Nassau County, located in the state of New York, has specific protocols and requirements for the ratification of oil and gas leases. This process is vital to ensure that all parties involved adequately understand and agree to the terms and conditions associated with the exploration and extraction of oil and gas resources within the county. The ratification of oil and gas leases in Nassau New York aims to maintain transparency, protect landowners' rights, and promote responsible resource development. One essential aspect of the Nassau New York ratification process is obtaining written consent from affected landowners. This ensures that all property owners have the opportunity to review and approve the terms of the lease before any activities commence. Landowners need to thoroughly understand the lease terms, including the payment structure, duration, and any potential environmental implications. In Nassau County, there are multiple types of ratification that may be required based on the specific circumstances and nature of the oil and gas lease: 1. Individual Landowner Ratification: This refers to cases where a lease agreement involves a single landowner. The landowner needs to provide their consent and signature on the lease, indicating their acceptance of the terms and conditions. 2. Joint Landowner Ratification: In scenarios where multiple property owners hold a shared interest in a particular tract of land, all landowners must sign and ratify the lease. This ensures that all parties have a say in the agreement and are in agreement with the proposed terms. 3. Unleashed Tract Ratification: If an oil and gas company wishes to exploit resources on an unleashed tract, they must obtain the consent of a majority of the landowners within that tract. This ensures that the leasing process is fair and considers the interests of every affected party. 4. Unitization Agreement Ratification: In some cases, oil and gas leases involve multiple tracts, which are then consolidated into a single unit for efficient resource extraction. To proceed with unitization, all landowners within the unit area need to ratify the unitization agreement. This agreement outlines how the resources within the unit will be accessed, managed, and revenue allocated. The ratification of oil and gas leases in Nassau County, New York, serves as a crucial step in fostering responsible and sustainable energy development. By ensuring all involved parties are informed and engaged through the ratification process, Nassau County aims to promote fair resource exploitation while protecting the rights and interests of property owners.

Nassau New York Ratification of Oil and Gas Lease

Description

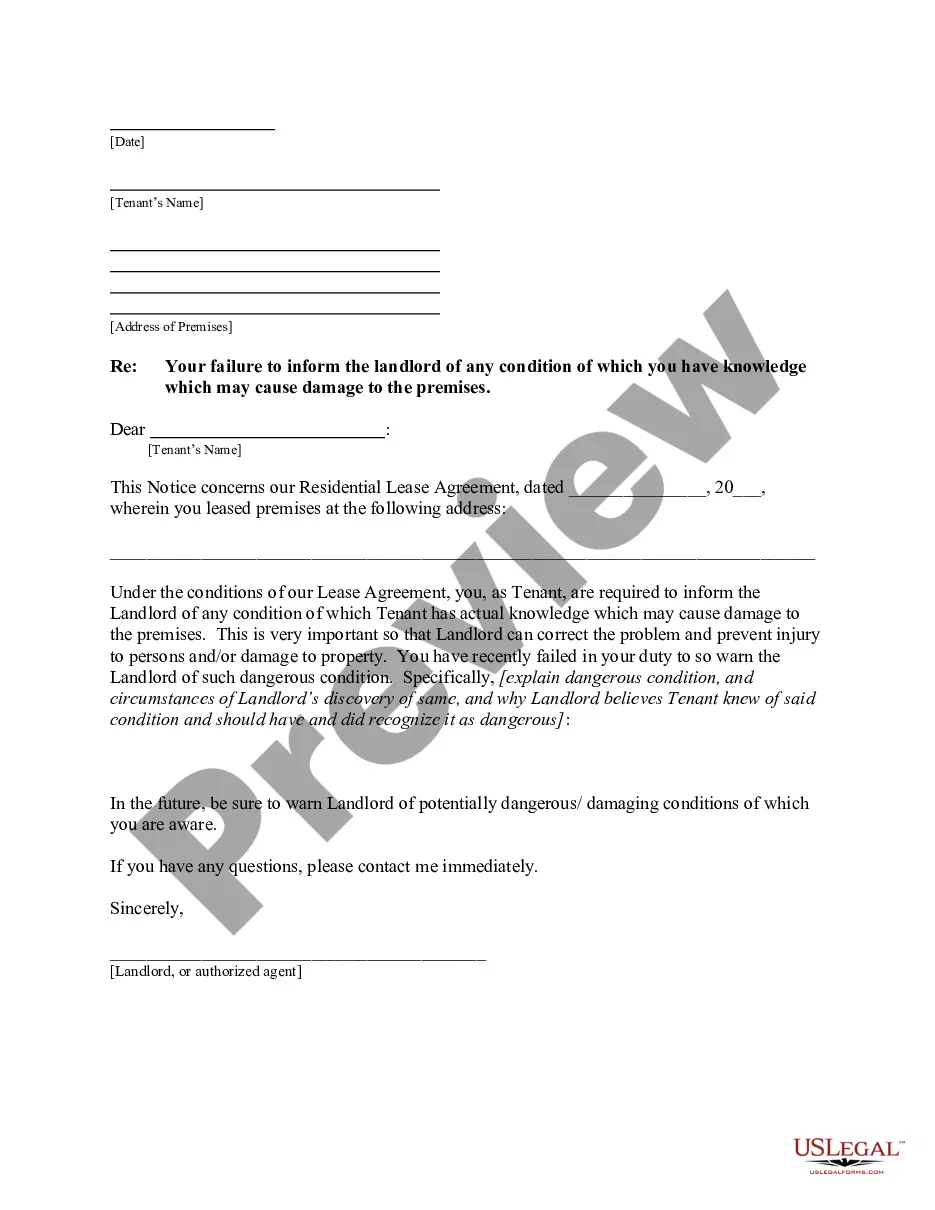

How to fill out Nassau New York Ratification Of Oil And Gas Lease?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business objective utilized in your county, including the Nassau Ratification of Oil and Gas Lease.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Nassau Ratification of Oil and Gas Lease will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Nassau Ratification of Oil and Gas Lease:

- Ensure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Nassau Ratification of Oil and Gas Lease on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

1. n. Oil and Gas Business Ownership in a share of production, paid to an owner who does not share in the right to explore or develop a lease, or receive bonus or rental payments. It is free of the cost of production, and is deducted from the royalty interest.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain royalty interest it is expensefree, bearing no operational costs of production.

To ratify a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

An oil or gas lease is a legal document where a landowner grants an individual or company the right to extract oil or gas from beneath the landowner's property. Courts generally find leases to be legally binding, so it is very important that you understand all the terms of a lease before you sign it.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain royalty interest it is expensefree, bearing no operational costs of production.

The owner of a nonparticipating royalty interest, like the owner of a nonparticipating nonexecutive mineral interest, does not have the right to enter into a lease of the minerals nor the right to enter upon the land for the purpose of exploring for or producing oil, natural gas, or other minerals.

Under Texas law, there is a rule of non-apportionment. It sets out that when the property is subdivided after the lease is already in place on the tract, the royalties are not apportioned but given to the royalty interest owner on whose property the well physically sits. Delay rentals however are apportioned.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

The primary term of a federal oil and gas lease is 10 years. The term is extended as long as the lease has at least one well capable of production. Leases do not authorize ground disturbance.