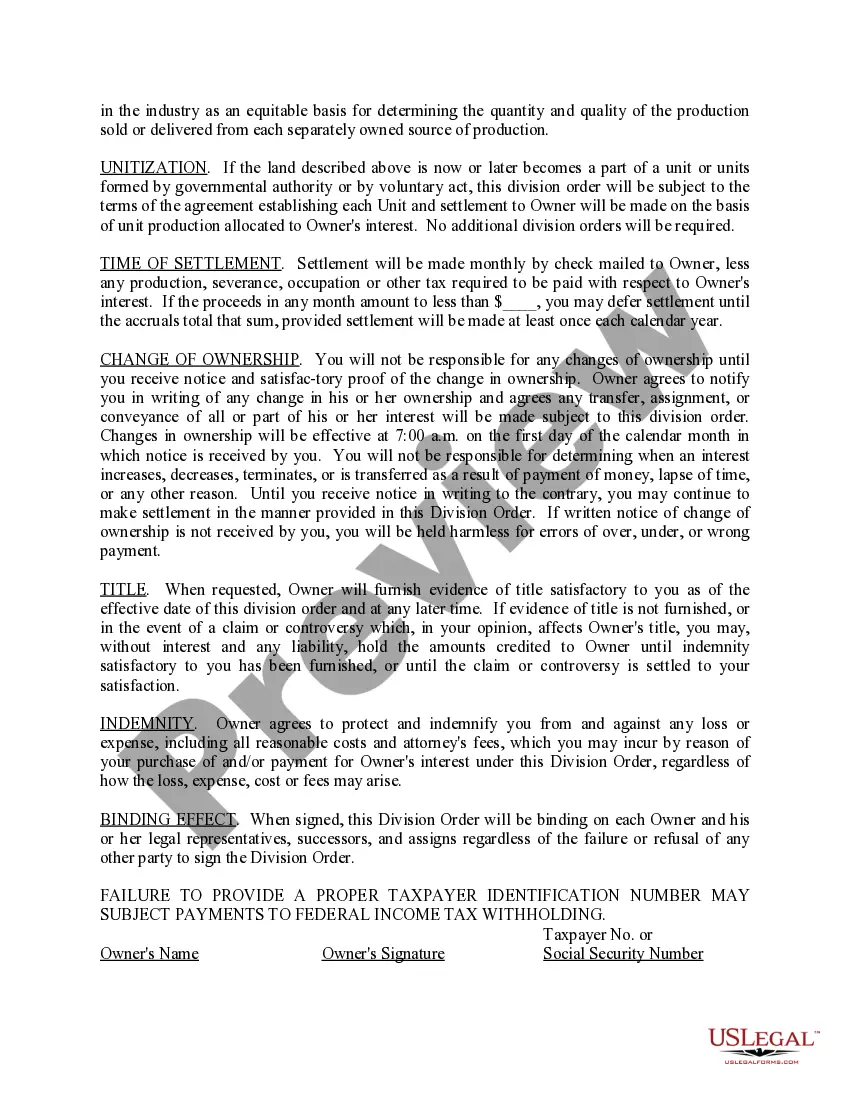

Franklin Ohio Oil and Gas Division Order is a legal document that stipulates the distribution of revenues generated from oil and gas production in Franklin County, Ohio. It outlines the rights, interests, and obligations of all parties involved in the production, including landowners, operators, and royalty owners. The Division Order acts as an agreement between the mineral rights owner and the oil and gas company, ensuring a fair and accurate distribution of the proceeds. It serves as a basis for calculating revenues and royalties, establishing the decimal interest of each party, and providing a clear understanding of ownership in the production. The primary purpose of a Franklin Ohio Oil and Gas Division Order is to establish clarity and transparency in the distribution process, avoiding disputes or disagreements among stakeholders. It includes essential information, such as well and lease details, land descriptions, and a breakdown of the interest percentage held by each party involved. Some different types of Franklin Ohio Oil and Gas Division Orders include: 1. Royalty Division Orders: These orders outline the distribution of royalties among multiple royalty owners associated with a particular well or lease. It specifies the decimal interest or royalty percentage allocated to each individual or entity, ensuring a proper share of the revenues. 2. Overriding Royalty Interest (ORRIS) Division Orders: These orders pertain to individuals or entities who hold overriding royalty interests. Orris are usually a percentage of the gross production, providing the holder with a percentage of oil and gas revenues before the distribution of other royalties. 3. Working Interest Division Orders: Working interest division orders are applicable to individuals or entities that have a financial stake in the operating costs and risks associated with oil and gas production. It outlines the percentage of costs and revenues allocated to each working interest owner, reflecting their investment and responsibilities. 4. Joint Interest Billing (JIB) Division Orders: JIB division orders govern the settlement of costs incurred during the drilling, development, and production stages. These orders establish a framework for sharing expenses among the working interest owners, providing a clear breakdown of costs and reimbursement responsibilities. In summary, Franklin Ohio Oil and Gas Division Orders are crucial legal documents that regulate the distribution of oil and gas revenues in Franklin County, Ohio. They ensure transparency, fairness, and accurate calculation of interests in mineral rights owners, operators, and royalty owners. The different types of division orders cater to specific ownership circumstances, such as royalties, overriding royalties, working interests, and joint interest billing.

Franklin Ohio Oil and Gas Division Order

Description

How to fill out Franklin Ohio Oil And Gas Division Order?

Whether you intend to start your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like Franklin Oil and Gas Division Order is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to get the Franklin Oil and Gas Division Order. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Franklin Oil and Gas Division Order in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

A division order is a record of your interest in a specific well. It contains your decimal interest, interest type, well number and well name. Division orders are issued to all that own an interest in a specific well after that well has achieved first sales of either oil or gas.

In Texas, courts have held that division orders are executed without consideration, but that they are an enforceable agreement until they are revoked. A division order can be revoked at any time by either party, after which it has no further effect.

A Division Order is an instrument which sets forth the proportional ownership in produced hydrocarbons, including crude oil, natural gas, and NGL's. Sometimes the Division Order is referred to as a division of interest.

A division order is a contract between you and the operator (an oil and gas company). Typically, receiving a division order means that the operator is about to drill, or that the operator has already drilled a well and your minerals are producing.

A Division Order is an instrument which sets forth the proportional ownership in produced hydrocarbons, including crude oil, natural gas, and NGL's. Sometimes the Division Order is referred to as a division of interest. More often than not, a single well or lease will have multiple owners.

A division order is a record of your interest in a specific well. It contains your decimal interest, interest type, well number and well name. Division orders are issued to all that own an interest in a specific well after that well has achieved first sales of either oil or gas.

Content. A division order is a record of your interest in a specific well. It contains your decimal interest, interest type, well number and well name. Division orders are issued to all that own an interest in a specific well after that well has achieved first sales of either oil or gas.

Your job as a Division Order Analyst is to determine each owner's share, and distribute checks accordingly. You may work for only one company, keeping detailed records about the people who own the company's equipment and resources.

Division Of Interest (DOI) DOI is frequently-used as an umbrella term to capture the joint ownership and how responsibilities and rewards for a given oil & gas asset (i.e. well) are split. Who pays for what portion of the costs and who is entitled to the produced hydrocarbons are dictated by a well's DOI.