Santa Clara California Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling

Description

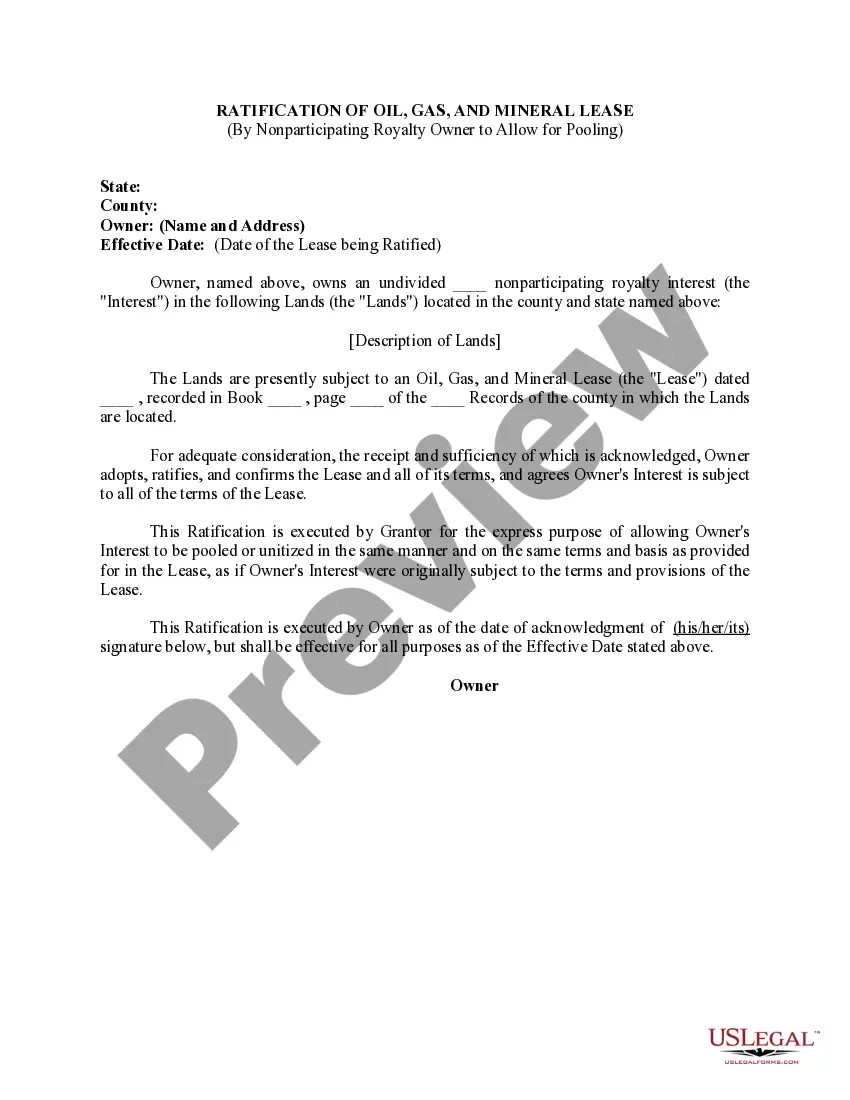

How to fill out Santa Clara California Ratification Of Oil, Gas, And Mineral Lease By Nonparticipating Royalty Owner To Allow For Pooling?

Whether you intend to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Santa Clara Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Santa Clara Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling. Follow the guide below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Santa Clara Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

Under Texas law, there is a rule of non-apportionment. It sets out that when the property is subdivided after the lease is already in place on the tract, the royalties are not apportioned but given to the royalty interest owner on whose property the well physically sits. Delay rentals however are apportioned.

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.

1. n. Oil and Gas Business Ownership in a share of production, paid to an owner who does not share in the right to explore or develop a lease, or receive bonus or rental payments. It is free of the cost of production, and is deducted from the royalty interest.

The owner of a nonparticipating royalty interest, like the owner of a nonparticipating nonexecutive mineral interest, does not have the right to enter into a lease of the minerals nor the right to enter upon the land for the purpose of exploring for or producing oil, natural gas, or other minerals.

The primary term of a federal oil and gas lease is 10 years. The term is extended as long as the lease has at least one well capable of production. Leases do not authorize ground disturbance.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

Unlike a mineral interest owner, a royalty interest owner does not possess executive rights. In addition, a royalty interest owner does not possess the right to receive lease bonuses, delay rental payments, or shut-in payments.

An oil or gas lease is a legal document where a landowner grants an individual or company the right to extract oil or gas from beneath the landowner's property. Courts generally find leases to be legally binding, so it is very important that you understand all the terms of a lease before you sign it.

To ratify a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain royalty interest it is expensefree, bearing no operational costs of production.