Harris Texas Dissolution of Unit refers to the legal process through which a particular unit, organization, or entity in Harris County, Texas, is officially terminated or dissolved. This procedure typically involves the winding up and termination of the unit's affairs, assets, liabilities, and legal obligations. The term "unit" in this context can refer to various entities, such as a business corporation, limited liability company (LLC), partnership, or nonprofit organization operating within Harris County, Texas. There are several types of Harris Texas Dissolution of Units, depending on the nature of the entity being dissolved: 1. Business Corporation Dissolution: This type of dissolution entails the termination of a corporation's existence within Harris County, Texas. It involves a formal process, including filing dissolution documents with the Texas Secretary of State, settling any pending legal matters, and distributing assets among shareholders. 2. Limited Liability Company (LLC) Dissolution: LLC dissolution in Harris County, Texas, involves the winding up of an LLC's affairs, including settling debts, liquidating assets, and terminating any ongoing contracts. The members or managers must file dissolution paperwork with the Texas Secretary of State to legally dissolve the LLC. 3. Partnership Dissolution: Partnerships formed in Harris County, Texas, such as general partnerships (GP) or limited partnerships (LP), can undergo dissolution. The process involves settling the partnership's debts, distributing assets, and legally terminating the partnership by filing dissolution paperwork with the Texas Secretary of State. 4. Nonprofit Organization Dissolution: Nonprofit organizations operating in Harris County, Texas, may choose to dissolve due to various reasons. This process involves adhering to state laws regarding the dissolution of nonprofits, filing appropriate paperwork, settling debts, distributing assets, and providing proper public notice as required by the Texas law. During the dissolution process, it is crucial to fulfill all legal obligations, address potential tax liabilities, pay off outstanding debts, settle any pending claims, and properly distribute remaining assets among the unit's stakeholders according to the relevant legal requirements. By following the prescribed dissolution procedures, entities in Harris County, Texas, can ensure a lawful and orderly termination of their existence, minimizing potential legal and financial consequences.

Harris Texas Dissolution of Unit

Description

How to fill out Harris Texas Dissolution Of Unit?

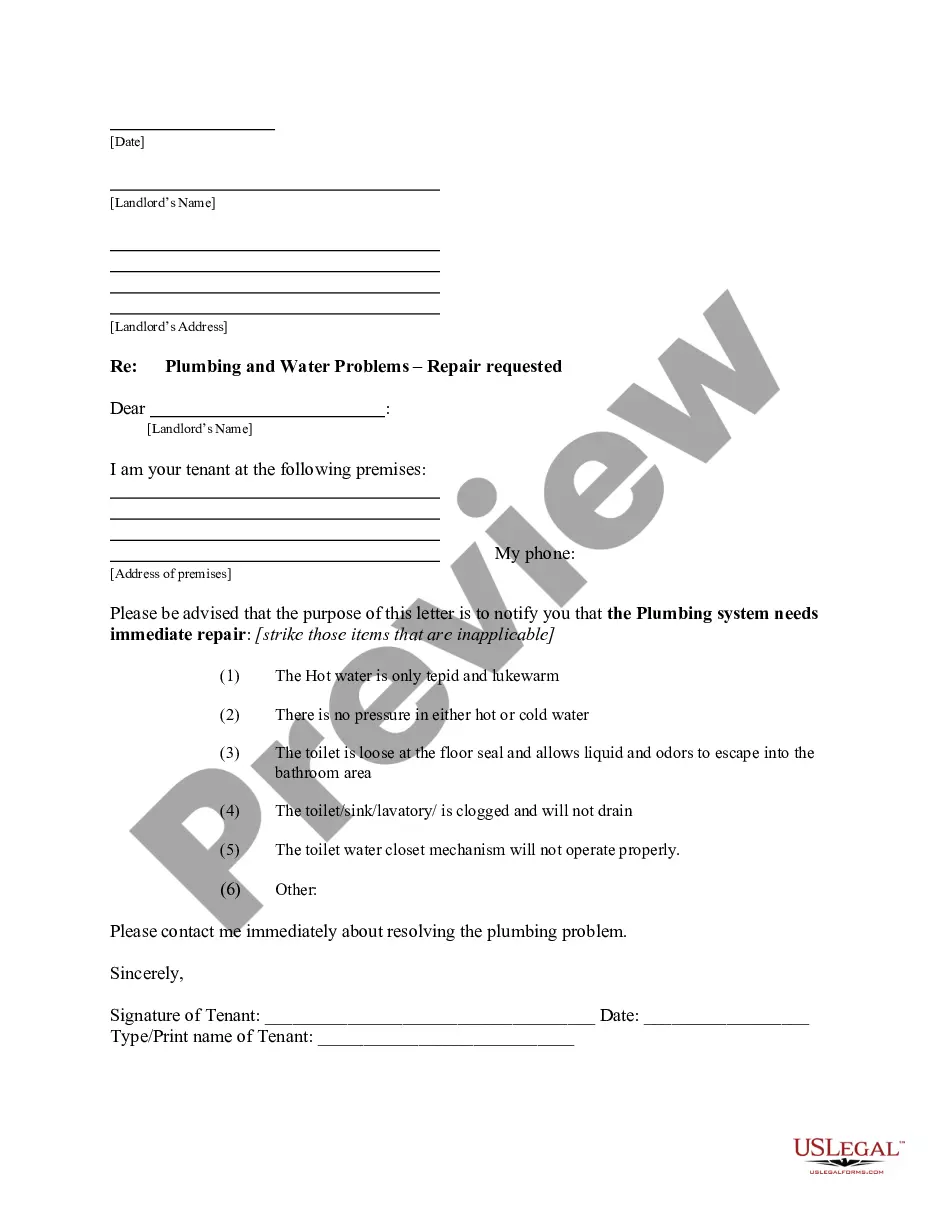

Do you need to quickly create a legally-binding Harris Dissolution of Unit or probably any other document to manage your own or corporate matters? You can go with two options: hire a legal advisor to write a valid document for you or draft it completely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you get neatly written legal papers without paying sky-high prices for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant document templates, including Harris Dissolution of Unit and form packages. We provide templates for an array of life circumstances: from divorce papers to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra hassles.

- First and foremost, double-check if the Harris Dissolution of Unit is adapted to your state's or county's laws.

- If the form includes a desciption, make sure to check what it's suitable for.

- Start the searching process over if the document isn’t what you were seeking by utilizing the search box in the header.

- Select the plan that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Harris Dissolution of Unit template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the documents we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!