Nassau New York Ratification of Oil and Gas Lease With No Rental Payments: Exploring the Benefits and Types In Nassau, New York, the ratification of an oil and gas lease with no rental payments is becoming a topic of interest. This lease agreement offers a unique opportunity for landowners and energy companies to mutually benefit from the extraction of natural resources without the need for upfront rental payments. Let's delve into the details of this arrangement and explore its various types. What is a Ratification of Oil and Gas Lease With No Rental Payments? A ratification of an oil and gas lease with no rental payments is a legal agreement between a landowner and an energy company, where the landowner allows the company to extract oil and gas resources from their property without the requirement of traditional rental payments. Instead, the landowner receives a percentage of the profits generated from the sale of extracted resources. Benefits of a Lease With No Rental Payments: 1. Mutual Benefit: Landowners can receive a significant portion of the profits generated, making it an attractive option for those seeking alternative income streams. 2. Lower Risk: The absence of rental payments reduces the financial burden on energy companies, allowing them to take on more projects and potentially explore untapped resources. 3. Long-Term Partnership: This type of lease fosters a collaborative relationship between landowners and energy companies, encouraging effective communication and sustainable resource management. Types of Nassau New York Ratification of Oil and Gas Lease With No Rental Payments: 1. Royalty Lease: In this type of agreement, the landowner receives a predetermined percentage or royalty rate on the net profits generated from the sale of oil and gas resources. The percentage can vary depending on negotiations and market conditions. 2. Overriding Royalty Interest Lease: This lease grants the landowner a specific percentage of the royalties derived from the extraction operations, like a royalty lease. However, unlike the royalty lease, it does not provide an ownership interest in the property itself. 3. Production Sharing Lease: Under this arrangement, the landowner and energy company share the costs, risks, and profits incurred during the extraction process. The sharing ratio is determined through negotiation and key factors like investment contribution and resource potential. In conclusion, the Nassau New York ratification of an oil and gas lease with no rental payments presents an intriguing opportunity for landowners and energy companies alike. By opting for this type of lease, parties can establish mutually beneficial relationships, create alternative income streams, and promote sustainable resource management practices. With various types of lease agreements available, interested parties can tailor the terms to suit their specific circumstances and objectives.

Nassau New York Ratification of Oil and Gas Lease With No Rental Payments

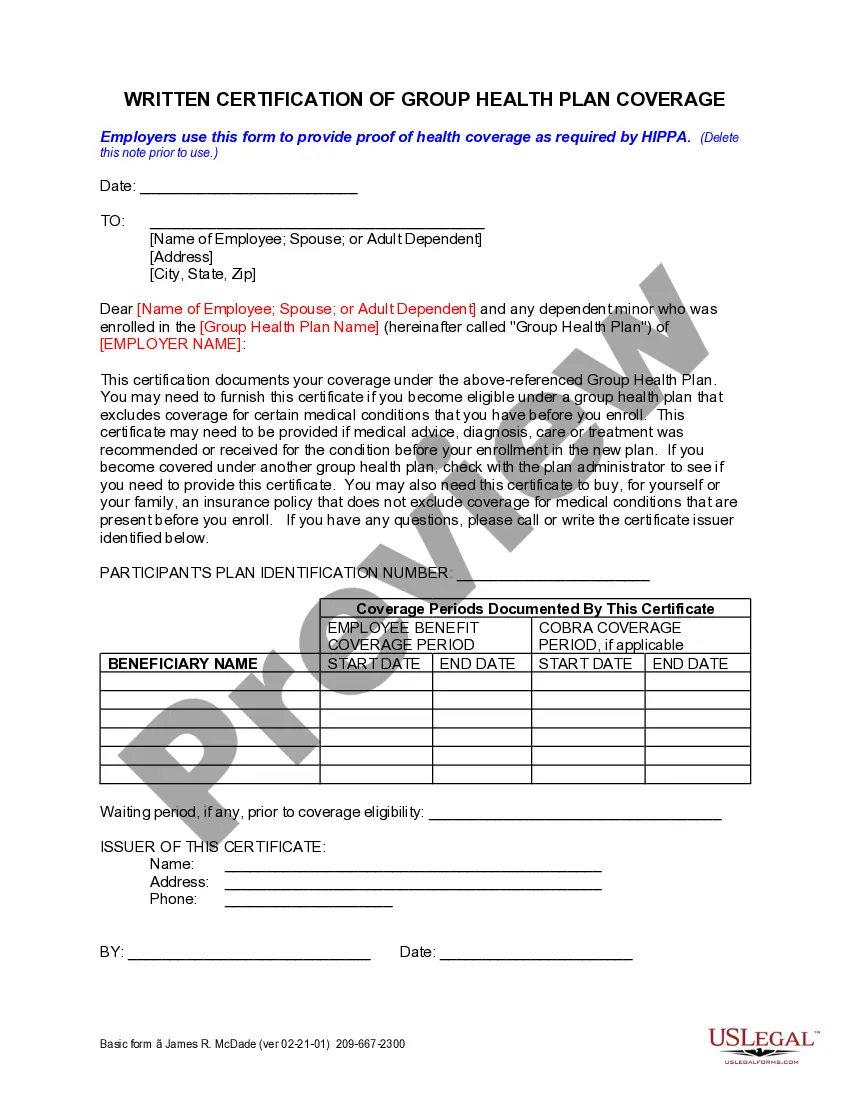

Description

How to fill out Nassau New York Ratification Of Oil And Gas Lease With No Rental Payments?

Drafting paperwork for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Nassau Ratification of Oil and Gas Lease With No Rental Payments without expert assistance.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Nassau Ratification of Oil and Gas Lease With No Rental Payments by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, follow the step-by-step guide below to get the Nassau Ratification of Oil and Gas Lease With No Rental Payments:

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that suits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!