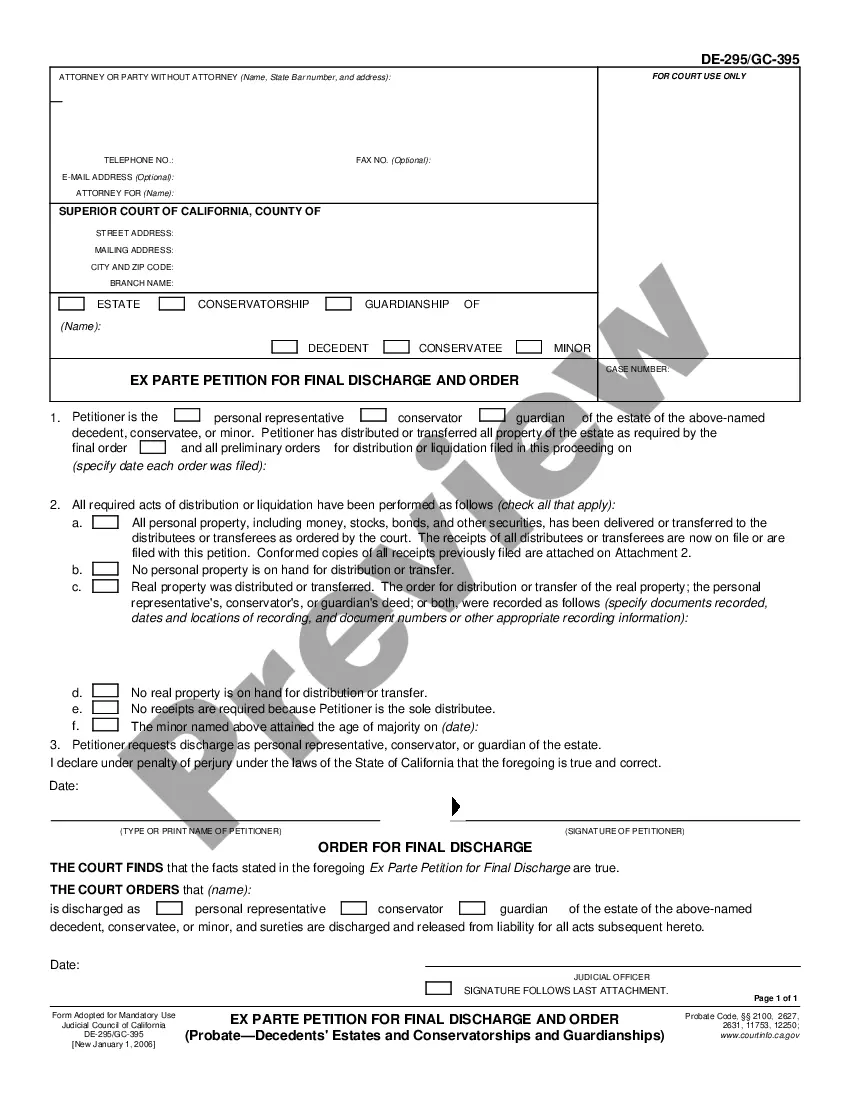

- Analyze the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Unlike a mineral interest owner, a royalty interest owner does not possess executive rights. In addition, a royalty interest owner does not possess the right to receive lease bonuses, delay rental payments, or shut-in payments.

Not owning the mineral rights to a parcel of land doesn't mean your property is worthless. If someone else owns the mineral rights and they sell those rights to an individual or corporation, you can still make a profit as the surface rights owner. You have the rights of ingress and egress.

By investing in mineral rights, you can receive greater returns on your real estate investments than just equity appreciation. Mineral rights to oil, coal, natural gas, or other valuable natural resources can substantially boost your investment portfolio as labor-free sources of revenue or passive income.

If you own surface rights, you are allowed to sell or transfer title to the land surface, but you may not sell or lease your property to an oil, gas, or mining company for exploration or extraction. Those rights do not legally belong to you.

Outstanding mineral rights are owned by a party other than the surface owner at the time the surface was conveyed to the United States. Reserved mineral rights are those rights held by the surface owner at the time the surface was conveyed to the United States.

The term severed mineral rights refers to a state of title to a given parcel of land in which the mineral estate is owned by a party other than the party that is the owner of the surface estate in other words, the mineral estate has been severed from the surface estate.

Coal Rights means all right, title and interest of the Issuer, the Co-Issuer or any Subsidiary in and to the assets described on Schedule 1.01 to this Indenture.

Types of Minerals Locatable These are mostly sedentary minerals, including metallic and industrial metals. They do not include coal, petroleum, phosphate, or potassium (Wikipedia). Leasable Rights to fluid minerals that move below the surface are commonly leased and include oil and gas and geothermal resources.

The owner of the mineral interest has the right to explore, develop, and produce the minerals. Producing minerals have one or more active oil and gas wells. Royalty owners are paid royalties on the proceeds from the sale oil, gas, and other minerals that are produced under a specific tract of land.

The Duhig rule essentially states that, if both a grant and a reservation in a warranty deed cannot be given effect, then the reservation fails.