Harris Texas Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow for Pooling In Harris County, Texas, owners of oil, gas, and mineral leases often face the need for ratification to allow for pooling. Pooling is a process where small oil, gas, or mineral leases are combined into one larger unit to maximize production and efficiency. Nonparticipating royalty owners, who don't have the right to explore or develop their own lease but receive compensation based on the production, may need to ratify their leases to enable pooling. This ensures fair and appropriate compensation for their royalties while facilitating efficient resource extraction. By ratifying their lease, a nonparticipating royalty owner authorizes the pooling of their leasehold interest with other contiguous leases. This consolidation enhances operational effectiveness and allows for the pooling of resources, such as drilling rigs and infrastructure, leading to increased production rates and reduced costs. There are a few different types of Harris Texas Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow for Pooling: 1. Ratification of Pooling Agreement: This type of ratification acknowledges the nonparticipating royalty owner's consent to pooling their leasehold interest with other leases. It addresses the terms and conditions of pooling, including royalty calculations and payment provisions. 2. Ratification of Pooling Order: In some cases, pooling may be established through a legal or administrative process by obtaining a pooling order from the regulatory authority. A nonparticipating royalty owner must ratify this pooling order to validate the pooling decision and secure their rights to compensation. 3. Ratification of Pooling Amendment: If there have been modifications or amendments to a previously ratified pooling agreement, a nonparticipating royalty owner may need to ratify these changes for them to be legally binding. This ensures that the owner is aware of and agrees to any alterations in the pooling arrangement. By ratifying their oil, gas, and mineral lease for pooling, nonparticipating royalty owners protect their interests while contributing to the optimal development and extraction of valuable resources. This collaborative approach promotes efficient operations, minimizes surface impact, and ultimately benefits both the industry and the local community by maximizing production and financial returns.

Harris Texas Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling

Description

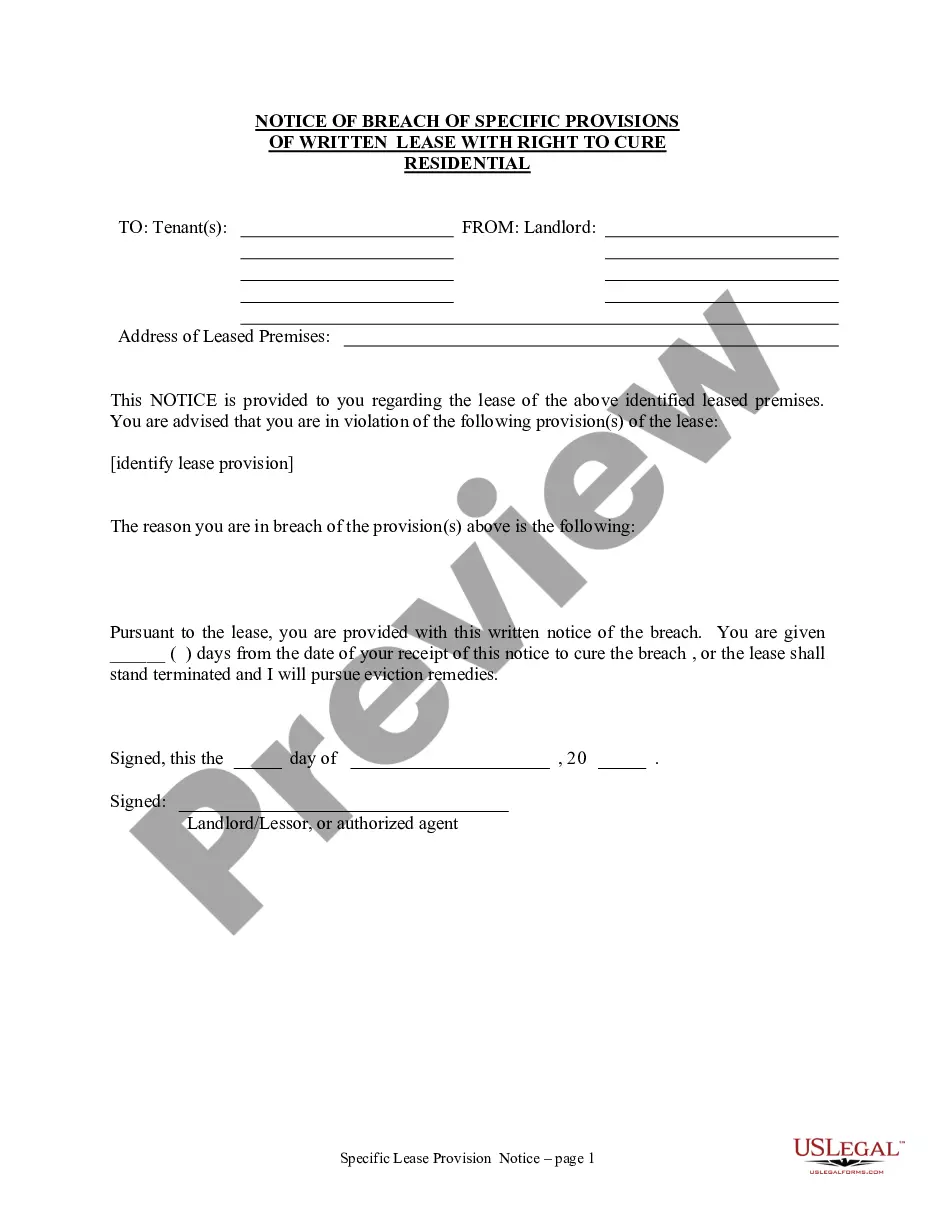

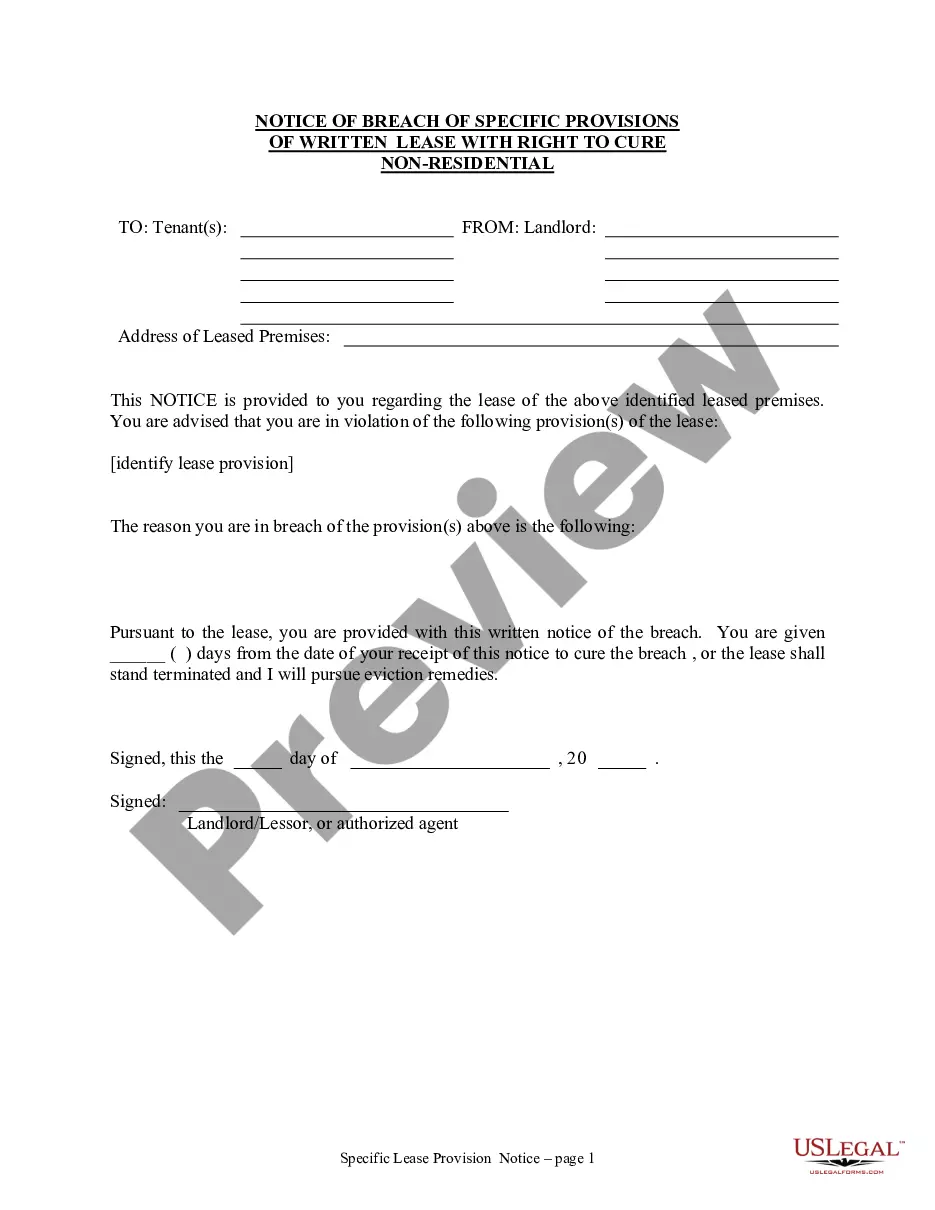

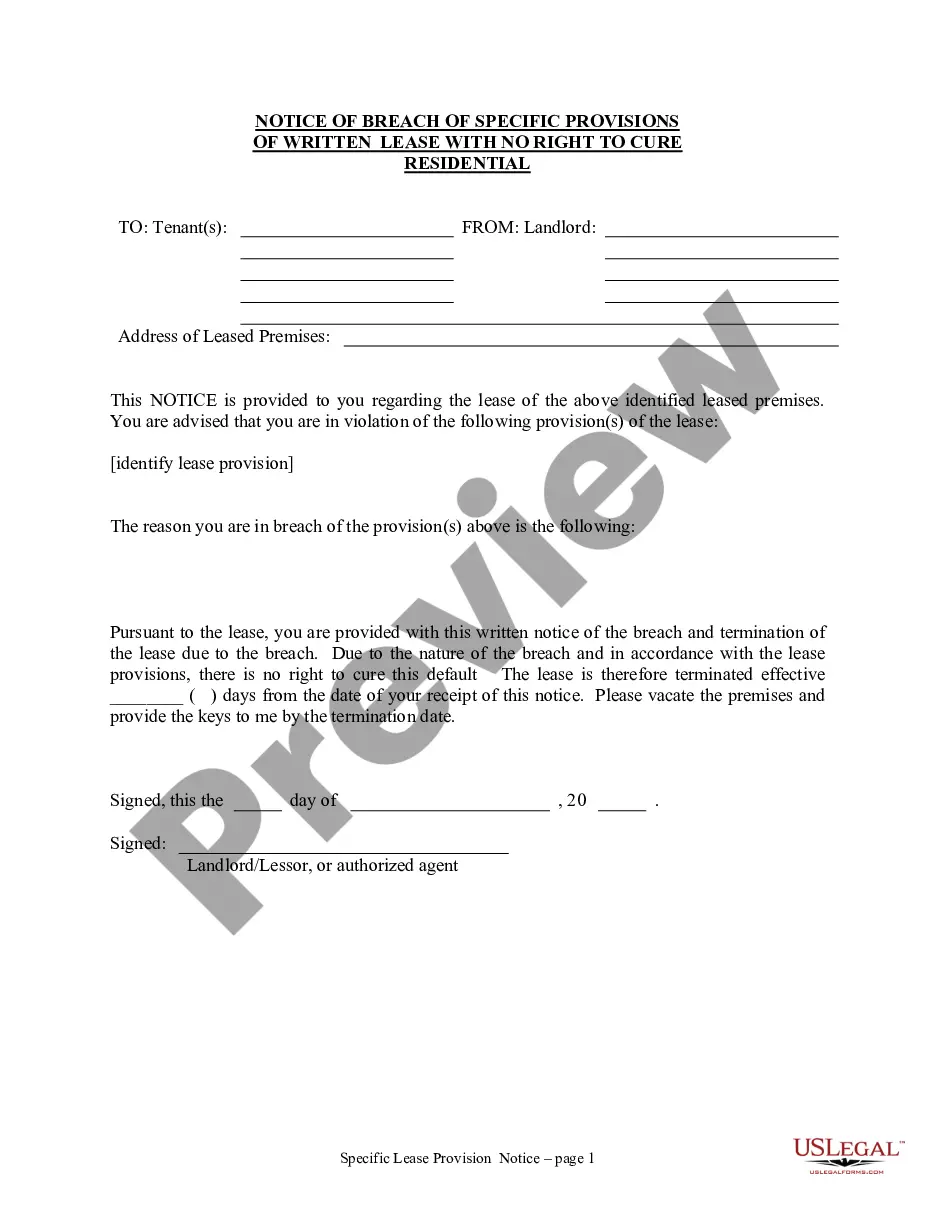

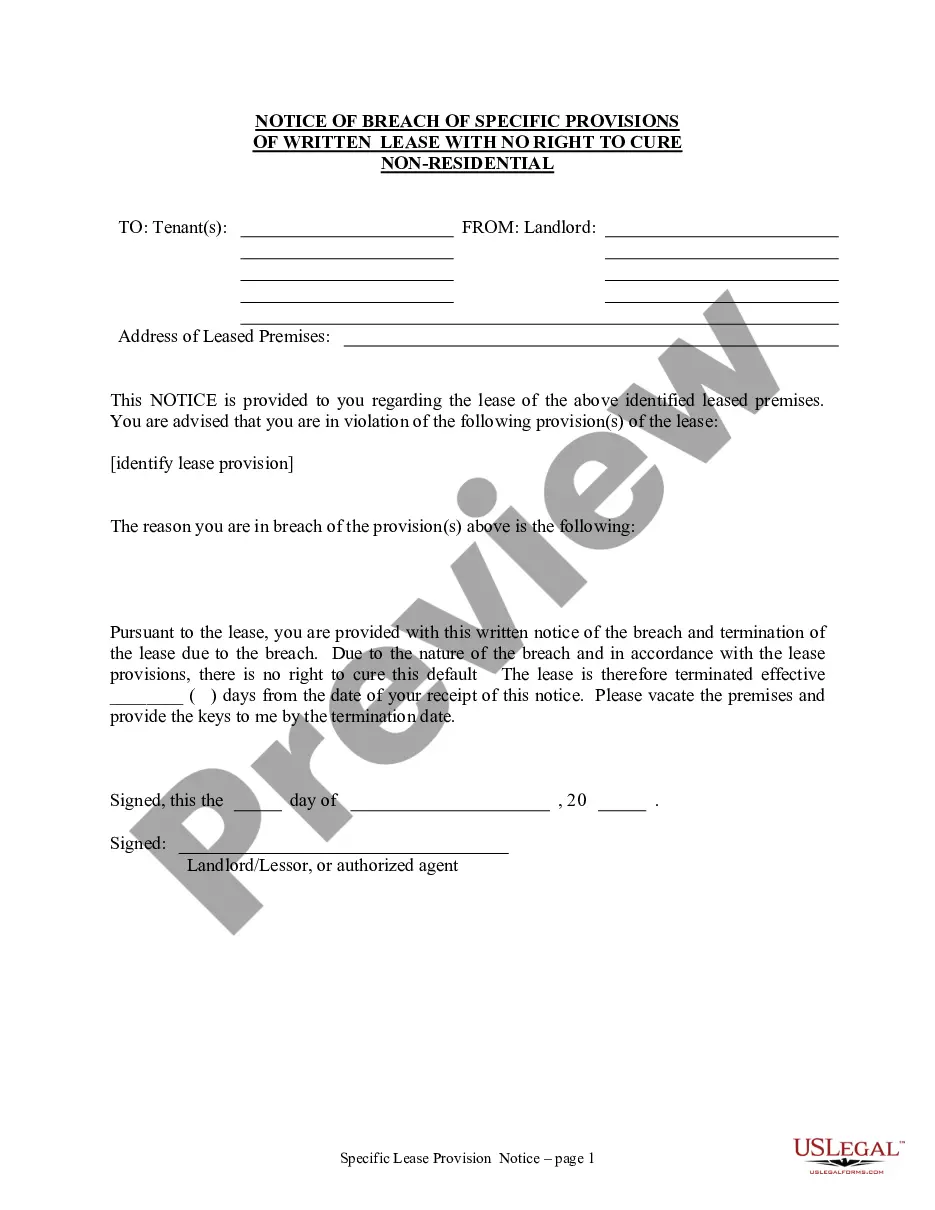

How to fill out Harris Texas Ratification Of Oil, Gas, And Mineral Lease By Nonparticipating Royalty Owner To Allow For Pooling?

Whether you plan to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business case. All files are collected by state and area of use, so opting for a copy like Harris Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to obtain the Harris Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling. Adhere to the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Harris Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

The formula to calculate NPRI without proportionate share reduction is LRR RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain royalty interest it is expensefree, bearing no operational costs of production.

participating royalty interest owner has a right to all or a portion of the royalty from gross production, but does not have the right to execute a lease, receive a bonus or any delay rentals.

Under Texas law, there is a rule of non-apportionment. It sets out that when the property is subdivided after the lease is already in place on the tract, the royalties are not apportioned but given to the royalty interest owner on whose property the well physically sits.

The owner of a nonparticipating royalty interest, like the owner of a nonparticipating nonexecutive mineral interest, does not have the right to enter into a lease of the minerals nor the right to enter upon the land for the purpose of exploring for or producing oil, natural gas, or other minerals.

The primary term of a federal oil and gas lease is 10 years. The term is extended as long as the lease has at least one well capable of production. Leases do not authorize ground disturbance. Operations (including roads) proposed pursuant to leases must go through a separate permitting process.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain royalty interest it is expensefree, bearing no operational costs of production.

To ratify a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.

An oil or gas lease is a legal document where a landowner grants an individual or company the right to extract oil or gas from beneath the landowner's property. Courts generally find leases to be legally binding, so it is very important that you understand all the terms of a lease before you sign it.