Title: Exploring Harris Texas Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner Introduction: In the world of mineral rights, it is essential for mineral owners in Harris County, Texas, to understand the significance of various documents such as the Harris Texas Bonus Receipt, Lease Ratification, and Rental Division Order. Each document serves a unique purpose and outlines the rights and responsibilities of the mineral owners. In this article, we will dive into each document, exploring their importance and the different types associated with them. I. Harris Texas Bonus Receipt: The Harris Texas Bonus Receipt is a crucial document, issued by the lessee (usually an oil and gas company), to the lessor (the mineral owner) upon receiving the monetary amount stated as a bonus payment. This payment represents the consideration given by the lessee for the rights to explore and extract minerals from the lessor's property. It serves as proof of transaction and helps establish the contractual relationship between the parties involved. Types of Harris Texas Bonus Receipts: 1. Standard Bonus Receipt: This is the most common type, where the bonus payment is explicitly mentioned, along with the terms and conditions agreed upon by both parties. 2. Split Bonus Receipt: In some cases, the bonus payment may be divided among multiple mineral owners when they share ownership of a property. The split bonus receipt outlines the distribution of the bonus payment among these owners. II. Lease Ratification: Lease Ratification is a legal document, often accompanying the Bonus Receipt, that confirms the mineral owner's agreement to lease their property for mineral exploration and exploitation. It signifies formal acceptance of the terms and conditions laid out in the lease agreement. Types of Lease Ratification: 1. General Lease Ratification: A standard document that affirms the mineral owner's consent to the lease agreement's stipulations, including drilling rights, royalty rates, and lease duration. 2. Amended Lease Ratification: If either the lessee or the mineral owner wishes to modify certain aspects of the original lease agreement, an amended lease ratification is used. This document formalizes the changes made and provides legal consent to the altered terms. III. Rental Division Order by Mineral Owner: The Rental Division Order is a document created by the mineral owner, specifying the distribution of rental payments among multiple parties who have a stake in the property's mineral rights. It ensures fair and accurate allocation of rental income generated from the leased property. Types of Rental Division Orders: 1. Standard Rental Division Order: This document defines the percentage or amount of rental income each party is entitled to receive based on their ownership interest in the mineral rights. It helps prevent any disputes or discrepancies related to rental disbursements. 2. Fractional Interest Rental Division Order: When multiple mineral owners collectively own a specific fractional interest in the leased property, this type of rental division order enables proportional and accurate distribution of rental payments. Conclusion: Understanding the importance and nuances of Harris Texas Bonus Receipt, Lease Ratification, and Rental Division Order is vital for mineral owners in Harris County. These documents play a crucial role in establishing legal relationships, ensuring fair payment distribution, and safeguarding the rights and interests of both the mineral owners and lessees involved in mineral exploration and extraction activities.

Harris Texas Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner

Description

How to fill out Harris Texas Bonus Receipt, Lease Ratification, And Rental Division Order By Mineral Owner?

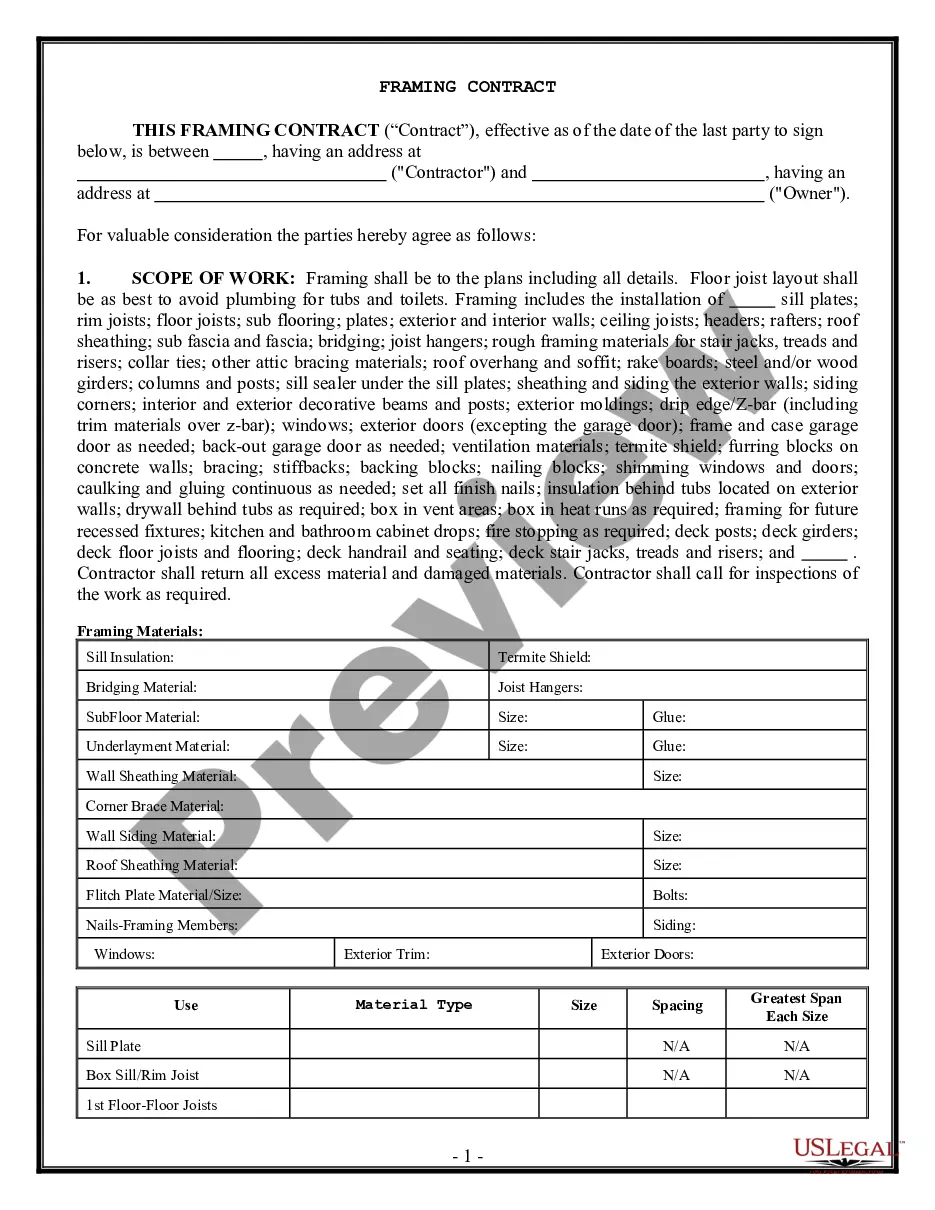

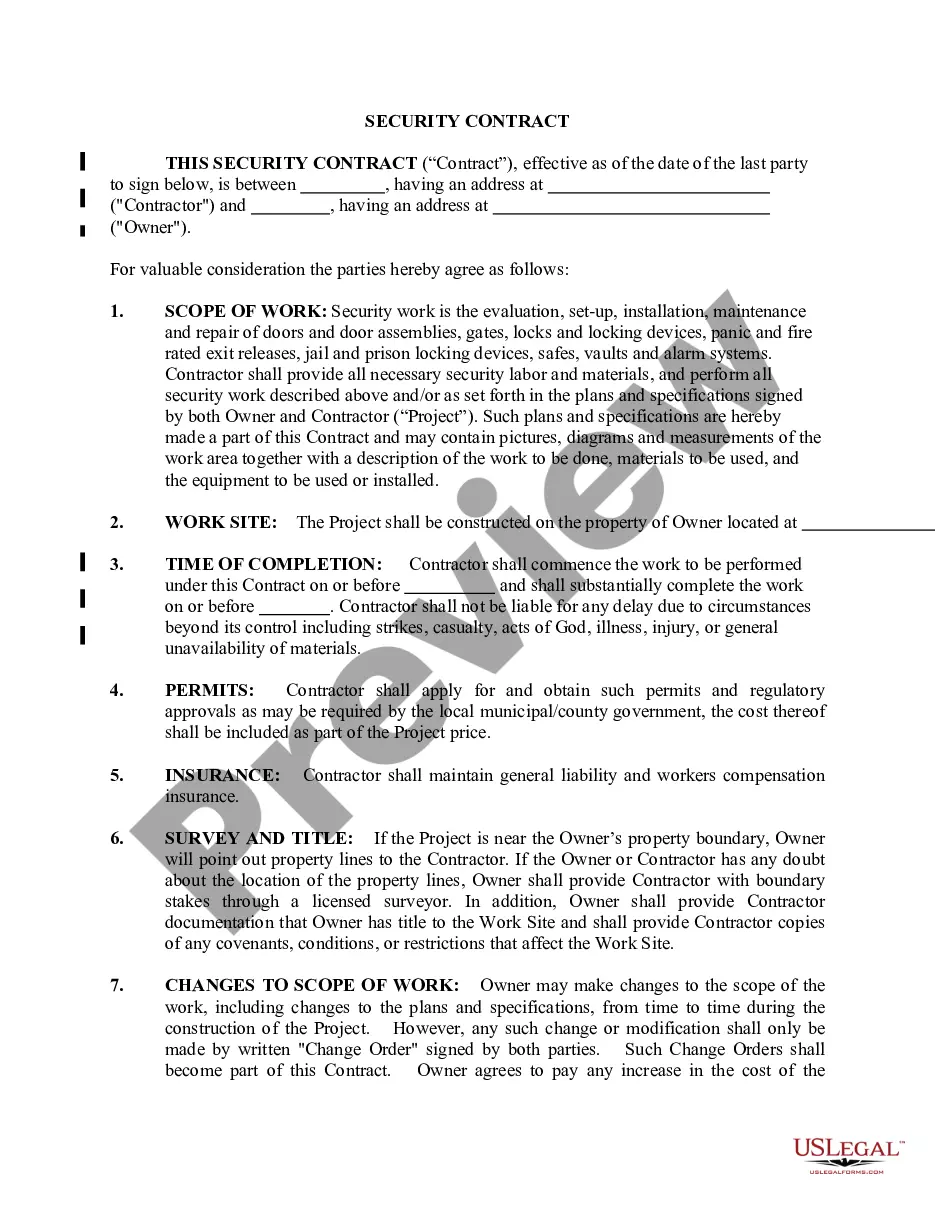

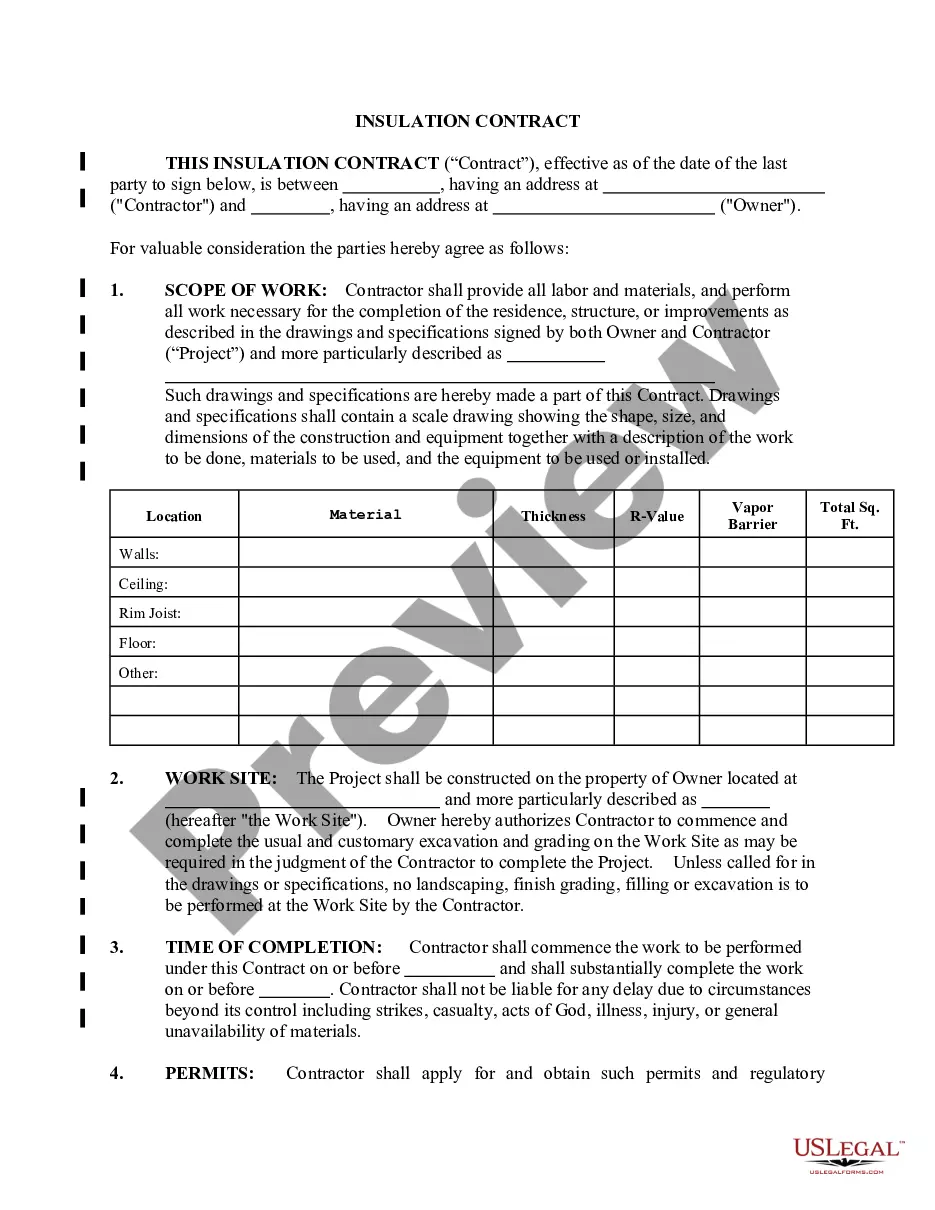

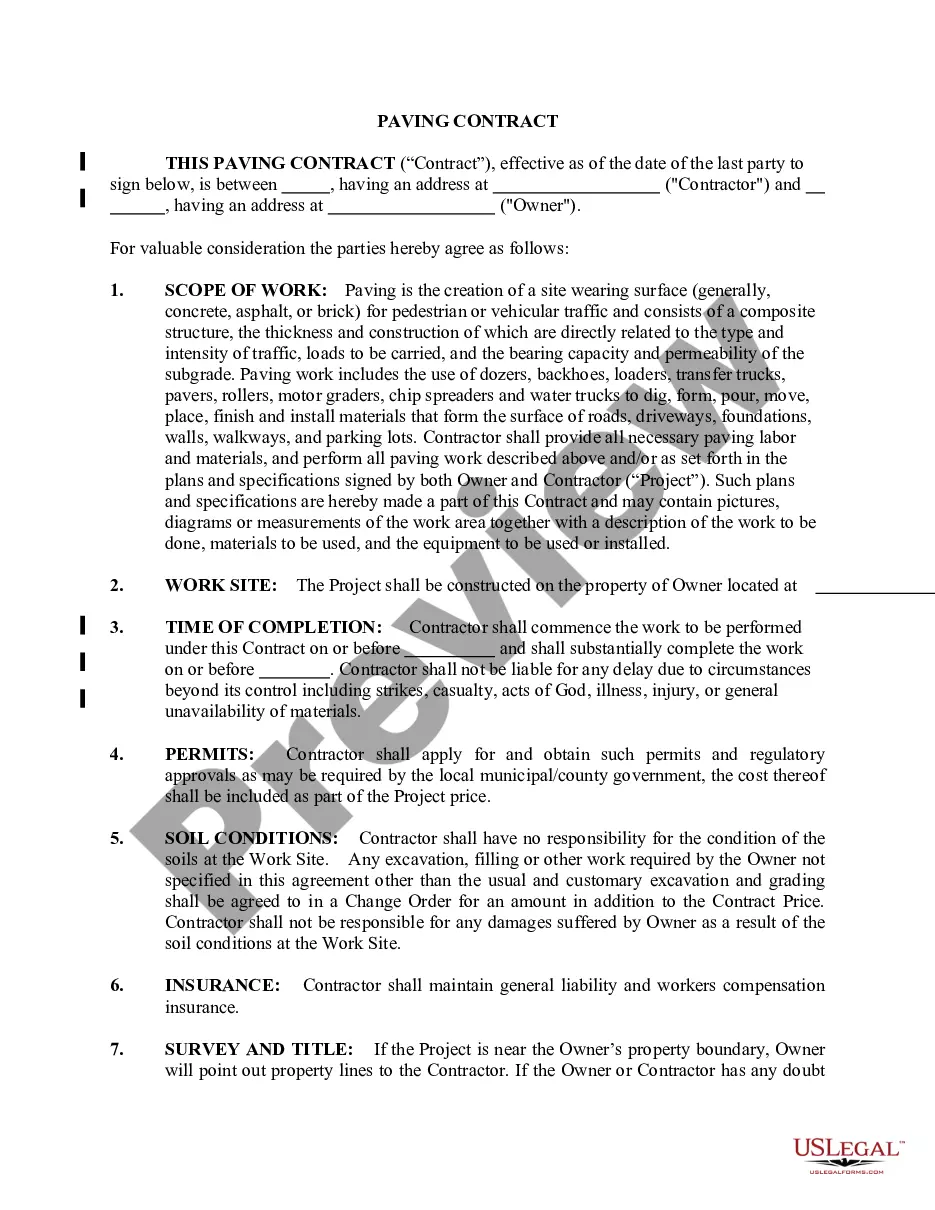

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Harris Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Harris Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Harris Bonus Receipt, Lease Ratification, and Rental Division Order by Mineral Owner:

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!