This form is when the Lessor ratifies the Lease and grants, leases, and lets all of Lessor's undivided mineral interest in the Lands to Lessee on the same terms and conditions as provided for in the Lease, and adopts and confirms the Lease as if Lessor was an original party to and named as a Lessor in the Lease.

Cuyahoga Ohio Ratification of Oil, Gas, and Mineral Lease by Mineral Owner

Description

How to fill out Cuyahoga Ohio Ratification Of Oil, Gas, And Mineral Lease By Mineral Owner?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, finding a Cuyahoga Ratification of Oil, Gas, and Mineral Lease by Mineral Owner suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. In addition to the Cuyahoga Ratification of Oil, Gas, and Mineral Lease by Mineral Owner, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Experts verify all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Cuyahoga Ratification of Oil, Gas, and Mineral Lease by Mineral Owner:

- Examine the content of the page you’re on.

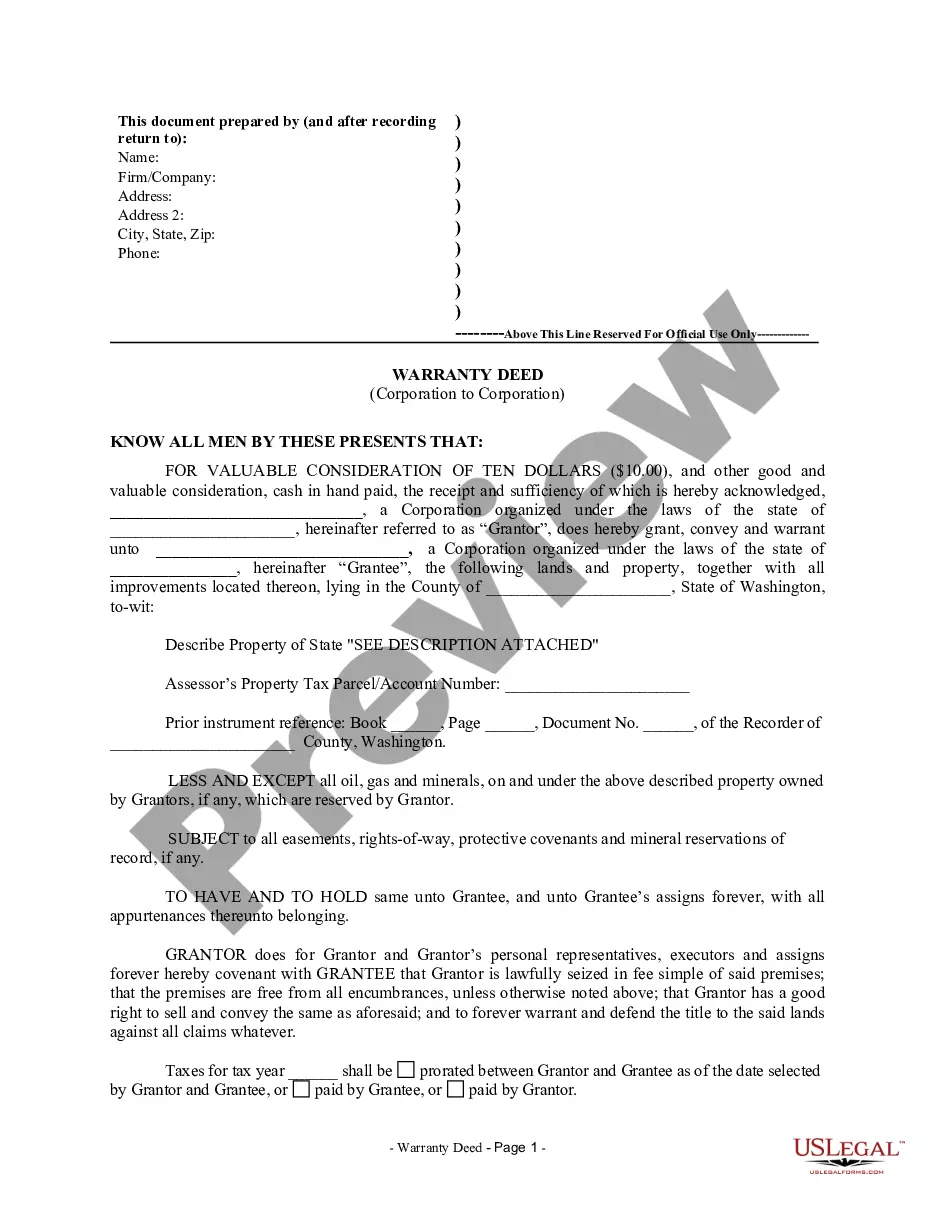

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Cuyahoga Ratification of Oil, Gas, and Mineral Lease by Mineral Owner.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

A mineral interest owner also possesses the right to receive lease bonuses, delay rental payments, shut-in payments and royalties. A royalty interest, on the other hand, is the property interest created that entitles the owner to receive a share of the production.

Mineral (oil) rights in land required by law to be separately listed and valued for taxation are considered as real estate for taxation purposes.

Mineral rights Ohio are normally sold separately from the land where the mineral reside. These rights give holders access to claim the mineral interests on their land.

To summarize, a mineral lease and mineral royalty are considered real property for federal tax purposes and may be eligible for a 1031 exchange; whereas, a production payment is not like kind to real estate and is not eligible for 1031 treatment.

Ohio adopted its Dormant Mineral Act ("DMA") in 1989 and amended it in 2006. Ohio Rev. Code § 5301.56. Act provided that a mineral interest "shall be deemed abandoned and vested in the owner of the surface" unless a savings event occurred within the preceding 20 years.

To ratify a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

Unleased mineral owner means a royalty interest owner who owns oil and/or gas rights free of a lease or other instrument conveying all or any portion of the working interest in such rights to another.