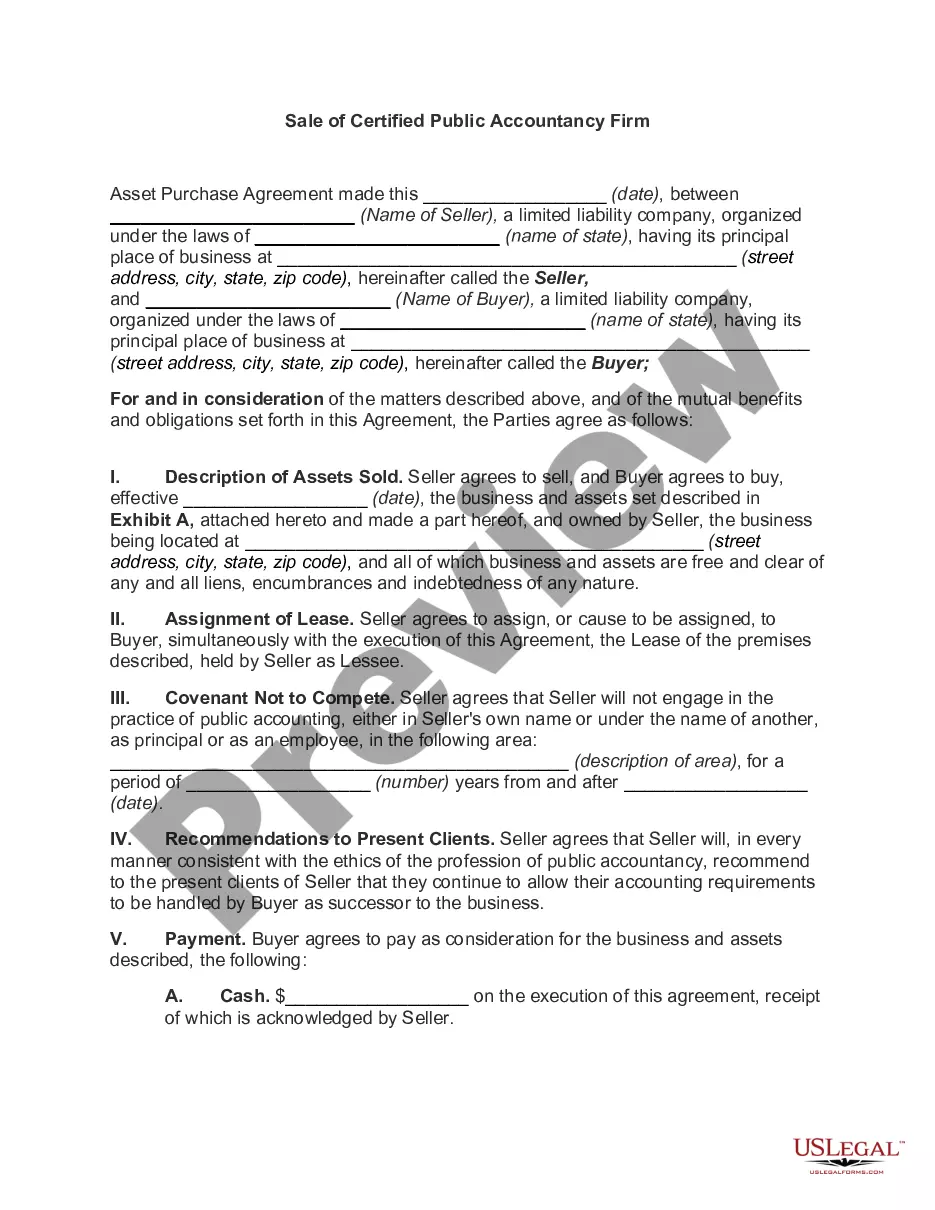

The Salt Lake Utah Memorandum of Trust Agreement is a legal document that establishes a trust in the state of Utah, specifically in the region of Salt Lake City. This agreement outlines the terms, conditions, and responsibilities of the parties involved in the trust arrangement. A Memorandum of Trust Agreement is a crucial aspect of estate planning, as it allows individuals to ensure that their assets are managed and distributed according to their wishes, even after their passing. This agreement grants the trustee the authority to manage the trust assets and carry out the instructions set forth by the trust or. There are various types of Salt Lake Utah Memorandum of Trust Agreements that cater to different situations and objectives: 1. Revocable Living Trust Agreement: This type of trust can be altered or revoked by the trust or during their lifetime. It allows for the seamless transfer of assets to beneficiaries upon the trust or's death, bypassing the probate process. 2. Irrevocable Trust Agreement: Unlike a revocable trust, an irrevocable trust cannot be modified or terminated without the consent of the beneficiaries. This type of trust is often utilized for complex estate planning purposes, such as minimizing estate taxes or protecting assets from potential creditors. 3. Special Needs Trust Agreement: This type of trust is designed to provide financial support for individuals with special needs, without jeopardizing their eligibility for government assistance programs. It ensures that funds are used to enhance the quality of life for the beneficiary while maintaining their eligibility for essential benefits. 4. Charitable Remainder Trust Agreement: This trust allows individuals to support charitable organizations while retaining an income stream from the trust assets during their lifetime. Upon their death, the remaining assets are distributed to the chosen charitable beneficiaries. Regardless of the type of Memorandum of Trust Agreement chosen, it is vital to consult with legal professionals specializing in estate planning to ensure that all legal requirements are met and the trust accurately reflects the trust or's intentions. These professionals can provide guidance in drafting, executing, and administering the trust agreement, promoting effective wealth management and proper asset distribution.

Salt Lake Utah Memorandum of Trust Agreement

Description

How to fill out Salt Lake Utah Memorandum Of Trust Agreement?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life situation, locating a Salt Lake Memorandum of Trust Agreement meeting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. Apart from the Salt Lake Memorandum of Trust Agreement, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Salt Lake Memorandum of Trust Agreement:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Salt Lake Memorandum of Trust Agreement.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!