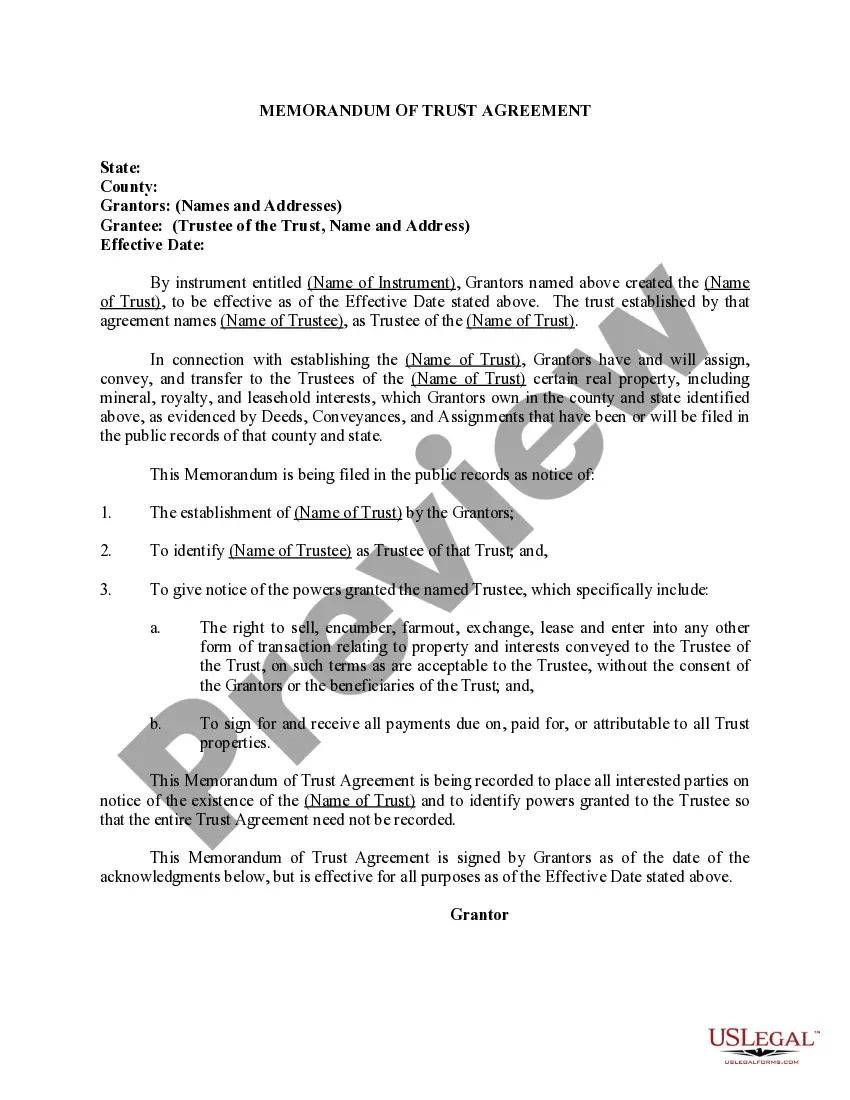

The Clark Nevada Memorandum of Trust Agreement is a legal document that establishes a trust in Clark County, Nevada. This agreement outlines the terms, conditions, and responsibilities between the trustee and the beneficiaries involved in the trust. The primary purpose of the Clark Nevada Memorandum of Trust Agreement is to provide a clear and concise understanding of how the trust assets will be managed, distributed, and protected. It serves as a guidebook for the trustee to ensure they adhere to the wishes and intentions of the granter (the person creating the trust). This document includes pertinent information such as the names and contact details of all parties involved, the date of the trust agreement's creation, the purpose and objectives of the trust, and the trustees' powers and limitations. Additionally, it outlines the specific assets that are part of the trust, such as real estate, stocks, bonds, or cash. The Clark Nevada Memorandum of Trust Agreement also details the conditions under which the beneficiaries will receive distributions from the trust. This can include specific instructions regarding timing, amounts, and circumstances under which distributions may be made. The agreement may also mention any conditions or requirements that beneficiaries must meet to maintain their eligibility for trust assets. In some cases, there may be variations of the Clark Nevada Memorandum of Trust Agreement to cater to different types of trusts, each serving unique purposes. These variations may include: 1. Revocable Living Trust Agreement: This agreement allows the granter to retain control over the trust assets during their lifetime. It can be modified or revoked at any time, providing flexibility in managing the trust. 2. Irrevocable Trust Agreement: Unlike the revocable living trust agreement, an irrevocable trust agreement cannot be easily modified or revoked once established. This type of trust offers potential tax advantages and creditor protection. 3. Special Needs Trust Agreement: This agreement caters specifically to individuals with disabilities who may require ongoing care or government benefits. It ensures that the trust assets do not interfere with the beneficiary's eligibility for assistance programs. 4. Testamentary Trust Agreement: Created within a will, this agreement comes into effect upon the granter's death. It allows for the management and distribution of assets after the granter's passing, providing guidance to the trustee. 5. Charitable Trust Agreement: This agreement is designed to benefit charitable organizations or causes. It allows the granter to support philanthropic endeavors while receiving potential tax benefits. In conclusion, the Clark Nevada Memorandum of Trust Agreement is a comprehensive legal document that establishes a trust and governs its operations and distributions. This agreement ensures that the intentions of the granter are upheld, creating a framework for the trustee to manage the trust assets for the benefit of the beneficiaries.

Clark Nevada Memorandum of Trust Agreement

Description

How to fill out Clark Nevada Memorandum Of Trust Agreement?

Draftwing paperwork, like Clark Memorandum of Trust Agreement, to take care of your legal matters is a tough and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task not really affordable. However, you can take your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms intended for various cases and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Clark Memorandum of Trust Agreement template. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before getting Clark Memorandum of Trust Agreement:

- Make sure that your form is compliant with your state/county since the regulations for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Clark Memorandum of Trust Agreement isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin utilizing our service and get the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your form is all set. You can go ahead and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!